Stock Market Outlook Report by Imperial Money Pvt. Ltd.

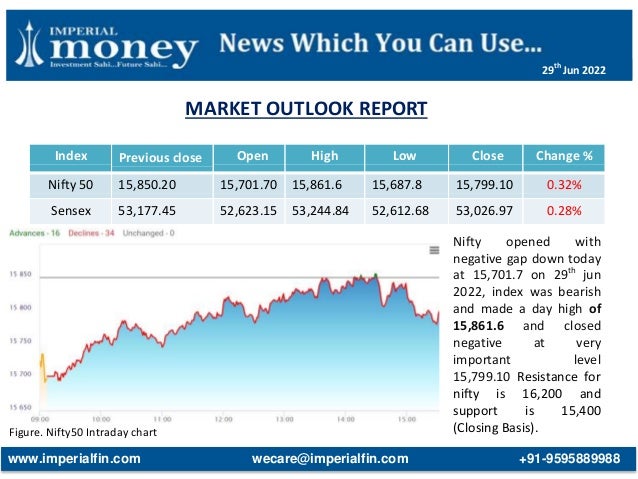

- 1. MARKET OUTLOOK REPORT Figure. Nifty50 Intraday chart Index Previous close Open High Low Close Change % Nifty 50 15,850.20 15,701.70 15,861.6 15,687.8 15,799.10 0.32% Sensex 53,177.45 52,623.15 53,244.84 52,612.68 53,026.97 0.28% Nifty opened with negative gap down today at 15,701.7 on 29th jun 2022, index was bearish and made a day high of 15,861.6 and closed negative at very important level 15,799.10 Resistance for nifty is 16,200 and support is 15,400 (Closing Basis). www.imperialfin.com wecare@imperialfin.com +91-9595889988 29th Jun 2022

- 2. Sectorial Performance 1.27% 1.29% 0.03% 0.96% 1.11% 0.15% 2.54% 0.22% 0.24% NIFTYFMCG NIFTYIT NIFTYPHARMA NIFTYFINSERVICE NIFTYBANK NIFTYAUTO NIFTYMEDIA NIFTYREALTY NIFTYMETAL SECTORS CHANGE % SECTORS CHANGE % www.imperialfin.com wecare@imperialfin.com +91-9595889988 29th Jun 2022

- 3. Top Trending News ’āś NMDC: ’āś THE STEEL MINISTRY HAD CONVENED TWO SEPARATE MEETINGS OF SHAREHOLDERS AND CREDITORS OF CO TO EXPEDITE THE PROCESS OF DEMERGING THE CO'S NAGARNAR STEEL PLANT - PTI ’āś BAJAJ ELECTRICALS: ’āś CO APPOINTS RAVINDRA SINGH NEGI AS CHIEF OPERATING OFFICER (COO) OF ITS CONSUMER PRODUCTS BUSINESS || NEGI WILL JOIN CO IN JULY 2022 FROM HAVELLS INDIA ’āś MASTEK: ’āś CO INFORMS NETSKOPE WILL HELP CO SECURELY IMPLEMENT ITŌĆÖS ŌĆśHIRE FROM ANYWHERE, DELIVER FROM EVERYWHEREŌĆÖ INITIATIVE AND STIMULATE GROWTH ’āś HINDALCO: ’āś CO TO MAKE INVESTMENT IN CLEANWIN ENERGY SIX LLP || CO TO TAKE 26% IN CLEANWIN ENERGY SIX LLP FOR RS 7.15M ’āś RAMCO SYSTEMS: ’āś AL FAISAL HOLDING CO SELECTS CO TO ENHANCE ITS HR AND PAYROLL SYSTEMS 29th Jun 2022 www.imperialfin.com wecare@imperialfin.com +91-9595889988

- 4. 4.36% 4.14% 3.44% 3.24% 3.21% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% HDFCLIFE JUBLFOOD MCDOWELL-N APOLLOHOSP LTI TOP LOSERS 5.91% 3.21% 2.30% 2.27% 2.08% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% BOSCHLTD ONGC JINDALSTEEL NTPC RELIANCE TOP GAINERS Stocks in Action www.imperialfin.com wecare@imperialfin.com +91-9595889988 29th Jun 2022

- 5. Corporate Actions ’āś Vaibhav Global Limited (AGM/Dividend Rs 1.5/Share on 29th Jun) ’āś Tata Steel Long Products Limited (AGM/Dividend Rs 12.5/Share on 29th Jun) FII/DII/FPI ACTION IN CAPITAL MARKET Category Date Buy Value Sell Value Net Value DII 28 Jun 2022 5177.24 cr 3971.61 cr 1205.63 cr FII/FPI 28 Jun 2022 5348.85 cr 6593.29 cr -1244.44 cr ’āś The following is combined Domestic Institutional Investors trading data across NSE, BSE and MSEI collated on the basis of trades executed by Banks, DFIs, Insurance, MFs and New Pension System. 29th Jun 2022 www.imperialfin.com wecare@imperialfin.com +91-9595889988

- 6. ENDURANCE. Sector:AutoANCILLARY. Important Parameter MARKET CAP P/B EPS BOOK VALUE PE ROE ROCE 19,425.54 CR 6.46 27.14 213.76 50.89 15.6% 20.30% FUNDAMENTALS. ’āś The company has significantly decreased its debt by 103.29 Cr. ’āś Company has been maintaining healthy ROCE of 23.45% over the past 3 years. ’āś Company is virtually debt free. ’āś Company has a healthy Interest coverage ratio of 110.59. ’āś The company has an efficient Cash Conversion Cycle of 14.85 days. ’āś Company has a healthy liquidity position with current ratio of 2.22. Stock Entry price Positional target ENDURANCE 1380 1580 www.imperialfin.com wecare@imperialfin.com +91-9595889988 29th Jun 2022

- 7. Disclaimer This document has been prepared for IMPERIAL MONEY PVT. LTD. by Mr. Praveen Dubey NISM (201800048686) is a Research Consultant for Imperial Money Pvt. Ltd. This Market Outlook is intended for use only by the person or entity to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice. This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive this report at the same time. Imperial Money Pvt. Ltd. Does not carry any responsibility in case to whomsoever using the information of this newsletter content and data www.imperialfin.com wecare@imperialfin.com +91-9595889988 29th Jun 2022