Self Help and Acq. Rehab App - Dec 2016

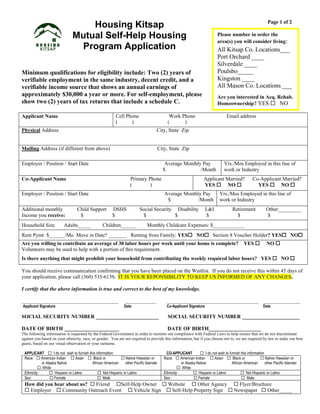

- 1. Housing Kitsap Mutual Self-Help Housing Program Application Minimum qualifications for eligibility include: Two (2) years of verifiable employment in the same industry, decent credit, and a verifiable income source that shows an annual earnings of approximately $30,000 a year or more. For self-employment, please show two (2) years of tax returns that include a schedule C. Page 1 of 2 Applicant Name Cell Phone Work Phone Email address ( ) ( ) Physical Address City, State Zip Mailing Address (if different from above) City, State Zip Employer / Position / Start Date Average Monthly Pay $ /Month Yrs./Mos Employed in this line of work or Industry Co-Applicant Name Primary Phone ( ) Applicant Married? Co-Applicant Married? YES  NO  YES  NO  Employer / Position / Start Date Average Monthly Pay $ /Month Yrs./Mos Employed in this line of work or Industry Additional monthly Child Support DSHS Social Security Disability L&I Retirement Other_________ Income you receive: $ $ $ $ $ $ $ Household Size Adults_____ Children______ Monthly Childcare Expenses: $____________ Rent Pymt $______/Mo Move in Date? _______ Renting from Family: YES NO Section 8 Voucher Holder? YES NO Are you willing to contribute an average of 30 labor hours per week until your home is complete? YES  NO  Volunteers may be used to help with a portion of this requirement. Is there anything that might prohibit your household from contributing the weekly required labor hours? YES  NO  You should receive communication confirming that you have been placed on the Waitlist. If you do not receive this within 45 days of your application, please call (360) 535-6139. IT IS YOUR REPONSIBILITY TO KEEP US INFORMED OF ANY CHANGES. I certify that the above information is true and correct to the best of my knowledge. _____________________________________ ____________ ___________________________________ ______________ Applicant Signature Date Co-Applicant Signature Date SOCIAL SECURITY NUMBER ________________________ SOCIAL SECURITY NUMBER ______________________ DATE OF BIRTH _____________________ DATE OF BIRTH____________________ The following information is requested by the Federal Government in order to monitor our compliance with Federal Laws to help ensure that we do not discriminate against you based on your ethnicity, race, or gender. You are not required to provide this information, but if you choose not to, we are required by law to make our best guess, based on our visual observation or your surname. APPLICANT  I do not wish to furnish this information CO-APPLICANT  I do not wish to furnish this information Race:  American Indian  Asian  Black or  Native Hawaiian or or Alaska Native African American other Pacific Islander  White Race:  American Indian  Asian  Black or  Native Hawaiian or or Alaska Native African American other Pacific Islander  White Ethnicity:  Hispanic or Latino  Not Hispanic or Latino Ethnicity:  Hispanic or Latino  Not Hispanic or Latino Sex:  Female  Male Sex:  Female  Male How did you hear about us?  Friend Self-Help Owner  Website  Other Agency  Flyer/Brochure  Employer  Community Outreach Event  Vehicle Sign  Self-Help Property Sign  Newspaper  Other_____ Please number in order the area(s) you will consider living: All Kitsap Co. Locations___ Port Orchard ____ Silverdale ____ Poulsbo_____ Kingston ____ All Mason Co. Locations ___ Are you interested in Acq. Rehab. Homeownership? YES  NO 

- 2. Housing Kitsap Page 2 of 2 Mutual Self-Help Housing Program Application CREDIT PULL AUTHORIZATION I/We hereby authorize Housing Kitsap to verify my/our past and present employment earnings records, bank accounts, retirement accounts and other asset balances needed to process my/our mortgage application. I/We further authorize Housing Kitsap to order a credit report and verify other credit information, including past and present landlord references. It is understood that a photocopy of this form will also serve as authorization. The information obtained by Housing Kitsap is only to be used in the processing of my/our application for a mortgage loan. Pre-qualified applications will be maintained on file for 365 days unless placed in a building group that exceeds this duration. _____________________________________ ____________ ___________________________________ ______________ Applicant Signature Date Co-Applicant Signature Date ______________________________________________ ______________________________________________ Applicant printed name Co-Applicant printed name Mail completed application to: Housing Kitsap ATTN: Self-Help Intake 345th Street, Suite 100 Bremerton, WA 98337 - OR - Fax completed application to: (360) 535-6169 - OR - Email completed application to: Marketing@HousingKitsap.org For questions, please call: Local: (360) 535-6139 TDD: (360) 535-6106 Toll Free: 1(800) 693-7070 x 6140 This is an Equal Opportunity Program. Discrimination is prohibited by Federal Law. Complaints of discrimination may be filed With USDA, Office of Civil Rights 1400 Independence Ave., SW Washington, DC 20250-9410 Telephone: (866) 632-9992 TDD (202) 401-0216