Risk modeling prortfolio diversification 4.0

- 1. Which is Safe to Invest Insurance or Technology ? Risk Modeling Portfolio Diversification Time Series Forecasting Nikhil Shrivastava 1

- 2. Executive Summary OBJECTIVE Approach Conclusion Using portfolio diversification and risk modeling techniques determine if Insurance portfolio is less volatile than Tech portfolio Two different techniques were applied, first assuming returns follow Normal Distribution, ARIMA model was used. After plotting residuals to observe heteroscedasticity and conditional variance ARMA+GARCH model was used with Copula It is determined there is 5% chance that Insurance portfolio would lose 1.35 % with expected shortfall of 1.84%. On the other hand there is 5% chance that Tech portfolio would lose 1.83% with expected shortfall of 2.43%. Hence on any next day (period) Insurance is expected to lose less than Tech. 2

- 3. Hypothesis ? Tech industry may experience larger loss than Insurance. Or Tech industry is more volatile than Insurance industry. ? For the purpose of this project, 3 assets in each portfolio are chosen as a representative of the industry. ? It is assumed that ? Insurance industry is only comprised of three Fortune 500 Insurance carriers- Chubb, Travelers and Prudential. ? Tech industry is only comprised of Fortune 500 tech giants ¨C Amazon, Google and Facebook 3

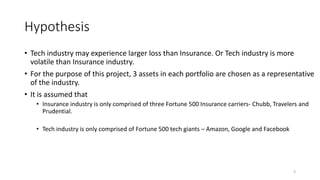

- 4. Data & Plots ? Yahoo finance historical data was obtained for all the companies in both portfolio ? For the purpose of this analysis, ˇ°Adj Closeˇ± price is used. Below two portfolios of assets have been created to further this analysis. ? InsuRet: This is the Insurance portfolio and contains the cleaned complete cases of return series of Chubb, Travelers and Prudential with time series attribute. ? TechRet: This is the Tech portfolio and contains the cleaned complete cases return series of Amazon, Google and Facebook with time series attribute. ? Insuloss = - 1 * InsuRet & TechLoss = -1 * TechRet ? It can be observed that from below histograms that losses are not truly normally distributed, they look leptokurtic 4

- 5. Approach 5 ? Two methods were used to predict the Value at Risk of Portfolio 1. Assuming Return/loss Follow Normal Distribution ? ? ? = ? ?? ?[??] ? ? ? :return on the portfolio, ??:weight of asset ? in the portfolio, ? ?? :expected return of asset ? 2. Plots of all returns/loss showed signs of high kurtosis hence for Non-Normal Distribution used ARMA + GARCH + Copula

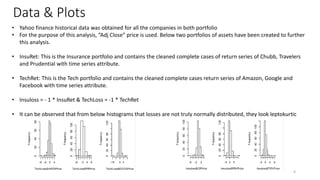

- 6. Value at Risk, VaR - Portfolio 6 ??? = ?0 ??p ? ? 2 = ? ? 2 ?? 2 + ? ? 2 ? ? 2 + ? ? 2 ? ? 2 + 2? ? ?? ? ?? ? ? ? ? + 2? ? ?? ? ?? ? ? ? ? + 2? ? ? ? ? ?? ? ? ? ? ? Results show at 95% confidence interval, there is 5% chance Tech portfolio will lose 2.52% whereas Insurance portfolio will lose 1.38%.

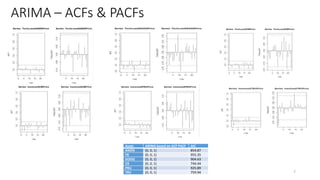

- 7. ARIMA ¨C ACFs & PACFs 7 Asset ARIMA based on ACF PACF AIC AMZN (0, 0, 1) 854.87 FB (0, 0, 1) 955.35 GOOG (0, 0, 1) 904.63 CB (0, 0, 1) 744.44 PRU (0, 0, 1) 925.89 TRV (0, 0, 1) 759.94

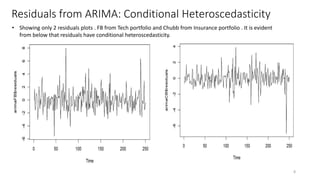

- 8. Residuals from ARIMA: Conditional Heteroscedasticity 8 ? Showing only 2 residuals plots . FB from Tech portfolio and Chubb from Insurance portfolio . It is evident from below that residuals have conditional heteroscedasticity.

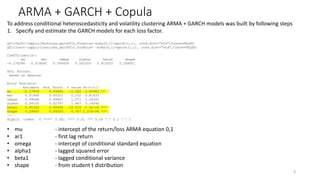

- 9. ARMA + GARCH + Copula 9 To address conditional heteroscedasticity and volatility clustering ARMA + GARCH models was built by following steps 1. Specify and estimate the GARCH models for each loss factor. gfitTech<-lapply(TechLoss,garchFit,formula=~arma(0,1)+garch(1,1), cond.dist="std",trace=FALSE) gfitInsu<-lapply(Insuloss,garchFit,formula= ~arma(0,1)+garch(1,1), cond.dist="std",trace=FALSE) Coefficient(s): mu ma1 omega alpha1 beta1 shape -0.176586 0.014660 0.094656 0.041029 0.915025 3.299001 Std. Errors: based on Hessian Error Analysis: Estimate Std. Error t value Pr(>|t|) mu -0.17659 0.06840 -2.582 0.00983 ** ma1 0.01466 0.06312 0.232 0.81633 omega 0.09466 0.08825 1.073 0.28347 alpha1 0.04103 0.02797 1.467 0.14245 beta1 0.91502 0.05540 16.516 < 2e-16 *** shape 3.29900 0.69503 4.747 2.07e-06 *** --- Signif. codes: 0 ˇ®***ˇŻ 0.001 ˇ®**ˇŻ 0.01 ˇ®*ˇŻ 0.05 ˇ®.ˇŻ 0.1 ˇ® ˇŻ 1 ? mu - intercept of the return/loss ARMA equation 0,1 ? ar1 - first lag return ? omega - intercept of conditional standard equation ? alpha1 - lagged squared error ? beta1 - lagged conditional variance ? shape - from student t distribution

- 10. ARMA + GARCH + Copula 10 2. Estimate Degree-of-freedom parameters for the GARCH model of each asset: gshapeTech<-unlist(lapply(gfitTech, function(x) x@fit$coef[6])) gshapeInsu<-unlist(lapply(gfitInsu, function(x) x@fit$coef[6])) We have to take coefficient that determine the shape, which is 6 in both cases:

- 11. ARMA + GARCH + Copula 11 3. Determine the standardized residuals : gresidTech<-as.matrix(data.frame(lapply(gfitTech,function(x) x@residuals / sqrt(x@h.t)))) gresidInsu<-as.matrix(data.frame(lapply(gfitInsu,function(x) x@residuals / sqrt(x@h.t)))) 4. Calculate the pseudo-uniform variables from the standardized residuals : U_Tech <- sapply(1:3, function(y) pt(gresidTech[, y], df = gshapeTech[y])) U_Insu <- sapply(1:3, function(y) pt(gresidInsu[, y], df = gshapeInsu[y])) 5. Estimate the copula model using kendall method : cop_Tech <- fit.tcopula(Udata = U_Tech, method = "Kendall") cop_Insu <- fit.tcopula(Udata = U_Insu, method = "Kendall") Kendall method describes the joint marginal distribution for the three pseudo-uniform variates. Below mentioned Kendall correlation matrix and nu are obtained :

- 12. ARMA + GARCH + Copula 12 6. Use the dependence structure determined by the estimated copula for generating N data sets of random variates for the pseudo-uniformly distributed variables. Histogram of rcop_Tech and rcop_Insu shows values between 0 and 1 and is uniformly distributed. Examples shown 7. Compute the quantiles for these Monte Carlo draws. qcop_Tech <- sapply(1:3, function(x) qstd(rcop_Tech[, x], nu = gshapeTech[x])) qcop_Insu <- sapply(1:3, function(x) qstd(rcop_Insu[, x], nu = gshapeInsu[x]))

- 13. ARMA + GARCH + Copula 13 8. Create a matix of 1 period ahead predictions of standard deviations. The matrix has 100,000 rows and 3 columns. Labeled the matrix as "ht.mat". Tech_ht.mat <- matrix(gprogTech, nrow = 100000, ncol = ncol(TechLoss), byrow = TRUE) Insu_ht.mat <- matrix(gprogInsu, nrow = 100000, ncol = ncol(Insuloss), byrow = TRUE) 9. Use these quantiles in conjunction with the weight vector to calculate the N portfolio return scenarios. Here weight vector was obtained by global minimum variance portfolio method. Tech_pfall <- (qcop_Tech * Tech_ht.mat) %*% wTech Insu_pfall <- (qcop_Insu * Insu_ht.mat) %*% wInsu 10. Finally, used this series for the calculation Expected Shortfall value of risk for the "global minimum variance portfolio" with 95% confidence. Tech_pfall.es95 <- median(tail(sort(Tech_pfall), 5000)) Tech_pfall.var95 <- min(tail(sort(Tech_pfall), 5000)) Insu_pfall.es95 <- median(tail(sort(Insu_pfall), 5000)) Insu_pfall.var95 <- min(tail(sort(Insu_pfall), 5000)) #For Tech Portfolio TechGMV<-PGMV(Techcov) www<-as.numeric(Weights(TechGMV))/100 wAMZN<-www[1] wFB<-www[2] wGOOG<-www[3] wTech<-c(wAMZN,wFB,wGOOG) #For Insu Portfolio InsuGMV<-PGMV(Insucov) www<-as.numeric(Weights(InsuGMV))/100 wCB<-www[1] wPRU<-www[2] wTRV<-www[3] wInsu <- c(wCB,wPRU,wTRV)

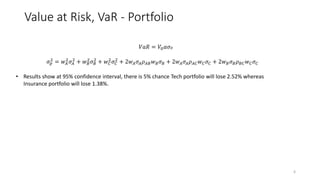

- 14. Results and Conclusion 14 Tech_pfall.es95 # 2.41 Tech_pfall.var95 # 1.83 Insu_pfall.es95 # 1.833 Insu_pfall.var95 #1.353 ? Based on above result we conclude our hypothesis that: ? There is 5% chance that Tech portfolio would lose 1.83% or more on next day (period) with expected shortfall of 2.41%. Meaning average losses could be around 2.41% and ? There is 5% chance that Insurance portfolio would lose 1.35% or more on next day. With average loss of 1.8% ? Comparing it with previous VaR on slide 6, where it was determined that there is 5% chance that Insurance portfolio will lose 1.38% is not huge different but ARMA+GARCH+Copula model is more accurate by .03% ? Similarly comparing for Tech portfolio earlier it was determined it may lose 2.52% where as ARMA+GARCH+Copula determined 1.83% and tell us that earlier the risk was over-estimated ? Hence, Insurance portfolio is safer than Tech portfolio, and as these were representations of Insurance and Tech industry, it is safe to invest in Insurance industry than in Tech industry.

- 15. Future Exploration 15 1. Using Different Methods to Obtain Weights PAveDD() : Portfolio optimization with average draw-down constraint PCDaR() : Portfolio optimization with conditional draw-down at-risk constraint PERC() : equal risk contributed portfolios PGMV() : global minimum variance portfolio PMD() : most diversified portfolio PMTD() : minimum tail-dependent portfolio PMaxDD() : portfolio optimization with maximum draw-down constraint PMinCDaR() : portfolio optimization for minimum conditional draw-down at risk 2. Understanding True Diversification ? Exploration of Asset Classes.

- 16. Thank You 16

![Approach

5

? Two methods were used to predict the Value at Risk of Portfolio

1. Assuming Return/loss Follow Normal Distribution

? ? ? =

?

?? ?[??]

? ? ? :return on the portfolio, ??:weight of asset ? in the portfolio, ? ?? :expected return of asset ?

2. Plots of all returns/loss showed signs of high kurtosis hence for Non-Normal Distribution used

ARMA + GARCH + Copula](https://image.slidesharecdn.com/riskmodelingprortfoliodiversification4-200306123125/85/Risk-modeling-prortfolio-diversification-4-0-5-320.jpg)

![ARMA + GARCH + Copula

10

2. Estimate Degree-of-freedom parameters for the GARCH model of each asset:

gshapeTech<-unlist(lapply(gfitTech, function(x) x@fit$coef[6]))

gshapeInsu<-unlist(lapply(gfitInsu, function(x) x@fit$coef[6]))

We have to take coefficient that determine the shape, which is 6 in both cases:](https://image.slidesharecdn.com/riskmodelingprortfoliodiversification4-200306123125/85/Risk-modeling-prortfolio-diversification-4-0-10-320.jpg)

![ARMA + GARCH + Copula

11

3. Determine the standardized residuals :

gresidTech<-as.matrix(data.frame(lapply(gfitTech,function(x) x@residuals / sqrt(x@h.t))))

gresidInsu<-as.matrix(data.frame(lapply(gfitInsu,function(x) x@residuals / sqrt(x@h.t))))

4. Calculate the pseudo-uniform variables from the standardized residuals :

U_Tech <- sapply(1:3, function(y) pt(gresidTech[, y], df = gshapeTech[y]))

U_Insu <- sapply(1:3, function(y) pt(gresidInsu[, y], df = gshapeInsu[y]))

5. Estimate the copula model using kendall method :

cop_Tech <- fit.tcopula(Udata = U_Tech, method = "Kendall")

cop_Insu <- fit.tcopula(Udata = U_Insu, method = "Kendall")

Kendall method describes the joint marginal distribution for the three pseudo-uniform variates. Below mentioned Kendall

correlation matrix and nu are obtained :](https://image.slidesharecdn.com/riskmodelingprortfoliodiversification4-200306123125/85/Risk-modeling-prortfolio-diversification-4-0-11-320.jpg)

![ARMA + GARCH + Copula

12

6. Use the dependence structure determined by the estimated copula for generating N data sets of random variates for the

pseudo-uniformly distributed variables.

Histogram of rcop_Tech and rcop_Insu shows values between 0 and 1 and is uniformly distributed. Examples shown

7. Compute the quantiles for these Monte Carlo draws.

qcop_Tech <- sapply(1:3, function(x) qstd(rcop_Tech[, x], nu = gshapeTech[x]))

qcop_Insu <- sapply(1:3, function(x) qstd(rcop_Insu[, x], nu = gshapeInsu[x]))](https://image.slidesharecdn.com/riskmodelingprortfoliodiversification4-200306123125/85/Risk-modeling-prortfolio-diversification-4-0-12-320.jpg)

![ARMA + GARCH + Copula

13

8. Create a matix of 1 period ahead predictions of standard deviations. The matrix has 100,000 rows and 3 columns. Labeled

the matrix as "ht.mat".

Tech_ht.mat <- matrix(gprogTech, nrow = 100000, ncol = ncol(TechLoss), byrow = TRUE)

Insu_ht.mat <- matrix(gprogInsu, nrow = 100000, ncol = ncol(Insuloss), byrow = TRUE)

9. Use these quantiles in conjunction with the weight vector to calculate the N portfolio return scenarios. Here weight vector

was obtained by global minimum variance portfolio method.

Tech_pfall <- (qcop_Tech * Tech_ht.mat) %*% wTech

Insu_pfall <- (qcop_Insu * Insu_ht.mat) %*% wInsu

10. Finally, used this series for the calculation Expected Shortfall value of risk for the "global minimum variance portfolio"

with 95% confidence.

Tech_pfall.es95 <- median(tail(sort(Tech_pfall), 5000))

Tech_pfall.var95 <- min(tail(sort(Tech_pfall), 5000))

Insu_pfall.es95 <- median(tail(sort(Insu_pfall), 5000))

Insu_pfall.var95 <- min(tail(sort(Insu_pfall), 5000))

#For Tech Portfolio

TechGMV<-PGMV(Techcov)

www<-as.numeric(Weights(TechGMV))/100

wAMZN<-www[1]

wFB<-www[2]

wGOOG<-www[3]

wTech<-c(wAMZN,wFB,wGOOG)

#For Insu Portfolio

InsuGMV<-PGMV(Insucov)

www<-as.numeric(Weights(InsuGMV))/100

wCB<-www[1]

wPRU<-www[2]

wTRV<-www[3]

wInsu <- c(wCB,wPRU,wTRV)](https://image.slidesharecdn.com/riskmodelingprortfoliodiversification4-200306123125/85/Risk-modeling-prortfolio-diversification-4-0-13-320.jpg)