1 of 5

Downloaded 16 times

Recommended

Pifagoriin teorem

Pifagoriin teoremMunguuzb

Ėý

"ÐŅŅÐēаÐŧÐķÐļÐ―" Ð―ŅÐģÐķ Ņ

ÐļŅŅŅÐŧÐļÐđÐ― Ņ

ŌŊŅŅŅÐ― ÐīŅŅ

ŅŅÐŧÐķÐļŅ Ņ

ÐļŅŅŅÐŧRoth Conversion

Roth Conversionmichnoel

Ėý

The document discusses the benefits and considerations of converting a traditional IRA to a Roth IRA. It notes that lower account values currently make conversions attractive. Converting now allows one to lock in today's low tax rates and take advantage of special tax treatment in 2010 and 2011 when income limits on Roth IRA conversions are eliminated. Key benefits of converting include tax-free withdrawals in retirement, allowing heirs to stretch out required minimum distributions, and diversifying retirement income sources for tax purposes.More Related Content

What's hot (18)

Pifagoriin teorem

Pifagoriin teoremMunguuzb

Ėý

"ÐŅŅÐēаÐŧÐķÐļÐ―" Ð―ŅÐģÐķ Ņ

ÐļŅŅŅÐŧÐļÐđÐ― Ņ

ŌŊŅŅŅÐ― ÐīŅŅ

ŅŅÐŧÐķÐļŅ Ņ

ÐļŅŅŅÐŧViewers also liked (12)

Roth Conversion

Roth Conversionmichnoel

Ėý

The document discusses the benefits and considerations of converting a traditional IRA to a Roth IRA. It notes that lower account values currently make conversions attractive. Converting now allows one to lock in today's low tax rates and take advantage of special tax treatment in 2010 and 2011 when income limits on Roth IRA conversions are eliminated. Key benefits of converting include tax-free withdrawals in retirement, allowing heirs to stretch out required minimum distributions, and diversifying retirement income sources for tax purposes.More from boogii_darhan (13)

ŌŊзŌŊŌŊÐŧŅÐ―

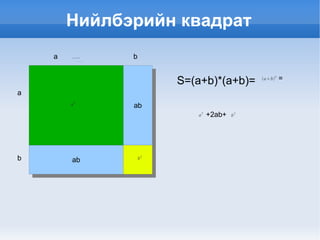

- 1. ÐÐļÐđÐŧÐąŅŅÐļÐđÐ― КÐēаÐīŅаŅ a a b b S=(a+b)*(a+b)= = +2ab+ ab ab

- 2. ÐĒŅаÐŋÐĩŅÐļÐđÐ― ŅаÐŧÐąÐ°Ðđ S= B C D A

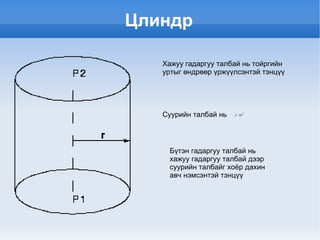

- 3. ÐĶÐŧÐļÐ―ÐīŅ ÐĨаÐķŅŅ ÐģаÐīаŅÐģŅŅ ŅаÐŧÐąÐ°Ðđ Ð―Ņ ŅÐūÐđŅÐģÐļÐđÐ― ŅŅŅŅÐģ ÓĐÐ―ÐīŅÓĐÓĐŅ ŌŊŅÐķŌŊŌŊÐŧŅŅÐ―ŅŅÐđ ŅŅÐ―ŅŌŊŌŊ ÐĄŅŅŅÐļÐđÐ― ŅаÐŧÐąÐ°Ðđ Ð―Ņ ÐŌŊŅŅÐ― ÐģаÐīаŅÐģŅŅ ŅаÐŧÐąÐ°Ðđ Ð―Ņ Ņ аÐķŅŅ ÐģаÐīаŅÐģŅŅ ŅаÐŧÐąÐ°Ðđ ÐīŅŅŅ ŅŅŅŅÐļÐđÐ― ŅаÐŧÐąÐ°ÐđÐģ Ņ ÐūŅŅ ÐīаŅ ÐļÐ― аÐēŅ Ð―ŅОŅŅÐ―ŅŅÐđ ŅŅÐ―ŅŌŊŌŊ