Social security time bomb

2 likes660 views

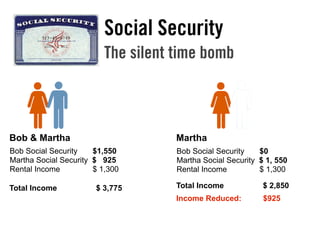

Bob and Martha receive Social Security and rental income totaling $3,775. If Bob were to pass away, Martha's Social Security would increase to $1,550 but rental income would remain $1,300, reducing their total joint income by $925 to $2,850.

1 of 1

Download to read offline

Ad

Recommended

Christmas Decor Themes by the Quicken Loans Zing Blog

Christmas Decor Themes by the Quicken Loans Zing BlogQuicken Loans Zing Blog

╠²

The document discusses various Christmas decor themes beyond traditional red and green. It highlights themes such as black and gold, blue Christmas, Victorian woodland, and others like Downton Abbey and tropical sea life. The themes incorporate elements of elegance and creativity for festive decorations.Qwizdom - Ratio dividing

Qwizdom - Ratio dividingQwizdom UK

╠²

The document contains several ratio division word problems asking how much different people would receive when splitting money according to given ratios. It asks how much Mark, Peter, Mary, and Jane would each get from splitting ┬Ż10 and ┬Ż30 based on 4:1 and 3:7 ratios. It also asks how much Alex, Sam, and Jane would each receive from splitting ┬Ż40 based on a 3:6:1 ratio. Finally, it asks the user to simplify some additional ratios using "/" instead of ":"BEST ELECTRIC GUITAR

BEST ELECTRIC GUITARmicrosoft789

╠²

The document lists various electric guitars available for purchase, with prices and discounts highlighted. Notable brands include Gibson, Fender, and PRS, showcasing a range of models and significant savings. The prices reflect discounts of up to 68% off retail values.Kaitlyns Sweet 16

Kaitlyns Sweet 16melayala01

╠²

Kaitlyn is turning 16 years old. Her parents Linda and John are throwing her a Sweet 16 birthday party to celebrate the occasion. They wish her a happy birthday and sign the card with love from both of them.Manthly budget

Manthly budgetUtkarshvardhanniit

╠²

This monthly budget document outlines a family's income and expenditures. The family earns Rs. 16,400 in salary and spends Rs. 10,696 with the largest expenses going to food, telephone bill, and maid's salary. After accounting for all income and costs, the family is able to save Rs. 3,425, which is 34% of their total monthly income.Kodaikanal Resorts

Kodaikanal ResortsKodaikanal Resorts

╠²

This document lists 9 resort options in Kodaikanal, India: Villa Retreat, Ferncreek Resorts, Hill Country Resorts, Holiday Home Resort, La-Flora Resorts, Lilly Valley Resorts, Mount Pleasant Resorts, Pine Borough Inn. It provides a website to book these Kodaikanal resorts online and get more information.SD Santo Yoseph 2 6A Dana Party

SD Santo Yoseph 2 6A Dana PartyGraciella@6LC

╠²

This document lists the names of 37 individuals and the total amount each contributed. It also indicates whether they received a bonus or not based on meeting certain contribution thresholds. The top 10 highest contributors are also listed by name and amount contributed, ranging from Dimas at Rp 125,000 to Ferdi at Rp 35,000. The document is signed off by Graciella Eunike Satriyo as the party chair.Hot Resort Deals

Hot Resort DealsPeter Lee

╠²

This document lists 10 international resorts offering deals for 1 week stays between $296-$398, including locations in Australia, Canada, the Bahamas, Italy, Barbados, Costa Rica, the Dominican Republic, Mexico, Spain, and the United States. Additional deals can be viewed by clicking the provided link for more travel deals from Travel News Saver.New reverse gary

New reverse garyShana Gough

╠²

- The document discusses how a reverse mortgage can help retirees access equity in their home to fund retirement. It provides information on how reverse mortgages work, the advantages, and how people are using them, such as supplementing retirement income or paying off existing mortgages.

- Key aspects of reverse mortgages outlined include that no repayments are required as long as the homeowner lives in the property, and the loan does not become due until the last owner no longer lives there or the home is sold. Qualifying is based on age, home value, and loan options chosen.

- The document explores new features that make reverse mortgages safer and more cost effective, and how financial advisors areReverse Mortgages Explained

Reverse Mortgages Explainedthompsonjr

╠²

A reverse mortgage is a loan that allows senior homeowners to convert home equity into income without selling their home or making monthly payments, primarily benefiting those aged 62 and older. Borrowers can access funds based on their home's value, location, and current interest rates, with repayment occurring only when they move, sell, or pass away. The Federal Housing Administration backs most reverse mortgages, ensuring borrowers never owe more than their home's worth and providing protections against foreclosure.Reverse Mortgage Purchase

Reverse Mortgage PurchaseElise A. David, Reverse Mortgages, Home Equity Conversion

╠²

A Home Equity Conversion Mortgage (HECM) for Purchase allows seniors to buy a new home using equity from the sale of their previous home and other assets. It is an FHA-insured loan that requires no monthly mortgage payments. Borrowers must be 62 years or older and use the home as their primary residence. The loan provides qualifying seniors with funds to purchase a home while eliminating monthly payments. Eligibility requirements include the youngest borrower being 62+, the purchased home being the primary residence, and the HECM for Purchase being the only mortgage loan used for the purchase.MetLife Reverse Mortgage Presentation

MetLife Reverse Mortgage PresentationTim_Allen_CMB

╠²

A reverse mortgage allows homeowners age 62+ to access their home equity through a loan. Key points:

1) You can receive funds as a lump sum, monthly payments, line of credit, or combination. Funds don't need to be repaid until you leave the home permanently.

2) Eligibility requires being 62+, owning your home outright or paying off existing mortgages with proceeds, and using the home as your principal residence.

3) You retain ownership and can choose how to use the funds, though it's not advised to invest proceeds due to costs. The loan is repaid when you pass away or permanently move out.HECM 4 PURCHASE INTRO BROCHURE

HECM 4 PURCHASE INTRO BROCHUREFreddie "Rainmaker" Lambert

╠²

A Home Equity Conversion Mortgage (HECM) for Purchase allows seniors to buy a new home using equity from the sale of their previous home without making monthly mortgage payments. It is an FHA-insured loan for homeowners aged 62+ that provides affordability and purchasing power to buy a primary residence. Seniors can right-size to a smaller home, purchase a retirement home, or buy a second home to rent out their existing home. The HECM for Purchase may help sellers reach more senior buyers and convert renters to homeowners. Borrowers must occupy the home, pay taxes and insurance, and the loan amount cannot exceed the home's value.Reverse Mortgage Marketing Fundamentals

Reverse Mortgage Marketing FundamentalsFBReverse

╠²

This document provides marketing strategies for reverse mortgages, including utilizing a 3-leg approach targeting existing customers, mass marketing techniques, and networking. It recommends a needs-based marketing focus and including a call to action. Specific mass marketing options discussed are TV, radio, direct mail, print, internet, and seminars. The document also offers additional resources and notes that the bank can provide assistance with marketing plans and materials.Reverse Mortgage Seminar

Reverse Mortgage SeminarYourOrlandoMortgage.com

╠²

The document provides a comprehensive overview of reverse mortgages, including definitions, eligibility requirements, types of reverse mortgages, and payment options. It explains the counseling requirements, interest rates, closing costs, and repayment conditions. Additionally, it offers insights into current trends and resources for further information.Training for Financial Professionals: Reverse Mortgages & Retirement Plans - ...

Training for Financial Professionals: Reverse Mortgages & Retirement Plans - ...George Omilan

╠²

The document outlines training for financial professionals on Home Equity Conversion Mortgages (HECMs), detailing their eligibility, workings, and benefits for retirement planning. It explains how HECMs enable homeowners 62 and older to access home equity without repaying the loan until they move or pass away, while highlighting their importance in managing wealth and retirement strategies. Various financial strategies, costs, product options, and government regulations surrounding HECMs are also discussed to aid financial professionals in advising clients effectively.Reverse Mortgage Presentation

Reverse Mortgage PresentationKeesha Taylor

╠²

The document outlines the history and benefits of reverse mortgages, specifically the Home Equity Conversion Mortgage (HECM) program, which allows seniors to access the equity in their homes without monthly payments. It discusses how reverse mortgages can improve seniors' financial situations, providing them options for living expenses while ensuring their home equity remains intact for heirs. Eligibility requires homeowners to be at least 62 years old and maintain insurance, taxes, and property maintenance to keep the mortgage in good standing.Nassau (bahamas) presentation

Nassau (bahamas) presentationJanna Lauver

╠²

Nassau, the capital of the Bahamas, is located on New Providence Island and has a population of around 240,000. It has a tropical climate and was historically a center of piracy before becoming a British colony in 1717. The economy relies heavily on tourism, with popular destinations including Paradise Island, Cable Beach, and swimming with dolphins at Blue Lagoon Island. The culture is influenced by both British and West African traditions, and the majority Black population speaks English with a distinct Bahamian accent.Reverse Mortgage Powerpoint

Reverse Mortgage PowerpointDiane Quitmeyer

╠²

This document provides an overview of reverse mortgages, detailing eligibility requirements, how they work, and their potential uses for seniors aged 62 and older. It explains that reverse mortgages allow homeowners to access their home equity without monthly payments, while still being responsible for property taxes and maintenance. The document also highlights the importance of independent counseling and the options available through MetLife Bank for those interested in pursuing a reverse mortgage.Bahamas Powerpoint

Bahamas Powerpointzackoo7

╠²

The Bahamas is an island country located in the Atlantic Ocean composed of a series of cays and islands, with Nassau as its capital and a population of around 353,658 people. The Bahamas has a tourism-based economy and a climate that ranges from subtropical to tropical, being warm in the summer and cold in the winter, and was once a haven for pirates but is now a popular tourist destination.New reverse presentation

New reverse presentation Thomas Mastromatto NMLS #145824

╠²

The document is a presentation about reverse mortgages developed by the National Reverse Mortgage Lenders Association for educational purposes. It discusses what a reverse mortgage is, how it works, recent changes that make it safer and more affordable, and how people are using reverse mortgages to supplement retirement income, pay off debts, defer social security, and afford longer retirements. The presentation aims to help homeowners determine if a reverse mortgage could fit into their retirement plans.Hecm and Divorce

Hecm and DivorceThomas Mastromatto NMLS #145824

╠²

This document discusses extenuating circumstances that may impact a home equity conversion mortgage (HECM) financial assessment. It lists loss of income due to death, divorce, unemployment, reduced work hours, or a health emergency as potential circumstances. It also mentions an increase in financial obligations from medical treatment or hospitalization as another circumstance that could affect the assessment.Lawyers argue for gay nuptials in final supreme court briefs

Lawyers argue for gay nuptials in final supreme court briefsThomas Mastromatto NMLS #145824

╠²

This document is a reply brief for petitioners in a case before the Supreme Court regarding Michigan's bans on same-sex marriage. It argues that the marriage bans violate principles of equal protection and liberty guaranteed by the Fourteenth Amendment. It asserts that the bans inflict substantial harms by denying same-sex couples access to marriage and the protections it provides. It also contends that excluding same-sex couples from marriage denies them equal dignity. The brief maintains that while states generally regulate marriage, this authority is limited by constitutional rights, and the bans here exceed those limits.IRS Form 8332

IRS Form 8332Thomas Mastromatto NMLS #145824

╠²

This document summarizes Form 8332, which allows a custodial parent to release their claim to an exemption for their child so that the noncustodial parent can claim the exemption. It provides instructions for the custodial parent to release the exemption for the current year (Part I), future years (Part II), or revoke a previous release for future years (Part III). Key details include defining custodial and noncustodial parents, the special rule for divorced/separated parents that allows the noncustodial parent to claim the exemption if certain conditions are met, and specifics on which pages of a pre-2009 divorce decree can substitute for using the form.Financial Advisors Top Firms

Financial Advisors Top FirmsThomas Mastromatto NMLS #145824

╠²

This document appears to be a survey and ranking of RIAs (Registered Investment Advisors) with over $1 billion in assets under management. It lists 88 RIAs, providing information such as their location, total assets, growth rates of assets and clients, and assets per client. The top RIA according to total assets is Hall Capital Partners from San Francisco with $27.6 billion in assets.Divorce information and worksheet

Divorce information and worksheetThomas Mastromatto NMLS #145824

╠²

This document serves as a comprehensive worksheet for individuals contemplating divorce, providing essential definitions, terms, and procedural instructions related to divorce actions. It includes sections for personal information, marriage details, children, income, assets, liabilities, and necessary documents. The aim is to facilitate organization and understanding for both parties before initial consultations with attorneys.Hidden assets

Hidden assetsThomas Mastromatto NMLS #145824

╠²

This document discusses various methods that some individuals use to hide assets and income during a divorce proceeding to avoid equitable distribution of marital property. Some of the methods mentioned include underreporting income by falsifying business records and expenses, transferring assets to friends, taking cash withdrawals, and hiding true compensation through deferred income or installment sales. The document cautions divorcing parties to thoroughly examine tax returns, lifestyles, expenses, and financial records for signs of hidden assets and income.Divorce Magazine

Divorce MagazineThomas Mastromatto NMLS #145824

╠²

The document is a magazine focused on divorce that contains articles on coping with divorce, the divorce process, finances during divorce, children and divorce, and health and well-being. The lead article discusses taking control of your life during a crisis by identifying the next right action to take rather than reacting immediately. It argues crises represent turning points that require a process to navigate rather than viewing them as disasters. The magazine also contains contact information for related resources and advertisements.Divorce: WhatŌĆÖs Love Got to Do With It?

Divorce: WhatŌĆÖs Love Got to Do With It?Thomas Mastromatto NMLS #145824

╠²

The document describes a 3-day international symposium hosted in May 2014 titled "Divorce: What's Love Got to Do With It?" which was funded by the Fetzer Institute to explore how the concepts of love, forgiveness, and compassion are relevant to collaborative family law practice. The author notes that while these concepts are implicitly part of collaborative work, the goal of the symposium was to have an open dialogue about bringing these concepts to the forefront. Over 50 participants including collaborative professionals and those outside the field gathered to generate new ideas about how these concepts could impact the future of family law.More Related Content

Viewers also liked (13)

New reverse gary

New reverse garyShana Gough

╠²

- The document discusses how a reverse mortgage can help retirees access equity in their home to fund retirement. It provides information on how reverse mortgages work, the advantages, and how people are using them, such as supplementing retirement income or paying off existing mortgages.

- Key aspects of reverse mortgages outlined include that no repayments are required as long as the homeowner lives in the property, and the loan does not become due until the last owner no longer lives there or the home is sold. Qualifying is based on age, home value, and loan options chosen.

- The document explores new features that make reverse mortgages safer and more cost effective, and how financial advisors areReverse Mortgages Explained

Reverse Mortgages Explainedthompsonjr

╠²

A reverse mortgage is a loan that allows senior homeowners to convert home equity into income without selling their home or making monthly payments, primarily benefiting those aged 62 and older. Borrowers can access funds based on their home's value, location, and current interest rates, with repayment occurring only when they move, sell, or pass away. The Federal Housing Administration backs most reverse mortgages, ensuring borrowers never owe more than their home's worth and providing protections against foreclosure.Reverse Mortgage Purchase

Reverse Mortgage PurchaseElise A. David, Reverse Mortgages, Home Equity Conversion

╠²

A Home Equity Conversion Mortgage (HECM) for Purchase allows seniors to buy a new home using equity from the sale of their previous home and other assets. It is an FHA-insured loan that requires no monthly mortgage payments. Borrowers must be 62 years or older and use the home as their primary residence. The loan provides qualifying seniors with funds to purchase a home while eliminating monthly payments. Eligibility requirements include the youngest borrower being 62+, the purchased home being the primary residence, and the HECM for Purchase being the only mortgage loan used for the purchase.MetLife Reverse Mortgage Presentation

MetLife Reverse Mortgage PresentationTim_Allen_CMB

╠²

A reverse mortgage allows homeowners age 62+ to access their home equity through a loan. Key points:

1) You can receive funds as a lump sum, monthly payments, line of credit, or combination. Funds don't need to be repaid until you leave the home permanently.

2) Eligibility requires being 62+, owning your home outright or paying off existing mortgages with proceeds, and using the home as your principal residence.

3) You retain ownership and can choose how to use the funds, though it's not advised to invest proceeds due to costs. The loan is repaid when you pass away or permanently move out.HECM 4 PURCHASE INTRO BROCHURE

HECM 4 PURCHASE INTRO BROCHUREFreddie "Rainmaker" Lambert

╠²

A Home Equity Conversion Mortgage (HECM) for Purchase allows seniors to buy a new home using equity from the sale of their previous home without making monthly mortgage payments. It is an FHA-insured loan for homeowners aged 62+ that provides affordability and purchasing power to buy a primary residence. Seniors can right-size to a smaller home, purchase a retirement home, or buy a second home to rent out their existing home. The HECM for Purchase may help sellers reach more senior buyers and convert renters to homeowners. Borrowers must occupy the home, pay taxes and insurance, and the loan amount cannot exceed the home's value.Reverse Mortgage Marketing Fundamentals

Reverse Mortgage Marketing FundamentalsFBReverse

╠²

This document provides marketing strategies for reverse mortgages, including utilizing a 3-leg approach targeting existing customers, mass marketing techniques, and networking. It recommends a needs-based marketing focus and including a call to action. Specific mass marketing options discussed are TV, radio, direct mail, print, internet, and seminars. The document also offers additional resources and notes that the bank can provide assistance with marketing plans and materials.Reverse Mortgage Seminar

Reverse Mortgage SeminarYourOrlandoMortgage.com

╠²

The document provides a comprehensive overview of reverse mortgages, including definitions, eligibility requirements, types of reverse mortgages, and payment options. It explains the counseling requirements, interest rates, closing costs, and repayment conditions. Additionally, it offers insights into current trends and resources for further information.Training for Financial Professionals: Reverse Mortgages & Retirement Plans - ...

Training for Financial Professionals: Reverse Mortgages & Retirement Plans - ...George Omilan

╠²

The document outlines training for financial professionals on Home Equity Conversion Mortgages (HECMs), detailing their eligibility, workings, and benefits for retirement planning. It explains how HECMs enable homeowners 62 and older to access home equity without repaying the loan until they move or pass away, while highlighting their importance in managing wealth and retirement strategies. Various financial strategies, costs, product options, and government regulations surrounding HECMs are also discussed to aid financial professionals in advising clients effectively.Reverse Mortgage Presentation

Reverse Mortgage PresentationKeesha Taylor

╠²

The document outlines the history and benefits of reverse mortgages, specifically the Home Equity Conversion Mortgage (HECM) program, which allows seniors to access the equity in their homes without monthly payments. It discusses how reverse mortgages can improve seniors' financial situations, providing them options for living expenses while ensuring their home equity remains intact for heirs. Eligibility requires homeowners to be at least 62 years old and maintain insurance, taxes, and property maintenance to keep the mortgage in good standing.Nassau (bahamas) presentation

Nassau (bahamas) presentationJanna Lauver

╠²

Nassau, the capital of the Bahamas, is located on New Providence Island and has a population of around 240,000. It has a tropical climate and was historically a center of piracy before becoming a British colony in 1717. The economy relies heavily on tourism, with popular destinations including Paradise Island, Cable Beach, and swimming with dolphins at Blue Lagoon Island. The culture is influenced by both British and West African traditions, and the majority Black population speaks English with a distinct Bahamian accent.Reverse Mortgage Powerpoint

Reverse Mortgage PowerpointDiane Quitmeyer

╠²

This document provides an overview of reverse mortgages, detailing eligibility requirements, how they work, and their potential uses for seniors aged 62 and older. It explains that reverse mortgages allow homeowners to access their home equity without monthly payments, while still being responsible for property taxes and maintenance. The document also highlights the importance of independent counseling and the options available through MetLife Bank for those interested in pursuing a reverse mortgage.Bahamas Powerpoint

Bahamas Powerpointzackoo7

╠²

The Bahamas is an island country located in the Atlantic Ocean composed of a series of cays and islands, with Nassau as its capital and a population of around 353,658 people. The Bahamas has a tourism-based economy and a climate that ranges from subtropical to tropical, being warm in the summer and cold in the winter, and was once a haven for pirates but is now a popular tourist destination.New reverse presentation

New reverse presentation Thomas Mastromatto NMLS #145824

╠²

The document is a presentation about reverse mortgages developed by the National Reverse Mortgage Lenders Association for educational purposes. It discusses what a reverse mortgage is, how it works, recent changes that make it safer and more affordable, and how people are using reverse mortgages to supplement retirement income, pay off debts, defer social security, and afford longer retirements. The presentation aims to help homeowners determine if a reverse mortgage could fit into their retirement plans.More from Thomas Mastromatto NMLS #145824 (20)

Hecm and Divorce

Hecm and DivorceThomas Mastromatto NMLS #145824

╠²

This document discusses extenuating circumstances that may impact a home equity conversion mortgage (HECM) financial assessment. It lists loss of income due to death, divorce, unemployment, reduced work hours, or a health emergency as potential circumstances. It also mentions an increase in financial obligations from medical treatment or hospitalization as another circumstance that could affect the assessment.Lawyers argue for gay nuptials in final supreme court briefs

Lawyers argue for gay nuptials in final supreme court briefsThomas Mastromatto NMLS #145824

╠²

This document is a reply brief for petitioners in a case before the Supreme Court regarding Michigan's bans on same-sex marriage. It argues that the marriage bans violate principles of equal protection and liberty guaranteed by the Fourteenth Amendment. It asserts that the bans inflict substantial harms by denying same-sex couples access to marriage and the protections it provides. It also contends that excluding same-sex couples from marriage denies them equal dignity. The brief maintains that while states generally regulate marriage, this authority is limited by constitutional rights, and the bans here exceed those limits.IRS Form 8332

IRS Form 8332Thomas Mastromatto NMLS #145824

╠²

This document summarizes Form 8332, which allows a custodial parent to release their claim to an exemption for their child so that the noncustodial parent can claim the exemption. It provides instructions for the custodial parent to release the exemption for the current year (Part I), future years (Part II), or revoke a previous release for future years (Part III). Key details include defining custodial and noncustodial parents, the special rule for divorced/separated parents that allows the noncustodial parent to claim the exemption if certain conditions are met, and specifics on which pages of a pre-2009 divorce decree can substitute for using the form.Financial Advisors Top Firms

Financial Advisors Top FirmsThomas Mastromatto NMLS #145824

╠²

This document appears to be a survey and ranking of RIAs (Registered Investment Advisors) with over $1 billion in assets under management. It lists 88 RIAs, providing information such as their location, total assets, growth rates of assets and clients, and assets per client. The top RIA according to total assets is Hall Capital Partners from San Francisco with $27.6 billion in assets.Divorce information and worksheet

Divorce information and worksheetThomas Mastromatto NMLS #145824

╠²

This document serves as a comprehensive worksheet for individuals contemplating divorce, providing essential definitions, terms, and procedural instructions related to divorce actions. It includes sections for personal information, marriage details, children, income, assets, liabilities, and necessary documents. The aim is to facilitate organization and understanding for both parties before initial consultations with attorneys.Hidden assets

Hidden assetsThomas Mastromatto NMLS #145824

╠²

This document discusses various methods that some individuals use to hide assets and income during a divorce proceeding to avoid equitable distribution of marital property. Some of the methods mentioned include underreporting income by falsifying business records and expenses, transferring assets to friends, taking cash withdrawals, and hiding true compensation through deferred income or installment sales. The document cautions divorcing parties to thoroughly examine tax returns, lifestyles, expenses, and financial records for signs of hidden assets and income.Divorce Magazine

Divorce MagazineThomas Mastromatto NMLS #145824

╠²

The document is a magazine focused on divorce that contains articles on coping with divorce, the divorce process, finances during divorce, children and divorce, and health and well-being. The lead article discusses taking control of your life during a crisis by identifying the next right action to take rather than reacting immediately. It argues crises represent turning points that require a process to navigate rather than viewing them as disasters. The magazine also contains contact information for related resources and advertisements.Divorce: WhatŌĆÖs Love Got to Do With It?

Divorce: WhatŌĆÖs Love Got to Do With It?Thomas Mastromatto NMLS #145824

╠²

The document describes a 3-day international symposium hosted in May 2014 titled "Divorce: What's Love Got to Do With It?" which was funded by the Fetzer Institute to explore how the concepts of love, forgiveness, and compassion are relevant to collaborative family law practice. The author notes that while these concepts are implicitly part of collaborative work, the goal of the symposium was to have an open dialogue about bringing these concepts to the forefront. Over 50 participants including collaborative professionals and those outside the field gathered to generate new ideas about how these concepts could impact the future of family law.Divorce and Medicare

Divorce and MedicareThomas Mastromatto NMLS #145824

╠²

This document provides instructions for requesting a reduction in Medicare premiums due to a life-changing event that has reduced income. It allows reporting of reduced income from either the current or previous tax year. Key details include choosing a qualifying life event, entering adjusted gross income and tax filing status for the selected year, and providing documentation of income and the event. Estimates for an even lower income in the following year can also be provided.ABC`s of Divorce

ABC`s of DivorceThomas Mastromatto NMLS #145824

╠²

The document discusses the various phases and considerations of divorce. It begins by outlining the three phases of divorce: thinking of divorce, moving forward with divorce, and being recently divorced. It then provides detailed advice and factors to consider in each phase, including reconciling, the emotional and financial impacts, custody, selecting an attorney, property division, telling children, and executing the final divorce agreement. The overall document serves as a comprehensive guide to navigating the divorce process from initial thoughts through the aftermath.Tax planning-for-same-sex-married-couples

Tax planning-for-same-sex-married-couplesThomas Mastromatto NMLS #145824

╠²

The IRS ruling provides clarity on tax treatment of same-sex marriages for federal purposes. Same-sex couples married as of December 31, 2013 must file federal taxes jointly or separately for 2013 onward. They may amend 2010-2012 returns to file jointly if beneficial. However, filing jointly may increase taxes due to differences in tax brackets and limitations for married couples. Additionally, state tax filing status varies depending on state marriage recognition laws. Planning is needed to navigate federal and state tax implications.GreyDivorce

GreyDivorceThomas Mastromatto NMLS #145824

╠²

This document provides an overview of important financial considerations for divorcing couples, including dividing assets, financial planning, financing homes, qualified domestic relations orders, social security benefits, alimony, and insurance. It covers topics spouses need to address when ending their marriage to separate their finances and plan for the future.Social Security Timing

Social Security TimingThomas Mastromatto NMLS #145824

╠²

This document provides information about social security benefits eligibility and calculations. It outlines the requirements to qualify for retired worker benefits at age 62, divorced spouse benefits if divorced for at least two years, and spousal benefits if married for at least one year. It also details eligibility for widow/surviving divorced spouse benefits at age 60, and lists the full retirement ages for beneficiaries based on their year of birth. Reduction percentages are shown for those claiming benefits before full retirement age.50 ways to flourish after divorce ebook

50 ways to flourish after divorce ebookThomas Mastromatto NMLS #145824

╠²

This document provides an overview and copyright information for the book "50 Ways to Flourish After Divorce" by Patti Handy. It notes that Patti Handy is not a licensed therapist or investment advisor and the book is not a substitute for professional advice. It encourages readers to visit the author's website for a free e-book on financial healing after divorce. The document contains a dedication and thanks to family and friends for their support. It then lists the first 10 of 50 suggestions for ways to flourish after divorce, including leaning on family and friends, exercising, getting massages, praying, and volunteering.CDLP

CDLPThomas Mastromatto NMLS #145824

╠²

The document discusses divorce lending services provided by Right Start Mortgage Inc. It addresses questions about whether a client wants to stay in the marital home or purchase a new one after divorce. It also discusses how the company's divorce lending experts can provide home loan information and guidance on achievable housing strategies prior to finalizing divorce agreements. The experts aim to help families stay in their current home after divorce and provide divorced clients with home loans to fund agreed-upon housing solutions. Their services are available at no charge to attorneys and other professionals involved in divorce cases.Post divorce parentinge book

Post divorce parentinge bookThomas Mastromatto NMLS #145824

╠²

This document is an excerpt from a book on post-divorce parenting strategies written by Rosalind Sedacca. It discusses several challenges that divorced parents may face, including co-parenting, conflicting lifestyles between parents, and dealing with acting out behaviors from children of divorce. The author provides advice and suggestions for addressing these issues in a cooperative manner focused on the children's well-being.Cfpb proposed modifications-mortgage-rules

Cfpb proposed modifications-mortgage-rulesThomas Mastromatto NMLS #145824

╠²

The Bureau of Consumer Financial Protection is proposing amendments to mortgage rules established in January 2013 under the Equal Credit Opportunity Act, Real Estate Settlement Procedures Act, and Truth in Lending Act. These amendments aim to clarify loss mitigation procedures, adjust loan originator compensation definitions, and revise exemptions for creditors in rural areas, among other changes. Public comments on these proposed rules are being accepted until July 22, 2013.Cfpb proposed modifications-mortgage-rules

Cfpb proposed modifications-mortgage-rulesThomas Mastromatto NMLS #145824

╠²

This document proposes amendments to certain mortgage rules issued by the Bureau of Consumer Financial Protection in January 2013. The proposed amendments focus on clarifying or revising provisions related to loss mitigation procedures, amounts counted as loan originator compensation, exemptions available to creditors operating in rural or underserved areas, application of loan originator compensation rules, and the prohibition on creditor-financed credit insurance. The Bureau is also proposing adjustments to effective dates and technical corrections to Regulations B, X, and Z. Comments on the proposals are due by July 22, 2013.Ad

Recently uploaded (20)

Affordable Luxury Apartments | Nakshatra Veda Vasai.

Affordable Luxury Apartments | Nakshatra Veda Vasai.jsbhomemakers6

╠²

Invest in Nakshatra Veda and secure your familyŌĆÖs future. Offering modern apartments in

Vasai a peaceful Vasai location with premium facilities.MSN Realty Hyderabad - Premium 4 BHK Residences in Neopolis Kokapet

MSN Realty Hyderabad - Premium 4 BHK Residences in Neopolis KokapetJagadishKR1

╠²

Discover refined living with MSN RealtyŌĆÖs premium 4 BHK apartments in Neopolis, Kokapet - HyderabadŌĆÖs fastest-growing upscale neighborhood. These spacious homes offer modern architecture, high-end finishes, and panoramic views. Located near IT corridors, international schools, and lifestyle hubs, every detail is crafted for elite urban living. Experience exclusivity, connectivity, and comfort in one of HyderabadŌĆÖs most coveted addresses.NLI - Istanbul - June 2025 Featured Portfolio

NLI - Istanbul - June 2025 Featured PortfolioListing Turkey

╠²

Welcome to Our Exclusive June 2025 Featured Portfolio

Curated exclusively for discerning real estate investors, our June 2025 Featured Portfolio presents an exclusive gateway to unparalleled investment opportunities in the vibrant city of Istanbul. This carefully selected collection of properties showcases the finest options available, each with its unique charm and investment potential.

By exploring our portfolio, you gain insights into the future of IstanbulŌĆÖs real estate market and the opportunity to actively participate in its promising growth. Whether you seek luxury, historical significance, or strategic investment opportunities, our portfolio has something tailored to your preferences and goals.

Discover IstanbulŌĆÖs Prime Properties

Our June portfolio presents a diverse range of properties, ensuring options for every taste and investment objective. From luxury apartments in the heart of Istanbul to affordable villas in peaceful suburbs, each listing is meticulously chosen to meet a variety of preferences and objectives.

Whether you are seeking a second home, a buy-to-let investment, or the ideal retirement property, our portfolio has options that will captivate your attention. Each listing provides comprehensive and detailed information, enabling you to make informed decisions. Furthermore, with our services reimbursed by developers, you will enjoy a commission-free experience that saves you money.Duramax Grow Room Wall Material Keeps Dampness and Mold at Bay

Duramax Grow Room Wall Material Keeps Dampness and Mold at BayDuramax PVC Wall Panels

╠²

Explore DuramaxŌĆÖs PVC grow wall solutions, offering ASTM certification and class-1 fire-resistant. As a top manufacturer and supplier of PVC panels in the USA, Duramax stands out in the market. Our panels are perfectly suited for grow rooms due to their non-porous surface, which prevents moisture absorption and helps regulate humidity levels. They are anti-mold and FDA-compliant, featuring an antibacterial coating that creates a clean and safe environment for plant cultivation. The reflective surface of our PVC grow room walls ensures even light distribution, creating ideal conditions for vibrant plant growth. With factory-direct pricing and a limited lifetime warranty, Duramax grow room wall materials are an excellent choice. Order yours today!

Reach Us: https://www.duramaxpvcpanels.com/applications/grow-rooms/

Why You Should Buy Verified Cash App Accounts.pdf

Why You Should Buy Verified Cash App Accounts.pdfBuy Verified Cash App Accounts From Trusted Seller

╠²

Need multiple Cash App accounts? Get 100% verified, phone-authenticated profiles with linked Gmail addresses. Whether you're managing clients, scaling marketing campaigns, or running online stores, our accounts are secure and efficient. Avoid sending limits, ensure backup access, and keep operations smooth with fast delivery and trustworthy customer support.Taxation on Agricultural Land in India_ A Comprehensive Overview.pdf

Taxation on Agricultural Land in India_ A Comprehensive Overview.pdfNaugaon Gurgaon

╠²

Naugaon Farms ŌĆō A Peaceful Investment Destination Near Sariska

Naugaon Farms ŌĆō A Peaceful Investment Destination Near Sariska

Social Etiquette for International Students Living in Canterbury

Social Etiquette for International Students Living in Canterburystevenjohnsonst01

╠²

International students in Canterbury can enjoy a smooth transition by understanding social etiquette in shared student housing. From polite conversation to respecting privacy, these customs make life in student apartments and student rooms more enjoyable. Early planning for the right student accommodation is essential, and StudentTenant.com offers a trusted platform with verified student apartments tailored to diverse needs. Embracing cultural differences and clear communication fosters lasting friendships in shared student rooms. With StudentTenant.com as your guide, youŌĆÖll find safe, affordable student housing that supports academic success and meaningful cultural exchange for all international students in Canterbury.2025 -JUNE Featured Apartments - Listing Turkey

2025 -JUNE Featured Apartments - Listing TurkeyListing Turkey

╠²

June 2025 Featured Apartments

Welcome to our exclusive June 2025 Featured Portfolio, meticulously curated for discerning real estate investors such as yourself. This document serves as your gateway to unlocking a realm of unparalleled investment potential within the dynamic metropolis of Istanbul. Delve into a carefully curated selection of exceptional properties, each imbued with its distinctive allure and investment promise. This document transcends mere observation; it presents an opportunity for you to become an integral part of IstanbulŌĆÖs captivating real estate odyssey. Whether your aspirations encompass opulence, historical significance, or strategic acumen, our portfolio caters to the diverse needs of investors.

Eager to delve deeper into these coveted properties? Engage with our team of seasoned professionals for personalized guidance and tailored investment strategies. Seize this moment to secure your position within IstanbulŌĆÖs burgeoning real estate landscape. Kindly contact us today to embark on a collaborative journey that transforms your real estate aspirations into tangible reality.

Find the best apartments for sale in Istanbul with Listing TurkeyŌĆÖs May 2025 featured portfolio.

This comprehensive collection of properties includes everything from luxury apartments in the city center to affordable villas in the suburbs. Whether youŌĆÖre looking for a second home, a buy-to-let investment, or your dream retirement property, youŌĆÖre sure to find something to your liking.

Our featured apartments offer a variety of benefits, including:

Transparent listings: We provide all the relevant information about each property, so you can make an informed decision.

No commission: Our services are reimbursed by the developers, so you can save money.

Expert advice: Our team of real estate experts can help you find the perfect property for your needs.

Browse our featured apartments today and start your journey to owning a property in Istanbul.Stephane Marchand on Sustainable Real Estate Development in Hawaii: Balancing...

Stephane Marchand on Sustainable Real Estate Development in Hawaii: Balancing...Stephane Marchand

╠²

Preserving Paradise Through Innovative Design

Hawaii has long been a dream destination ŌĆö a land of volcanic majesty, crystal-clear waters, and rich Polynesian heritage. But for all its natural beauty and cultural depth, the Aloha State stands at a crossroads. As tourism grows and demand for property surges, so does the strain on its limited resources and delicate ecosystems. Sustainable real estate development has emerged not just as an option, but as an obligation. At the heart of this movement is visionary developer Stephane Marchand, whose leadership is helping Hawaii redefine how development and environmental harmony can coexist.Applying Service Design to the Workplace

Applying Service Design to the WorkplaceJeremy Johnson

╠²

Employee experience is shaped by digital tools, processes, and physical spaces. This session explores how service design principles can transform work environments into user-centric spaces, enhancing productivity and well-being in the age of hybrid work and technological innovation.Pushti Realty Vadodara's Best Real Estate Broker, Real Estate Agent

Pushti Realty Vadodara's Best Real Estate Broker, Real Estate AgentPushti Realty

╠²

Vadodara's Best Real Estate Company Pushti Realty is a phenomenal name in the real estate sector of Vadodara. Working in the industry with a team of dedicated and astute professionals, we have been able to offer a wide range of best-in-class real estate services to the clients at reasonable charges. Our list of real estate services includes architectural services, home inspection services, interior designing services, and real estate agent services. Whether it is a commercial property or residential property, we provide our services for all clients without making them splurge. Pushti Realty is a Vadodara (Gujarat, India) based company, which is owned and managed by Pushti Group of Realty. Under leadership of Pushti Group, we have become instrumental in finalizing deals for different types of properties in the real estate industry. Please connect with us for latest properties, resale properties in Vadodara (Gujarat) India District. Pushti Realty, a Vadodara based well known group for real estate development, real estate services and interior designing services. One roof, all solution for your dream property Loans Property Advisor 150+ Builders Tie ups Easy Documentation Property Documents Rent Agreement Industrial Properties Commercial Properties Industrial Lands Agriculture Lands Residential Properties Rented Properties Penthouse Builders Floor Hotel Properties Restaurant Properties Specialized Field of working Residential Commercial Lands Builder's Project Resale Properties Agriculture Lands Factory Lands Industrial Lands Resale Properties With more than 7+ years in real estate business ŌĆō we have the knowledge, experience & expertise to deliver value for money projects and satisfy your every need. Effortless elegance is a virtue found in rarity. The unblemished finesse and charm allures everyone. At Pushti Realty Services, each of our endeavors is a presentation of ultimate style and luxury class. Our main locations in Vadodara All Area, Ankleshwar GIDC, Saykha GIDC Our main locations in Vadodara are Dabhoi, Jawaharnagar Gujarat Refinery, Karachiya, Karjan, Nandesari, Padra, Ranoli, Tarsali, Waghodia, Akota, Alkapuri, Bajwa, Bhadarpur, Vasna-Bhayli, Karelibaug, New Alkapuri, Gotri Area, Sevasi, Harni, Sama Savli road, Harni Sama Link road, Sindhrot and many more location in Vadodara, Gujarat India. Real Estate Services Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Chhattisgarh, Goa, Gujarat, Haryana, Himachal Pradesh, Jammu and Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Punjab, Rajasthan, Sikkim, Tamil Nadu, Telangana, Tripura, Uttar Pradesh, Uttarakhand, West Bengal, Diu, Daman, Union Territories and Capitals, Andaman and Nicobar Islands, Chandigarh, The Government of NCT of Delhi, Dadra and Nagar Haveli (Silvassa), Lakshadweep, Puducherry.Oro Dynasty ŌĆō Premium 2 BHK Apartments in Arjunganj, Lucknow

Oro Dynasty ŌĆō Premium 2 BHK Apartments in Arjunganj, Lucknowdigitalstare

╠²

Experience a new standard of urban living at Oro Dynasty, a premium residential project in the heart of Arjunganj, Lucknow. Designed for modern families, this new launch project offers spacious and thoughtfully planned 2 BHK apartments with top-class amenities and seamless connectivity to key city locations. Whether you're a first-time homebuyer or an investor, Oro Dynasty brings together luxury, location, and lifestyle at an unmatched value. Embrace elegant living in a fast-developing neighborhood with schools, hospitals, shopping centers, and entertainment hubs just minutes away.

Tata Housing Shaping the Future of Real Estate in India

Tata Housing Shaping the Future of Real Estate in Indiaashutoshpropertyinin

╠²

Pioneering Excellence in Real Estate Development

Since it was founded in 2006, Tata Housing has rapidly grown to become one of the most active real estate builders. Its goal is to "delight customers by providing quality life spaces through continuous innovation," Tata Housing brings experience and commitment to every project, from the selection of site and design to sales implementation and event management.

A Versatile Portfolio for Every Homebuyer

Tata Housing caters to a large number of clients with properties that span from the budget-friendly to the luxury segment. With more than 3.34 million square feet at various stages of development, Tata Housing's properties span all price points from the low of Rs34 lakhs up to Rs8.5 crores. This means the availability of a house for all. Signature projects such as Primanti and Myst boast IGBC Platinum Certification. This demonstrates Tata Housing's dedication to environmentally sustainable and green construction.How Can I Decorate My Bedroom to Look Modern.pptx

How Can I Decorate My Bedroom to Look Modern.pptxprashantshreeconstru

╠²

Discover how to transform your bedroom into a modern, stylish space with our expert design tips. This presentation by Shree Constructions & Interior explores the key elements of modern bedroom d├®cor ŌĆō from minimalist furniture and neutral color schemes to smart lighting and functional layouts. Whether you're redesigning a small bedroom or planning a complete makeover, this PPT offers inspiration and practical ideas tailored to todayŌĆÖs modern living. Perfect for homeowners looking to upgrade with elegance, comfort, and contemporary appeal.

Randy Bocook - Passionate About Real Estate

Randy Bocook - Passionate About Real EstateRandy Bocook

╠²

Randy Bocook was born to a modest life and grew up consuming booksŌĆöparticularly on real estate. After high school, he sought new life experiences including Marine training at Parris Island before beginning his real estate career at the age of 28. Alaa Daloussi Explores 5 Effective Methods to Reduce Construction Risk

Alaa Daloussi Explores 5 Effective Methods to Reduce Construction RiskAlaa Daloussi

╠²

Alaa Daloussi is an experienced entrepreneur from Canada who works in both the construction equipment and real estate industries. Alaa Daloussi helps bring machinery from international suppliers to buyers across North America, taking care of the entire process, from choosing the right equipment to getting it delivered. His strong focus on dependability and quality has made him a trusted name among developers, builders, and contractors. In addition to equipment supply, he also manages real estate projects, guiding them from the early planning stages through to completion, always keeping long-term growth in mind. With his deep understanding of the industry, Alaa Daloussi shares five effective Methods to reduce risk in construction, helping teams stay on budget, avoid delays, and keep work sites safe.

New Project Eldeco Ballads of Bliss at Yamuna Expressway,Greater Noida

New Project Eldeco Ballads of Bliss at Yamuna Expressway,Greater NoidaInvest Mango

╠²

Eldeco Ballads of Bliss at Yamuna Expressway is a premium residential project offering spacious 3BHK air-conditioned apartments in a serene 5-acre gated community. With just 3 units per floor, it ensures unmatched privacy, comfort, and modern living close to Greater NoidaŌĆÖs key landmarks.

Project Highlights:

¤ÅĪ Eldeco Ballads of Bliss in Sector 22D Yamuna Expressway, Greater Noida| 3BHK Luxury Apartments

¤ī¤ Project Area: 5 Acres

¤ōÅ Sizes: 1550 - 2800 Sq. Ft.

¤Åó Units: 558 Flats

¤ÅÖ’ĖÅ Towers: 3 Towers & 32 Floors

¤øÅ’ĖÅ Configurations: 3BHK Apartments

¤ōģ Launch Date: April 2025

¤ÅĪ Possession Date: April 2030

¤ō£ RERA Number: UPRERAPRJ921261/05/2025

¤ī¤Get Free Consultation for this property. Call us at +91-8595-189-189

For more Information visit now:

https://www.investmango.com/eldeco-ballads-of-bliss-sector-22d-yamuna-expressway-greater-noida

It's Halftime - Are you ready for the 2nd half?

It's Halftime - Are you ready for the 2nd half?Tom Blefko

╠²

The Berkshire Hathaway HomeServices Homesale Realty's County Sales Meeting for June, 2025, covering the following topics: 1. Wire fraud and cybersecurity, 2. Benefits of property management, 3. Lead free families, 4. QuickBuy revisions, 5. Town Hall meeting reminder, 6. Dolly's Tuesday tune-up, 7. Sunshine Kids golf tournament, 8. Premiere listing marketing package process, 9. Testimonial graphics, 10. Zillow Showcase, 11. Fair housing advertising words, 12. Appraisals are changing, 13. LCAR corner, 14. It's HalftimeWhy You Should Buy Verified Cash App Accounts.pdf

Why You Should Buy Verified Cash App Accounts.pdfBuy Verified Cash App Accounts From Trusted Seller

╠²

Ad

Social security time bomb

- 1. Social Security The silent time bomb Bob & Martha Bob Social Security $1,550 Martha Social Security $ 925 Rental Income $ 1,300 Total Income $ 3,775 Martha Bob Social Security $0 Martha Social Security $ 1, 550 Rental Income $ 1,300 Total Income $ 2,850 Income Reduced: $925