Spire Edge by ANBuildwell Manesar - The perfect office space for Environment Conscious Businesses

- 1. present

- 2. Good news : 12.12.12 was NOT the end of the world

- 3. But 2013 : Signaled an economic end of the world!!

- 4. Global recession now impacting India directly

- 5. Inflation in excess of 8% most part of the year

- 6. Interest rates continue to stay high…

- 7. And SENSEX continues to be a roller-coaster ride… 1 Month BSE 30 Index Chart Source : infomine.com/

- 8. Inflation is eating into your fixed deposits too!!

- 9. Is your investment giving you returns, or is inflation just eating into your capital? Avg. Inflation (8.25%) • Lack of good investment options that beat the inflation • So where do you invest today?

- 10. “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.” “You know, people talk about this being an uncertain time. You know, all time is uncertain. I mean, it was uncertain back in – in 2007, we just didn’t know it was uncertain. It was – uncertain on September 10th, 2001. It was uncertain on October 18th, 1987, you just didn’t know it.”

- 11. Unlock The Investment Potential of Real Estate

- 12. Real Estate in India Growth in North Indian Cities • Investments made in 2007 in real estate in NCR would have doubled your capital by now – Jan-Mar 2013 Index for Noida, Greater Noida and Gurgaon is 188 Source: http://www.nhb.org.in/Residex/Data&Graphs.php)

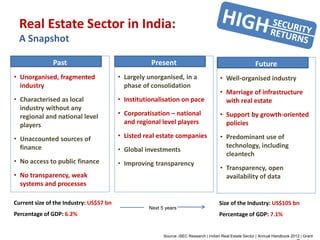

- 13. Real Estate Sector in India: A Snapshot Past • Unorganised, fragmented industry • Characterised as local industry without any regional and national level players • Unaccounted sources of finance • No access to public finance • No transparency, weak systems and processes Present • Largely unorganised, in a phase of consolidation • Institutionalisation on pace • Corporatisation – national and regional level players • Listed real estate companies • Global investments • Improving transparency Future • Well-organised industry • Marriage of infrastructure with real estate • Support by growth-oriented policies • Predominant use of technology, including cleantech • Transparency, open availability of data Source: iSEC Research | Indian Real Estate Sector | Annual Handbook 2012 | Grant Thornton Current size of the Industry: US$57 bn Percentage of GDP: 6.2% Size of the Industry: US$105 bn Percentage of GDP: 7.1% Next 5 years

- 14. Real Estate in India The Growth Drivers : the Demand-Supply Gap Residential : • “There will be a total pending demand of 23 lakh units of residential property in the next five years, while the estimated supply in the same period is expected to be approximately 2 lakh units p.a., leaving a shortfall of over 13 lakh units". (Cushman & Wakefield) • NCR is expected to record highest demand of over 7 lakh units in next 5 years, followed by Mumbai and Bangalore with demands of 6.51 lakh units and 2.87 lakh units, respectively. ". (Cushman & Wakefield) • "There is an acute shortage of homes, especially in and around the main cities due to population migration that is happening due to growth opportunities. As a result, prices have generally tended to increase over the medium to long term." Balaji Raghavan, CEO & CIO, Real Estate Fund, IIFL.

- 15. Real Estate in India The Growth Drivers : the Demand-Supply Gap Commercial : • Office space absorption in India to grow 21% in 2014-15 (DTZ report) – over 2.5 lakh additional analytics jobs by the end of 2015. – IT sector to see better growth, create more jobs in 2014-15 (Kris Gopalakrishnan, Infosys) • Office space absorption rose 11 % to 1.38 million sq ft in Delhi-NCR during the April- June quarter, over the year-ago period, on higher demand from IT/ITeS sector, global property consultant DTZ said. http://economictimes.indiatimes.com/markets/real-estate/news/office-space-absorption-up-11-per-cent-in-delhi-ncr/articleshow/39099387.cms

- 16. Real Estate in India The Growth Drivers : the FDI Inflow • Between year 2000-11, India attracted cumulative FDI inflow of US$ 237 bn. (Rs. 13,03,500 crores) • For the eight months of FY 2011-12, India garnered US$ 33 bn (Rs. 1,81,500 crores), and expected to increase by 20% in 2013-14 • Housing, Real Estate and Construction account for 14% of all FDI • It is estimated that the FDI in the sector will grow from the current US$4 billion to US$25 billion within a span of 10 years Source: http://www.cedar-consulting.com/pdf/Cedar_USIBC_%20Report.pdf )

- 17. Real Estate in India The Growth Drivers : the +ve Policy Framework Some of the recent policy initiatives which are expected to boost further transparency, confidence and hence investments in the sector include: • The Union Budget 2012-13 proposed 1% Tax Deduction at Source (TDS) on transfer of immovable property of beyond Rs 50 lakh • Foreign citizens of Indian origin have been granted RBI permission to purchase property in India for residential or commercial purposes • 100% FDI allowed in townships, built-up infrastructure and construction development projects • 51% FDI allowed in multi-brand retail Source: http://www.cedar-consulting.com/pdf/Cedar_USIBC_%20Report.pdf )

- 18. Real Estate in India The Growth Drivers : Access to Funding • Urban housing fund of Rs 2000 crores set up by the National Housing Bank • HDFC, in association with SBI, raising Rs 750 crore for a real estate fund. It is likely to invest in residential, commercial, and in IT properties • Kotak is also raising a real estate fund while ICICI Venture is in the process of raising Rs. 750 crore real estate fund • International investors like the US-based Warburg Pincus, Blackstone Group, Broadstreet, Morgan Stanley Real Estate Fund (MSREF), Columbia Endowment Fund, California Public Employees' Retirement System (CalPERS), Hines, Tishman Speyer, Sam Zell's Equity International, JP Morgan Partners and Amaranth Advisors have been found to show interest. A few funds belonging to Warren Buffet's Berkshire Hathway are also interested. Source : http://www.indianground.com/investments.aspx )