Shopify Investor Deck 08032016

- 1. 300,000+ ACTIVE SHOPIFY MERCHANTS $3.4 BILLION+ GMV IN Q2 2016

- 2. 2 Safe Harbour This presentation contains forward-looking statements that are based on our managementŌĆÖs current estimates, beliefs and assumptions, which are based on managementŌĆÖs perception of historic trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Although we believe that the plans, intentions, expectations, assumptions and strategies re’¼éected in these forward-looking statements are reasonable, these statements relate to future events or our future ’¼ünancial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from any future results expressed or implied by these forward-looking statements. Although the forward- looking statements contained in this presentation are based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on these statements since actual results may vary from the forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. These risks are described in further detail in the section entitled ŌĆ£Risk FactorsŌĆØ and elsewhere in our ’¼ülings with regulatory agencies. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual results may vary signi’¼ücantly from those implied or projected by the forward-looking statements. References to long-term trends in our model are forward-looking and made as of the current date. Nothing in this presentation should be regarded as a representation by any person that these long- term trends will be achieved and we undertake no duty to update its long-term trends. We believe that the case studies presented in this presentation provide a representative sample of how our merchants have been able to use various features of our platform to grow their respective businesses. References in this presentation to increased visits, growth and sales following implementation of our platform do not necessarily mean that our platform was the only factor contributing to such increases. To supplement the ’¼ünancial measures prepared in accordance with generally accepted accounting principles (GAAP), we use non-GAAP ’¼ünancial measures that exclude certain items. Non-GAAP ’¼ünancial measures are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. AUGUST 2016

- 3. 3 Store #1: Snowdevil C I R C A 2 0 0 4

- 4. Brick-and-Mortar One Platform, Every Channel, Any Device. STOREFRONTS 4

- 5. 5 One Platform, Every Channel, Any Device. ŌĆó snowboards ŌĆó shredding ŌĆó winter gear Inventory ShippingOrder Management AnalyticsPromotionsPayments Apps A single, integrated back office Financing

- 6. 6 Our Market E N T R E P R E N E U R S H I P S M B L A R G E R 299$ PER MONTH 79$ PER MONTH 29$ PER MONTH Enterprise SMB Entrepreneurs

- 7. 7 Build-a-Business GENERATED TOTAL GMV > $600 MILLION 2011 2012 2013 2014 TIM FERRISS SETH GODI N G ARY VAYNE RC HU K DAYMOND JOH N 2015 SI R RICHARD BRANS ON 2016 TONY ROBBINS

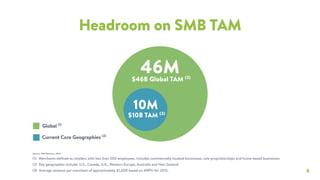

- 8. 8 Headroom on SMB TAM Source: AMI Partners, 2014 (1) Merchants defined as retailers with less than 500 employees. Includes commercially located businesses, sole proprietorships and home-based businesses (2) Key geographies include: U.S., Canada, U.K., Western Europe, Australia and New Zealand (3) Average revenue per merchant of approximately $1,000 based on ARPU for 2015. Global (1) Current Core Geographies (2) 10M 46M$46B Global TAM (3) $10B TAM (3)

- 10. 10 Partner Ecosystem SH OPIFY APP STORE SH OPIFY TH EM E STORE SH OPIFY E XPE R TS 300k+ Merchants App Developers Theme Designers Agencies

- 11. Partners APP AND INTEGRATION PARTNERS DESIGN AND DEVELOPMENT AGENCIES STRATEGIC PARTNERS 11

- 13. 13 Synonymous with Ecommerce ŌĆ£ShopifyŌĆØ ŌĆ£EcommerceŌĆØ G O O G L E T R E N D S D ATA F I LT E R E D F O R U S A 2009 2010 2011 2012 2013 2014 2015 2016

- 14. TH E NUMBE RS 14

- 15. 15 Financial Highlights LONG-TERM FOCUSIII Strong, consistent growth in Revenue, MRR and GMV Success-based revenue stream built on a large recurring subscription (SaaS) base Strong track record of cash management and investing for the long term GROWTHI POWERFUL BUSINESS MODELII

- 16. 16 Strong Consistent Revenue Growth ŌĆó Growing merchant base ŌĆó Expanding GMV ŌĆó Introduction and adoption of merchant offerings ŌĆó Robust partner ecosystem D R I V E R S Q2 2015 + 93% $86.6M $44.9M Subscription solutions Merchant solutions $23.7M $105.0M 2013 20142012 $50.3M +109% +112% Q2 2016 +95% 2015 $205.2M

- 17. 17 Strong Consistent MRR Growth Monthly Recurring Revenue, or MRR, is calculated at the end of each period by multiplying the number of merchants who have subscription plans with us at the period end date by the average monthly subscription plan fee revenue in effect on the last day of that period, assuming they maintain their subscription plans the following month. 2013 20142012 2015 Q1 Q1 Q1Q1 $14.4M 82% CAGR $1.1M 2016 Q1

- 18. 18 Strong Consistent GMV Growth ŌĆó More merchants ŌĆó Shopify Plus, POS, new sales channels ŌĆó Higher avg. GMV per merchant D R I V E R S Q2 ŌĆś15 Q2 ŌĆś16 +106% $3.4B $1.6B $0.7B $3.8B 2013 20142012 $1.6B +133% +128% 2015 $7.7B+105%

- 19. 19 Powerful Business Model $18.9M $61.8M 2013 20142012 $36.7M Q2 ŌĆś15 Q2 ŌĆś16 $46.2M $25.3M +94% GROSS PROFIT +68% 2015 $111.1M+80% +83%

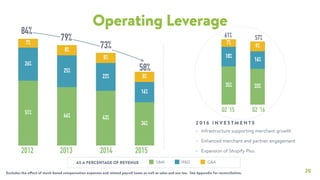

- 20. 20 Operating Leverage Excludes the effect of stock-based compensation expenses and related payroll taxes as well as sales and use tax. See Appendix for reconciliation. 8% 8% 8% 7% 16% 22% 25% 26% 34% 43%46% 51% S&M R&D G&A 2013 20142012 2015 84% 79% 73% AS A PERCENTAGE OF REVENUE 9% 7% 16% 18% 33%35% Q2 ŌĆś15 Q2 ŌĆś16 ŌĆó Infrastructure supporting merchant growth ŌĆó Enhanced merchant and partner engagement ŌĆó Expansion of Shopify Plus 2 0 1 6 I N V E S T M E N T S 61% 57% 58%

- 21. 21 More Merchants & More GMV More Partners More Solutions More International Penetration More Channels Growth Vectors

- 22. 22 Make commerce better for everyone.

- 23. APPENDIX 23

- 24. 24 Non-GAAP Financial Measures To supplement its consolidated ’¼ünancial statements, which are prepared and presented in accordance with United States generally accepted accounting principles (GAAP), Shopify uses certain non-GAAP ’¼ünancial measures to provide additional information in order to assist investors in understanding its ’¼ünancial and operating performance. Adjusted operating loss, adjusted net loss and adjusted net loss per share are non-GAAP ’¼ünancial measures that exclude the effect of stock-based compensation expenses and related payroll taxes as well as sales and use tax. Management uses non-GAAP ’¼ünancial measures internally for ’¼ünancial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past ’¼ünancial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its ’¼ünancial and operational decision making.Non-GAAP ’¼ünancial measures are not recognized measures for ’¼ünancial statement presentation under US GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP ’¼ünancial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. See the ’¼ünancial tables below for a reconciliation of the non-GAAP measures. AUGUST 2016

- 25. 25 Reconciliation to GAAP Figures 2012 2013 2014 2015 Q2ŌĆÖ15 Q2ŌĆÖ16 GAAP Sales and marketing 12,262 23,351 45,929 70,374 16,091 29,413 less: Sales and marketing SBC and SBC-related payroll taxes 66 354 696 1,351 182 1,025 Non-GAAP Sales and Marketing 12,196 22,997 45,233 69,023 15,909 28,388 % of Revenue 51% 46% 43% 34% 35% 33% GAAP Research and development 6,452 13,682 25,915 39,722 8,800 16,732 less: Research and development SBC and SBC-related payroll taxes 282 1,152 2,776 6,373 826 3,255 Non-GAAP Research and development 6,170 12,530 23,139 33,349 7,974 13,477 % of Revenue 26% 25% 22% 16% 18% 16% GAAP General and administrative 1,737 3,975 11,566 18,731 3,822 8,680 less: General and administrative SBC and SBC-related payroll taxes 49 147 712 2,419 491 1,016 less: Non-recurring sales and use tax expense - - 2,182 566 - - Non-GAAP General and administrative 1,688 3,828 8,672 15,746 3,331 7,664 % of Revenue 7% 8% 8% 8% 7% 9% GAAP Operating Expense 20,451 41,008 83,410 128,827 28,713 54,825 less: Operating SBC and SBC-related payroll taxes 397 1,653 4,184 10,143 1,499 5,296 less: Non-recurring sales and use tax expense - - 2,182 566 - - Non-GAAP Operating Expense 20,054 39,355 77,044 118,118 27,214 49,529 % of Revenue 84% 79% 73% 58% 61% 57% Numbers may not foot due to rounding.