Say On Pay

- 1. Say on Pay Corporate Governance Seminar UCLA School of Law 2011 ÂĐ Stephen M. Bainbridge 2011 2/26/2012

- 2. Executive Compensation and Corporate Governance Reform ï The Dodd-Frank Act provides for the following reforms: ï Executive Compensation ï Recoupment/Clawback Policies ï Compensation Committee Independence ï Additional Compensation Proxy Disclosure ï Corporate Governance ï Mandatory Proxy Access ï Disclosure About Chairman and CEO Positions ï Broker Discretionary Voting ï Disclosure of Any Employee or Director Hedging ÂĐ Stephen M. Bainbridge 2011 2 2/26/2012

- 3. Dodd-Frank § 951 ï Applies to companies registered under Section 12 of the 1934 Act and therefore subject to the proxy rules. 1. Say on Pay: Mandated a non-binding vote on executive compensation beginning with the first shareholder meeting after January 21, 2011. 2. Say on Frequency: The initial proxy statement for the first meeting after January 21, 2011 must give shareholders the decision as to the frequency of such vote: annually, every two years, or at most every three years. a. At least once every six years, shareholders must be provided with a new opportunity to vote on the frequency of Say on Pay votes. 3. Say on Golden Parachutes. A non-binding shareholder vote must be given to shareholders, by separate resolution, in connection with any vote on a merger, consolidation, sale of assets or similar transaction, to approve âgolden parachute compensationâ ÂĐ Stephen M. Bainbridge 2011 3 2/26/2012 šÝšÝßĢ 3

- 4. Covered Executives ï Requires a vote on compensation of CEO, CFO and three other most highly compensated executive officers ï No âKatie Couricâ provision ÂĐ Stephen M. Bainbridge 2011 4 2/26/2012

- 5. Say on Pay VotesâOther ï Companies must disclose in the CD&A whether and, if so, how their compensation policies and decisions have taken into account the results of the most recent say-on-pay vote. ï A Form 8-K must be filed to disclose the companyâs decision regarding the frequency of say-on-pay votes in light of the results of the shareholdersâ frequency vote. ï Companies must disclose in the proxy statement the current frequency of say-on-pay votes and when the next frequency vote would occur. ï The company may exclude shareholder proposals on the same matters as the say-on-pay votes (e.g., provide for a say-on-pay vote, seeks future say- on-pay votes, or relates to the frequency of say-on-pay votes) if: ï A single frequency (one, two, or three years) receives support of majority of votes cast ï Company adopts the frequency ÂĐ Stephen M. Bainbridge 2011 5 2/26/2012

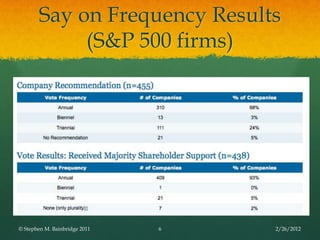

- 6. Say on Frequency Results (S&P 500 firms) ÂĐ Stephen M. Bainbridge 2011 6 2/26/2012

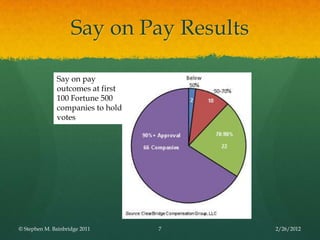

- 7. Say on Pay Results Say on pay outcomes at first 100 Fortune 500 companies to hold votes ÂĐ Stephen M. Bainbridge 2011 7 2/26/2012

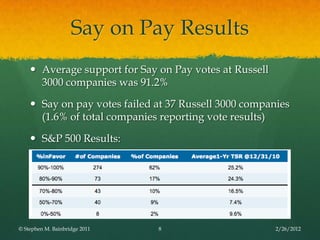

- 8. Say on Pay Results ï Average support for Say on Pay votes at Russell 3000 companies was 91.2% ï Say on pay votes failed at 37 Russell 3000 companies (1.6% of total companies reporting vote results) ï S&P 500 Results: ÂĐ Stephen M. Bainbridge 2011 8 2/26/2012

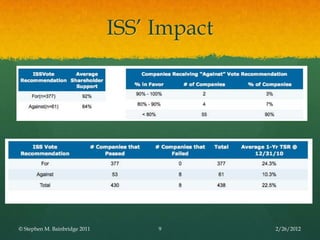

- 9. ISSâ Impact ÂĐ Stephen M. Bainbridge 2011 9 2/26/2012

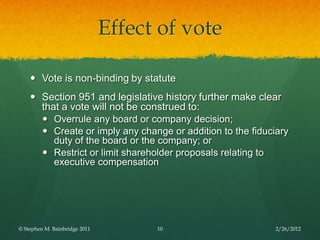

- 10. Effect of vote ï Vote is non-binding by statute ï Section 951 and legislative history further make clear that a vote will not be construed to: ï Overrule any board or company decision; ï Create or imply any change or addition to the fiduciary duty of the board or the company; or ï Restrict or limit shareholder proposals relating to executive compensation ÂĐ Stephen M. Bainbridge 2011 10 2/26/2012

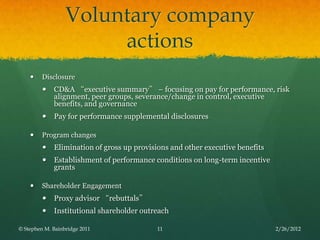

- 11. Voluntary company actions ï Disclosure ï CD&A âexecutive summaryâ â focusing on pay for performance, risk alignment, peer groups, severance/change in control, executive benefits, and governance ï Pay for performance supplemental disclosures ï Program changes ï Elimination of gross up provisions and other executive benefits ï Establishment of performance conditions on long-term incentive grants ï Shareholder Engagement ï Proxy advisor ârebuttalsâ ï Institutional shareholder outreach ÂĐ Stephen M. Bainbridge 2011 11 2/26/2012

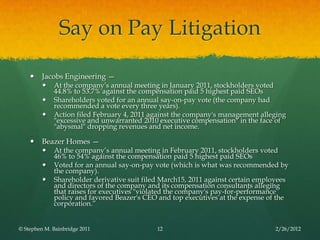

- 12. Say on Pay Litigation ï Jacobs Engineering â ï At the companyâs annual meeting in January 2011, stockholders voted 44.8% to 53.7% against the compensation paid 5 highest paid SEOs ï Shareholders voted for an annual say-on-pay vote (the company had recommended a vote every three years). ï Action filed February 4, 2011 against the company's management alleging "excessive and unwarranted 2010 executive compensation" in the face of "abysmal" dropping revenues and net income. ï Beazer Homes â ï At the companyâs annual meeting in February 2011, stockholders voted 46% to 54% against the compensation paid 5 highest paid SEOs ï Voted for an annual say-on-pay vote (which is what was recommended by the company). ï Shareholder derivative suit filed March15, 2011 against certain employees and directors of the company and its compensation consultants alleging that raises for executives "violated the company's pay-for-performance policy and favored Beazer's CEO and top executives at the expense of the corporation.â ÂĐ Stephen M. Bainbridge 2011 12 2/26/2012

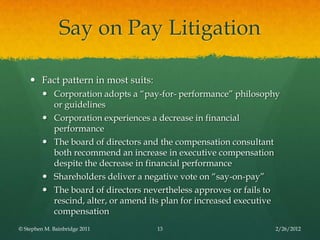

- 13. Say on Pay Litigation ï Fact pattern in most suits: ï Corporation adopts a âpay-for- performanceâ philosophy or guidelines ï Corporation experiences a decrease in financial performance ï The board of directors and the compensation consultant both recommend an increase in executive compensation despite the decrease in financial performance ï Shareholders deliver a negative vote on âsay-on-payâ ï The board of directors nevertheless approves or fails to rescind, alter, or amend its plan for increased executive compensation ÂĐ Stephen M. Bainbridge 2011 13 2/26/2012

- 14. The Law ÂĐ Stephen M. Bainbridge 2011 14 2/26/2012

- 15. An Interesting Theory ï Some plaintiff counsel have advanced a novel theory: ï The negative votes reflect the âindependent business judgmentâ of the shareholders that the executive compensation packages are unreasonable, disloyal, excessively large, irrational and not in the best interests of the corporation ï The shareholders are equally capable of assessing, and did assess, the merits of the proposed executive compensation package based on the same information that the directors had at their disposal ï Accordingly, the contrary position taken by the board of directors rebuts the presumption that the board is entitled to the protection of the business judgment rule ÂĐ Stephen M. Bainbridge 2011 15 2/26/2012

- 16. Blatant Disregard of Shareholder Preferences ï âThe board was on notice of what the shareholders wanted and purposely acted in disregard of the shareholdersâ preferences.â ï To what extent is board obliged to do as shareholders wish? ï Delaware Chancellor William Allen: âcorporation law does not operate on the theory that directors, in exercising their powers to manage the firm, are obligated to follow the wishes of a majority of shares. In fact, directors, not shareholders, are charged with the duty to manage the firm.â Paramount Communications Inc. v. Time Inc., 1989 WL 79880 at *30 (Del. Ch. 1989), affâd, 571 A.2d 1140 (Del. 1990). ï Allen further stated that the fact that âmany, presumably most, shareholdersâ would have preferred the board to make a different decision âdone does not . . . afford a basis to interfere with the effectuation of the boardâs business judgment.â ÂĐ Stephen M. Bainbridge 2011 16 2/26/2012