Stock Exchange, Stock Market & SEBI Functions

- 2. 2 • 3.1 Introduction to stock markets: History of Stock Exchange • 3.2 Stock index: NSE & BSE • 3.3 Function of Stock exchange & Regulatory framework Contents

- 3. 3 • Stock Markets • The stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place • Functions of Stock Market: • Fair Dealing in Securities Transactions: To ensure that all interested market participants have instant access to data for all buy and sell orders thereby helping in the fair and transparent pricing of securities. • Efficient Price Discovery: Deciding the proper price of a security and is usually performed by assessing market supply and demand and other factors associated with the transactions. • Liquidity Maintenance: While getting the number of buyers and sellers for a particular financial security are out of control for the stock market, it needs to ensure that whosoever is qualified and willing to trade gets instant access to place orders which should get executed at the fair price. • Security and Validity of Transactions: While more participants are important for efficient working of a market, the same market needs to ensure that all participants are verified and remain compliant with the necessary rules and regulations 3.1 Introduction to stock markets: History of Stock Exchange

- 4. 4 • Support All Eligible Types of Participants: A marketplace is made by a variety of participants, which include market makers, investors, traders, speculators, and hedgers. All these participants operate in the stock market with different roles and functions. For instance, an investor may buy stocks and hold them for long term spanning many years, while a trader may enter and exit a position within seconds. • Investor Protection: The stock exchange must implement necessary measures to offer the necessary protection to small investors to shield them from financial loss and ensure customer trust. • Balanced Regulation: Listed companies are largely regulated and their dealings are monitored by market regulators, like the SEBI. Additionally, exchanges also mandate certain requirements – like, timely filing of quarterly financial reports and instant reporting of any relevant developments - to ensure all market participants become aware of corporate happenings. Failure to adhere to the regulations can lead to suspension of trading by the exchanges and other disciplinary measures. 3.1 Introduction to stock markets: History of Stock Exchange

- 5. 5 BSE – Bombay Stock Exchange 1875: • Bombay Stock Exchange is located on Dalal street, Mumbai. • BSE is the oldest stock exchange in India. • In the beginning during 1855, some stock brokers were gathering under Banyan tree. But later on when the number of stock brokers increased, the group shifted in 1874. • In 1875, the group became an official organization named as “The Native Chor and Stock Brokers Association”. • In 1986, BSE developed its Index named as SENSEX to measure the performance of the exchange. Initially, there was an open outcry floor trading system which in 1995 switched to electronic trading system. • The exchange made the whole transition in just fifty days. • BSE Online Trading, known as BOLT is a automated, screen based trading platform with a capacity of 8 millions orders per day. • BSE provides an transparent and efficient market for trading in equities, debentures, bonds, derivatives and mutual funds etc. • It is the first exchange across India and second across world to get an ISO 9000:2000 certification. 3.2 Indian Stock Markets: NSE & BSE

- 6. 6 NSE – National Stock Exchange 1993: • The National Stock Exchange is located in Mumbai. It was incorporated in 1992 and became a stock exchange in 1993. • The basic purpose of this exchange was to bring the transparency in the stock markets. • It started its operations in the wholesale debt market in June 1994. • The equity market segment of the National Stock Exchange commenced its operations in November, 1994 whereas in the derivatives segment, it started it operations in June, 2000. • It has completely modern and fully automated 3 screen based trading system having more than two lakh trading terminals • The total 1696 companies are listed in National Stock Exchange. • The popular index of NSE, The CNX NIFTY is extremely used by the investor throughout India as well as internationally. • There are number of domestic and global companies that hold stake in the exchange. Some domestic companies include GIC, LIC, SBI and IDFC ltd. • NSE also created National Securities Depository Limited (NSDL) which permitted investors to hold and manage their shares and bonds electronically through demat account. An investor can hold and trade in even one share. • Now, the physical handling of securities eliminated so the chances of damage or misplacing of securities reduced to minimum and to hold the equities become more convenient. • The National Security Depository Limited’s electronically security handling, convenience, transparency, low transaction prices and efficiency in trade which is affected by NSE, has enhanced the reach of Indian stock market to domestic as well as international investors 3.2 Indian Stock Markets: NSE & BSE

- 7. 7 3.2 Indian Stock Markets: NSE & BSE

- 8. 8 Functions of Stock Exchange • Ideal Meeting Place: For buyers & sellers • Mobilization of savings: Investors can save money • Providing safety to investors: Through transparency • Distribution of new securities: After listing, one can purchase • Ready market: To buy and sell shares • Liquidity: Very easy for transactions. Will be very liquid • Capital formation: From company's prespective • Speculative trading: Day traders can speculate • Investor education: Regarding capital markets • Company regulation: Listing of shares and other compliance 3.3 Functions of Stock Exchange & SEBI

- 9. 9 SEBI • The Securities and Exchange Board of India (SEBI) was officially appointed as the authority for regulating the financial markets in India on 12th April 1988. • It was initially established as a non-statutory body, i.e. it had no control over anything but later in 1992, it was declared an autonomous body with statutory powers. • SEBI plays an important role in regulating the securities market of India. 3.3 Functions of Stock Exchange & SEBI

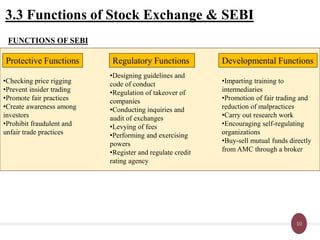

- 10. 10 FUNCTIONS OF SEBI 3.3 Functions of Stock Exchange & SEBI Protective Functions Regulatory Functions Developmental Functions •Checking price rigging •Prevent insider trading •Promote fair practices •Create awareness among investors •Prohibit fraudulent and unfair trade practices •Designing guidelines and code of conduct •Regulation of takeover of companies •Conducting inquiries and audit of exchanges •Levying of fees •Performing and exercising powers •Register and regulate credit rating agency •Imparting training to intermediaries •Promotion of fair trading and reduction of malpractices •Carry out research work •Encouraging self-regulating organizations •Buy-sell mutual funds directly from AMC through a broker

- 11. 11 THANK YOU