Standpoint Presentation Q1 2011

- 1. December 2010 Contents About Us 1 Performance and Rank 2 Balancing quantitative research with fundamental Our Services and Products 3 Equity and Portfolio Diagnostics 4 and subjective overlays Recent Developments 5 Standpoint Research provides independent equity research that is free from the conflicts of asset management, investment banking, proprietary Beyond a Quantitative trading and fee-for-research arrangements. The firm offers Model recommendations, analysis, diagnostics and forecasts on domestic and Proprietary valuation and international equities and markets backed by alpha-generating variables diagnostic model back-tested on many years of data. Ronnie Moas founded Standpoint Our model looks for specific Research in 2003 after spending more than five years developing a combinations in more than 150 fundamental, valuation, technical, proprietary 155-variable valuation and diagnostic model to assist him in accounting, and proprietary variables that have been back-tested and proven generating equity investment recommendations. In addition to his to identify undervalued stocks. quantitative model, Mr. Moas and his team execute proven fundamental Fundamental and valuation variables receive the heaviest weighting in the and subjective overlays in their research before issuing a recommendation. model while extreme technical readings are looked at from a contrarian Using this approach, the firm has been able to consistently outperform its perspective. competitors, ranking near the top of the charts at major tracking firms Fundamental and subjective since it began operations eight years ago. Standpoint Research is currently overlays ranked # 4 versus 191 firms according to Yahoo! Finance, Briefing.com and Pure quantitative models are widely used the Motley Fool (October 2008 through November 2010). and have lost their edge. We saw this problem coming years ago, which is why we use a hybrid approach. Our subjective Standpoint is now widely recognized as one of the top equity research and fundamental overlays have allowed firms in the U.S. and internationally, advising and selling its research to us to avoid the widely-publicized troubles that plagued other quant models and pension funds, hedge funds and asset management firms. Founder Ronnie hedge funds in recent years. This added Moas has made multiple appearances on Bloomberg, and has been quoted human element has been proven to enhance our performance. See page 2 for in Fortune Magazine, The Wall St. Journal, The New York Times, Barron s more information. and BusinessWeek, among others.

- 2. Performance Standpoint Research is currently ranked risk-adjusted at # 4 versus 191 funds and research firms according to Motley Fool, briefing.com & Yahoo! Finance through November 14, 2010. Motley Fool, briefing.com and Yahoo! For the four years ending December 31, Finance have a formula that factors in 2009, Investars had Standpoint performance (two-thirds weight) and Research ranked # 1 versus 75 financial institutions. Standpoint was ranked # 3 accuracy (one-third weight), where versus 119 financial institutions in 2009 accuracy is defined as the percentage of according to gainerstoday.com. Motley recommendations beating the S&P-500 by Fool, briefing.com, Yahoo! Finance and Our rank vs. other firms at least 500 basis points. They have been gainerstoday.com have all been tracking us since Q4, 2008. Investars has all of our Top 20 out of 191 tracking us since October 2008 and have recommendations since July 2003 on file. all 123 recommendations on file time- 001 - Einhorn 99.23 They have time-stamped all of our stamped that we have made since then. 002 - Edward Owens 98.30 recommendations since September 2006. Fifty-one are open, and seventy-two have Investars keeps only the most recent four 003 - Rich Aster 98.15 004 - Standpoint Research 97.60 been closed. We are ranked in the 94th years posted on their web site. For 005 - B. Rogers 97.59 percentile on performance (defined as the recommendations made pre-2006, visit 006 - Benchmark 97.50 average gain per recommendation versus our web site. Our eight-year track record 007 - First Analysis 97.15 document will be updated in Q1. 008 - Ed Lampert 96.32 the S&P-500), and 97th percentile on 009 - AG Edwards 96.20 accuracy. See table on the right side. We have beaten the S&P consistently 010 - KeyBanc 95.96 We have issued 123 recommendations since 2003 via our turnover strategy, 011 - Dreman 95.67 stock-picking and industry bets. We do 012 - Barclays 95.15 since October 2008. The average gain per not take big sector bets. We are 013 - Bank of America 95.10 recommendation versus the S&P was diversified, and currently have 68 stocks 014 - B. Riley & Co. 94.87 1084 basis points. More than two-thirds on our list of open recommendations 015 - Cross Research 94.70 of our recommendations have beaten the spread out across all ten sectors, down 016 - Hillman 94.60 S&P. Fifty-one outperformed by at least from our eight-year high of 105 open 017 - Bill Nygren 94.35 positions at the market low in Q1, 2009 018 - Credit Suisse 94.26 1500 bps, while 19 underperformed by at (and up slightly from 58 at the market top 019 - Stifel Nicolaus 94.25 least 1500 bps. If we use a +/- 3000 bps 020 - Soleil Securities 94.04 in 2007). We have beaten the S&P-500 in cut-off point, the figures were 24 and 6, seven of the last eight years by ~ 300 bps respectively. Note: 67% accuracy on Wall annually (on average). The 300 bps figure Notables Street is considered extraordinary is even more impressive on a risk-adjusted basis. 036 Citigroup 91.44 performance. See below. 038 George Soros 91.14 046 HSBC 90.66 058 Sterne Agee 88.23 Two-Year Performance (October 2008 November 2010) 077 Wedbush 85.20 098 Needham 77.86 Average Gain vs. S&P 1084 bps 123 117 Susquehanna 70.12 124 Edward Jones 65.00 Recommendations that Beat S&P 67.4% 83/123 166 Goldman Sachs < 40.00 185 CL King < 40.00 Out/Underperformed by +/- 1500 bps 51 19 Out/Underperformed by +/- 3000 bps 24 6

- 3. z Reporting Schedule December 2010 Dec 03: S&P-500 (#713) Dec 07: Financials-200 (#714) Dec 10: Individual write-up TBD (#715) Dec 13: Short Interest-1000 (#716) Dec 17: Energy-150 (#717) Dec 23: Industrials-300 (#718) Dec 27: Individual write-up TBD (#719) Services and Products Dec 30: ADR/International-200 (#720) January 2011 Standpoint Sector and Index Reports are Standpoint provides custom reporting for Jan 03: Utilities-100 (#721) published weekly. a select number of clients. Jan 06: Russell-2000 (#722) Jan 09: Technology-300 (#723) S&P-500, S&P-1500, Healthcare-300, Utilities- We perform thorough, absolute and relative Jan 12: Individual write-up TBD (#724) 100, Industrials-300, ADR/International-200, analysis on client holdings and focus lists. A Jan 16: Telecom-100 (#725) Russell-2000, Energy-150, Financials-200, Jan 20: Individual write-up TBD (#726) client s list is merged with all stocks from Jan 24: Consumer Disc.-300 (#727) Consumer Discretionary-300, Consumer their respective benchmark, giving the client Jan 28: Healthcare-300 (#728) Staples-100, Telecom-100, Materials-100 and an idea of how their holdings scored relative February 2011 Technology-300 are each published quarterly. to their universe. Feb 02: Materials-100 (#729) We also have quarterly special reports on Feb 05: S&P-1500 (#730) high-paying dividend stocks (200 companies Customized packages are available to suit your Feb 08: Individual write-up TBD (#731) covered) and Short Interest (1000 companies personal needs. Please contact us for package Feb 11: Financials-200 (#732) and subscription pricing information. We sell our Feb 15: Dividend Stocks-200 (#733) covered). Mid-quarter updates are available research mainly to institutional clients, though Feb 19: Individual write-up TBD (#734) for each of the reports on request. Each Feb 23: Energy-150 (#735) high net worth individuals are welcome to Feb 27: Industrials-300 (#736) sector report includes two files, one in Excel contact us. (five sheets) and one PDF (three pages of notes, updates and recommendations). Clients also receive individual stock write- Ronnie Moas Founder & Director of Research ups/recommendations generated from these Ronnie Moas is the Founder and Director of Research at Standpoint. Mr. Moas began his career on sector reports (and special reports). Wall Street as an analyst and market strategist at Herzog Heine Geduld. He was responsible for making sector, industry and stock recommendations, identifying arbitrage opportunities, options and hedging strategies. During his years at HHG, he demonstrated remarkable accuracy with his Standpoint Individual Write-Ups are market forecasts and stock recommendations. Mr. Moas left HHG in late 2000 in order to start his published twice per month. own firm (a few months after correctly forecasting the Nasdaq collapse in a timely manner). Our recommendations are issued after Ronnie spent the next few years developing and back-testing a 155-variable equity valuation and applying a heavy fundamental and subjective diagnostic model. The model has been run more than 400 times since development was completed overlay to the ideas generated by our in June 2003. The model has since then built an exceptional track record. Mr. Moas has authored, computer model. Individual write-ups are 8-12 published and distributed more than 700 research reports to-date. In 2002, he wrote a 284-page research report back-testing more than one-dozen different trading strategies on 20 years of data. pages in length and usually come out a few In 2003, Mr. Moas was one of the first analysts on Wall Street to forecast bull markets in weeks after the actual recommendation was commodities, Brazil, Russia, India and China. He also exited (mid-2007) and re-entered (late-2008) made. The reports cover the recommended in a timely manner. Ronnie has issued more than 400 stock recommendations since 2003. stock, its industry and competitors. If you missed any reports, they can be re-sent on Mr. Moas received a Bachelor s degree in Economics and Business with Honors from the State request. A short write-up will usually go out University of New York at Stony Brook, and a Masters degree in Finance and Investments from with the actual recommendation; the long Baruch College, City University of New York. Mr. Moas was born in New York and lived in Israel from report follows at a later date. We put out 40-60 1983-1994. He returned to New York after completing a three-year Israeli military service in artillery and intelligence with rank of Sergeant. Before returning to the United States in 1994, Ronnie new ideas annually, but long reports only go out worked at Shuki Weiss International Concert Productions where a few of his production credits on approximately half of those names. On- included the Haifa Seaport Blues Festival, Bob Dylan, Radiohead, Buddy Guy and Suede. Ronnie has demand service for these reports is available traveled to more than 30 countries since 2003, he designed this web site, is the owner of an upon request. articulate African Grey Parrot and a very large music collection of 1,500 cds.

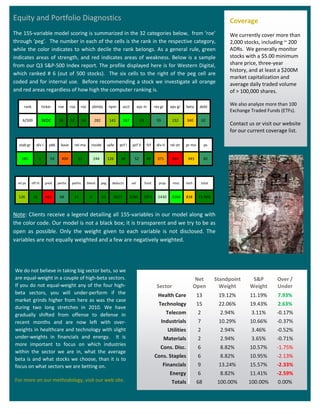

- 4. Equity and Portfolio Diagnostics Coverage The 155-variable model scoring is summarized in the 32 categories below, from roe We currently cover more than through peg . The number in each of the cells is the rank in the respective category, 2,000 stocks, including ~ 200 while the color indicates to which decile the rank belongs. As a general rule, green ADRs. We generally monitor indicates areas of strength, and red indicates areas of weakness. Below is a sample stocks with a $5.00 minimum from our Q3 S&P-500 Index report. The profile displayed here is for Western Digital, share price, three-year history, and at least a $200M which ranked # 6 (out of 500 stocks). The six cells to the right of the peg cell are market capitalization and coded and for internal use. Before recommending a stock we investigate all orange average daily traded volume and red areas regardless of how high the computer ranking is. of > 100,000 shares. rank ticker roe roa roc ebitda npm acct eps m rev gr eps gr beta debt We also analyze more than 100 Exchange Traded Funds (ETFs). 6/500 WDC 36 32 24 282 141 167 23 59 132 340 62 Contact us or visit our website for our current coverage list. stab gr div I pbk base rel-ma inside safe pcf I pcf II fcf div II rel str pr mo ps 181 1 54 404 11 244 126 46 52 49 371 484 343 82 rel ps off hi pred pertix perhis blend peg deducts val fund prop misc tech total 126 21 461 68 11 5 22 9627 2284 1971 2430 2104 838 73.98% Note: Clients receive a legend detailing all 155-variables in our model along with the color code. Our model is not a black box; it is transparent and we try to be as open as possible. Only the weight given to each variable is not disclosed. The variables are not equally weighted and a few are negatively weighted. We do not believe in taking big sector bets, so we are equal-weight in a couple of high-beta sectors. Net Standpoint S&P Over / If you do not equal-weight any of the four high- Sector Open Weight Weight Under beta sectors, you will under-perform if the Health Care 13 19.12% 11.19% 7.93% market grinds higher from here as was the case Technology 15 22.06% 19.43% 2.63% during two long stretches in 2010. We have gradually shifted from offense to defense in Telecom 2 2.94% 3.11% -0.17% recent months and are now left with over- Industrials 7 10.29% 10.66% -0.37% weights in healthcare and technology with slight Utilities 2 2.94% 3.46% -0.52% under-weights in financials and energy. It is Materials 2 2.94% 3.65% -0.71% more important to focus on which industries Cons. Disc. 6 8.82% 10.57% -1.75% within the sector we are in, what the average Cons. Staples 6 8.82% 10.95% -2.13% beta is and what stocks we choose, than it is to focus on what sectors we are betting on. Financials 9 13.24% 15.57% -2.33% Energy 6 8.82% 11.41% -2.59% For more on our methodology, visit our web site. Totals 68 100.00% 100.00% 0.00%

- 5. Recent Developments Conflict-Free Research November 2010 Standpoint Research, Inc. is a Ronnie Moas was quoted in Forbes and Computer Weekly, and was featured in Fortune member of the Investorside Magazine (Volume 162, Number 8). Research Association; a Washington D.C. based non- Q2 & Q3, 2010 profit organization. Ronnie appeared multiple times on Bloomberg s Taking Stock with Pimm Fox and was Investorside certifies that its members have no investment quoted in Barron s. banking or other conflicts. Q1, 2010 Ronnie Moas was featured in full-length interviews at streetinsider.com and benzinga.com. In the Media, 2009 For Institutional Clients Ronnie Moas was quoted in a number of publications including The New York Times, The UBS, Barclays, Instinet & Wall Street Journal and BusinessWeek. In addition, Mr. Moas made multiple appearances Credit Suisse are our on Bloomberg and BNN Canada. preferred brokers. Q4, 2008 Ronnie received an award on behalf of Standpoint Research for the company s 2003-2007 performance at The Cornell Club in New York from the Investorside Research Association. Ronnie Moas receiving an award from Patrick Shea (Executive Director, Investorside Research Association). Standpoint Research Flamingo South Beach, Center Tower 1504 Bay Road # 2210 Miami Beach, FL 33139 Web: www.standpointresearch.com E-mail: admin@standpointresearch.com Tel: 786.768.2317 Alt: 212.752.0330