Steve Merritt: Barracuda Networks

- 1. Barracuda Networks Steve Merritt (stevemer)

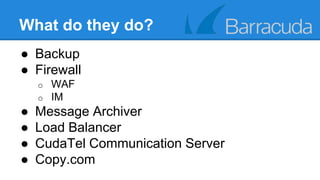

- 2. What do they do? ● Backup ● Firewall o WAF o IM ● Message Archiver ● Load Balancer ● CudaTel Communication Server ● Copy.com

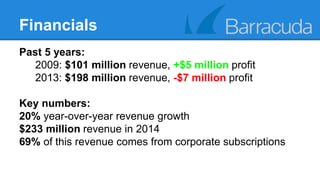

- 3. Financials Past 5 years: 2009: $101 million revenue, +$5 million profit 2013: $198 million revenue, -$7 million profit Key numbers: 20% year-over-year revenue growth $233 million revenue in 2014 69% of this revenue comes from corporate subscriptions

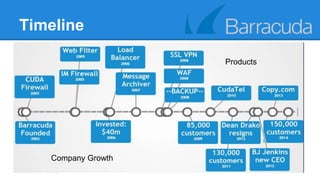

- 4. Timeline Products Company Growth

- 5. What’s Hot - Strongest Product: BBS: Barracuda Backup Service - Fastest Growing Product: BMAS: Barracuda Message Archiver Service - Newest Product: BC: Barracuda Copy (copy.com)

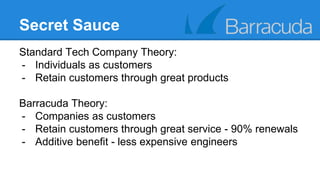

- 6. Secret Sauce Standard Tech Company Theory: - Individuals as customers - Retain customers through great products Barracuda Theory: - Companies as customers - Retain customers through great service - 90% renewals - Additive benefit - less expensive engineers

- 7. Competition Barracuda competes in many diverse fields

- 8. Buy or Sell? Considerations: ● Overview: Tech Company ● Primary focus: Retention of subscriptions o Compare: Microsoft Office Suite

- 9. Buy or Sell? Considerations: ● Overview: Tech Company Service Provider ● Primary focus: Retention of subscriptions o Compare: Microsoft Office Suite

- 10. Buy or Sell? Considerations: ● Overview: Tech Company Service Provider ● Primary focus: Retention of subscriptions o Compare: Microsoft Office Suite

- 11. Buy or Sell? Considerations: ● Overview: Tech Company Service Provider ● Primary focus: Retention of subscriptions o Compare: Microsoft Office Suite ● Key differences: o Aggressive product development o Willing to cannibalize existing tech ? BBS, BMAS o Young company + young market

- 12. Buy or Sell? Considerations: ● Overview: Tech Company Service Provider ● Primary focus: Retention of subscriptions o Compare: Microsoft Office Suite ● Key differences: o Aggressive product development o Willing to cannibalize existing tech ? BBS, BMAS o Young company + young market Conclusion: Buy now, watch closely