Sm ppt

- 2. ACQUISITION ïĒA transaction where one firms buys another firm with the intent of more effectively using a core competence by making the acquired firm a subsidiary within its portfolio of business ïĒ It also known as a takeover or a buyout ïĒ It is the buying of one company by another. ïĒ In acquisition two companies are combine together to form a new company altogether. ïĒExample: Company A+ Company B= Company A.

- 3. MERGER o A transaction where two firms agree to integrate their operations on a relatively co-equal basis because they have resources and capabilities that together may create a stronger competitive advantage. o The combining of two or more companies, generally by offering the stockholders of one company securities in the acquiring company in exchange for the surrender of their stock o Example: Company A+ Company B= Company C. 3

- 4. DIFFERENCE BETWEEN MERGER AND ACQUISITION: MERGER ACQUISITION i. Merging of two organization in to one. ii. It is the mutual decision. iii. Merger is expensive than acquisition(higher legal cost). iv. Through merger shareholders can increase their net worth. v. It is time consuming and the company has to maintain so much legal issues. vi. Dilution of ownership occurs in merger. i. Buying one organization by another. ii. It can be friendly takeover or hostile takeover. iii. Acquisition is less expensive than merger. iv. Buyers cannot raise their enough capital. v. It is faster and easier transaction. vi. The acquirer does not experience the dilution of ownership.

- 5. M&A DEALSâĶ

- 6. 1. TATA STEEL-CORUS: $12.2 BILLION ïĒ January 30, 2007 ïĒ Largest Indian take-over ïĒ After the deal TATAâS became the 5th largest STEEL co. ïĒ 100 % stake in CORUS paying Rs 428/- per share Image: B Mutharaman, Tata Steel MD; Ratan Tata, Tata chairman; J Leng, Corus chair; and P Varin, Corus CEO.

- 7. 2. VODAFONE-HUTCHISON ESSAR: $11.1 BILLION ïĒTELECOM sector ïĒ11th February 2007 ïĒ2nd largest takeover deal ïĒ67 % stake holding in hutch Image: The then CEO of Vodafone Arun Sarin visits Hutchison Telecommunications head office in Mumbai.

- 8. 11. RIL-RPL MERGER: $1.68 BILLION ïĒMarch 2009 ïĒ Merger deal ïĒamalgamation of its subsidiary Reliance Petroleum with the parent company Reliance industries ltd. ïĒ Rs 8,500 crore ïĒ RIL-RPL merger swap ratio was at 16:1 Image: Reliance Industries' chairman Mukesh Ambani.

- 9. MERGER BETWEEN AIR INDIA AND INDIAN AIRLINES ïĒ The government of India on 1 march 2007 approved the merger of Air India and Indian airlines. ïĒ Consequent to the above a new company called National Aviation Company of India limited was incorporated under the companies act 1956 on 30 march 2007 with its registered office at New Delhi. 9

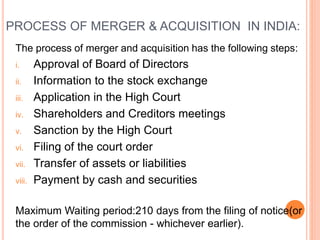

- 10. PROCESS OF MERGER & ACQUISITION IN INDIA: The process of merger and acquisition has the following steps: i. Approval of Board of Directors ii. Information to the stock exchange iii. Application in the High Court iv. Shareholders and Creditors meetings v. Sanction by the High Court vi. Filing of the court order vii. Transfer of assets or liabilities viii. Payment by cash and securities Maximum Waiting period:210 days from the filing of notice(or the order of the commission - whichever earlier).