RISK MANAGEMENT THROUGH RISK AUDIT

- 1. APINS CONSULTANTS PRIVATE LIMITED.APINS CONSULTANTS PRIVATE LIMITED. RISK MANAGEMENTTHROUGH RISK AUDIT HEARTILY WELCOMES ALL DELEGATES TO THE GLOBAL STEEL 2011,16-18 January,2011 TAJ PALACE HOTEL, NEW DELHI, INDIA. We at APINS take immense pleasure to present before you in brief our innovative and profitable way of Risk Management through Risk Audit, a presentation specially prepared for 6th International Conference on Steel and Steel making raw materials. ’ā╝ UNDERLINED HEADINGS ARE HYPERLINKED

- 2. WHAT IS RISK MANAGEMENTWHAT IS RISK MANAGEMENT ŌĆ£It is a managerial function concerned with the protection of a FirmŌĆÖs assets, earnings, legal liabilities and personnel against financial losses that may result from fortuitous events i.e. accidental happenings. Risk management is a new managerial discipline which has become a part of business management in many corporate firmsŌĆØ PLEASE CLICK ON HYPERLINK

- 3. HOW RISK MANAGEMENT WORKS ?HOW RISK MANAGEMENT WORKS ?

- 4. WHAT IS RISK AUDIT?WHAT IS RISK AUDIT? Risk Audit ŌĆōProcess that studies the culture, procedure and structure that all are directed towards the effective management of potential opportunity and adverse effects. WHAT IS THE NEED FOR RISK AUDIT ?WHAT IS THE NEED FOR RISK AUDIT ? PLEASE CLICK ON HYPERLINK

- 5. APPROACH OF RISK AUDITAPPROACH OF RISK AUDIT

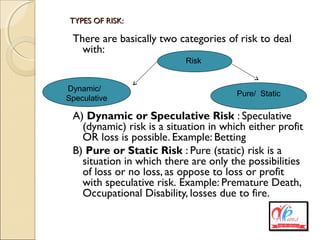

- 6. TYPES OF RISK:TYPES OF RISK: There are basically two categories of risk to deal with: A) Dynamic or Speculative Risk : Speculative (dynamic) risk┬Āis a situation in which either profit OR loss is possible. Example: Betting B) Pure or Static Risk : Pure (static)┬Ārisk is a situation in which there are only the possibilities of loss or no┬Āloss, as oppose to loss or profit with speculative risk.┬ĀExample: Premature Death, Occupational Disability, losses due to fire. Risk Pure/ Static Dynamic/ Speculative

- 7. Difference between the two RISKS:Difference between the two RISKS: Dynamic Risk Pure Risk ’āĀCannot be transferred to INSURERS. ’āĀCan be transferred to INSURERS. ’āĀThe LAW OF LARGE NUMBERS not applicable i.e the loss figures can not be predicted. ’āĀThe LAW OF LARGE NUMBERS is applicable i.e the loss figures can be predicted. ’āĀSociety may benefit from the risk. ’āĀSociety may never benefit from the Risk. PURE RISK associated with the great economic and financial insecurity are: ’āĀPersonal Risk ’āĀProperty Risk ’āĀLiability Risk

- 8. Backward & Forward Integration

- 9. DUE TO THE ABOVE RISKS, BUSINESS INTERRUPTION WILL CERTAINLY OCCUR

- 10. DUE TO THE ABOVE FOUR RISKS, BUSINESS INTERRUPTION WILL CERTAINLY OCCUR PLEASE CLICK ON HYPERLINK

- 11. RISKS EXPOSED DURING MANUFACTURING PROCESS The basic raw material used are pig iron, sponge iron, iron ore fines/lumps & Coking Coal/Met Coke (LAMC) ŌĆ£Low Ash Metallurgical coke)

- 12. PLEASE CLICK ON HYPERLINK WE DO NOT SELL INSURANCE POLICY WE ARE PURELY CONSULTANTS

- 13. HOW CAN WE BE OF HELP ?HOW CAN WE BE OF HELP ? RISK AUDIT RISK MANAGEMENT PLAN ’ā╝ Occupational health audit ’ā╝ Safety& Environmental audit RISK ACCOUNTING & FUNDING AND LOSS RECOVERY FROM INSURER ’ā╝ Selection Of Insurer ’ā╝ Analysis of all existing insurance policies in the market. ’ā╝ Rationalize Risk/ Rate Code ’ā╝ Providing guidelines for adequacy of Sum Insured. ’ā╝ Scope of Discounts for reduction of insurance premium cost. APINS PROVIDE COMPLETE RISK MANAGEMENT AS OUTSOURCE OF RISK MANAGEMENT & INSURANCE DEPARTMENT OF YOURS . OTHERS ’ā╝ PREPARATION ’ā╝ ON SITE AUDIT ’ā╝ DISCUSSION ’ā╝ EVALUATION& REPORTING ATTACHED PRESENTATION RISK RETENTION TRANSFER OF RISK PLEASE CLICK ON HYPERLINK

- 14. FOUR WAYS TO DEAL WITH THE RISK RISK REDUCTION OF RISK AVOIDANCE OF RISK RISK RETENTION/ SELF INSURANCE OR FUNDING TRANSFER OF RISK PLEASE CLICK ON HYPERLINK

- 15. HOW CAN WE TRANSFER THE RISK TO INSURANCEHOW CAN WE TRANSFER THE RISK TO INSURANCE COMPANIES/ POOL FUNDS LIKE P & I CLUBS ?COMPANIES/ POOL FUNDS LIKE P & I CLUBS ? Risk like EXPLOSION, FIRE and SPOILAGE can be transferred through a Standard Fire and Special Allied Perils Policy. This policy provides coverage against material damage. For example: Building, Plant and Machinery and Stocks. Risk like MACHINERY BREAKDOWN can be covered through a cover named as Machinery Breakdown Insurance. This policy provides coverage against the breakdown of the equipment. RADIO ACTIVE CONTAMINATION risk can not be transferred to any insurance company. However, some safety measures can be suggested as per the products available in the market. BUSINESS INTERRUPTION LOSS will certainly occur if in any case any of the above stated risk happens to take place. This risk can be transferred through a CONSEQUENTIAL LOSS POLICY. PLEASE CLICK ON HYPERLINK

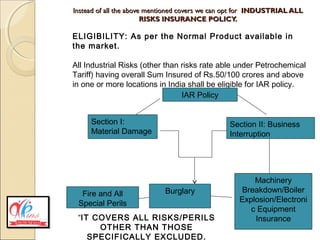

- 16. Instead of all the above mentioned covers we can opt forInstead of all the above mentioned covers we can opt for INDUSTRIAL ALLINDUSTRIAL ALL RISKS INSURANCE POLICY.RISKS INSURANCE POLICY. ELIGIBILITY: As per the Normal Product available in the market. All Industrial Risks (other than risks rate able under Petrochemical Tariff) having overall Sum Insured of Rs.50/100 crores and above in one or more locations in India shall be eligible for IAR policy. IAR Policy Section II: Business Interruption Section I: Material Damage Machinery Breakdown/Boiler Explosion/Electroni c Equipment Insurance BurglaryFire and All Special Perils ŌĆ£IT COVERS ALL RISKS/PERILS OTHER THAN THOSE SPECIFICALLY EXCLUDED.

- 17. DIFFERENCE BETWEENDIFFERENCE BETWEEN STANDARD FIRE & SPECIAL PERILS POLICYSTANDARD FIRE & SPECIAL PERILS POLICY AND IAR POLICYAND IAR POLICY S.No IAR POLICY STANDARD FIRE &SPECIAL PERILS POLICY 1. It is unnamed policy subject to EXCLUSIONS It is a named Perils Policy. 2. It is issued on RIV basis only Whereas, SFSP can be issued on both RIV and Market Value policy. 3. Underinsurance can be waived of upto 15% But here ,the condition of average is strictly applicable.

- 18. About UsAbout Us ’éŚ Apins Consultant Private Limited is working from last three years and has developed an effective tool of Risk Audit to cater the Risk Management Industry.Apins has In-house dedicated team of more than 30 members of Experts including engineers, CAŌĆÖs ,MBAŌĆÖs & industry experience holders etc. ’éŚ Apins has various verticals managed by the experts and experienced persons including an exclusive vertical for the Research on past losses and improvement of Risk Management Process. ’éŚ The team at Apins is also supported byValuable guidance of the senior insurance officers, carrying an experience of above 30 years. ’éŚ Apins utilize expertise knowledge of person associated or linked to the industries as per the requirements. ’éŚ Presently Apins offices are located at Jaipur, Kolkata & many places in Rajasthan, Apins has proposed offices in Gujarat, Delhi & other major cities.

- 19. Our Achievements WE Conducted Risk Audit For PLEASE CLICK ON HYPERLINK

- 20. ’éŚApins is ready to provide you detailed presentation at your door. Please write/ E-mail us. Or ’éŚPlease feel free to call us for subject discussions. Our representative will be happy to render the services to you.

- 21. Contact InformationContact Information We are available at:We are available at: Head Office: Mrs. Ritu Mathur 309-IIIrd Floor Durga Business Center Opposite Hotel Gangour M I Road, Jaipur (Raj.) India Pin 302 001 Phone: +91-0141-3104548/0141- 4028969 Fax: +91-0141-4027969 E-mail: infojaipur@apins.co Corporate Office: Mrs. Preeti Agarwal 12 C, Diamond Heights, 20/1 Chetla Central Road Opposite Chetla Boys School Kolkata (W.B.) India Pin 700 026 Phone: +91-033-24491416 Fax: +91-033-24491416 E-mail: infokolkata@apins.co Corporate Office: Mr. Pawan Gaur Suri Niwas, 150, Guman Pura Kota (Raj.) India Pin 324007 Mob.: +91-9300424152 Mob1.: +91-9300424153 E-mail: infokota@apins.co Corporate Office: Smt. V. Dixit 6B3, JNV Colony, Bikaner(Raj.) India Mob.: +91-9413389414 E-mail: infobikaner@apins.co www.apins.co