Risk Beyond Acquiring: Merchant Risk Across FinTech

- 1. 0 IdentityMind GlobalÔäó ┬®2016 All Rights Reserved Risk Beyond Acquiring The Importance of Merchant Risk Across FinTech

- 2. 1 About IdentityMind IdentityMind GlobalÔÇÖs core technology, Electronic DNAÔäó (eDNAÔäó), builds digital identities for both consumers and business and evaluates their reputation. Two fundamental aspects make this technology a superior solution to prevent account origination fraud: 1. It describes and recognizes an identity based on its digital attributes, which are dynamically validated and constantly updated in real-time as more transactions are evaluated, making sure the information is always relevant. 2. It associates the identity's digital attributes with an aggregated reputation value based on financial transactions behavior. ┬® IdentityMind Global 2016

- 3. 2 AGENDA ÔÇó Quick Overview of IDMÔÇÖs view on Merchant Risk ÔÇó Merchant Risk in FinTech: 3 Use Cases Use Case #1 Merchant Sentinel: An alternative strategy to De-Risk. Use Case #2 Payment Service Provider managing risk portfolio. Use Case #3 An alternative currency goes into payments. ÔÇó Conclusions ┬® IdentityMind Global 2016

- 4. 3 IDM Takes on Merchant Risk ÔÇó Take Control: Underwriting and Monitoring o Lots of effort before opening an account and lots of effort while account is operational ÔÇó Merchant Sentinel: Collaborative o Compliance collaboration framework for high-risk merchants and Processing Banks/Payment Service Providers ÔÇó OnBoard for Businesses o The intersection between BSA compliance and account origination protection for immediate decisioning ┬® IdentityMind Global 2016

- 5. 4 Use Case #1: Merchant Sentinel An Alternative Strategy to ÔÇ£De-RiskÔÇØ CLICK HERE TO LEARN MORE ┬® IdentityMind Global 2016

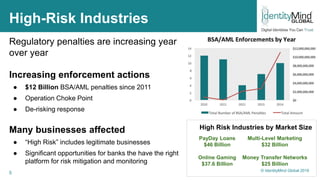

- 6. 5 High-Risk Industries Regulatory penalties are increasing year over year Increasing enforcement actions ÔùÅ $12 Billion BSA/AML penalties since 2011 ÔùÅ Operation Choke Point ÔùÅ De-risking response Many businesses affected ÔùÅ ÔÇ£High RiskÔÇØ includes legitimate businesses ÔùÅ Significant opportunities for banks the have the right platform for risk mitigation and monitoring High Risk Industries by Market Size Multi-Level Marketing $32 Billion Money Transfer Networks $25 Billion PayDay Loans $46 Billion Online Gaming $37.6 Billion ┬® IdentityMind Global 2016

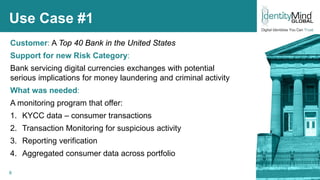

- 7. 6 Use Case #1 Customer: A Top 40 Bank in the United States Support for new Risk Category: Bank servicing digital currencies exchanges with potential serious implications for money laundering and criminal activity What was needed: A monitoring program that offer: 1. KYCC data ÔÇô consumer transactions 2. Transaction Monitoring for suspicious activity 3. Reporting verification 4. Aggregated consumer data across portfolio ┬® IdentityMind Global 2016

- 8. 7 Deployment Virtual Currency Firms 3) Transaction info in real time via API 2) KYC, Fraud Prevention, AML & Risk Monitoring Services Bank ┬® IdentityMind Global 2016

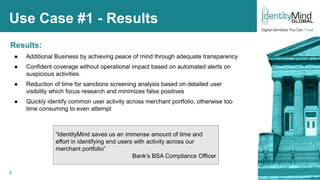

- 9. 8 Use Case #1 - Results Results: ÔùÅ Additional Business by achieving peace of mind through adequate transparency ÔùÅ Confident coverage without operational impact based on automated alerts on suspicious activities. ÔùÅ Reduction of time for sanctions screening analysis based on detailed user visibility which focus research and minimizes false positives ÔùÅ Quickly identify common user activity across merchant portfolio, otherwise too time consuming to even attempt ÔÇ£IdentityMind saves us an immense amount of time and effort in identifying end users with activity across our merchant portfolioÔÇØ BankÔÇÖs BSA Compliance Officer ┬® IdentityMind Global 2016

- 10. 9 Use Case #2: PSP Managing Risk Portfolio Aggregated and centralized fraud prevention ┬® IdentityMind Global 2016

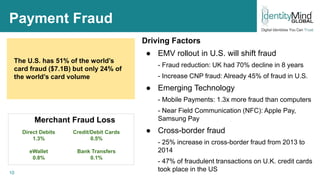

- 11. 10 Payment Fraud Driving Factors ÔùÅ EMV rollout in U.S. will shift fraud - Fraud reduction: UK had 70% decline in 8 years - Increase CNP fraud: Already 45% of fraud in U.S. ÔùÅ Emerging Technology - Mobile Payments: 1.3x more fraud than computers - Near Field Communication (NFC): Apple Pay, Samsung Pay ÔùÅ Cross-border fraud - 25% increase in cross-border fraud from 2013 to 2014 - 47% of fraudulent transactions on U.K. credit cards took place in the US The U.S. has 51% of the worldÔÇÖs card fraud ($7.1B) but only 24% of the worldÔÇÖs card volume Direct Debits 1.3% eWallet 0.8% Merchant Fraud Loss Credit/Debit Cards 0.5% Bank Transfers 0.1%

- 12. 11 Use Case #2 Customer: European Payment Service Provider Take Fraud Prevention Operations PSP operates with clients in Europe but most consumers from the US. ÔÇó Growing fraud rates across portfolio. ÔÇó Clients going international with lack of cross border payments risk expertise ÔÇó Fraud tools cobbled together What was needed: A platform that could offer centralized fraud prevention for diverse set of requirements. Leverage similarities across merchant base ┬® IdentityMind Global 2016

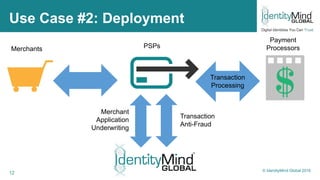

- 13. 12 Use Case #2: Deployment Merchants PSPs Payment Processors Transaction Processing Transaction Anti-Fraud Merchant Application Underwriting ┬® IdentityMind Global 2016

- 14. 13 Use Case #2 - Results Results: ÔùÅ Operational within one month ÔùÅ Aggregated chargeback rate drop by 75% ÔùÅ Cost savings by consolidating tools into single platform ÔùÅ Cost savings by reducing operational cost ÔùÅ Growing merchant portfolio ┬® IdentityMind Global 2016

- 15. 14 Use Case #3: Alternative Currency goes into Payments Aggregated and centralized fraud prevention ┬® IdentityMind Global 2016

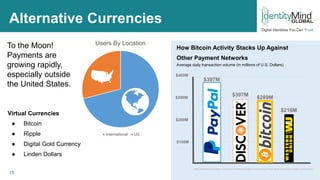

- 16. 15 Alternative Currencies To the Moon! Payments are growing rapidly, especially outside the United States. How Bitcoin Activity Stacks Up Against Other Payment Networks Average daily transaction volume (in millions of U.S. Dollars) $400M $200M $300M $100M $397M $397M $289M $216M http://letstalkpayments.com/visa-mastercard-face-increasing-threat-local-networks-crypto-currencies/ Users By Location International US Virtual Currencies ÔùÅ Bitcoin ÔùÅ Ripple ÔùÅ Digital Gold Currency ÔùÅ Linden Dollars

- 17. 16 Use Case #3 Customer: Canadian provider of alternative currency backed by Gold Turning Currency into Payment Options at Merchants Starts onboarding merchants to accept their currency as a form of payment ÔÇó Translate acquiring practices however not as strict. Liability is quite different. ÔÇó Heavy scrutiny for Money Laundering ÔÇó Small merchants ÔÇô Fraud prevention What was needed: A platform that can offer business onboarding with heavy focus on money laundering. ┬® IdentityMind Global 2016

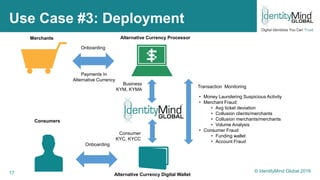

- 18. 17 Use Case #3: Deployment Merchants Onboarding Payments In Alternative Currency Alternative Currency Processor Alternative Currency Digital Wallet Transaction Monitoring ÔÇó Money Laundering Suspicious Activity ÔÇó Merchant Fraud: ÔÇó Avg ticket deviation ÔÇó Collusion clients/merchants ÔÇó Collusion merchants/merchants ÔÇó Volume Analysis ÔÇó Consumer Fraud ÔÇó Funding wallet ÔÇó Account Fraud Business KYM, KYMA Consumer KYC, KYCC Onboarding Consumers ┬® IdentityMind Global 2016

- 19. 18 Use Case #3 - Results Results: ÔùÅ Integrated staged onboarding for merchants in real-time ÔùÅ MerchantÔÇÖs adoption of alternative currency is slow ┬® IdentityMind Global 2016

- 20. 19 Conclusions ÔÇó FinTech is moving fast. Merchant Risk practices common on the acquiring world are being selectively adopted. ÔÇó Self inflicted ÔÇ£De-RiskingÔÇØ is leaving a very profitable opportunity for acquirers with deep monitoring practices. ÔÇó Online onboarding is real time and less concerned about Financial Risk ÔÇó KYCC is being pushed from the banks downstream given AML regulations ÔÇó Financial terrorism will continue to drive extended visibility across portfolio actions. ┬® IdentityMind Global 2016

- 21. 20 Learn More For more case studies and in- depth content related to onboarding and acquiring risk, CLICK HERE ┬® IdentityMind Global 2016