SBI -CSP- PPT

- 2. WHY FINANCIAL INCLUSION BENEFITS TO THE CSP SELF EMPLOYMENT AT THE DOORSTEP SBIŌĆÖS STRONG BRAND EQUITY SOCIAL RECOGNITION PERFORMANCE LINKED INCENTIVES ATTRACTIVE REMUNERATION

- 3. WHY FINANCIAL INCLUSION BENEFITS TO THE CUSTOMERS NO QUEUE DBT/DBTL , SOCIAL SECURITY SCHEMES, MUDRA LOAN 8 AM TO 8 PM EASY ACCESSIBLE DOOR STEP BANKING/LOCA TION

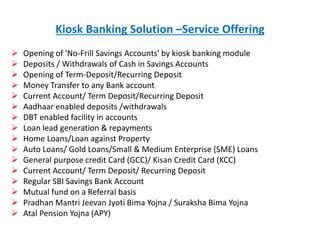

- 4. Kiosk Banking Solution ŌĆōService Offering ’āś Opening of 'No-Frill Savings Accounts' by kiosk banking module ’āś Deposits / Withdrawals of Cash in Savings Accounts ’āś Opening of Term-Deposit/Recurring Deposit ’āś Money Transfer to any Bank account ’āś Current Account/ Term Deposit/Recurring Deposit ’āś Aadhaar enabled deposits /withdrawals ’āś DBT enabled facility in accounts ’āś Loan lead generation & repayments ’āś Home Loans/Loan against Property ’āś Auto Loans/ Gold Loans/Small & Medium Enterprise (SME) Loans ’āś General purpose credit Card (GCC)/ Kisan Credit Card (KCC) ’āś Current Account/ Term Deposit/ Recurring Deposit ’āś Regular SBI Savings Bank Account ’āś Mutual fund on a Referral basis ’āś Pradhan Mantri Jeevan Jyoti Bima Yojna / Suraksha Bima Yojna ’āś Atal Pension Yojna (APY)

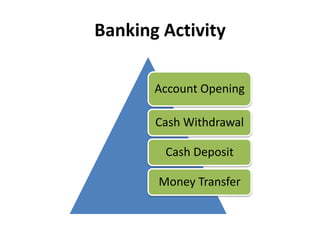

- 5. Banking Activity Account Opening Cash Withdrawal Cash Deposit Money Transfer

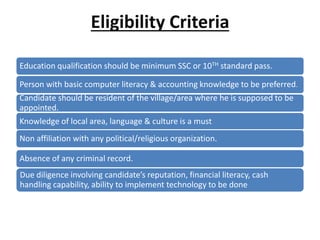

- 6. Eligibility Criteria Education qualification should be minimum SSC or 10TH standard pass. Person with basic computer literacy & accounting knowledge to be preferred. Candidate should be resident of the village/area where he is supposed to be appointed. Knowledge of local area, language & culture is a must. Non affiliation with any political/religious organization. Absence of any criminal record. Due diligence involving candidateŌĆÖs reputation, financial literacy, cash handling capability, ability to implement technology to be done

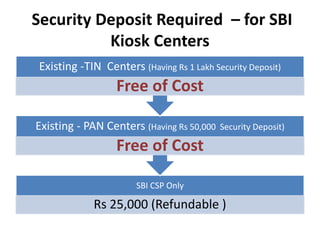

- 7. Security Deposit Required ŌĆō for SBI Kiosk Centers SBI CSP Only Rs 25,000 (Refundable ) Existing - PAN Centers (Having Rs 50,000 Security Deposit) Free of Cost Existing -TIN Centers (Having Rs 1 Lakh Security Deposit) Free of Cost

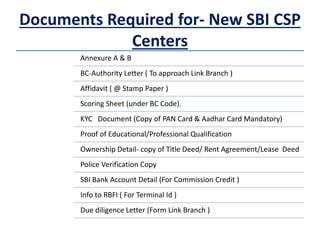

- 8. Documents Required for- New SBI CSP Centers Annexure A & B BC-Authority Letter ( To approach Link Branch ) Affidavit ( @ Stamp Paper ) Scoring Sheet (under BC Code). KYC Document (Copy of PAN Card & Aadhar Card Mandatory) Proof of Educational/Professional Qualification Ownership Detail- copy of Title Deed/ Rent Agreement/Lease Deed Police Verification Copy SBI Bank Account Detail (For Commission Credit ) Info to RBFI ( For Terminal Id ) Due diligence Letter (Form Link Branch )

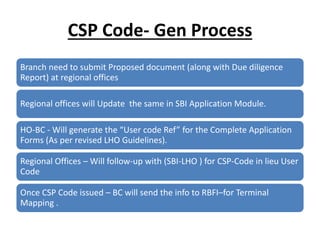

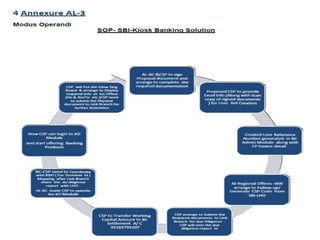

- 9. CSP Code- Gen Process Branch need to submit Proposed document (along with Due diligence Report) at regional offices Regional offices will Update the same in SBI Application Module. HO-BC - Will generate the ŌĆ£User code RefŌĆØ for the Complete Application Forms (As per revised LHO Guidelines). Regional Offices ŌĆō Will follow-up with (SBI-LHO ) for CSP-Code in lieu User Code Once CSP Code issued ŌĆō BC will send the info to RBFIŌĆōfor Terminal Mapping .

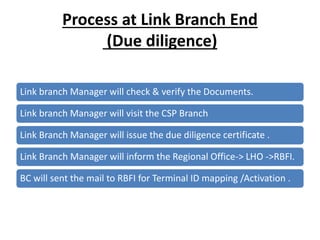

- 10. Process at Link Branch End (Due diligence) Link branch Manager will check & verify the Documents. Link branch Manager will visit the CSP Branch Link Branch Manager will issue the due diligence certificate . Link Branch Manager will inform the Regional Office-> LHO ->RBFI. BC will sent the mail to RBFI for Terminal ID mapping /Activation .

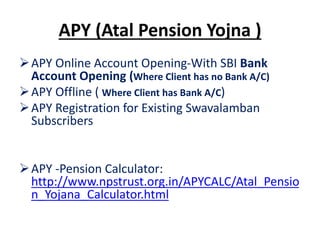

- 13. Now Earn Rs 35@ (Per form) ŌĆ”By Opening of APY A/C

- 14. APY (Atal Pension Yojna ) ’āśAPY Online Account Opening-With SBI Bank Account Opening (Where Client has no Bank A/C) ’āśAPY Offline ( Where Client has Bank A/C) ’āśAPY Registration for Existing Swavalamban Subscribers ’āśAPY -Pension Calculator: http://www.npstrust.org.in/APYCALC/Atal_Pensio n_Yojana_Calculator.html

- 15. THANK YOU

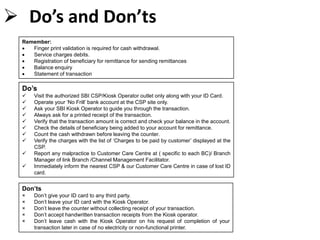

- 16. Remember: ’éĘ Finger print validation is required for cash withdrawal. ’éĘ Service charges debits. ’éĘ Registration of beneficiary for remittance for sending remittances ’éĘ Balance enquiry ’éĘ Statement of transaction DoŌĆÖs ’ā╝ Visit the authorized SBI CSP/Kiosk Operator outlet only along with your ID Card. ’ā╝ Operate your ŌĆśNo FrillŌĆÖ bank account at the CSP site only. ’ā╝ Ask your SBI Kiosk Operator to guide you through the transaction. ’ā╝ Always ask for a printed receipt of the transaction. ’ā╝ Verify that the transaction amount is correct and check your balance in the account. ’ā╝ Check the details of beneficiary being added to your account for remittance. ’ā╝ Count the cash withdrawn before leaving the counter. ’ā╝ Verify the charges with the list of ŌĆśCharges to be paid by customerŌĆÖ displayed at the CSP. ’ā╝ Report any malpractice to Customer Care Centre at ( specific to each BC)/ Branch Manager of link Branch /Channel Management Facilitator. ’ā╝ Immediately inform the nearest CSP & our Customer Care Centre in case of lost ID card. DonŌĆÖts ├Ś DonŌĆÖt give your ID card to any third party. ├Ś DonŌĆÖt leave your ID card with the Kiosk Operator. ├Ś DonŌĆÖt leave the counter without collecting receipt of your transaction. ├Ś DonŌĆÖt accept handwritten transaction receipts from the Kiosk operator. ├Ś DonŌĆÖt leave cash with the Kiosk Operator on his request of completion of your transaction later in case of no electricity or non-functional printer. ’āś DoŌĆÖs and DonŌĆÖts

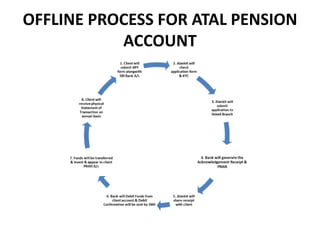

- 17. OFFLINE PROCESS FOR ATAL PENSION ACCOUNT

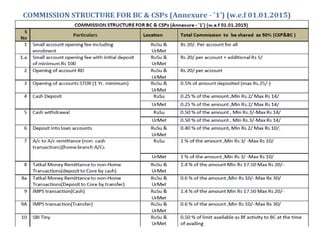

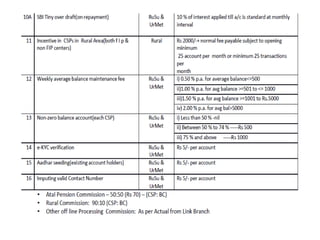

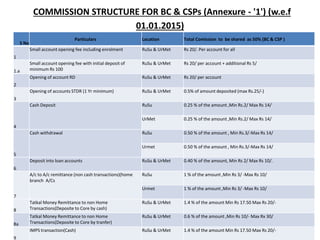

- 18. COMMISSION STRUCTURE FOR BC & CSPs (Annexure - '1') (w.e.f 01.01.2015) S No Particulars Location Total Comission to be shared as 50% (BC & CSP ) 1 Small account opening fee including enrolment RuSu & UrMet Rs 20/. Per account for all 1.a Small account opening fee with initial deposit of minimum Rs 100 RuSu & UrMet Rs 20/ per account + additional Rs 5/ 2 Opening of account RD RuSu & UrMet Rs 20/ per account 3 Opening of accounts STDR (1 Yr minimum) RuSu & UrMet 0.5% of amount deposited (max Rs.25/-) 4 Cash Deposit RuSu 0.25 % of the amount ,Min Rs.2/ Max Rs 14/ UrMet 0.25 % of the amount ,Min Rs.2/ Max Rs 14/ 5 Cash withdrawal RuSu 0.50 % of the amount , Min Rs.3/-Max Rs 14/ Urmet 0.50 % of the amount , Min Rs.3/-Max Rs 14/ 6 Deposit into loan accounts RuSu & UrMet 0.40 % of the amount, Min Rs 2/ Max Rs 10/. 7 A/c to A/c remittance (non cash transactions)(home branch A/Cs RuSu 1 % of the amount ,Min Rs 3/ -Max Rs 10/ Urmet 1 % of the amount ,Min Rs 3/ -Max Rs 10/ 8 Tatkal Money Remittance to non Home Transactions(Deposite to Core by cash) RuSu & UrMet 1.4 % of the amount Min Rs 17.50 Max Rs 20/- 8a Tatkal Money Remittance to non Home Transactions(Deposite to Core by tranfer) RuSu & UrMet 0.6 % of the amount ,Min Rs 10/- Max Rx 30/ 9 IMPS transaction(Cash) RuSu & UrMet 1.4 % of the amount Min Rs 17.50 Max Rs 20/-

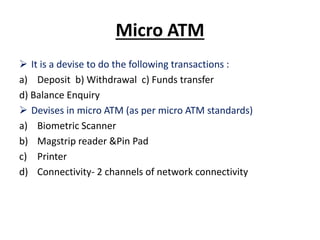

- 19. Micro ATM ’āś It is a devise to do the following transactions : a) Deposit b) Withdrawal c) Funds transfer d) Balance Enquiry ’āś Devises in micro ATM (as per micro ATM standards) a) Biometric Scanner b) Magstrip reader &Pin Pad c) Printer d) Connectivity- 2 channels of network connectivity

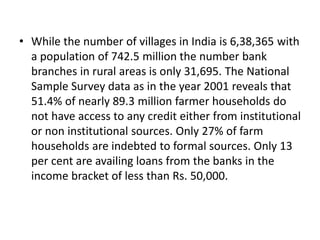

- 21. ŌĆó While the number of villages in India is 6,38,365 with a population of 742.5 million the number bank branches in rural areas is only 31,695. The National Sample Survey data as in the year 2001 reveals that 51.4% of nearly 89.3 million farmer households do not have access to any credit either from institutional or non institutional sources. Only 27% of farm households are indebted to formal sources. Only 13 per cent are availing loans from the banks in the income bracket of less than Rs. 50,000.