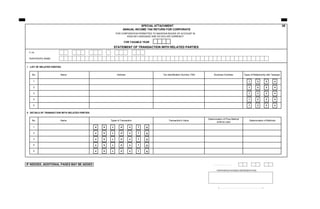

special attachment_statement of transaction with related parties

- 1. 3B FOR TAXABLE YEAR T I N: TAXPAYER'S NAME : I LIST OF RELATED PARTIES 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 II DETAILS OF TRANSACTION WITH RELATED PARTIES a b c d e f g a b c d e f g a b c d e f g a b c d e f g a b c d e f g ¡¡¡¡¡¡¡¡¡, TAXPAYER/AUTHORIZED REPRESENTATIVE 4 5 SPECIAL ATTACHMENT ANNUAL INCOME TAX RETURN FOR CORPORATE FOR CORPORATION PERMITTED TO MAINTAIN BOOKS OF ACCOUNT IN ENGLISH LANGUAGE AND US DOLLAR CURRENCY STATEMENT OF TRANSACTION WITH RELATED PARTIES No. Name Address Tax Identification Number (TIN) Business Activities Types of Relationship with Taxpayer 1 2 3 4 No. Name Types of Transaction Transaction's Value 5 Determination of Price Method shall be used Determination of Methods 1 2 3 IF NEEDED, ADDITIONAL PAGES MAY BE ADDED (¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡) RESET IF THIS FORM INADEQUATE PLEASE USE A FILE ADDITIONAL 3B THAT HAS PROVIDED

- 2. 3B NPWP: Nama : I DAFTAR PIHAK YANG MEMILIKI HUBUNGAN ISTIMEWA No 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 II RINCIAN TRANSAKSI DENGAN PIHAK YANG MEMILIKI HUBUNGAN ISTIMEWA No a b c d e f g a b c d e f g a b c d e f g a b c d e f g a b c d e f g ¡¡¡¡¡¡¡¡¡, JIKA FORMULIR INI TIDAK MENCUKUPI, DAPAT DIBUAT SENDIRI SESUAI DENGAN BENTUK INI WAJIB PAJAK / KUASA (¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡) 4 5 2 3 Metode Penetapan Harga yang digunakan Alasan Penggunaan Metode 1 5 Nama Mitra Transaksi Jenis Transaksi Nilai Transaksi 3 4 1 2 Nama Alamat NPWP/ Tax Identification Number Kegiatan Usaha Bentuk Hubungan dengan Wajib Pajak LAMPIRAN KHUSUS SPT TAHUNAN PAJAK PENGHASILAN WAJIB PAJAK BADAN BAGI WAJIB PAJAK YANG DIIZINKAN MENYELENGGARAKAN PEMBUKUAN DALAM MATA UANG DOLLAR AMERIKA SERIKAT TAHUN PAJAK PERNYATAAN TRANSAKSI DENGAN PIHAK YANG MEMILIKI HUBUNGAN ISTIMEWA RESET JIKA FORMULIR INI TIDAK MENCUKUPI SILAKAN GUNAKAN FILE TAMBAHAN 3B YANG TELAH DISEDIAKAN