RWS Presentation Final

- 1. Alternative Sources of Financing: Banks & VCs October 4, 2011 Case Study: Russian World Studios Loan

- 2. The loan to Russian World Studios, secured by its content library, represents a first in the Russian market The traditional broadcaster-funded production model constrains independent producersˇŻ library growth RWS has a strong track record based on a strategy of full rights ownership The RWS transaction is unprecedented in the Russian corporate credit market RWS obtained funding due to three key success factors: Success factor #1: quality content - delivered on-time, on budget Success factors #2 and #3: relationships with customers and demonstrated cost control All producers can learn from the RWS success in crafting a ˇ°bank-friendlyˇ± credit story (the 3 Cs) If you are looking for debt production financing, ING would like to hear your credit story

- 3. The traditional broadcaster-funded production model constrains independent producersˇŻ library growth ˇ° Traditionalˇ± model: Without access to capital, Russian producers act as ˇ°service shopsˇ± for the major Russian broadcasters, with broadcasters retaining the rights Russian production companies have typically had to provide tangible assets as security in order to obtain loan financing Consequence: Russian producers can be constrained in building up library value and exploiting productions without adequate access to capital

- 4. RWS, founded in 1998, is a key player in Russian TV-series production, ranked #1 in 2010 among first-run series producers The Russian-produced TV content market is believed to have exceeded USD 1bn in 2010 Still a fragmented market: top 12 TV-series producers received 75% of orders in 2010 RWS operates two studios in Moscow and St. Petersburg ¨C the St. Petersburg studio, launched in October 2008, is the first dedicated, state-of-the-art film studio built in Russia during the past 60 years RWS has transitioned to a model of full rights ownership to enable it to fully exploit its growing content library RWS now holds more than 1500 hours of diverse content RWS is a subsidiary of JSFC ˇ°Sistemaˇ±, one of the largest diversified holding companies in Russia Sources: Federal Agency for Press and Mass Communications, ˇ°TV in Russiaˇ± industry report 2010. Nevafilm: 2010, The Russian Film Industry Review Russian World Studios has a strong track record based on a strategy of full rights ownership

- 5. The RWS transaction is unprecedented in the Russian corporate credit market On June 29, 2011, RWS closed a RUB 1.2bn (USD 43m) three-year secured loan to fund TV-series production For the first time in the history of the Russian media industry, a loan was structured with a library of video content as security The financing need was created due to a combination of: Working capital required to shift to full rights ownership Increased production slate to consolidate RWSˇŻs market position Align with Sistema policy for its subsidiaries to be financed independently

- 6. A challenging transaction made possible by INGˇŻs media finance expertise The loan was structured and coordinated by ING Bank Challenges: limited history of secondary sales, discount rate, Russian law library pledge, delivery and storage of master copies The necessary risk assessment was made possible by: ING leveraging its global media finance expertise and bringing it to Russia SberbankˇŻs local expertise as RussiaˇŻs largest bank At the same time, Sistema, ING and Sberbank, signed an MOU to further develop the Russian Media industry

- 7. Success factor #1: quality content, delivered on-time, on-budget ˇ° Indianˇ± TV series nominated at Monte Carlo IntˇŻl Television Festival ˇ° Palm Sundayˇ± wins Golden Eagle award in ˇ°best TV movie or miniseries categoryˇ± ˇ° WomanˇŻs Dreams of Neverlandˇ±, shown primetime on Channel 1 ˇ° Sea Patrolˇ± now in 2 nd season, shown on Zvezda, ranking second only to football RWSˇŻs productions garner international praise and highlight increasing demand for domestically produced content Client roster includes: Sony, Hallmark, HBO, Beacon

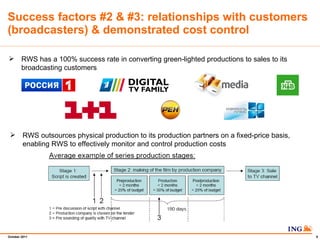

- 8. Success factors #2 & #3: relationships with customers (broadcasters) & demonstrated cost control RWS has a 100% success rate in converting green-lighted productions to sales to its broadcasting customers RWS outsources physical production to its production partners on a fixed-price basis, enabling RWS to effectively monitor and control production costs

- 9. All producers can learn from the RWS success in crafting a ˇ°bank-friendlyˇ± credit story (the 3 Cs) Bank funding typically comes later in the life-cycle development of a production studio ¨C enabling the demonstration of its track record and allowing banks to assess risk The better a bank can extrapolate past-performance into the future, the less perceived risk, which leads to a lower funding cost Three Cs : ? C ontent: high-quality, produced on-time and on-budget ? C ustomers: provide evidence of enduring relationships with key customers ? C osts: transparency in the budget-setting and monitoring process is a must As a borrower, be prepared to: Provide your content library as collateral Provide a detailed business plan for the tenor of the loan, and be held accountable to meet the business plan through bank-covenant monitoring We see security over a content library as an effective risk mitigant - however, the primary goal is to structure a loan based on future expected cash flows

- 10. If you are looking for debt production financing, ING would like to hear your credit story Questions?