eFinancial Communications Services Brochure

- 1. Services Overview eFinancial Communications 2012 www.efinancialcommunications.com

- 2. Contents THE eFC PROCESS 1 SERVING THE FINANCIAL SERVICES INDUSTRY 2 PAPERLESS SOLUTIONS 3 DIGITAL SERVICE PROVIDER CONSOLIDATION 4 CUSTOM PORTAL AND DASHBOARD DESIGN 5 INTELLEGENT MARKETING 6 LEADERSHIP 7 ADVISORY BOARD 8 Headquarters: San Diego, CA Established: 2010 info@efinancialcommunications.com 619-333-6245 www.efinancialcommunications.com

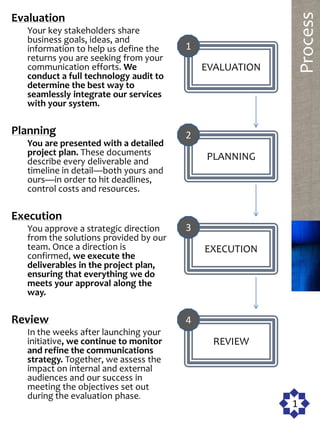

- 3. Process Evaluation Your key stakeholders share business goals, ideas, and information to help us define the 1 returns you are seeking from your communication efforts. We EVALUATION conduct a full technology audit to determine the best way to seamlessly integrate our services with your system. Planning 2 You are presented with a detailed project plan. These documents PLANNING describe every deliverable and timeline in detailâboth yours and oursâin order to hit deadlines, control costs and resources. Execution You approve a strategic direction 3 from the solutions provided by our team. Once a direction is EXECUTION confirmed, we execute the deliverables in the project plan, ensuring that everything we do meets your approval along the way. Review 4 In the weeks after launching your initiative, we continue to monitor REVIEW and refine the communications strategy. Together, we assess the impact on internal and external audiences and our success in meeting the objectives set out during the evaluation phase. 1

- 4. FINANCIAL SERVICES Financial Services Compliance: FFIEC, FDIC, OCC, Federal Reserve Board, SEC, NAFCU, CUNA, World Council of Credit Unions, SSAE16, FINRA, and many more. Go paperless and significantly reduce costs. Example: A major bank in the US currently spends approximately $10 to electronically distribute disclosure documents during the mortgage application process. If done with the eFC system, the paperless application processing would be approximately 80 â 90% less! Imagine the cost savings of a full paperless initiative. Additionally, the paperless solution combined with the digital signature solution provides efficiency and tracking throughout the application process. Gain efficiency by consolidating digital service providers to a single relationship Example: A credit union desiring paperless operations, targeted emails, digital signature capabilities, text messaging capabilities, QR code capabilities and landing page analytics would have to manage six or more relationships, which most likely means a full-time in-house resource. With eFC, the credit union would only need one relationship and one integration. eFC continually adds new providers as emerging technologies come to market, providing the credit union with access to new digital services without needing to continually pay for integrations or in-house labor hours. Turn regular communication into relevant cross-selling opportunities Example: An insurance company misses an important opportunity for relevant communication with its customers every time it sends a policy statement. With eFC, regular paper statements can become relevant cross-selling opportunities, based on information in the eFC business intelligence platform. For example, a client with a policy that has not been reviewed in over 24 months could automatically receive information in their statement indicating that they are due for a policy review. Or, a client with only minimal insurance coverage could receive up-selling messages about additional coverage specifically applicable to their needs. Offer client access to account information with a custom portal or dashboard Example: An investment services company can partner with eFC to offer client access to account information via a custom portal or dashboard. âĶAND MORE!! 2

- 5. eDocuments Total Document Management Manage and track document workflow âĒ Capture electronic signatures âĒ Store and access documents remotely Example: A credit union can receive and process a loan application digitally and in compliance with regulations. The application can be transferred seamlessly between required departments for processing and the stages of processing can be tracked. Additionally, all truth in lending communications can be digitally sent to the consumer and tracked. This means cost savings through greater efficiency and reduced printing, postage and handling costs. Search content from scanned documents Example: With the underlying eFC business intelligence database, a university could scan paper student application documents and then query reports off of the content from the paper documents. The university could search the information for all applicants with a GPA of 3.5 or higher, or search for any applicants with essay topics related to information technology, or any other relevant search. Reduce printing and postage costs Example: A private school partnered with eFC and reduced their invoicing costs by nearly 80% by switching to paperless solutions. The school is now able to track receipt of invoices and late payments, leading to shortened collection times and a less time intensive collections process. Additionally, invoice recipients are able to view their invoice on any number of devices making review and payment easier and faster. Enrich business intelligence data Example: A major bank in the US recently closed thousands of accounts due to their understanding of the account holders. As it turns out, many of the closed accounts belonged to high net worth individuals. If the bank had partnered with eFC, it would have been able to identify and nurture the meaningful relationships. Additionally, the enriched data set would have allowed the bank to tailor the content of their communications to each individual client, ensuring that efforts to nurture relationships were effective. 3 PAPERLESS SOLUTIONS

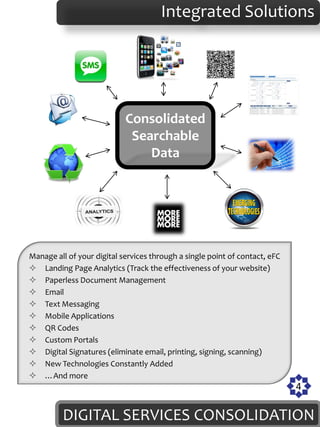

- 6. Integrated Solutions Consolidated Searchable Data Manage all of your digital services through a single point of contact, eFC ïē Landing Page Analytics (Track the effectiveness of your website) ïē Paperless Document Management ïē Email ïē Text Messaging ïē Mobile Applications ïē QR Codes ïē Custom Portals ïē Digital Signatures (eliminate email, printing, signing, scanning) ïē New Technologies Constantly Added ïē âĶAnd more 4 DIGITAL SERVICES CONSOLIDATION

- 7. Access Relevant Data Provide account information to authenticated clients with a custom web portal Example: A financial advisory firm could allow client access to sophisticated, client specific sets of information driven by the eFC business intelligence tool. The information made available would be at the discretion of the firm and could vary on a client to client basis. Provide internal access to business performance with a custom dashboard. Example: An insurance can track their brokersâ performance and the type of coverage that is trending in real-time, allowing proactive action to take place instead of the traditional reactive approach to regular business performance reporting. 5 CUSTOM PORTAL & DASHBOARD

- 8. Targeted Communications Consolidated Searchable Data The powerful eFC business intelligence database is able to consolidate and leverage data from an array of sources for targeted communications. ïķAccount Statements Emails ïķ Newsletters ïķ Legal Correspondence ïķ ïķ Invoices ïķ Any other form of communication ïķ The generic becomes customized The manual becomes automated The aimless becomes targeted 6 INTELLIGENT MARKETING

- 9. We provide advanced, dependable, scalable and cost-effective integrated technology solutions. LEADERSHIP: Sandeep Shah, CEO (MBA): Working primarily within the financial services industry (large mutual fund companies, mortgage companies, broker dealers etc.) as an IT Project Manager and Business Consultant Sandeep has an in-depth understanding of the complex IT and business regulations with regards to developing intricate software solutions. Sandeep specializes in bridging the business requirements and processes and the information technology that they rely on. Sandeep also has extensive experience working at a boutique marketing firm where he was deploying systems that served retailers in nurturing and retaining customers. Sandeep has a B.S in computer science with management from Kings College London, England and a MBA from Pepperdine, California, CA. John Mueller, CTO: John has over 28 years of experience within the financial industry working as a Database Architect & Data Warehouse Architect defining and building many financial services applications and platforms. He has worked for commercial and retail banks as well as large brokerage firms. John specializes within Microsoft SQL Server technologies. John is spearheading the Microsoft Azure transition from the traditional rack-space architecture. Steven Cavanaugh, Head of Marketing (MBA): Steven Cavanaugh is an experienced, highly versatile marketing professional, specializing in International Marketing and Media Production. Steven is fluent in Spanish and has experience in industries including but not limited to Music, Retail Banking, and Web Advertising. Mr. Cavanaugh is also a seasoned public speaker, and brings brand messaging expertise to the leadership at eFC. Steven has a BA in comparative literature and a MBA from Pepperdine, California, CA. Emily Rosenberry, Head of Operations (MBA): Emily Rosenberry is a seasoned strategy, business development and operations management professional. Her engagement highlights include successful management of 25+ person teams; management of product categories in excess of $194 million; development of the Best Buy Mobile model during concept phase; development of successful operations in European, Asian, Australian & North American Markets for a start-up software company; and the development of a multi-million dollar mCommerce initiative at Qualcomm. Emily holds a BS in Management from Michigan State University and a MBA from Carlson School of Management at the University of Minnesota. Swati Patel, Sr. VP IT Audit Consulting Manager: Certified Information System Auditor (CISA) and is certified in Risk and Information Systems Control (CRISC). She has over 10 years of IT Risk, Audit, and consulting experience. Mrs. Patel has experience in a variety of industries including: Financial Services, Software, Entertainment, and Energy. Swati specializes in SOX Compliance and Operational Audits. Swati has her BS in Business Administration from University of Southern California. 7

- 10. We provide advanced, dependable, scalable and cost-effective integrated technology solutions. ADVISORY BOARD: Gary Lewis Evans: Gary Lewis Evans is former CEO of Bank of Internet USA (BofI Holding, Inc. NASDAQ: BOFI). Mr. Evans has established himself as an Internet banking Pioneer; founder of Bank of Internet USA, entrepreneur and co-author of the first book on Internet finance in 1996. In 2008, Mr. Evans was a finalist in the Ernst & Young Entrepreneur of The Year Award for the founding and growth of Bank of Internet USA. He has been actively involved in multiple startup companies and two successful IPOâs. Mr. Evans has served on many non-profit boards including, the American Red Cross, San Diego Mid-Cities Development Corporation, San Diego Hospice, the Salvation Army and San Diego Neighborhood Housing Services. Robert Copeland: Bob is a partner at Sheppard Mullin in the Corporate Securities practice group. Bob practices in the area of corporate law with an emphasis on corporate finance, securities, real estate and mergers and acquisitions law. His clients have included startup business ventures, private and public U.S. and offshore manufacturing, construction and service corporations, venture capital and private equity firms, media firms, real estate developers and syndicators. Recently he has had success connecting business owners seeking a liquidity solution with acquisition sources. John Bryan: A proven, Certified Management Consultant (CMC) with more than twenty-five years of broad-based experience in business consulting to a broad range of clients, Dr. Bryan has helped plan and launch more than a dozen startups and has improved the operational and financial performance of Fortune 500-size companies on four continents involving six languages. Through his own firm or contracted through other consulting firms, his extensive experience includes management of projects at multiple simultaneous locations; performance assessments and lean projects in mining, manufacturing, telecommunications, and service industries and for several large healthcare organizations, government agencies, insurance and financial institutions; customer service, sales, and call center operations; management training development and delivery; organizational behavior and development; and strategic planning. Aside from performance improvement, John also has significant experience in mentoring entrepreneurs and assisting startups with business planning, financial forecasts, and capital investment 8

- 11. Headquarters: San Diego, CA Established: 2010 info@efinancialcommunications.com 619-333-6245 www.efinancialcommunications.com