Sss contributions payment form edited

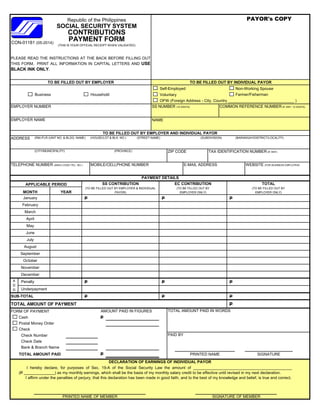

- 1. Self-Employed Non-Working Spouse Voluntary Farmer/Fisherman OFW (Foreign Address - City, Country ______________________________ ) EMPLOYER NUMBER SS NUMBER (10 DIGITS) COMMON REFERENCE NUMBER (IF ANY, 12 DIGITS) EMPLOYER NAME NAME ADDRESS (RM./FLR./UNIT NO. & BLDG. NAME) (HOUSE/LOT & BLK. NO.) (STREET NAME) (SUBDIVISION) (BARANGAY/DISTRICT/LOCALITY) (CITY/MUNICIPALITY) (PROVINCE) ZIP CODE TAX IDENTIFICATION NUMBER (IF ANY) TELEPHONE NUMBER (AREA CODE+TEL. NO.) MOBILE/CELLPHONE NUMBER E-MAIL ADDRESS WEBSITE (FOR BUSINESS EMPLOYER) TOTAL (TO BE FILLED OUT BY EMPLOYER ONLY) Republic of the Philippines SOCIAL SECURITY SYSTEM CONTRIBUTIONS (THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED) TO BE FILLED OUT BY EMPLOYER AND INDIVIDUAL PAYOR PAYOR's COPY PLEASE READ THE INSTRUCTIONS AT THE BACK BEFORE FILLING OUT THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. APPLICABLE PERIOD TO BE FILLED OUT BY INDIVIDUAL PAYORTO BE FILLED OUT BY EMPLOYER PAYMENT DETAILS MONTH PAYMENT FORM Business Household SS CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER & INDIVIDUAL PAYOR) EC CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER ONLY)YEAR CON-01181 (05-2014) P P P P P P P P P TOTAL AMOUNT OF PAYMENT P FORM OF PAYMENT TOTAL AMOUNT PAID IN WORDS Cash P Postal Money Order Check Check Number PAID BY Check Date Bank & Branch Name TOTAL AMOUNT PAID P O O ) SIGNATURE I hereby declare, for purposes of Sec. 19-A of the Social Security Law the amount of _____________________________________________ (P ______________) as my monthly earnings, which shall be the basis of my monthly salary credit to be effective until revised in my next declaration. I affirm under the penalties of perjury, that this declaration has been made in good faith, and to the best of my knowledge and belief, is true and correct. January February March Underpayment AMOUNT PAID IN FIGURES June PRINTED NAME July O ) O O ) A D D Penalty DECLARATION OF EARNINGS OF INDIVIDUAL PAYOR December SUB-TOTAL August May September October November April PRINTED NAME OF MEMBER SIGNATURE OF MEMBER

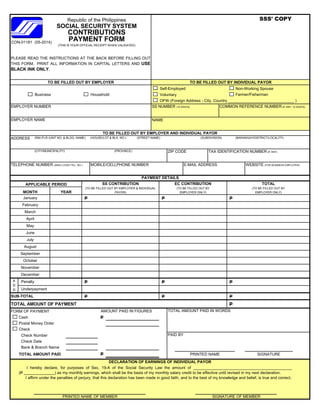

- 2. Self-Employed Non-Working Spouse Voluntary Farmer/Fisherman OFW (Foreign Address - City, Country ______________________________ ) EMPLOYER NUMBER SS NUMBER (10 DIGITS) COMMON REFERENCE NUMBER (IF ANY, 12 DIGITS) EMPLOYER NAME NAME ADDRESS (RM./FLR./UNIT NO. & BLDG. NAME) (HOUSE/LOT & BLK. NO.) (STREET NAME) (SUBDIVISION) (BARANGAY/DISTRICT/LOCALITY) (CITY/MUNICIPALITY) (PROVINCE) ZIP CODE TAX IDENTIFICATION NUMBER (IF ANY) TELEPHONE NUMBER (AREA CODE+TEL. NO.) MOBILE/CELLPHONE NUMBER E-MAIL ADDRESS WEBSITE (FOR BUSINESS EMPLOYER) PAYMENT FORM Business Household SS CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER & INDIVIDUAL PAYOR) EC CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER ONLY)YEARMONTH SOCIAL SECURITY SYSTEM CONTRIBUTIONS (THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED) TO BE FILLED OUT BY EMPLOYER AND INDIVIDUAL PAYOR PAYMENT DETAILS SSS' COPY PLEASE READ THE INSTRUCTIONS AT THE BACK BEFORE FILLING OUT THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. APPLICABLE PERIOD TO BE FILLED OUT BY INDIVIDUAL PAYORTO BE FILLED OUT BY EMPLOYER TOTAL (TO BE FILLED OUT BY EMPLOYER ONLY) Republic of the Philippines CON-01181 (05-2014) P P P P P P P P P TOTAL AMOUNT OF PAYMENT P FORM OF PAYMENT TOTAL AMOUNT PAID IN WORDS Cash P Postal Money Order Check Check Number PAID BY Check Date Bank & Branch Name TOTAL AMOUNT PAID P November April O ) O O ) DECLARATION OF EARNINGS OF INDIVIDUAL PAYOR December SUB-TOTAL August March Underpayment AMOUNT PAID IN FIGURES June PRINTED NAME July May September October I hereby declare, for purposes of Sec. 19-A of the Social Security Law the amount of _____________________________________________ (P ______________) as my monthly earnings, which shall be the basis of my monthly salary credit to be effective until revised in my next declaration. I affirm under the penalties of perjury, that this declaration has been made in good faith, and to the best of my knowledge and belief, is true and correct. January February SIGNATURE A D D Penalty O O ) PRINTED NAME OF MEMBER SIGNATURE OF MEMBER

- 3. Self-Employed Non-Working Spouse Voluntary Farmer/Fisherman OFW (Foreign Address - City, Country ______________________________ ) EMPLOYER NUMBER SS NUMBER (10 DIGITS) COMMON REFERENCE NUMBER (IF ANY, 12 DIGITS) EMPLOYER NAME NAME ADDRESS (RM./FLR./UNIT NO. & BLDG. NAME) (HOUSE/LOT & BLK. NO.) (STREET NAME) (SUBDIVISION) (BARANGAY/DISTRICT/LOCALITY) (CITY/MUNICIPALITY) (PROVINCE) ZIP CODE TAX IDENTIFICATION NUMBER (IF ANY) TELEPHONE NUMBER (AREA CODE+TEL. NO.) MOBILE/CELLPHONE NUMBER E-MAIL ADDRESS WEBSITE (FOR BUSINESS EMPLOYER) PAYMENT FORM Business Household SS CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER & INDIVIDUAL PAYOR) EC CONTRIBUTION (TO BE FILLED OUT BY EMPLOYER ONLY)YEARMONTH SOCIAL SECURITY SYSTEM CONTRIBUTIONS (THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED) TO BE FILLED OUT BY EMPLOYER AND INDIVIDUAL PAYOR PAYMENT DETAILS COA's COPY PLEASE READ THE INSTRUCTIONS AT THE BACK BEFORE FILLING OUT THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. APPLICABLE PERIOD TO BE FILLED OUT BY INDIVIDUAL PAYORTO BE FILLED OUT BY EMPLOYER TOTAL (TO BE FILLED OUT BY EMPLOYER ONLY) Republic of the Philippines CON-01181 (05-2014) P P P P P P P P P TOTAL AMOUNT OF PAYMENT P FORM OF PAYMENT TOTAL AMOUNT PAID IN WORDS Cash P Postal Money Order Check Check Number PAID BY Check Date Bank & Branch Name TOTAL AMOUNT PAID P November April O ) O O ) DECLARATION OF EARNINGS OF INDIVIDUAL PAYOR December SUB-TOTAL August March Underpayment AMOUNT PAID IN FIGURES June PRINTED NAME July May September October I hereby declare, for purposes of Sec. 19-A of the Social Security Law the amount of _____________________________________________ (P ______________) as my monthly earnings, which shall be the basis of my monthly salary credit to be effective until revised in my next declaration. I affirm under the penalties of perjury, that this declaration has been made in good faith, and to the best of my knowledge and belief, is true and correct. January February SIGNATURE A D D Penalty O O ) PRINTED NAME OF MEMBER SIGNATURE OF MEMBER