Single Tenant Net Lease Cap Rate Research Report

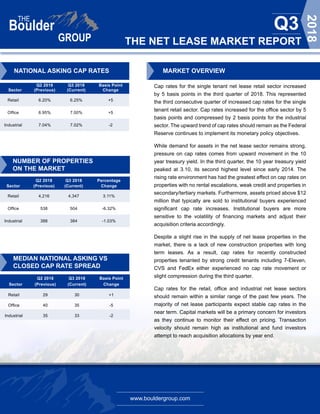

- 1. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2018 Q2 2018 Q3 2018 Basis Point Sector (Previous) (Current) Change Retail 6.20% 6.25% +5 Office 6.95% 7.00% +5 Industrial 7.04% 7.02% -2 NUMBER OF PROPERTIES ON THE MARKET Q2 2018 Q3 2018 Percentage Sector (Previous) (Current) Change Retail 4,216 4,347 3.11% Office 538 504 -6.32% Industrial 388 384 -1.03% MEDIAN NATIONAL ASKING VS CLOSED CAP RATE SPREAD MARKET OVERVIEW Cap rates for the single tenant net lease retail sector increased by 5 basis points in the third quarter of 2018. This represented the third consecutive quarter of increased cap rates for the single tenant retail sector. Cap rates increased for the office sector by 5 basis points and compressed by 2 basis points for the industrial sector. The upward trend of cap rates should remain as the Federal Reserve continues to implement its monetary policy objectives. While demand for assets in the net lease sector remains strong, pressure on cap rates comes from upward movement in the 10 year treasury yield. In the third quarter, the 10 year treasury yield peaked at 3.10, its second highest level since early 2014. The rising rate environment has had the greatest effect on cap rates on properties with no rental escalations, weak credit and properties in secondary/tertiary markets. Furthermore, assets priced above $12 million that typically are sold to institutional buyers experienced significant cap rate increases. Institutional buyers are more sensitive to the volatility of financing markets and adjust their acquisition criteria accordingly. Despite a slight rise in the supply of net lease properties in the market, there is a lack of new construction properties with long term leases. As a result, cap rates for recently constructed properties tenanted by strong credit tenants including 7-Eleven, CVS and FedEx either experienced no cap rate movement or slight compression during the third quarter. Cap rates for the retail, office and industrial net lease sectors should remain within a similar range of the past few years. The majority of net lease participants expect stable cap rates in the near term. Capital markets will be a primary concern for investors as they continue to monitor their effect on pricing. Transaction velocity should remain high as institutional and fund investors attempt to reach acquisition allocations by year end. Q2 2018 Q3 2018 Basis Point Sector (Previous) (Current) Change Retail 29 30 +1 Office 40 35 -5 Industrial 35 33 -2 NATIONAL ASKING CAP RATES

- 2. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2018 SELECTED SINGLE TENANT SALES COMPARABLES Sale Date Sector Tenant City State Price Price Per SF Cap Rate Lease Term Remaining Aug-18 Office NetScout Allen TX $54,000,000 $372 6.58% 12 Jul-18 Office Alliance Data Center Columbus OH $49,950,000 $194 6.61% 14 Jul-18 Industrial Preferred Freezer Storage Perth Amboy NJ $38,300,000 $147 7.00% 12 Jul-18 Office Liberty Mutual Chandler AZ $28,500,000 $279 5.75% 10 Jul-18 Industrial Newell Rubbermaid Akron OH $21,376,099 $32 6.89% 10 Jul-18 Retail Safeway Kings Beach CA $18,425,000 $484 4.75% 20 Jul-18 Retail Jewel-Osco Palos Heights IL $15,500,000 $269 5.88% 19 Jul-18 Industrial SuperValu Oglesby IL $15,450,000 $48 6.49% 20 Jul-18 Retail LA Fitness Menifee CA $14,600,000 $384 6.00% 15 Aug-18 Retail Regal Cinemas Christiansburg VA $12,900,000 $239 8.06% 12 Aug-18 Industrial FedEx Brockton MA $9,825,000 $137 8.90% 4 Jul-18 Retail Walgreens Chestertown MD $9,787,500 $655 5.50% 16 Aug-18 Retail Home Depot (GL) South Elgin IL $8,800,000 -- 4.50% 29 Aug-18 Retail Wawa (GL) West Palm Beach FL $7,700,000 -- 4.45% 20 Sep-18 Industrial FedEx Kalamazoo MI $7,350,000 $61 8.55% 2 Aug-18 Retail CVS Saint Augustine FL $6,369,000 $494 5.77% 15 Sep-18 Retail Sam's Club (GL) Castle Rock CO $6,300,000 -- 4.60% 20 Sep-18 Office DaVita (Call Center) Everett WA $6,070,000 $200 5.78% 14 NET LEASE CAP RATE TRENDS Retail Office Industrial 5,75% 6.25% 6.75% 7.25% 7.75% 8.25% 8.75% Q1 2004 Q3 2004 Q1 2005 Q3 2005 Q1 2006 Q3 2006 Q1 2007 Q3 2007 Q1 2008 Q3 2008 Q1 2009 Q3 2009 Q1 2010 Q3 2010 Q1 2011 Q3 2011 Q1 2012 Q3 2012 Q1 2013 Q3 2013 Q1 2014 Q3 2014 Q1 2015 Q3 2015 Q1 2016 Q3 2016 Q1 2017 Q3 2017 Q1 Q3 2018 2018

- 3. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2018 © 2018. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. FOR MORE INFORMATION John Feeney Senior Vice President john@bouldergroup.com Scott Harris | Senior Analyst scott@bouldergroup.com Jeff Weil | Analyst jeff@bouldergroup.com Tenant 2012-2018 2005-2011 2000-2005 Pre 2000 7-Eleven 4.85% 5.30% 5.95% 6.30% Advance Auto Parts 6.00% 6.80% 7.40% 7.90% AutoZone 5.00% 5.62% 6.32% 7.05% Bank of America N/A 5.15% 6.10% 6.50% Chase Bank 4.40% 4.65% 4.95% 5.50% CVS Pharmacy 5.30% 5.70% 6.25% 7.10% DaVita Dialysis Center 5.68% 6.10% 6.80% 7.20% Dollar General 7.02% 7.79% 8.11% 8.60% Family Dollar 7.10% 7.55% 8.18% 8.75% FedEx 6.00% 6.55% 7.03% 7.50% Fresenius 5.80% 6.40% 6.95% 7.33% McDonald's (GL) 4.00% 4.30% 4.60% 4.90% O'Reilly Auto Parts 5.63% 6.00% 6.35% 6.90% Rite Aid 6.50% 7.12% 7.83% 8.55% Starbucks 5.15% 5.50% 6.05% 6.65% Walgreens 5.52% 6.00% 6.85% 7.25% MEDIAN ASKING CAP RATES BY YEAR BUILT CONTRIBUTORS Randy Blankstein | President randy@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com AUTHOR