Ruby

Download as xlsx, pdf0 likes211 views

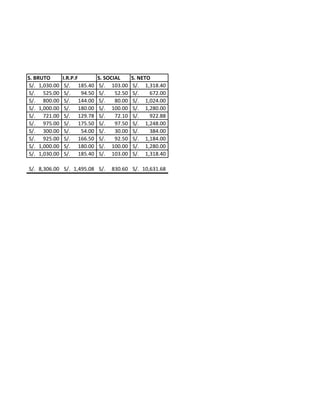

The document contains a payroll table listing 10 employees with their department, position, base salary, hours worked, and additional pay if applicable. It also includes totals for base salary and additional pay. A second section outlines payroll taxes and deductions for retirement, healthcare, and taxes that are applied to employees' gross salary to determine their net salary. Calculations are provided for a sample employee's gross salary before taxes, taxes and social security withheld, and final net salary received.

1 of 2

Download to read offline

Ad

Recommended

Resultado

Resultadomdione

Ėý

This document is a list of 114 people who have been called for an interview for the nursing program at the Jorge Amado University Center in Salvador, Brazil in 2009. It provides the registration number, full name, and identification number for each candidate who has been called.Form 22 a shorter notice to call agm and egm

Form 22 a shorter notice to call agm and egmsatyasivadarshan

Ėý

This document provides consent from a shareholder for a company to hold an Extraordinary General Meeting (EGM) on shorter notice than required by law. The shareholder owns 10,000 fully paid equity shares of the company and is giving their consent, along with their nominees, for the company to hold the EGM on November 12, 2007 pursuant to Section 171(2) of the Companies Act of 1956, which allows for shorter notice periods with shareholder approval. The consent is signed by a director of the shareholder company.Clase 04 10 2009 Tutorial+šÝšÝßĢsharePAULA

Ėý

Este documento proporciona instrucciones paso a paso para insertar una presentaciÃģn de diapositivas propia o ajena en un blog. Primero, los estudiantes deben crear una presentaciÃģn con PowerPoint y guardarla en su ordenador. Luego, deben registrarse en šÝšÝßĢShare y cargar su presentaciÃģn allÃ. Finalmente, deben copiar el cÃģdigo embed o el enlace URL de la presentaciÃģn de šÝšÝßĢShare e insertarlo en una nueva entrada de su blog. El documento explica el proceso de registro, carga y publicaciÃģn de presentaciones en šÝšÝßĢShare, asà como laColumnas PeriodÃSticasPAULA

Ėý

El documento describe la capacidad de MS Word 2007 para crear textos con mÚltiples columnas, conocido como formato periodÃstico. Explica que para crear un texto periodÃstico se debe escribir el contenido, seleccionarlo y luego elegir la cantidad de columnas deseadas usando la cinta de opciones de pÃĄgina.Funciones HiperbolicasPAULA

Ėý

El documento describe las funciones hiperbÃģlicas, incluyendo sus definiciones, grÃĄficas, dominios y rangos, y propiedades. Define el coseno y seno hiperbÃģlico en tÃĐrminos de exponenciales y explica cÃģmo estas funciones se relacionan con la hipÃĐrbola unitaria. TambiÃĐn cubre identidades clave y las funciones hiperbÃģlicas inversas.2024 Trend Updates: What Really Works In SEO & Content Marketing

2024 Trend Updates: What Really Works In SEO & Content MarketingSearch Engine Journal

Ėý

The document outlines key SEO and content marketing trends for 2024, emphasizing the impact of AI, the importance of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness), and a shift towards user-centric content strategies. It advises against focusing on outdated trends like voice search and stresses the need for creating value-driven, authoritative content. Additionally, it highlights the need to leverage AI as a supportive tool rather than relying solely on it for content creation.Storytelling For The Web: Integrate Storytelling in your Design Process

Storytelling For The Web: Integrate Storytelling in your Design ProcessChiara Aliotta

Ėý

The document outlines a livestream presentation by Chiara Aliotta on integrating storytelling into web design to enhance user experiences. It covers the storytelling process for designers, emphasizing aspects such as understanding the audience, structuring narratives, and creating emotional connections. The presentation also includes case studies and practical examples to demonstrate effective storytelling in UX/UI design.The Growing Value and Application of FME & GenAI

The Growing Value and Application of FME & GenAISafe Software

Ėý

With the cost of using Generative AI services dropping exponentially and the array of available models continually expanding, integrating AI into FME workflows has become inexpensive, accessible and effective. This presentation explores how GenAI within FME can cost-effectively transform data workflows by automating data extraction, validation, classification and augmentation tasks. Weâll discuss how FMEâs no-code flexibility enables users to combine Generative AI and Computer Vision tools that create efficient workflows tailored to specific challenges. Using recent practical examples, weâll demonstrate how these integrations can simplify complex tasks, save time and enhance data quality.Raman Bhaumik - Passionate Tech Enthusiast

Raman Bhaumik - Passionate Tech EnthusiastRaman Bhaumik

Ėý

A Junior Software Developer with a flair for innovation, Raman Bhaumik excels in delivering scalable web solutions. With three years of experience and a solid foundation in Java, Python, JavaScript, and SQL, she has streamlined task tracking by 20% and improved application stability.Lessons Learned from Developing Secure AI Workflows.pdf

Lessons Learned from Developing Secure AI Workflows.pdfPriyanka Aash

Ėý

Lessons Learned from Developing Secure AI WorkflowsQuantum AI Discoveries: Fractal Patterns Consciousness and Cyclical Universes

Quantum AI Discoveries: Fractal Patterns Consciousness and Cyclical UniversesSaikat Basu

Ėý

Embark on a cosmic journey exploring the intersection of quantum

computing, consciousness, and ancient wisdom. Together we'll uncover the

recursive patterns that bind our reality.Connecting Data and Intelligence: The Role of FME in Machine Learning

Connecting Data and Intelligence: The Role of FME in Machine LearningSafe Software

Ėý

In this presentation, we want to explore powerful data integration and preparation for Machine Learning. FME is known for its ability to manipulate and transform geospatial data, connecting diverse data sources into efficient and automated workflows. By integrating FME with Machine Learning techniques, it is possible to transform raw data into valuable insights faster and more accurately, enabling intelligent analysis and data-driven decision making."How to survive Black Friday: preparing e-commerce for a peak season", Yurii ...

"How to survive Black Friday: preparing e-commerce for a peak season", Yurii ...Fwdays

Ėý

We will explore how e-commerce projects prepare for the busiest time of the year, which key aspects to focus on, and what to expect. Weâll share our experience in setting up auto-scaling, load balancing, and discuss the loads that Silpo handles, as well as the solutions that help us navigate this season without failures.EIS-Webinar-Engineering-Retail-Infrastructure-06-16-2025.pdf

EIS-Webinar-Engineering-Retail-Infrastructure-06-16-2025.pdfEarley Information Science

Ėý

As AI reshapes expectations in retail and B2B commerce, organizations are recognizing a critical reality: meaningful AI outcomes depend on well-structured, adaptable infrastructure. In this session, Seth Earley is joined by Phil Ryan - AI strategist, search technologist, and founder of Glass Leopard Technologies - for a candid conversation on what it truly means to engineer systems for scale, agility, and intelligence.

Phil draws on more than two decades of experience leading search and AI initiatives for enterprise organizations. Together, he and Seth explore the challenges businesses face when legacy architectures limit personalization, agility, and real-time decisioning - and what needs to change to support agentic technologies and next-best-action capabilities.

Key themes from the webinar include:

Composability as a prerequisite for AIĖý- Why modular, loosely coupled systems are essential for adapting to rapid innovation and evolving business needs

Search and relevance as foundational to AIĖý- How techniques honed-in enterprise search have laid the groundwork for more responsive and intelligent customer experiences

From MDM and CDP to agentic systemsĖý- How data platforms are evolving to support richer customer context and dynamic orchestration

Engineering for business alignmentĖý- Why successful AI programs require architectural decisions grounded in measurable outcomes

The conversation is practical and forward-looking, connecting deep technical understanding with real-world business needs. Whether youâre modernizing your commerce stack or exploring how AI can enhance product discovery, personalization, or customer journeys, this session provides a clear-eyed view of the capabilities, constraints, and priorities that matter most.A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and Privacy.pdf

A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and Privacy.pdfPriyanka Aash

Ėý

A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and PrivacyCracking the Code - Unveiling Synergies Between Open Source Security and AI.pdf

Cracking the Code - Unveiling Synergies Between Open Source Security and AI.pdfPriyanka Aash

Ėý

Cracking the Code - Unveiling Synergies Between Open Source Security and AIQuantum AI: Where Impossible Becomes Probable

Quantum AI: Where Impossible Becomes ProbableSaikat Basu

Ėý

Imagine combining the "brains" of Artificial Intelligence (AI) with the "super muscles" of Quantum Computing. That's Quantum AI!

It's a new field that uses the mind-bending rules of quantum physics to make AI even more powerful.Wenn alles versagt - IBM Tape schÞtzt, was zÃĪhlt! Und besonders mit dem neust...

Wenn alles versagt - IBM Tape schÞtzt, was zÃĪhlt! Und besonders mit dem neust...Josef Weingand

Ėý

IBM LTO10cnc-processing-centers-centateq-p-110-en.pdf

cnc-processing-centers-centateq-p-110-en.pdfAmirStern2

Ėý

ŨŨĻŨŨ ŨĒŨŨŨŨŨŨ ŨŠŨĒŨĐŨŨŨŠŨ ŨŨĒŨ 3/4/5 ŨĶŨŨĻŨŨ, ŨĒŨ 22 ŨŨŨŨĪŨŨŠ ŨŨŨŨ ŨĒŨ ŨŨ ŨŨĪŨĐŨĻŨŨŨŨŠ ŨŨĒŨŨŨŨ ŨŨŨĻŨŨĐŨŨŠ.ĖýŨŨĒŨ ŨĐŨŨ ŨĒŨŨŨŨ ŨŨŨŨ ŨŨŨŨĐŨ Ũ ŨŨ ŨŨ§Ũ ŨŨŨĪŨĒŨŨ ŨŨĐŨĪŨ ŨŨĒŨŨĻŨŨŠ/ŨĻŨŨĄŨŨŠ/ŨŨ ŨŨŨŨŠ/ŨĄŨĪŨĻŨŨŨŠ/ŨĒŨĻŨŨŨŠ ŨŨĒŨŨ..

ŨŨĄŨŨŨ ŨŨŨĶŨĒ ŨĪŨĒŨŨŨŨŠ ŨĒŨŨŨŨ ŨĐŨŨ ŨŨŠ ŨŨŨŠŨŨŨŨŨŠ ŨŨĒŨ ŨĪŨŨ ŨĐŨŨ ŨŨ: Ũ§ŨŨŨŨ ŨŨ ŨŨ, ŨŨŨĪŨ§Ũ, Ũ ŨŨĄŨŨĻ, ŨŨŨĻŨĄŨŨ ŨŨ ŨŨ.Techniques for Automatic Device Identification and Network Assignment.pdf

Techniques for Automatic Device Identification and Network Assignment.pdfPriyanka Aash

Ėý

Techniques for Automatic Device Identification and Network AssignmentAgentic AI for Developers and Data Scientists Build an AI Agent in 10 Lines o...

Agentic AI for Developers and Data Scientists Build an AI Agent in 10 Lines o...All Things Open

Ėý

Presented at All Things Open RTP Meetup

Presented by William Hill - Developer Advocate, NVIDIA

Title: Agentic AI for Developers and Data Scientists

Build an AI Agent in 10 Lines of Code and the Concepts Behind the Code

Abstract: In this talk we will demonstrate building a working data science AI agent in 10 lines of basic Python code in a Colab notebook. Our AI Agent will perform LLM prompt-driven visual analysis using open-source libraries. In this session we will show how to develop an AI Agent using GPUs through NVIDIAâs developer program and Google Colab notebooks. After coding our AI Agent, we will break down the 10 lines of code. We will show the key components and open source library integrations that enable the agent's functionality, focusing on practical implementation details and then the theoretical concepts. The presentation concludes with a survey of current LLM technologies and the latest trends in developing AI applications for enthusiasts and enterprisesUsing the SQLExecutor for Data Quality Management: aka One man's love for the...

Using the SQLExecutor for Data Quality Management: aka One man's love for the...Safe Software

Ėý

The SQLExecutor is one of FMEâs most powerful and flexible transformers. Pivvot maintains a robust internal metadata hierarchy used to support ingestion and curation of thousands of external data sources that must be managed for quality before entering our platform. By using the SQLExecutor, Pivvot can efficiently detect problems and perform analysis before data is extracted from our staging environment, removing the need for rollbacks or cycles waisted on a failed job. This presentation will walk through three distinct examples of how Pivvot uses the SQLExecutor to engage its metadata hierarchy and integrate with its Data Quality Management workflows efficiently and within the source postgres database. Spatial Validation âValidating spatial prerequisites before entering a production environment. Reference Data Validation - Dynamically validate domain-ed columns across any table and multiple columns per table. Practical De-duplication - Removing identical or near-identical well point locations from two distinct source datasets in the same table.Coordinated Disclosure for ML - What's Different and What's the Same.pdf

Coordinated Disclosure for ML - What's Different and What's the Same.pdfPriyanka Aash

Ėý

Coordinated Disclosure for ML - What's Different and What's the SameThe Future of Product Management in AI ERA.pdf

The Future of Product Management in AI ERA.pdfAlyona Owens

Ėý

Hi, Iâm Aly Owens, I have a special pleasure to stand here as over a decade ago I graduated from CityU as an international student with an MBA program. I enjoyed the diversity of the school, ability to work and study, the network that came with being here, and of course the price tag for students here has always been more affordable than most around.

Since then I have worked for major corporations like T-Mobile and Microsoft and many more, and I have founded a startup. I've also been teaching product management to ensure my students save time and money to get to the same level as me faster avoiding popular mistakes. Today as Iâve transitioned to teaching and focusing on the startup, I hear everybody being concerned about Ai stealing their jobsâĶ Weâll talk about it shortly.

But before that, I want to take you back to 1997. One of my favorite movies is âFifth Elementâ. It wowed me with futuristic predictions when I was a kid and Iâm impressed by the number of these predictions that have already come true. Self-driving cars, video calls and smart TV, personalized ads and identity scanning. Sci-fi movies and books gave us many ideas and some are being implemented as we speak. But we often get ahead of ourselves:

Flying cars,Colonized planets, Human-like AI: not yet, Time travel, Mind-machine neural interfaces for everyone: Only in experimental stages (e.g. Neuralink).

Cyberpunk dystopias: Some vibes (neon signs + inequality + surveillance), but not total dystopia (thankfully).

On the bright side, we predict that the working hours should drop as Ai becomes our helper and there shouldnât be a need to work 8 hours/day. Nobody knows for sure but we can require that from legislation. Instead of waiting to see what the government and billionaires come up with, I say we should design our own future.

So, we as humans, when we donât know something - fear takes over. The same thing happened during the industrial revolution. In the Industrial Era, machines didnât steal jobsâthey transformed them but people were scared about their jobs. The AI era is making similar changes except it feels like robots will take the center stage instead of a human. First off, even when it comes to the hottest space in the military - drones, Ai does a fraction of work. AI algorithms enable real-time decision-making, obstacle avoidance, and mission optimization making drones far more autonomous and capable than traditional remote-controlled aircraft. Key technologies include computer vision for object detection, GPS-enhanced navigation, and neural networks for learning and adaptation. But guess what? There are only 2 companies right now that utilize Ai in drones to make autonomous decisions - Skydio and DJI.

OpenACC and Open Hackathons Monthly Highlights June 2025

OpenACC and Open Hackathons Monthly Highlights June 2025OpenACC

Ėý

The OpenACC organization focuses on enhancing parallel computing skills and advancing interoperability in scientific applications through hackathons and training. The upcoming 2025 Open Accelerated Computing Summit (OACS) aims to explore the convergence of AI and HPC in scientific computing and foster knowledge sharing. This year's OACS welcomes talk submissions from a variety of topics, from Using Standard Language Parallelism to Computer Vision Applications. The document also highlights several open hackathons, a call to apply for NVIDIA Academic Grant Program and resources for optimizing scientific applications using OpenACC directives.Securing Account Lifecycles in the Age of Deepfakes.pptx

Securing Account Lifecycles in the Age of Deepfakes.pptxFIDO Alliance

Ėý

Securing Account Lifecycles in the Age of DeepfakesArtificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...

Artificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...OECD Directorate for Financial and Enterprise Affairs

Ėý

This presentation by Thibault Schrepel, Associate Professor of Law at Vrije Universiteit Amsterdam University, was made during the discussion âArtificial Intelligence, Data and Competitionâ held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/aicomp.

This presentation was uploaded with the authorâs consent.

How to Leverage AI to Boost Employee Wellness - Lydia Di Francesco - SocialHR...

How to Leverage AI to Boost Employee Wellness - Lydia Di Francesco - SocialHR...SocialHRCamp

Ėý

The document discusses leveraging AI to enhance employee wellness through data analytics, automating tasks, and personalized wellness apps, emphasizing the shared responsibility of employee well-being between leaders and organizations. It outlines best practices for using AI in wellness strategies, including ensuring data privacy and security, understanding employee needs, and promoting inclusivity. Lydia Di Francesco, a wellness specialist, shares insights to optimize workplace wellness strategy using AI-driven data analytics and encourages collaboration and transparency.More Related Content

Recently uploaded (20)

The Growing Value and Application of FME & GenAI

The Growing Value and Application of FME & GenAISafe Software

Ėý

With the cost of using Generative AI services dropping exponentially and the array of available models continually expanding, integrating AI into FME workflows has become inexpensive, accessible and effective. This presentation explores how GenAI within FME can cost-effectively transform data workflows by automating data extraction, validation, classification and augmentation tasks. Weâll discuss how FMEâs no-code flexibility enables users to combine Generative AI and Computer Vision tools that create efficient workflows tailored to specific challenges. Using recent practical examples, weâll demonstrate how these integrations can simplify complex tasks, save time and enhance data quality.Raman Bhaumik - Passionate Tech Enthusiast

Raman Bhaumik - Passionate Tech EnthusiastRaman Bhaumik

Ėý

A Junior Software Developer with a flair for innovation, Raman Bhaumik excels in delivering scalable web solutions. With three years of experience and a solid foundation in Java, Python, JavaScript, and SQL, she has streamlined task tracking by 20% and improved application stability.Lessons Learned from Developing Secure AI Workflows.pdf

Lessons Learned from Developing Secure AI Workflows.pdfPriyanka Aash

Ėý

Lessons Learned from Developing Secure AI WorkflowsQuantum AI Discoveries: Fractal Patterns Consciousness and Cyclical Universes

Quantum AI Discoveries: Fractal Patterns Consciousness and Cyclical UniversesSaikat Basu

Ėý

Embark on a cosmic journey exploring the intersection of quantum

computing, consciousness, and ancient wisdom. Together we'll uncover the

recursive patterns that bind our reality.Connecting Data and Intelligence: The Role of FME in Machine Learning

Connecting Data and Intelligence: The Role of FME in Machine LearningSafe Software

Ėý

In this presentation, we want to explore powerful data integration and preparation for Machine Learning. FME is known for its ability to manipulate and transform geospatial data, connecting diverse data sources into efficient and automated workflows. By integrating FME with Machine Learning techniques, it is possible to transform raw data into valuable insights faster and more accurately, enabling intelligent analysis and data-driven decision making."How to survive Black Friday: preparing e-commerce for a peak season", Yurii ...

"How to survive Black Friday: preparing e-commerce for a peak season", Yurii ...Fwdays

Ėý

We will explore how e-commerce projects prepare for the busiest time of the year, which key aspects to focus on, and what to expect. Weâll share our experience in setting up auto-scaling, load balancing, and discuss the loads that Silpo handles, as well as the solutions that help us navigate this season without failures.EIS-Webinar-Engineering-Retail-Infrastructure-06-16-2025.pdf

EIS-Webinar-Engineering-Retail-Infrastructure-06-16-2025.pdfEarley Information Science

Ėý

As AI reshapes expectations in retail and B2B commerce, organizations are recognizing a critical reality: meaningful AI outcomes depend on well-structured, adaptable infrastructure. In this session, Seth Earley is joined by Phil Ryan - AI strategist, search technologist, and founder of Glass Leopard Technologies - for a candid conversation on what it truly means to engineer systems for scale, agility, and intelligence.

Phil draws on more than two decades of experience leading search and AI initiatives for enterprise organizations. Together, he and Seth explore the challenges businesses face when legacy architectures limit personalization, agility, and real-time decisioning - and what needs to change to support agentic technologies and next-best-action capabilities.

Key themes from the webinar include:

Composability as a prerequisite for AIĖý- Why modular, loosely coupled systems are essential for adapting to rapid innovation and evolving business needs

Search and relevance as foundational to AIĖý- How techniques honed-in enterprise search have laid the groundwork for more responsive and intelligent customer experiences

From MDM and CDP to agentic systemsĖý- How data platforms are evolving to support richer customer context and dynamic orchestration

Engineering for business alignmentĖý- Why successful AI programs require architectural decisions grounded in measurable outcomes

The conversation is practical and forward-looking, connecting deep technical understanding with real-world business needs. Whether youâre modernizing your commerce stack or exploring how AI can enhance product discovery, personalization, or customer journeys, this session provides a clear-eyed view of the capabilities, constraints, and priorities that matter most.A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and Privacy.pdf

A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and Privacy.pdfPriyanka Aash

Ėý

A Constitutional Quagmire - Ethical Minefields of AI, Cyber, and PrivacyCracking the Code - Unveiling Synergies Between Open Source Security and AI.pdf

Cracking the Code - Unveiling Synergies Between Open Source Security and AI.pdfPriyanka Aash

Ėý

Cracking the Code - Unveiling Synergies Between Open Source Security and AIQuantum AI: Where Impossible Becomes Probable

Quantum AI: Where Impossible Becomes ProbableSaikat Basu

Ėý

Imagine combining the "brains" of Artificial Intelligence (AI) with the "super muscles" of Quantum Computing. That's Quantum AI!

It's a new field that uses the mind-bending rules of quantum physics to make AI even more powerful.Wenn alles versagt - IBM Tape schÞtzt, was zÃĪhlt! Und besonders mit dem neust...

Wenn alles versagt - IBM Tape schÞtzt, was zÃĪhlt! Und besonders mit dem neust...Josef Weingand

Ėý

IBM LTO10cnc-processing-centers-centateq-p-110-en.pdf

cnc-processing-centers-centateq-p-110-en.pdfAmirStern2

Ėý

ŨŨĻŨŨ ŨĒŨŨŨŨŨŨ ŨŠŨĒŨĐŨŨŨŠŨ ŨŨĒŨ 3/4/5 ŨĶŨŨĻŨŨ, ŨĒŨ 22 ŨŨŨŨĪŨŨŠ ŨŨŨŨ ŨĒŨ ŨŨ ŨŨĪŨĐŨĻŨŨŨŨŠ ŨŨĒŨŨŨŨ ŨŨŨĻŨŨĐŨŨŠ.ĖýŨŨĒŨ ŨĐŨŨ ŨĒŨŨŨŨ ŨŨŨŨ ŨŨŨŨĐŨ Ũ ŨŨ ŨŨ§Ũ ŨŨŨĪŨĒŨŨ ŨŨĐŨĪŨ ŨŨĒŨŨĻŨŨŠ/ŨĻŨŨĄŨŨŠ/ŨŨ ŨŨŨŨŠ/ŨĄŨĪŨĻŨŨŨŠ/ŨĒŨĻŨŨŨŠ ŨŨĒŨŨ..

ŨŨĄŨŨŨ ŨŨŨĶŨĒ ŨĪŨĒŨŨŨŨŠ ŨĒŨŨŨŨ ŨĐŨŨ ŨŨŠ ŨŨŨŠŨŨŨŨŨŠ ŨŨĒŨ ŨĪŨŨ ŨĐŨŨ ŨŨ: Ũ§ŨŨŨŨ ŨŨ ŨŨ, ŨŨŨĪŨ§Ũ, Ũ ŨŨĄŨŨĻ, ŨŨŨĻŨĄŨŨ ŨŨ ŨŨ.Techniques for Automatic Device Identification and Network Assignment.pdf

Techniques for Automatic Device Identification and Network Assignment.pdfPriyanka Aash

Ėý

Techniques for Automatic Device Identification and Network AssignmentAgentic AI for Developers and Data Scientists Build an AI Agent in 10 Lines o...

Agentic AI for Developers and Data Scientists Build an AI Agent in 10 Lines o...All Things Open

Ėý

Presented at All Things Open RTP Meetup

Presented by William Hill - Developer Advocate, NVIDIA

Title: Agentic AI for Developers and Data Scientists

Build an AI Agent in 10 Lines of Code and the Concepts Behind the Code

Abstract: In this talk we will demonstrate building a working data science AI agent in 10 lines of basic Python code in a Colab notebook. Our AI Agent will perform LLM prompt-driven visual analysis using open-source libraries. In this session we will show how to develop an AI Agent using GPUs through NVIDIAâs developer program and Google Colab notebooks. After coding our AI Agent, we will break down the 10 lines of code. We will show the key components and open source library integrations that enable the agent's functionality, focusing on practical implementation details and then the theoretical concepts. The presentation concludes with a survey of current LLM technologies and the latest trends in developing AI applications for enthusiasts and enterprisesUsing the SQLExecutor for Data Quality Management: aka One man's love for the...

Using the SQLExecutor for Data Quality Management: aka One man's love for the...Safe Software

Ėý

The SQLExecutor is one of FMEâs most powerful and flexible transformers. Pivvot maintains a robust internal metadata hierarchy used to support ingestion and curation of thousands of external data sources that must be managed for quality before entering our platform. By using the SQLExecutor, Pivvot can efficiently detect problems and perform analysis before data is extracted from our staging environment, removing the need for rollbacks or cycles waisted on a failed job. This presentation will walk through three distinct examples of how Pivvot uses the SQLExecutor to engage its metadata hierarchy and integrate with its Data Quality Management workflows efficiently and within the source postgres database. Spatial Validation âValidating spatial prerequisites before entering a production environment. Reference Data Validation - Dynamically validate domain-ed columns across any table and multiple columns per table. Practical De-duplication - Removing identical or near-identical well point locations from two distinct source datasets in the same table.Coordinated Disclosure for ML - What's Different and What's the Same.pdf

Coordinated Disclosure for ML - What's Different and What's the Same.pdfPriyanka Aash

Ėý

Coordinated Disclosure for ML - What's Different and What's the SameThe Future of Product Management in AI ERA.pdf

The Future of Product Management in AI ERA.pdfAlyona Owens

Ėý

Hi, Iâm Aly Owens, I have a special pleasure to stand here as over a decade ago I graduated from CityU as an international student with an MBA program. I enjoyed the diversity of the school, ability to work and study, the network that came with being here, and of course the price tag for students here has always been more affordable than most around.

Since then I have worked for major corporations like T-Mobile and Microsoft and many more, and I have founded a startup. I've also been teaching product management to ensure my students save time and money to get to the same level as me faster avoiding popular mistakes. Today as Iâve transitioned to teaching and focusing on the startup, I hear everybody being concerned about Ai stealing their jobsâĶ Weâll talk about it shortly.

But before that, I want to take you back to 1997. One of my favorite movies is âFifth Elementâ. It wowed me with futuristic predictions when I was a kid and Iâm impressed by the number of these predictions that have already come true. Self-driving cars, video calls and smart TV, personalized ads and identity scanning. Sci-fi movies and books gave us many ideas and some are being implemented as we speak. But we often get ahead of ourselves:

Flying cars,Colonized planets, Human-like AI: not yet, Time travel, Mind-machine neural interfaces for everyone: Only in experimental stages (e.g. Neuralink).

Cyberpunk dystopias: Some vibes (neon signs + inequality + surveillance), but not total dystopia (thankfully).

On the bright side, we predict that the working hours should drop as Ai becomes our helper and there shouldnât be a need to work 8 hours/day. Nobody knows for sure but we can require that from legislation. Instead of waiting to see what the government and billionaires come up with, I say we should design our own future.

So, we as humans, when we donât know something - fear takes over. The same thing happened during the industrial revolution. In the Industrial Era, machines didnât steal jobsâthey transformed them but people were scared about their jobs. The AI era is making similar changes except it feels like robots will take the center stage instead of a human. First off, even when it comes to the hottest space in the military - drones, Ai does a fraction of work. AI algorithms enable real-time decision-making, obstacle avoidance, and mission optimization making drones far more autonomous and capable than traditional remote-controlled aircraft. Key technologies include computer vision for object detection, GPS-enhanced navigation, and neural networks for learning and adaptation. But guess what? There are only 2 companies right now that utilize Ai in drones to make autonomous decisions - Skydio and DJI.

OpenACC and Open Hackathons Monthly Highlights June 2025

OpenACC and Open Hackathons Monthly Highlights June 2025OpenACC

Ėý

The OpenACC organization focuses on enhancing parallel computing skills and advancing interoperability in scientific applications through hackathons and training. The upcoming 2025 Open Accelerated Computing Summit (OACS) aims to explore the convergence of AI and HPC in scientific computing and foster knowledge sharing. This year's OACS welcomes talk submissions from a variety of topics, from Using Standard Language Parallelism to Computer Vision Applications. The document also highlights several open hackathons, a call to apply for NVIDIA Academic Grant Program and resources for optimizing scientific applications using OpenACC directives.Securing Account Lifecycles in the Age of Deepfakes.pptx

Securing Account Lifecycles in the Age of Deepfakes.pptxFIDO Alliance

Ėý

Securing Account Lifecycles in the Age of DeepfakesFeatured (20)

Artificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...

Artificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...OECD Directorate for Financial and Enterprise Affairs

Ėý

This presentation by Thibault Schrepel, Associate Professor of Law at Vrije Universiteit Amsterdam University, was made during the discussion âArtificial Intelligence, Data and Competitionâ held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/aicomp.

This presentation was uploaded with the authorâs consent.

How to Leverage AI to Boost Employee Wellness - Lydia Di Francesco - SocialHR...

How to Leverage AI to Boost Employee Wellness - Lydia Di Francesco - SocialHR...SocialHRCamp

Ėý

The document discusses leveraging AI to enhance employee wellness through data analytics, automating tasks, and personalized wellness apps, emphasizing the shared responsibility of employee well-being between leaders and organizations. It outlines best practices for using AI in wellness strategies, including ensuring data privacy and security, understanding employee needs, and promoting inclusivity. Lydia Di Francesco, a wellness specialist, shares insights to optimize workplace wellness strategy using AI-driven data analytics and encourages collaboration and transparency.2024 State of Marketing Report â by Hubspot

2024 State of Marketing Report â by HubspotMarius Sescu

Ėý

The State of Marketing 2024 report highlights the transformative impact of AI and automation, emphasizing the importance of personalization and engagement to drive growth in a competitive landscape. Marketers are focusing on optimizing budgets, leveraging social media for brand awareness, and utilizing AI tools to enhance efficiency across tasks. Key trends for 2024 include the rise of experiential marketing, content creation that meets user needs, and strengthened connections through personalized customer experiences.Everything You Need To Know About ChatGPT

Everything You Need To Know About ChatGPTExpeed Software

Ėý

ChatGPT is an AI chatbot developed by OpenAI, built on advanced language models to facilitate human-like conversational interactions. Launched in November 2022, it utilizes a transformer architecture to understand and generate text, with applications ranging from content creation to customer service. Despite its capabilities, there are concerns about potential misuse and biases in its responses, which OpenAI aims to mitigate through moderation and user feedback.Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage EngineeringsPixeldarts

Ėý

The realm of product design is a constantly changing environment where technology and style intersect. Every year introduces fresh challenges and exciting trends that mold the future of this captivating art form. In this piece, we delve into the significant trends set to influence the look and functionality of product design in the year 2024.How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental HealthThinkNow

Ėý

The November 2023 mental health report indicates that 70% of respondents rate their mental health as 'good' or 'excellent,' with higher diagnoses reported among African Americans and non-Hispanic whites compared to Hispanics and Asians. Younger generations, particularly Gen Z and millennials, are more likely to experience mental health challenges, seek information online, and report that their mental health impacts their work and relationships. Half of the respondents feel comfortable discussing their mental health with professionals, although Gen Z shows the least comfort in this area.AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdfmarketingartwork

Ėý

Creative operations teams expect increased AI use in 2024. Currently, over half of tasks are not AI-enabled, but this is expected to decrease in the coming year. ChatGPT is the most popular AI tool currently. Business leaders are more actively exploring AI benefits than individual contributors. Most respondents do not believe AI will impact workforce size in 2024. However, some inhibitions still exist around AI accuracy and lack of understanding. Creatives primarily want to use AI to save time on mundane tasks and boost productivity.Skeleton Culture Code

Skeleton Culture CodeSkeleton Technologies

Ėý

Organizational culture includes values, norms, systems, symbols, language, assumptions, beliefs, and habits that influence employee behaviors and how people interpret those behaviors. It is important because culture can help or hinder a company's success. Some key aspects of Netflix's culture that help it achieve results include hiring smartly so every position has stars, focusing on attitude over just aptitude, and having a strict policy against peacocks, whiners, and jerks.PEPSICO Presentation to CAGNY Conference Feb 2024

PEPSICO Presentation to CAGNY Conference Feb 2024Neil Kimberley

Ėý

PepsiCo provided a safe harbor statement noting that any forward-looking statements are based on currently available information and are subject to risks and uncertainties. It also provided information on non-GAAP measures and directing readers to its website for disclosure and reconciliation. The document then discussed PepsiCo's business overview, including that it is a global beverage and convenient food company with iconic brands, $91 billion in net revenue in 2023, and nearly $14 billion in core operating profit. It operates through a divisional structure with a focus on local consumers.Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)contently

Ėý

This document provides an overview of content methodology best practices. It defines content methodology as establishing objectives, KPIs, and a culture of continuous learning and iteration. An effective methodology focuses on connecting with audiences, creating optimal content, and optimizing processes. It also discusses why a methodology is needed due to the competitive landscape, proliferation of channels, and opportunities for improvement. Components of an effective methodology include defining objectives and KPIs, audience analysis, identifying opportunities, and evaluating resources. The document concludes with recommendations around creating a content plan, testing and optimizing content over 90 days.How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024Albert Qian

Ėý

The document provides guidance on preparing a job search for 2024. It discusses the state of the job market, focusing on growth in AI and healthcare but also continued layoffs. It recommends figuring out what you want to do by researching interests and skills, then conducting informational interviews. The job search should involve building a personal brand on LinkedIn, actively applying to jobs, tailoring resumes and interviews, maintaining job hunting as a habit, and continuing self-improvement. Once hired, the document advises setting new goals and keeping skills and networking active in case of future opportunities.Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie InsightsKurio // The Social Media Age(ncy)

Ėý

The 2024 social media marketing trends report highlights significant shifts influenced by generative AI, including the emergence of personalized content, the rise of virtual influencers, and a stronger focus on user-generated content. Insights were gathered from 33 experts across 23 leading independent agencies, providing a perspective that emphasizes creativity and authenticity in marketing strategies. Key trends also include the blending of B2B and B2C approaches, reflecting changes in consumer behavior and the evolving landscape of social media engagement.Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024Search Engine Journal

Ėý

The document discusses trends in paid search for 2024, highlighting changes in user behavior, the implications for financial services, and privacy challenges. It emphasizes the importance of adapting search strategies, utilizing AI-driven tools like performance max and smart bidding, and leveraging first-party data for better marketing efficacy. Key takeaways include holistic SEO and SEM approaches, monitoring shifting user intents, and the need for continuous performance evaluation.5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summarySpeakerHub

Ėý

The document outlines five public speaking tips from Chris Anderson, TED Talks curator, emphasizing the importance of eye contact, vulnerability, humor, humility, and storytelling. These skills are presented as essential for engaging audiences effectively and are increasingly valuable in today's economy. The article posits that mastering these techniques can enhance speakers' ability to communicate ideas powerfully.ChatGPT and the Future of Work - Clark Boyd

ChatGPT and the Future of Work - Clark Boyd Clark Boyd

Ėý

The document provides an overview of generative AI, particularly focusing on ChatGPT and its implications for business and the job market. It discusses the rapid growth of generative AI, its applications in marketing, and the skills needed for the AI era while addressing potential job displacement and the need for adaptation. The agenda includes a Q&A session and emphasizes rethinking work in collaboration with AI technology.Getting into the tech field. what next

Getting into the tech field. what next Tessa Mero

Ėý

The document provides career advice for getting into the tech field, including:

- Doing projects and internships in college to build a portfolio.

- Learning about different roles and technologies through industry research.

- Contributing to open source projects to build experience and network.

- Developing a personal brand through a website and social media presence.

- Networking through events, communities, and finding a mentor.

- Practicing interviews through mock interviews and whiteboarding coding questions.Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search IntentLily Ray

Ėý

1. Core updates from Google periodically change how its algorithms assess and rank websites and pages. This can impact rankings through shifts in user intent, site quality issues being caught up to, world events influencing queries, and overhauls to search like the E-A-T framework.

2. There are many possible user intents beyond just transactional, navigational and informational. Identifying intent shifts is important during core updates. Sites may need to optimize for new intents through different content types and sections.

3. Responding effectively to core updates requires analyzing "before and after" data to understand changes, identifying new intents or page types, and ensuring content matches appropriate intents across video, images, knowledge graphs and more.How to have difficult conversations

How to have difficult conversations Rajiv Jayarajah, MAppComm, ACC

Ėý

The document provides essential tips on how to handle difficult conversations in a workplace setting, emphasizing the importance of preparation, environment, and timing. It highlights that many employees dread such conversations, often leading to avoidance and worsening situations. Ultimately, the guide aims to promote positive outcomes while maintaining professional relationships.Introduction to Data Science

Introduction to Data ScienceChristy Abraham Joy

Ėý

The document discusses the rise and importance of data science and machine learning, highlighting the growing demand for data scientists and the challenges they face. It explains machine learning concepts such as supervised and unsupervised learning, along with various real-world applications and the necessary steps involved in a machine learning workflow. Additionally, the document emphasizes the iterative process of model improvement and feature engineering used to enhance machine learning outcomes.Time Management & Productivity - Best Practices

Time Management & Productivity - Best PracticesVit Horky

Ėý

The document outlines best practices for time management and productivity, focusing on effective meeting habits, structured work blocks, and the importance of reflection and goal setting. It emphasizes the need for proper planning, the use of appropriate tools, and prioritizing tasks to enhance both personal and team efficiency. Additionally, personal anecdotes and strategies are shared to encourage a positive mindset and enjoyment in achieving work-related goals.Artificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...

Artificial Intelligence, Data and Competition â SCHREPEL â June 2024 OECD dis...OECD Directorate for Financial and Enterprise Affairs

Ėý

Ad

Ruby

- 1. EMPLEADO N° de horas DEPARTAMENRO CARGO S. BASE PLUS/CARGOS Luis garcia 40 INFORMATICA DIRECTIVO S/. 1,000.00 S/. 30.00 maria sanz 21 CONTABILIDAD AUXILIAR S/. 525.00 S/. - rosa santos 32 INFORMATICA COMERCIAL S/. 800.00 S/. - pablo ruiz 40 FACTURACION COMERCIAL S/. 1,000.00 S/. - Ana sanchez 28 FACTURACION DIRECTIVO S/. 700.00 S/. 21.00 Sonia diaz 39 INFORMATICA COMERCIAL S/. 975.00 S/. - Juan Ferman 12 CONTABILIDAD AUXILIAR S/. 300.00 S/. - pedro santos 37 INFORMATICA AUXILIAR S/. 925.00 S/. - elena diaz 40 FACTURACION COMERCIAL S/. 1,000.00 S/. - sara cano 40 CONTABILIDAD DIRECTIVO S/. 1,000.00 S/. 30.00 TOTALES S/. 8,225.00 S/. 81.00 PLUSES Y RETENCIONES PRECIO POR HORA S/. 8.00 CARGO DIRECTIVO 3% I.R.P.F 18% SEGURIDAD SOCIAL 10%

- 2. S. BRUTO I.R.P.F S. SOCIAL S. NETO S/. 1,030.00 S/. 185.40 S/. 103.00 S/. 1,318.40 S/. 525.00 S/. 94.50 S/. 52.50 S/. 672.00 S/. 800.00 S/. 144.00 S/. 80.00 S/. 1,024.00 S/. 1,000.00 S/. 180.00 S/. 100.00 S/. 1,280.00 S/. 721.00 S/. 129.78 S/. 72.10 S/. 922.88 S/. 975.00 S/. 175.50 S/. 97.50 S/. 1,248.00 S/. 300.00 S/. 54.00 S/. 30.00 S/. 384.00 S/. 925.00 S/. 166.50 S/. 92.50 S/. 1,184.00 S/. 1,000.00 S/. 180.00 S/. 100.00 S/. 1,280.00 S/. 1,030.00 S/. 185.40 S/. 103.00 S/. 1,318.40 S/. 8,306.00 S/. 1,495.08 S/. 830.60 S/. 10,631.68