The Rule of 72

- 1. The RULE OF 72

- 2. The RULE OF 72 IT HAS BEEN YEARS NOW THAT I WAS SEARCHING FOR A FINANCIAL MENTOR…

- 3. The RULE OF 72 FINALLY, I FOUND THE RIGHT MENTOR…

- 4. The RULE OF 72 AND HE TAUGHT ME A VERY POWERFUL CONCEPT…

- 5. The RULE OF 72 WHICH UNTIL NOW BLOWS OFF MY MIND…

- 6. The RULE OF 72 HE TAUGHT ME THIS VERY POWERFUL RULE…

- 7. The RULE OF 72 THE RULE OF 72

- 8. The RULE OF 72 OR WHAT WE CALL…

- 9. The RULE OF 72 THE RULE OF MONEY…

- 10. The RULE OF 72 HAVE YOU EVER HEARD OF THE RULE OF 72?

- 11. The RULE OF 72 IT’S A VERY SIMPLE, YET VERY POWERFUL FORMULA…

- 12. The RULE OF 72 IT WAS FORMULATED BY MY DEAREST BELOVED FRIEND, ALBERT EINSTEIN…

- 13. The RULE OF 72

- 14. The RULE OF 72 SOME WOULD SAY IT IS THE 8TH WONDER OF THE WORLD…

- 15. The RULE OF 72 WHAT DOES THIS FORMULA SAY?

- 16. The RULE OF 72 THE RULE OF 72 SAYS …

- 17. The RULE OF 72 TAKE THE NUMBER 72…

- 18. The RULE OF 72 DIVIDE THIS BY THE PERCENTAGE INTEREST

- 19. The RULE OF 72 WILL RESULT TO APPROXIMATELY…

- 20. The RULE OF 72 THE NUMBER OF YEARS YOUR MONEY WILL DOUBLE…

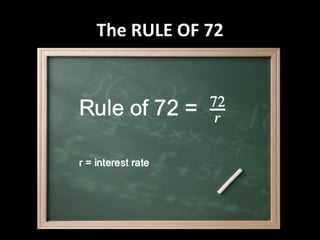

- 21. The RULE OF 72 HERE IS WHAT THE FORMULA LOOKS LIKE…

- 22. The RULE OF 72

- 23. The RULE OF 72 72 /% INTEREST = NUMBER OF YEARS 2X

- 24. The RULE OF 72 THIS IS ACTUALLY THE COMPOUNDING INTEREST FORMULA, SIMPLIFIED

- 25. The RULE OF 72 JUST TO GIVE YOU SOME ILLUSTRATIONS…

- 26. The RULE OF 72 LETS SAY, YOUR AGE TODAY IS 22…

- 27. The RULE OF 72 AND YOU HAVE WITH YOU…

- 28. The RULE OF 72 P100,000.00 CASH…

- 29. The RULE OF 72 AND YOU WANT TO INVEST IT IN A BANK…

- 30. The RULE OF 72 THAT YIELDS 1% INTEREST PER YEAR…

- 31. The RULE OF 72 APPLYING THE FORMULA…

- 32. The RULE OF 72 72 / % INTEREST = NUMBER OF YEARS 2X

- 33. The RULE OF 72 72 / 1% = 72 YEARS

- 34. The RULE OF 72 SO… IF TODAY YOU ARE 22 YEARS OLD…

- 35. The RULE OF 72 22 + 72 = 94 YEARS OLD

- 36. The RULE OF 72 THIS MEANS THAT AT 94 YEARS OLD, YOUR MONEY WILL BECOME P200,000.00…

- 37. The RULE OF 72 LET ME EXPLAIN THIS INTO A DETAILED ILLUSTRATION…

- 38. The RULE OF 72 WHAT IF AT THE AGE OF 29, YOU LEARNED AND INVESTED ON A HIGHER INTEREST RATE…

- 39. The RULE OF 72 LET’S SAY, YOU INVESTED AT 4% INTEREST PER YEAR…

- 40. The RULE OF 72 APPLYING AGAIN THE FORMULA…

- 41. The RULE OF 72 72 / % INTEREST = NUMBER OF YEARS 2X

- 42. The RULE OF 72 72 / 4% = 18 YEARS

- 43. The RULE OF 72 SO, IF AT THE AGE OF 29, YOU INVESTED P100,000 WITH AN INTEREST OF 4%...

- 44. The RULE OF 72 AGE 4% 29 P100,000

- 45. The RULE OF 72 BY THE AGE OF 47, YOU WOULD HAVE…

- 46. The RULE OF 72 AGE 4% 29 P100,000 47 P200,000

- 47. The RULE OF 72 AND BY THE AGE OF 65, YOU WOULD HAVE…

- 48. The RULE OF 72 AGE 4% 29 P100,000 47 P200,000 65 P400,000 P400,000 AT AGE 65? ARE YOU KIDDING ME?

- 49. The RULE OF 72 FRIEND… ARE YOU STILL WITH ME?

- 50. The RULE OF 72 I DO HOPE SO…

- 51. The RULE OF 72 BECAUSE THE NEXT SLIDES WOULD REVEAL THE BEST PART OF THIS PRESENTATION…

- 52. The RULE OF 72 NOW…

- 53. The RULE OF 72 ASSUMING THAT YOU LEARNED MORE ABOUT HOW MONEY WORKS…

- 54. The RULE OF 72 AND INVESTED ON A MUCH HIGHER INTEREST…

- 55. The RULE OF 72 LET’S SAY….

- 56. The RULE OF 72 AT 6% PER YEAR…

- 57. The RULE OF 72 LET’S DO THE MATH, SHALL WE?

- 58. The RULE OF 72 72 / 6% = 12 YEARS

- 59. The RULE OF 72 JUST A QUICK ILLUSTRATION ON THE RESULT…

- 60. The RULE OF 72 AGE 6% 29 P100,000 MONEY DOUBLES EVERY 12 YEARS….

- 61. The RULE OF 72 AGE 6% 29 P100,000 41 P200,000 MONEY DOUBLES EVERY 12 YEARS….

- 62. The RULE OF 72 AGE 6% 29 P100,000 41 P200,000 53 P400,000 MONEY DOUBLES EVERY 12 YEARS….

- 63. The RULE OF 72 AGE 6% 29 P100,000 41 P200,000 53 P400,000 65 P800,000 MONEY DOUBLES EVERY 12 YEARS….

- 64. The RULE OF 72 A HIGHER INTEREST RATE PERHAPS?

- 65. The RULE OF 72 LET’S TRY 8%?

- 66. The RULE OF 72 DO THE MATH AGAIN…

- 67. The RULE OF 72 72 / 8% = 9 YEARS

- 68. The RULE OF 72 A QUICK ILLUSTRATION AGAIN…

- 69. The RULE OF 72 AGE 8% 29 P100,000 MONEY DOUBLES EVERY 9 YEARS….

- 70. The RULE OF 72 AGE 8% 29 P100,000 38 P200,000 MONEY DOUBLES EVERY 9 YEARS….

- 71. The RULE OF 72 AGE 8% 29 P100,000 38 P200,000 47 P400,000 MONEY DOUBLES EVERY 9 YEARS….

- 72. The RULE OF 72 AGE 8% 29 P100,000 38 P200,000 47 P400,000 56 P800,000 MONEY DOUBLES EVERY 9 YEARS….

- 73. The RULE OF 72 AGE 8% 29 P100,000 38 P200,000 47 P400,000 56 P800,000 65 P1,600,000 MONEY DOUBLES EVERY 9 YEARS….

- 74. The RULE OF 72 NOT BAD HUH?

- 75. The RULE OF 72 HOW ABOUT INVESTING IT AT 12%?

- 76. The RULE OF 72 WE WOULD THEN HAVE…

- 77. The RULE OF 72 72 / 12% = 6 YEARS

- 78. The RULE OF 72 ANOTHER QUICK ILLUSTRATION…

- 79. The RULE OF 72 AGE 12% 29 P100,000 MONEY DOUBLES EVERY 6 YEARS….

- 80. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 MONEY DOUBLES EVERY 6 YEARS….

- 81. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 41 P400,000 MONEY DOUBLES EVERY 6 YEARS….

- 82. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 41 P400,000 47 P800,000 MONEY DOUBLES EVERY 6 YEARS….

- 83. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 41 P400,000 47 P800,000 53 P1,600,000 MONEY DOUBLES EVERY 6 YEARS….

- 84. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 41 P400,000 47 P800,000 53 P1,600,000 59 P3,200,000 MONEY DOUBLES EVERY 6 YEARS….

- 85. The RULE OF 72 AGE 12% 29 P100,000 35 P200,000 41 P400,000 47 P800,000 53 P1,600,000 59 P3,200,000 65 P6,400,000 MONEY DOUBLES EVERY 6 YEARS….

- 86. The RULE OF 72 HERE IS A CLEARER VIEW AS TO WHAT WE DID…

- 87. The RULE OF 72 AGE 4% AGE 6% AGE 8% AGE 12% 29 P100,000 29 P100,000 29 P100,000 29 P100,000 47 P200,000 41 P200,000 38 P200,000 35 P200,000 65 P400,000 53 P400,000 47 P400,000 41 P400,000 65 P800,000 56 P800,000 47 P800,000 65 P1,600,000 53 P1,600,000 59 P3,200,000 65 P6,400,000

- 88. The RULE OF 72 MOST FILIPINOS DON’T KNOW HOW MONEY WORKS…

- 89. The RULE OF 72 SOME WOULD INVEST IN BANK’S TIME DEPOSIT THAT YIELDS 4%

- 90. The RULE OF 72 AGE 4% AGE 6% AGE 8% AGE 12% 29 P100,000 29 P100,000 29 P100,000 29 P100,000 47 P200,000 41 P200,000 38 P200,000 35 P200,000 65 P400,000 53 P400,000 47 P400,000 41 P400,000 65 P800,000 56 P800,000 47 P800,000 65 P1,600,000 53 P1,600,000 59 P3,200,000 65 P6,400,000

- 91. The RULE OF 72 BUT BANKS ARE WISE…

- 92. The RULE OF 72 THEY WOULD INVEST YOUR MONEY IN A FACILITY THAT YIELDS HIGHER INTERESTS…

- 93. The RULE OF 72 MAYBE AT 12%...

- 94. The RULE OF 72 AGE 4% AGE 6% AGE 8% AGE 12% 29 P100,000 29 P100,000 29 P100,000 29 P100,000 47 P200,000 41 P200,000 38 P200,000 35 P200,000 65 P400,000 53 P400,000 47 P400,000 41 P400,000 65 P800,000 56 P800,000 47 P800,000 65 P1,600,000 53 P1,600,000 59 P3,200,000 65 P6,400,000

- 95. The RULE OF 72 SO AT AGE 65…

- 96. The RULE OF 72 THEY WOULD GIVE YOU THE P400,000.00 THAT THEY PROMISED TO GIVE…

- 97. The RULE OF 72 AGE 4% AGE 6% AGE 8% AGE 12% 29 P100,000 29 P100,000 29 P100,000 29 P100,000 47 P200,000 41 P200,000 38 P200,000 35 P200,000 65 P400,000 53 P400,000 47 P400,000 41 P400,000 65 P800,000 56 P800,000 47 P800,000 65 P1,600,000 53 P1,600,000 59 P3,200,000 65 P6,400,000

- 98. The RULE OF 72 BUT THEY ALREADY EARNED P6,000,000.00, FROM YOUR MONEY…

- 99. The RULE OF 72 AGE 4% AGE 6% AGE 8% AGE 12% 29 P100,000 29 P100,000 29 P100,000 29 P100,000 47 P200,000 41 P200,000 38 P200,000 35 P200,000 65 P400,000 53 P400,000 47 P400,000 41 P400,000 65 P800,000 56 P800,000 47 P800,000 65 P1,600,000 53 P1,600,000 59 P3,200,000 65 P6,400,000P6,000,000.00 BANK

- 100. The RULE OF 72 THANKS TO YOU… THEY ALREADY HAVE BIG BUILDINGS…

- 101. The RULE OF 72 … THE END…

- 102. The RULE OF 72 … BUT WAIT…

- 103. The RULE OF 72 … THERE’S MORE …

- 104. The RULE OF 72 YES, THIS IS THE END OF THE LESSON…

- 105. The RULE OF 72 AND LET ME PERSONALLY CONGRATULATE YOU FOR FINISHING A VERY SHORT COURSE ON FINANCIAL LITERACY…

- 106. The RULE OF 72 BUT…

- 107. The RULE OF 72 I WANT TO BE HONEST WITH YOU…

- 108. The RULE OF 72 THIS IS NOT REALLY THE END…

- 109. The RULE OF 72 BUT THE BEGINNING OF YOUR JOURNEY…

- 110. The RULE OF 72 THE JOURNEY TO YOUR FINANCIAL FREEDOM…

- 111. The RULE OF 72 ARE YOU INTERESTED TO JOURNEY IT WITH ME?

- 112. The RULE OF 72 IF YOU ARE INTERESTED IN ATTENDING FREE SEMINARS ON THESE TOPICS…

- 113. The RULE OF 72 OR IF YOU ARE INTERESTED IN INCREASING YOUR FINANCIAL IQ…

- 114. The RULE OF 72 OR, IF YOU WANT TO AVAIL OUR FREE FINANCIAL CHECK-UP…

- 115. CONTACT ME NOW@ Levi IMG FINANCIAL TRAINOR levi_img@yahoo.com +65-96-551-557 The RULE OF 72

- 116. The RULE OF 72 … it does not matter how much you earn… what matters is what you do with what you earn…

- 117. The RULE OF 72 - END OF PART II -