section 7 modified-2.pdf

- 1. Economics of Chemical Plants Eng. Kareem H. Mokhtar

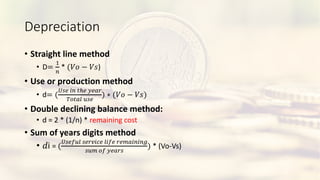

- 2. Depreciation âĒ Straight line method âĒ D= ! " * (ðð â ðð ) âĒ Use or production method âĒ d= ( #$% &" '(% )%*+ ,-'*. /$% ) â (ðð â ðð ) âĒ Double declining balance method: âĒ d = 2 * (1/n) * remaining cost âĒ Sum of years digits method âĒ ði = ( #$%0/. $%+1&2% .&0% +%3*&"&"4 $/3 -0 )%*+$ ) * (Vo-Vs)

- 3. Question 1 âĒ A 2020 car costs 200,000 L.E, if you will buy this car and sell it at 2030 with expected price of 100,000 L.E. you predict that you will be using it each year 1.5 times more than the previous year with total of 200,000 Km. Calculate the depreciation using âĒ 1- straight line method âĒ 2- use or production method âĒ 3- Double declining method âĒ 3- sum of years digits

- 4. âĒ Straight line method âĒ D= ! " * (ðð â ðð ) âĒ D = (1/10) * (200000-100000) = 10000 $ each year âĒ use or production method âĒ d= ( #$% &" '(% )%*+ ,-'*. /$% ) â (ðð â ðð ) Year Use 2020 x 2021 1.5x 2022 1.5*1.5x : : 2030 âĶ..

- 5. year Use (f(x)) Dep ($) 1 1 882.3783 2 1.5 1323.567 3 2.25 1985.351 4 3.375 2978.027 5 5.0625 4467.04 6 7.59375 6700.56 7 11.39063 10050.84 8 17.08594 15076.26 9 25.62891 22614.39 10 38.44336 33921.59 113.3301

- 6. double dec dep 40000.00 32000.00 25600.00 Double declining balance method: d = 2 * (1/n) * remaining cost In 2020 : 2* (1/10) * 200000 In 2021: 2* (1/10) * (200000-40000) . . In 2030

- 7. âĒ Sum of years digits method âĒ ði = ( #$%0/. $%+1&2% .&0% +%3*&"&"4 $/3 -0 )%*+$ ) * (Vo-Vs) sum of years 18181.82 16363.64 14545.45 12727.27 10909.09 9090.91 7272.73 5454.55 3636.36 1818.18 x ðððð ððððððððð year 1 10 year 2 9 year 3 8 year 4 7 Year 5 6 year 6 5 year 7 4 year 8 3 year 9 2 year 10 1 Summation 55