1 of 180

Download to read offline

Ad

Recommended

direc tv group Feb 22, 2006 Analyst Meeting

direc tv group Feb 22, 2006 Analyst Meetingfinance15

?

The document summarizes DIRECTV's analyst meeting held on February 22, 2006. Michael Palkovic, DIRECTV's CFO, provided an overview of DIRECTV's infrastructure and recent results. By the end of 2007, DIRECTV will have 12 satellites in orbit providing over 3,200 channels, with over half being high definition. DIRECTV currently has 15 million customers, with 2.5 million having DVR and 1 million having HD service. Palkovic also reviewed DIRECTV's customer demographics and geographic composition.direc tv group The DIRECTV Group, Inc. at Merrill Lynch Media & Entertainment...

direc tv group The DIRECTV Group, Inc. at Merrill Lynch Media & Entertainment...finance15

?

1) DIRECTV reported strong second quarter 2006 results with revenue increasing 12% and operating profit before depreciation and amortization increasing 93% compared to the second quarter of 2005.

2) DIRECTV has maintained or increased its share of the industry's gross additions despite new cable competition launching services like high definition and video-on-demand.

3) DIRECTV is improving subscriber quality with a decreasing percentage of higher risk subscribers and increasing percentage of lower risk subscribers.direc tv group Merrill Lynch Media Fall Preview Conference

direc tv group Merrill Lynch Media Fall Preview Conference finance15

?

DIRECTV Latin America is the 4th largest pay-TV platform outside the US with 5.5 million subscribers across Brazil, PanAmericana, and Mexico. The company aims to be the leader in content and technology through securing exclusive sports rights, partnerships, and leveraging the DIRECTV US roadmap. Key metrics like subscribers and ARPU are expected to grow through 2008 and 2009 as the company expands its HD, DVR, broadband, and pre-paid offerings across regions. Financial projections show increasing revenue, operating profit before depreciation and amortization, and cash flow before interest and taxes through 2009.direc tv group Annual Reports 1998

direc tv group Annual Reports 1998finance15

?

Satellite TV dishes on tens of millions of homes and seamless global telephone service are some developing markets driving a $70 billion satellite and wireless industry. Hughes is uniquely positioned to take advantage of opportunities in this industry due to its leadership in satellite and wireless systems, proven record of innovation, strong finances, and highly skilled workforce.2008Q2_google_earnings_slides

2008Q2_google_earnings_slidesfinance15

?

Google reported strong revenue growth of 39% year-over-year for Q2 2008. International revenue grew significantly while search quality improvements and ad quality initiatives continued. Costs remained a focus while investing in opportunities. Free cash flow increased substantially from the prior quarter.anheuser-busch2005AR_MgmntDiscuss

anheuser-busch2005AR_MgmntDiscussfinance15

?

1) Anheuser-Busch reported disappointing financial results for 2005 as net sales increased only 0.7% while earnings per share declined 15.2%.

2) International beer sales increased due to higher volume in China, Canada, and Mexico. Packaging and entertainment operations also saw sales growth.

3) However, domestic beer sales declined 2.5% due to a 1.8% drop in volume and slightly lower revenue per barrel. The company is implementing initiatives to boost domestic sales and market share going forward.anheuser-busch A-Bproxy2007

anheuser-busch A-Bproxy2007finance15

?

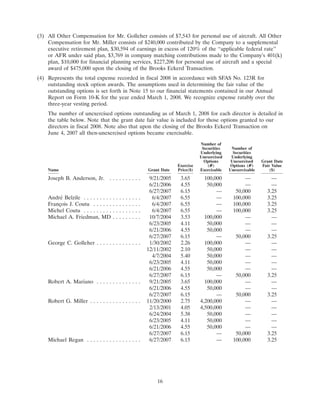

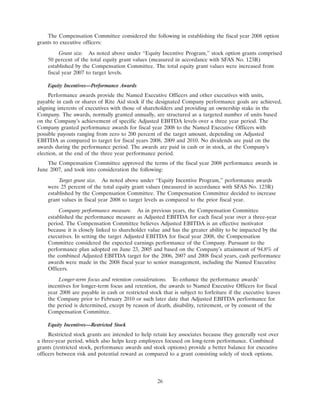

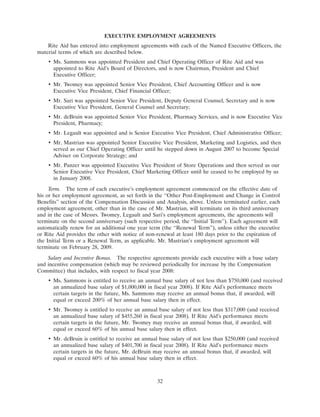

- The document is a proxy statement from Anheuser-Busch Companies, Inc. inviting shareholders to attend the company's Annual Meeting on April 25, 2007 in Orlando, Florida to vote on various agenda items.

- Shareholders will vote on electing six directors, approving new equity and employee stock plans, appointing an accounting firm, and a shareholder proposal regarding charitable contributions reporting. The board recommends voting for all management proposals and against the shareholder proposal.

- The proxy statement provides details on the voting process and recommendations, meeting logistics, director biographies and compensation, and other business to be conducted at the annual meeting.2007_google_proxy_statement

2007_google_proxy_statementfinance15

?

This document is Google's proxy statement and notice for its 2007 annual stockholders meeting. It provides details on the meeting such as date, time, and location as well as items of business to be voted on including election of directors. It also contains information on corporate governance policies, board committees, and stockholder proposal submission deadlines. Stockholders are directed to read this document in its entirety to learn about matters subject to a stockholder vote at the upcoming annual meeting.anheuser-busch 2005AR_InternationalBeerOperations

anheuser-busch 2005AR_InternationalBeerOperationsfinance15

?

Anheuser-Busch has established itself as a leading brewer in China through its Budweiser Wuhan brewery, acquisition of Harbin brewery, and strategic partnership with Tsingtao brewery. China is now the second largest profit contributor to Anheuser-Busch International and has tremendous long-term growth potential as beer consumption increases along with China's economic rise. Anheuser-Busch is well-positioned to capitalize on China's growing beer market through its existing operations and partnerships.anheuser-busch ABProxy2003

anheuser-busch ABProxy2003finance15

?

The document is a proxy statement from Anheuser-Busch Companies, Inc. for its 2003 Annual Meeting of Stockholders. It provides information on the meeting, including details on the five items to be voted on: election of five directors, approval of an amendment to the 1998 Incentive Stock Plan, approval of the Stock Plan for Non-Employee Directors, approval of PricewaterhouseCoopers LLP as independent accountants, and a stockholder proposal. It also answers frequently asked questions about voting procedures and requirements.2007Q4_google_earnings_slides

2007Q4_google_earnings_slidesfinance15

?

- Google reported strong revenue growth of 51% year-over-year and 14% quarter-over-quarter for Q4 2007, driven by growth in Google properties revenue and network revenues.

- Executing on its Search.Ads.Apps strategy led to improved search quality worldwide and better advertiser control and return on investment. Significant progress was also made in mobile with the launch of Android.

- International revenues grew to $2.3 billion in Q4 2007 and accounted for over half of total revenues, demonstrating Google's strong global performance.2008Q4_google_earnings_slides

2008Q4_google_earnings_slidesfinance15

?

Google reported strong Q4 2008 results despite economic challenges:

- Revenue grew 18% year-over-year and 3% quarter-over-quarter to $5.7 billion.

- International revenue reached $2.9 billion, accounting for 50% of total revenue.

- Traffic and revenue remained solid in Q4, and investments continued in search, ads, and newer areas like display, mobile, and enterprise.

- Cost containment efforts aimed to better position Google for long-term growth.2008_google_additional_proxy_materials

2008_google_additional_proxy_materialsfinance15

?

This document is a SEC filing by Google Inc. that supplements its previous proxy statement. It discloses that the SEC staff intends to recommend bringing a civil proceeding against Ann Mather, a Google director, for alleged violations of securities laws related to stock option transactions during her prior employment at Pixar Animation Studios. The recommendation stems from her role as Pixar's CFO, not from her service on Google's board. It provides background on Mather's career and board service at other companies.anheuser-busch 2005AR_NotesToConFinStatement

anheuser-busch 2005AR_NotesToConFinStatementfinance15

?

This document provides notes to the consolidated financial statements of Anheuser-Busch Companies and Subsidiaries. It summarizes the company's significant accounting policies, including principles of consolidation, foreign currency, revenue recognition, delivery costs, advertising and promotional costs, financial derivatives, stock-based compensation, income taxes, inventories, intangible assets, plant and equipment, and research and development costs. The notes disclose details on the company's accounting treatment in key areas and are intended to assist in evaluating the company's consolidated financial statements in accordance with US GAAP.anheuser-busch 2004AR_InvestorOtherInfo

anheuser-busch 2004AR_InvestorOtherInfofinance15

?

This document lists the principal officers and board of directors of Anheuser-Busch Companies, Inc. and its subsidiaries. It provides the names and titles of individuals in leadership positions at the corporate office and various subsidiaries, including Anheuser-Busch, Inc., Anheuser-Busch International, Inc., and Anheuser-Busch Packaging Group, Inc. It also lists the names and brief backgrounds of the members of the board of directors of Anheuser-Busch Companies, Inc.Index

Indexguest30bdff

?

The document discusses several technical topics including GDI, MPI, SI, and FAX. It also lists various product codes, model numbers, and dates. The main topics appear to be different models of electronic components released in 1996 and their corresponding product codes.What is a meteoroid

What is a meteoroidAmy Dickey

?

A meteoroid is a small particle from space, ranging from sand to boulder-sized, which becomes a meteor when it enters a planet's atmosphere and produces light. If it survives the descent and lands on the surface, it is referred to as a meteorite. Various definitions and classifications exist for meteoroids based on size, composition, and orbits, with an estimated 15,000 tonnes entering Earth's atmosphere each year.Podcasting Workflow

Podcasting WorkflowJames Clay

?

Do you want to know what is a podcast, how to podcast and importantly what to podcast, then this is the online conference for you. Covering the workflow in creating, editing and distributing podcasts.O L P C Pune 1st Survey.........

O L P C Pune 1st Survey.........VARUN HIRVE

?

This document summarizes a survey of a potential site for a project near a ZP Primary School in Malavali, Pune. The school is near the Malavali Railway station, has students from standards 1 to 4, a total of 74 students, and 3 teachers. The document provides basic details about the location and operations of the ZP Primary School being surveyed as a potential site for implementation of a new project.20040930_google_10Q

20040930_google_10Qfinance15

?

This document is a Form 10-Q quarterly report filed by Google Inc. with the SEC for the quarter ended September 30, 2004. The summary provides:

- Google reported revenues of $805.9 million for the quarter, up from $393.9 million in the same quarter the previous year. Net income was $52 million compared to $20.4 million.

- Costs and expenses for the quarter were $794.8 million, primarily driven by a $201 million settlement payment to Yahoo.

- As of September 30, 2004, Google held $344.5 million in cash and cash equivalents and $1.5 billion in short-term investments.20050331_google_10Q

20050331_google_10Qfinance15

?

This document is Google's Form 10-Q quarterly report filed with the SEC for the quarter ending March 31, 2005. It includes condensed consolidated financial statements and notes. The financial statements show that for the quarter, Google's revenues increased 93% year-over-year to $1.26 billion, with net income increasing 478% to $369 million. Cash and marketable securities totaled $2.5 billion as of March 31, 2005. Management's discussion and analysis provides details on financial results and business outlook.20050630_google_10Q

20050630_google_10Qfinance15

?

This document is Google's Form 10-Q filing with the SEC for the quarterly period ended June 30, 2005. It includes Google's condensed consolidated balance sheets as of December 31, 2004 and June 30, 2005 (unaudited), as well as condensed consolidated statements of income and cash flows for the three and six month periods ended June 30, 2004 and 2005 (unaudited). Notes to the unaudited condensed consolidated financial statements are also provided. The filing provides key financial information about Google's financial position and performance during the reported periods.20050930_google_10Q

20050930_google_10Qfinance15

?

This document is Google's Form 10-Q filing with the SEC for the quarterly period ended September 30, 2005. It includes Google's condensed consolidated balance sheets as of December 31, 2004 and September 30, 2005, which shows an increase in total assets from $2.7 billion to $8.4 billion over that period. It also includes condensed consolidated statements of income for quarters ended September 30, 2004 and 2005 and condensed consolidated statements of cash flows for the nine month periods ended September 30, 2004 and 2005. The filing also includes notes to the unaudited condensed consolidated financial statements and sections for management's discussion of financial results, market risk disclosures, and controls and procedures.More Related Content

Viewers also liked (15)

anheuser-busch A-Bproxy2007

anheuser-busch A-Bproxy2007finance15

?

- The document is a proxy statement from Anheuser-Busch Companies, Inc. inviting shareholders to attend the company's Annual Meeting on April 25, 2007 in Orlando, Florida to vote on various agenda items.

- Shareholders will vote on electing six directors, approving new equity and employee stock plans, appointing an accounting firm, and a shareholder proposal regarding charitable contributions reporting. The board recommends voting for all management proposals and against the shareholder proposal.

- The proxy statement provides details on the voting process and recommendations, meeting logistics, director biographies and compensation, and other business to be conducted at the annual meeting.2007_google_proxy_statement

2007_google_proxy_statementfinance15

?

This document is Google's proxy statement and notice for its 2007 annual stockholders meeting. It provides details on the meeting such as date, time, and location as well as items of business to be voted on including election of directors. It also contains information on corporate governance policies, board committees, and stockholder proposal submission deadlines. Stockholders are directed to read this document in its entirety to learn about matters subject to a stockholder vote at the upcoming annual meeting.anheuser-busch 2005AR_InternationalBeerOperations

anheuser-busch 2005AR_InternationalBeerOperationsfinance15

?

Anheuser-Busch has established itself as a leading brewer in China through its Budweiser Wuhan brewery, acquisition of Harbin brewery, and strategic partnership with Tsingtao brewery. China is now the second largest profit contributor to Anheuser-Busch International and has tremendous long-term growth potential as beer consumption increases along with China's economic rise. Anheuser-Busch is well-positioned to capitalize on China's growing beer market through its existing operations and partnerships.anheuser-busch ABProxy2003

anheuser-busch ABProxy2003finance15

?

The document is a proxy statement from Anheuser-Busch Companies, Inc. for its 2003 Annual Meeting of Stockholders. It provides information on the meeting, including details on the five items to be voted on: election of five directors, approval of an amendment to the 1998 Incentive Stock Plan, approval of the Stock Plan for Non-Employee Directors, approval of PricewaterhouseCoopers LLP as independent accountants, and a stockholder proposal. It also answers frequently asked questions about voting procedures and requirements.2007Q4_google_earnings_slides

2007Q4_google_earnings_slidesfinance15

?

- Google reported strong revenue growth of 51% year-over-year and 14% quarter-over-quarter for Q4 2007, driven by growth in Google properties revenue and network revenues.

- Executing on its Search.Ads.Apps strategy led to improved search quality worldwide and better advertiser control and return on investment. Significant progress was also made in mobile with the launch of Android.

- International revenues grew to $2.3 billion in Q4 2007 and accounted for over half of total revenues, demonstrating Google's strong global performance.2008Q4_google_earnings_slides

2008Q4_google_earnings_slidesfinance15

?

Google reported strong Q4 2008 results despite economic challenges:

- Revenue grew 18% year-over-year and 3% quarter-over-quarter to $5.7 billion.

- International revenue reached $2.9 billion, accounting for 50% of total revenue.

- Traffic and revenue remained solid in Q4, and investments continued in search, ads, and newer areas like display, mobile, and enterprise.

- Cost containment efforts aimed to better position Google for long-term growth.2008_google_additional_proxy_materials

2008_google_additional_proxy_materialsfinance15

?

This document is a SEC filing by Google Inc. that supplements its previous proxy statement. It discloses that the SEC staff intends to recommend bringing a civil proceeding against Ann Mather, a Google director, for alleged violations of securities laws related to stock option transactions during her prior employment at Pixar Animation Studios. The recommendation stems from her role as Pixar's CFO, not from her service on Google's board. It provides background on Mather's career and board service at other companies.anheuser-busch 2005AR_NotesToConFinStatement

anheuser-busch 2005AR_NotesToConFinStatementfinance15

?

This document provides notes to the consolidated financial statements of Anheuser-Busch Companies and Subsidiaries. It summarizes the company's significant accounting policies, including principles of consolidation, foreign currency, revenue recognition, delivery costs, advertising and promotional costs, financial derivatives, stock-based compensation, income taxes, inventories, intangible assets, plant and equipment, and research and development costs. The notes disclose details on the company's accounting treatment in key areas and are intended to assist in evaluating the company's consolidated financial statements in accordance with US GAAP.anheuser-busch 2004AR_InvestorOtherInfo

anheuser-busch 2004AR_InvestorOtherInfofinance15

?

This document lists the principal officers and board of directors of Anheuser-Busch Companies, Inc. and its subsidiaries. It provides the names and titles of individuals in leadership positions at the corporate office and various subsidiaries, including Anheuser-Busch, Inc., Anheuser-Busch International, Inc., and Anheuser-Busch Packaging Group, Inc. It also lists the names and brief backgrounds of the members of the board of directors of Anheuser-Busch Companies, Inc.Index

Indexguest30bdff

?

The document discusses several technical topics including GDI, MPI, SI, and FAX. It also lists various product codes, model numbers, and dates. The main topics appear to be different models of electronic components released in 1996 and their corresponding product codes.What is a meteoroid

What is a meteoroidAmy Dickey

?

A meteoroid is a small particle from space, ranging from sand to boulder-sized, which becomes a meteor when it enters a planet's atmosphere and produces light. If it survives the descent and lands on the surface, it is referred to as a meteorite. Various definitions and classifications exist for meteoroids based on size, composition, and orbits, with an estimated 15,000 tonnes entering Earth's atmosphere each year.Podcasting Workflow

Podcasting WorkflowJames Clay

?

Do you want to know what is a podcast, how to podcast and importantly what to podcast, then this is the online conference for you. Covering the workflow in creating, editing and distributing podcasts.O L P C Pune 1st Survey.........

O L P C Pune 1st Survey.........VARUN HIRVE

?

This document summarizes a survey of a potential site for a project near a ZP Primary School in Malavali, Pune. The school is near the Malavali Railway station, has students from standards 1 to 4, a total of 74 students, and 3 teachers. The document provides basic details about the location and operations of the ZP Primary School being surveyed as a potential site for implementation of a new project.More from finance15 (20)

20040930_google_10Q

20040930_google_10Qfinance15

?

This document is a Form 10-Q quarterly report filed by Google Inc. with the SEC for the quarter ended September 30, 2004. The summary provides:

- Google reported revenues of $805.9 million for the quarter, up from $393.9 million in the same quarter the previous year. Net income was $52 million compared to $20.4 million.

- Costs and expenses for the quarter were $794.8 million, primarily driven by a $201 million settlement payment to Yahoo.

- As of September 30, 2004, Google held $344.5 million in cash and cash equivalents and $1.5 billion in short-term investments.20050331_google_10Q

20050331_google_10Qfinance15

?

This document is Google's Form 10-Q quarterly report filed with the SEC for the quarter ending March 31, 2005. It includes condensed consolidated financial statements and notes. The financial statements show that for the quarter, Google's revenues increased 93% year-over-year to $1.26 billion, with net income increasing 478% to $369 million. Cash and marketable securities totaled $2.5 billion as of March 31, 2005. Management's discussion and analysis provides details on financial results and business outlook.20050630_google_10Q

20050630_google_10Qfinance15

?

This document is Google's Form 10-Q filing with the SEC for the quarterly period ended June 30, 2005. It includes Google's condensed consolidated balance sheets as of December 31, 2004 and June 30, 2005 (unaudited), as well as condensed consolidated statements of income and cash flows for the three and six month periods ended June 30, 2004 and 2005 (unaudited). Notes to the unaudited condensed consolidated financial statements are also provided. The filing provides key financial information about Google's financial position and performance during the reported periods.20050930_google_10Q

20050930_google_10Qfinance15

?

This document is Google's Form 10-Q filing with the SEC for the quarterly period ended September 30, 2005. It includes Google's condensed consolidated balance sheets as of December 31, 2004 and September 30, 2005, which shows an increase in total assets from $2.7 billion to $8.4 billion over that period. It also includes condensed consolidated statements of income for quarters ended September 30, 2004 and 2005 and condensed consolidated statements of cash flows for the nine month periods ended September 30, 2004 and 2005. The filing also includes notes to the unaudited condensed consolidated financial statements and sections for management's discussion of financial results, market risk disclosures, and controls and procedures.20060630_google_10Q

20060630_google_10Qfinance15

?

This document is Google Inc.'s Form 10-Q filing for the quarterly period ended June 30, 2006. It provides financial statements and disclosures including the condensed consolidated balance sheet, statements of income, and statements of cash flows. Revenues increased significantly year-over-year to $2.46 billion for the quarter due to growth in advertising revenues. Net income for the quarter was $721.1 million, also up significantly from the prior year.20060930_google_10Q

20060930_google_10Qfinance15

?

- The document is Google Inc.'s Form 10-Q filing with the SEC for the quarter ended September 30, 2006.

- It provides Google's condensed consolidated financial statements, including balance sheets, income statements, and cash flow statements for the periods presented.

- The financial statements show Google's revenues increased to $2.7 billion for the quarter from $1.6 billion in the prior year, while net income increased to $733 million from $381 million.2006Q3_google_earnings_slides

2006Q3_google_earnings_slidesfinance15

?

- The document discusses Google's Q3 2006 earnings conference call, reporting 70% year-over-year revenue growth and 10% quarter-over-quarter growth driven by increased monetization and traffic.

- Operating income and net income reached record levels, and the company continued investing in products and infrastructure while forming new partnerships.

- Google agreed to acquire YouTube for $1.65 billion in stock, hoping to enable anyone to upload, watch and share videos worldwide.2006Q4_google_earnings_slides

2006Q4_google_earnings_slidesfinance15

?

Google reported strong financial results for Q4 2006 with 67% year-over-year revenue growth and 19% quarter-over-quarter growth. Revenues increased due to a healthy holiday season with strong traffic growth as well as international revenue growth, particularly in Germany and France. Costs and expenses grew but Google continued investing aggressively in employees and infrastructure for long term success. Non-GAAP net income was $997.3 million, up 23% from the previous quarter.2007Q1_google_earnings_slides

2007Q1_google_earnings_slidesfinance15

?

Google reported strong revenue growth in Q1 2007, with revenue up 63% year-over-year and 14% quarter-over-quarter. International markets contributed significantly to revenue growth. Non-GAAP net income was $1.16 billion, with continued investments in infrastructure and employees. Google also announced an agreement to acquire DoubleClick during the quarter.2007Q2_google_earnings_slides

2007Q2_google_earnings_slidesfinance15

?

Google reported strong revenue growth of 58% year-over-year and 6% quarter-over-quarter for Q2 2007. Investments in hiring and infrastructure remained priorities. Google continued to lead in search and ads while launching new products. International revenue increased significantly in key markets like Spain, Italy and France.20070930_google_10Q

20070930_google_10Qfinance15

?

- The document is Google Inc.'s Form 10-Q filing with the SEC for the quarterly period ended September 30, 2007.

- It provides Google's consolidated financial statements including balance sheets, income statements, and cash flow statements for interim periods.

- The financial statements show Google's revenues increased over the comparable prior year periods as did costs and expenses, resulting in increased income from operations and net income.2007Q3_google_earnings_slides

2007Q3_google_earnings_slidesfinance15

?

- Google reported revenue growth of 57% year-over-year and 9% quarter-over-quarter for Q3 2007, driven by increases in Google properties revenue and network revenues.

- International markets continued to show strong growth, accounting for over 50% of total revenue.

- The company continued executing on its Search.Ads.Apps strategy and expanding its product offerings.2008Q1_google_earnings_slides

2008Q1_google_earnings_slidesfinance15

?

Google reported strong financial results for Q1 2008 with revenue growth of 42% year-over-year and 7% quarter-over-quarter. Revenue from Google properties grew 49% year-over-year driven by growth in search and international markets. Operating expenses increased but margins remained high at 30% due to operational discipline. Free cash flow was $938 million for the quarter.2008Q3_google_earnings_slides

2008Q3_google_earnings_slidesfinance15

?

- Revenue grew 31% year-over-year and 3% quarter-over-quarter to $5.5 billion, with international revenue reaching $2.8 billion.

- Despite economic challenges, traffic and revenue remained solid in Q3 due to investments in core search and ads businesses.

- Operating margin was 30% under GAAP and 37% non-GAAP, with net income of $1.29 billion GAAP and $1.56 billion non-GAAP.Ad

Recently uploaded (20)

Economic security of a logistics company: financial, marketing, and environme...

Economic security of a logistics company: financial, marketing, and environme...Igor Britchenko

?

This paper explores the multifaceted nature of economic security for logistics companies by examining three interdependent dimensions: financial, marketing, and environmental. Each of these pillars contributes to the company¨s stability, growth potential, and adaptability in a dynamic business environment. Financial management ensures resource optimization and risk mitigation; marketing strategies support revenue generation and brand differentiation; and environmental sustainability enhances operational efficiency and regulatory compliance. By analyzing these aspects, the authors provides recommendations for logistics companies to enhance resilience, profitability, and long-term sustainability in a rapidly evolving global market.Invoice Factoring Broker Training | Charter Capital

Invoice Factoring Broker Training | Charter CapitalKeith Mabe

?

If you are new to brokering invoice factoring deals. Here is a quick primer to get you started.Shivsrushti¨s Cultural Revival Backed Strongly by Abhay Bhutada Foundation.pdf

Shivsrushti¨s Cultural Revival Backed Strongly by Abhay Bhutada Foundation.pdfLokesh Agrawal

?

Shivsrushti, a cultural theme park near Pune dedicated to the legacy of Chhatrapati Shivaji Maharaj, has received strong and consistent support from the Abhay Bhutada Foundation. Under the guidance of historian Babasaheb Purandare, the park blends traditional fort replicas with modern technology like augmented reality and interactive exhibits to make history come alive. The Foundation¨s contributions have enabled operational upgrades, improved access for underprivileged students, and introduced mobile museums that take cultural learning to remote areas. Through hands-on workshops and community involvement, Shivsrushti promotes both education and local skill development. With plans for digital centres and cultural exchange, the Foundation¨s long-term commitment is helping transform the park into a vibrant, forward-looking hub of historical learning.2025 RWA Report: When Crypto Gets Real | CoinGecko

2025 RWA Report: When Crypto Gets Real | CoinGeckoCoinGecko Research

?

The revival of real world assets (RWA) in crypto marked one of 2024¨s most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

We¨ve summarized the key highlights, but be sure to dig into the full 18 slides below.HUMAN BEHAVIOR cultural intelligence and global leadeership.pptx

HUMAN BEHAVIOR cultural intelligence and global leadeership.pptxzeriannebochorno

?

human behavior organizationThe Ultimate Guide to Buy Verified LinkedIn Accounts.docx

The Ultimate Guide to Buy Verified LinkedIn Accounts.docxBuy Verified Linkedin Accounts

?

Now, We providing verified LinkedIn accounts designed for businesses and professionals aiming to enhance their online presence and networking capabilities. These accounts are fully verified, secure, and perfect for marketing, recruitment, or expanding your professional network. 2025 RWA Report: When Crypto Gets Real | CoinGecko

2025 RWA Report: When Crypto Gets Real | CoinGeckoCoinGecko Research

?

The revival of real world assets (RWA) in crypto marked one of 2024¨s most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

We¨ve summarized the key highlights, but be sure to dig into the full 18 slides below.Analytical procedures for audit and assurance

Analytical procedures for audit and assuranceNguytHi7

?

Didu nay iluoc sua.d6i theo-quy dinh tai Dieu 1 cua euytit dinh s6 t146l2004/eDN[{NN vd vi6c sua a6i oiau z quyciainl s6 +lstzooatqo NHt[\r 2gt4t2oo4 cira thdng ioc

Ngan hang Nhd nu6c ban hdnh HO th5ng tiri khoan k6 toan c6c T6 chric tin dung, c6 hi0u luc

kd tu ngdy 04 thaag 10 nlm 2004Family Owned Business Succession/Estate Planning

Family Owned Business Succession/Estate Planningimccci

?

Family Owned Business Succession/Estate PlanningIssues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehtaimccci

?

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Ad