Risk assessment and portfolio management

- 1. Risk Assessment in the Context of Portfolio Management and Decision Making Graeme Simpson Bernie Vining Fiona Macmillan AAPG International Conference and Exhibition, Perth, November, 2006

- 2. Outline ŌĆó Role of risk and uncertainty assessment in resource classification ŌĆó Geological versus economic chance of success ŌĆó Is chance of success an uncertain variable? ŌĆó What is the impact on portfolio management and decision making?

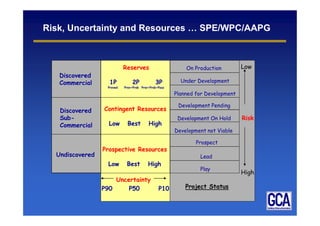

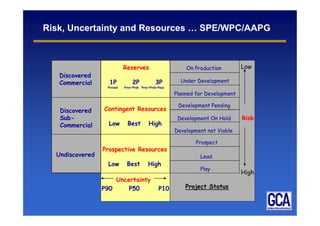

- 3. Risk, Uncertainty and Resources ŌĆ” SPE/WPC/AAPG Reserves On Production Low Discovered Commercial 1P 2P 3P Under Development Proved Prov+Prob Prov+Prob+Poss Planned for Development Development Pending Discovered Contingent Resources Noble plans $300m notes offering Sub- Development On Hold Risk Commercial Low Best High Development not Viable Prospect Prospective Resources Undiscovered Lead Low Best High Play High Uncertainty P90 P50 P10 Project Status

- 4. Risk really matters ŌĆ” ŌĆó Jason McVean (2000) in ŌĆ£The Significance of Risk on Portfolio SelectionŌĆØ, SPE 62966, quote: ŌĆ£The definition of risk can significantly affect portfolio selection.ŌĆØ

- 5. Risk and uncertainty are defined as ŌĆ” ŌĆó Risk (or, better, chance) ŌĆ” the probability of a discrete event occurring (and so one minus the risk is the chance that the discrete event will not happen). ŌĆó Uncertainty ŌĆ” the (usually continuous) range of possible outcomes if the discrete event happens.

- 6. Risk, Uncertainty and Resources ŌĆ” SPE/WPC/AAPG Reserves On Production Low Discovered Commercial 1P 2P 3P Under Development Proved Prov+Prob Prov+Prob+Poss Planned for Development Development Pending Discovered Contingent Resources Noble plans $300m notes offering Sub- Development On Hold Risk Commercial Low Best High Development not Viable Prospect Prospective Resources Undiscovered Lead Low Best High Play High Uncertainty P90 P50 P10 Project Status

- 7. Risk and uncertainty are defined as ŌĆ” ŌĆó Risk (or, better, chance) ŌĆ” the probability of a discrete event occurring (and so one minus the risk is the chance that the discrete event will not happen). ŌĆó Uncertainty ŌĆ” the (usually continuous) range of possible outcomes if the discrete event happens. ŌĆó But itŌĆÖs actually not quite that simple ŌĆ”

- 8. Risk and uncertainty Figure 17, page 32, from Rose (2001) Should risk measurement be Pg / GCoS or Pe / ECoS?

- 9. Hypothetical Prospect ŌĆō GCoS = 30% Sample volumes for economic analysis

- 10. Minimum Economic Volume 200 150 100 NPVx 50 0 0 20 40 60 80 100 -50 -100 MMBbls Zero crossing on x-axis gives Minimum Economic Volume

- 11. ECoS = 20% Portion of curve above Minimum Economic Volume gives ECoS

- 12. So a potential source of confusion is ŌĆ” ŌĆó A ŌĆ£discrete eventŌĆØ can be the achievement of at least a certain value on a continuous distribution

- 13. Risk, Uncertainty and Resources ŌĆ” GCoS Approx GCoS % Reserves On Production Low 100 Discovered 100 Commercial 1P 2P 3P Under Development Proved Prov+Prob Prov+Prob+Poss Planned for Development 100 Development Pending 100 Discovered Contingent Resources Noble plans $300m notes offering Sub- Development On Hold Risk 100 Commercial Low Best High Development not Viable 100 Prospect 10-50 Prospective Resources Undiscovered Lead 0-15 Low Best High Play N/A High Uncertainty P90 P50 P10 Project Status

- 14. Risk, Uncertainty and Resources ŌĆ” ECoS Approx ECoS % Reserves On Production Low 100 Discovered 100 Commercial 1P 2P 3P Under Development Proved Prov+Prob Prov+Prob+Poss Planned for Development 90-100 Development Pending 50-95 Discovered Contingent Resources Noble plans $300m notes offering Sub- Development On Hold Risk 20-80 Commercial Low Best High Development not Viable 0-30 Prospect 5-25 Prospective Resources Undiscovered Lead 0-10 Low Best High Play N/A High Uncertainty P90 P50 P10 Project Status

- 15. Risk, Uncertainty and Resources ŌĆ” Reserves On Production Low Discovered Commercial 1P 2P 3P Under Development Proved Prov+Prob Prov+Prob+Poss Planned for Development CoD Development Pending Discovered Contingent Resources Noble plans $300m notes offering Sub- Development On Hold Risk ECoS Commercial Low Best High Development not Viable GCoS Prospect Prospective Resources Undiscovered Lead Low Best High Play High Uncertainty P90 P50 P10 Project Status

- 16. Is ŌĆ£Chance of SuccessŌĆØ an uncertain variable? ŌĆó Yes, but does it matter? ŌĆó No, if uncertainty is symmetrical, for the distribution acts as if it is the mean, and the mean = the most likely (the mode) ŌĆó Maybe GCoS estimates ought to have symmetric uncertainty ranges, so using the most likely estimate is fine ŌĆó But ECoS is a function of economic assessment, that is multiplicative calculations involving independent variables ŌĆó So the Central Limit Theorem suggests uncertainty in ECoS should tend towards being lognormally (i.e. asymmetrically) distributed ŌĆó So the most likely does not equal the mean, and hence the most likely deterministic and the probabilistic methods give different results

- 17. Hypothetical Case Percentiles: Forecast values P100 0.00 P90 0.00 P80 0.00 P70 0.00 Deterministic P60 0.00 P50 0.00 GCoS = 40% P40 0.00 P30 217.22 P20 245.51 P10 276.26 P0 505.38 Percentiles: Forecast values P100 0.00 P90 0.00 Probabilistic P80 0.00 P70 0.00 Symmetrical P60 0.00 P50 0.00 GCoS P40 0.00 P30 216.91 ML = 40% P20 244.50 P10 276.45 P0 481.46 Percentiles: Forecast values P100 0.00 P90 0.00 Probabilistic P80 0.00 P70 0.00 Asymmetrical P60 0.00 P50 0.00 GCoS P40 207.96 P30 233.96 ML = 40% P20 256.35 P10 286.08 P0 445.28

- 18. Risk and uncertainty Figure 17, page 32, from Rose (2001) Floating, uncertain event Fixed, binary event Should risk measurement be Pg / GCoS or Pe / ECoS?

- 19. Alternative Definitions ŌĆ” ŌĆó GCoS is the probability of a Prospective Resource maturing into a Contingent Resource ŌĆó ECoS is the probability of a Prospective Resource maturing into a Reserve ŌĆó And the chance of a Contingent Resource maturing into a Reserve is usually less than 100%. We call this the Chance of Development, CoD

- 20. And the impact on Portfolio Management and Decision Making is ŌĆ” ŌĆó To optimise on discovered volumes, use GCoS ŌĆó To optimise on economic volumes, use ECoS / CoD ŌĆó To optimise on value, use ECoS / CoD ŌĆó When using ECoS / CoD, take the mean of the distribution, not the most likely, or perform the calculation probabilistically, using the whole distribution

- 21. Thank you ŌĆ” questions?

- 22. Back-up ║▌║▌▀Żs

- 23. Objective of Resource Management is to ŌĆ” ’üČ Maximise value of a portfolio of assets by: ’üČ Optimising, relative to goals and constraints, in terms of: ŌĆō Asset content and timing ŌĆō Identification, by product type, portfolio performance, including resource maturation ’üČ Hence identify options and opportunities for improving resource management performance

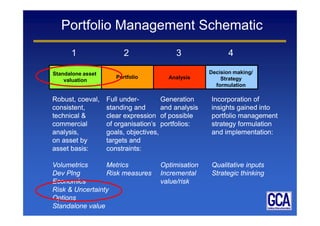

- 24. Portfolio Management Schematic 1 2 3 4 Standalone asset Decision making/ Portfolio Analysis Strategy valuation formulation Robust, coeval, Full under- under- Generation Incorporation of consistent, standing and and analysis insights gained into technical & clear expression of possible portfolio management commercial of organisationŌĆÖs portfolios: strategy formulation analysis, goals, objectives, and implementation: on asset by targets and asset basis: constraints: Volumetrics Metrics Optimisation Qualitative inputs Dev Plng Risk measures Incremental Strategic thinking Economics value/risk Risk & Uncertainty Options Standalone value

- 26. GCoS calculation ŌĆ” Min ML Max Reservoir 0.7 0.8 0.9 Source 0.4 0.5 0.6 Timing 0.3 0.4 0.5 Trap and seal 0.7 0.8 0.9 Multiply, to get ŌĆ”.

- 27. GCoS distribution ŌĆ” Best fit is an asymmetric Beta distribution