Securitisation

- 1. SECURITISATION SARFAESI has brought a legal framework for following important activities in the credit market. 1.Securitisation of Financial Assets. 2.Reconstruction of Financial Assets. 3.Recognition of any âinterestâ created in security created for due repayment of a loan as âSecurity Interestâ irrespective of its form & nature but it is not in possession of creditor. 1

- 2. 4. Power to enforce such security for realisation of money due to Banks and Financial Institutions in the event of default without intervention of Courts. 5. Enabling provisions for setting up Central Registry for the purpose of registration of transactions of securitisation reconstruction & creation of security interest. 6. Securitisation as a financial technique gained popularity in the US, in the seventies. 7. Securitisation is best understood as âthe repackaging of receivables in tradable form.â 2

- 3. Certain Important Definitions 1. Originator When Bank/FI lend money, they are originator. Originator is the owner of a financial asset that is acquired by a securitisation company or reconstruction company for the purpose of securitisation or asset reconstruction. 2. Obligor A person liable i. To pay to the originator, whether under a contract or otherwise or ii. To discharge any obligation in respect of a financial asset â existing, future, conditional or contingent. Obligor includes a borrower. 3

- 4. Certain Important Definitions (ContdâĶ) 3. Property Property means i. Immovable property ii. Movable property iii. Any debt or any right to receive payment of money whether secured or un secured. iv. Receivables whether existing or future. v. Intangible assets such as know-how, prize, copyright, trademarks, license, franchise or any other business or commercial right of a similar nature. 4

- 5. Certain Important Definitions (contdâĶ) 4. Qualified Institutional Buyer A FI or a Bank or an Insurance Co., or a state Financial Dev. Corp. or Trustee or an Asset Management Co. making investment on behalf of a mutual fund or provident fund or pension fund or a FII (Foreign Institutional Investor) registered under SEBI Act 1992 or any other body corporate as may be specified by SEBI. This definition does not include a company registered under The Companies Act 1956 unless that Company is registered with SEBI. 5

- 6. Certain Important Definitions (ContdâĶ) 5. Reconstruction Company A company formed for the purpose of asset reconstruction and registered under The Companies Act 1956. 6. Asset Reconstruction The takeover of loans or advances from bank or FI for the purpose of recovery. 7. Bank Includes Nationalised Bank, SBI & its subsidiaries and co- op banks but excludes RRBs. 6

- 7. Certain Important Definitions (ContdâĶ) 8. Financial Institution i. Public Fin. Dist. â Companies Act 1956 ii. Under DRT 1993 iii. International Finance Corp. under Int. Fin. Corp. Act 1958. iv. Any other institution or NBFC as defined in RBI Act 1934 which Central Govt. specifies as FI for the purpose of this Act. 9. Financial Assets Means debt or receivables. 7

- 8. Certain Important Definitions (ContdâĶ) 10. Financial Assistance Any bank/FI grants loan or advance or makes subscription of debenture or bonds or guarantee or issues L/C or any credit facility â it is called financial assistance. 11. Security Receipt Receipt by secuterisation Co. or Reconstruction Co. to any qualified institutional buyer pursuant to a scheme evidencing the purchase or acquisition by the holder thereof of an undivided right, title or interest in the financial asset involved in securitisation is called security receipt. 8

- 9. Certain Important Definitions (ContdâĶ) 12. Scheme The secuterisation Co. or reconstruction Co. can raise funds from qualified institutional buyers by formulating schemes. Funds so raised are required to be maintained in, separate distinct accounts schemewise. The scheme invites subscription to security receipts proposed to be issued by such company. 13. Asset Based Securities (ABs) Assets are of uniform nature & character eg. Car loans or housing loans. Housing loans are mortgage based securities (MBS). 9

- 10. Certain Important Definitions (ContdâĶ) 14. Collecterised Debt Obligations (CDO) Represent diversified pool of assets. 15. Secuterisation Company Company registered under Companies Act 1956 for the purpose of securitisation. It also needs registration from RBI as per SARFAESI Act. The Co. can set up separate trusts â schemewise â and act as a trustee for such schemes as provided in âSecuritisation Companies (Reserve Bank) Guidelines and Discretions 2003â. The investors in the secuterisation Co. are the beneficieries of such trusts. 10

- 12. Securitisation Means acquisition of financial asset by securitisation or reconstruction Co. from the originator â by raising funds by such company from qualified institutional buyers by issue of security receipts representing undivided interest in the financial asset or otherwise. Now SARFAESI Act has made the loans secured by mortgage or other charges transferable. RBI is the regulatory authority for all securitisation or reconstruction company. 12

- 13. Securitisation (Cont.) ïSecuritisation is the process of converting existing assets or future cash flows into tradable securities through a special purpose vehicle (SPV) ïSecurities issued by SPV are referred to as (PTC) Pass Through Certificates. ïInvestors are purchasers of Pass Through Certificates. ïServicer collects periodic installments due from individual borrowers in pool, makes payout to investors & follows up on delinquent A/cs. Furnishes information to rating agencies & trustees on pool performance. He gets service fees.

- 14. Securitisation (contdâĶ) As per guidelines of 29/03/2004, the minimum capital requirement for secuterised company is -2- crores at the time of registration â Capital Adequacy of 15% of total asset acquires or Rs.100 crores whichever is less. Secuterisation is the process of converting existing assets or future cash flows into tradable securities through a special purpose vehicle ( secuterised company) which may then be sold in the market. 14

- 15. Securitisation & Housing Finance Mortgage based securities â long maturity & create asset â liability gaps in lenderâs books. Lenders securitise & sell to Investors. In housing loans credit risk is low but for investor, major risk is interest rate risk particularly on fixed rate in falling interest rate â prepayment possibilities â alters cash flows upsets investment decisions. 15

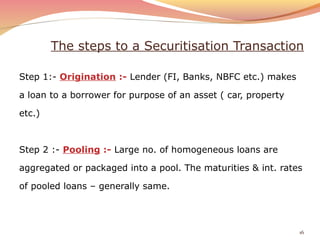

- 16. The steps to a Securitisation Transaction Step 1:- Origination :- Lender (FI, Banks, NBFC etc.) makes a loan to a borrower for purpose of an asset ( car, property etc.) Step 2 :- Pooling :- Large no. of homogeneous loans are aggregated or packaged into a pool. The maturities & int. rates of pooled loans â generally same. 16

- 17. The steps to a Securitisation Transaction (contdâĶ) Step 3:- Sale / Transfer :- of assets from originator to an entity â SPV â Special Purpose Vehicleâ â SPV may be a trust, a public sector entity. Step 4:- Issue of ABS (Asset Based Securities) :- SPV issues securities to investors and the proceeds from the issuance are used to pay the originator for the pool of loans 17

- 18. Advantages to Investor 1. Liquidity:- Instruments are freely tradable in market. 2. Safety:- Rated instruments & backed by assets. 3. Securities:- fetch 50 to 100 basis points above the yields for similar rated debt paper. 4. Diversification:- Different types of instrument in diff. cash flow requirements. 18

- 19. Advantages to Seller (Originator) 1. Securitisation mitigates risk arising on account of liquidity & interest rates. 2. Exposure norms i.e. Borrowerwise (single/group) & industry can be taken care. 3. Diversification of funding services whenever seller wants to fund new projects. 4. Capital adequacy requirement can be addressed. If CAR is inadequate, by securitisation, CAR can be fixed as per regulatory requirement. 19

- 20. Advantages to Market 1. It creates more depth in the market by adding more diversified instruments with different maturities. 2. More fee based income for financial institutions, since they may act as administrators. 20

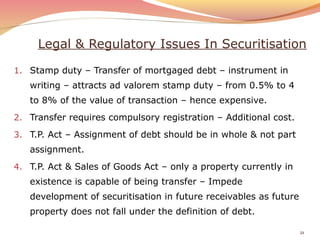

- 21. Legal & Regulatory Issues In Securitisation 1. Stamp duty â Transfer of mortgaged debt â instrument in writing â attracts ad valorem stamp duty â from 0.5% to 4 to 8% of the value of transaction â hence expensive. 2. Transfer requires compulsory registration â Additional cost. 3. T.P. Act â Assignment of debt should be in whole & not part assignment. 4. T.P. Act & Sales of Goods Act â only a property currently in existence is capable of being transfer â Impede development of securitisation in future receivables as future property does not fall under the definition of debt. 21

- 22. Legal & Regulatory Issues In Securitisation (contdâĶ) 5. I.T. Act â Sec.60 contemplates transfer of income without transfer of assets (which are source of income). The income so transferred is chargeable to income tax as income of the transferor & is included in his total income. 6. Foreclosure Laws â Sec. 67 of T.P.Act â on default by mortgager â mortgagee has right to obtain a decree that mortgager be deferred forever to get back the property. This makes it difficult to transfer property in cases of default. 7. SPV structured as a Company under companies Act may come under definition of NBFC â hence subject to prudential norms. 22

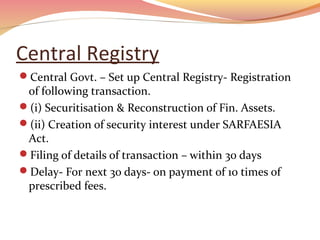

- 23. Central Registry ïCentral Govt. â Set up Central Registry- Registration of following transaction. ï(i) Securitisation & Reconstruction of Fin. Assets. ï(ii) Creation of security interest under SARFAESIA Act. ïFiling of details of transaction â within 30 days ïDelay- For next 30 days- on payment of 10 times of prescribed fees.

- 24. Modification & Satisfaction Of Charge ïWithin 30 days- Modification-additional 30 days- fees- 10 times of fees ïSatisfaction- Notice to secured creditor- to show cause within 14 days why satisfaction be not recorded as initialled. ïPenalties: (Sec.23)Rs. 5000 for each day of delay for reg./mod./satisfaction. ïPenalties: Non-compliance of RBI directives- Fine of Rs. 5 lacs- then Rs. 10000 per day.

- 25. The New Draft Guidelines (Issued in April 2010) A minimum holding period (MHP) and a minimum retention requirement (MRR) by the originator. MHP â A) 9 months for loans with maturity of less than 24 months. B) 12 months for loans with maturity of more than 24 months. MRR â A) Loans with maturity of less than -24- months â proposed as 5%. B) Loans with maturity of more than -24- months â proposed as 10%. 25

- 26. The New Draft Guidelines (contdâĶ) Banks will not be permitted to hedge the credit risks in the retained exposures (MRR). The total exposure of Banks to SPV should not exceed 20% Complex securitisation structures viz.re-securitisation synthetic securitisation and securities with revolving structures are specifically prohibited Loan Restructuring Not possible for borrower since the banker â customer relationship is snapped when the loans are secuterised. 26