Stock Tips and Recommended For Today

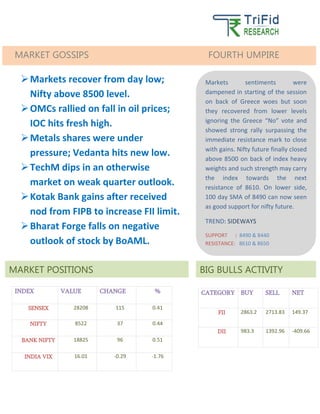

- 2. S S INDEX VALUE CHANGE % SENSEX 28208 115 0.41 NIFTY 8522 37 0.44 BANK NIFTY 18825 96 0.51 INDIA VIX 16.01 -0.29 -1.76 CATEGORY BUY SELL NET FII 2863.2 2713.83 149.37 DII 983.3 1392.96 -409.66 BIG BULLS ACTIVITY MARKET GOSSIPS FOURTH UMPIRE Markets sentiments were dampened in starting of the session on back of Greece woes but soon they recovered from lower levels ignoring the Greece ŌĆ£NoŌĆØ vote and showed strong rally surpassing the immediate resistance mark to close with gains. Nifty future finally closed above 8500 on back of index heavy weights and such strength may carry the index towards the next resistance of 8610. On lower side, 100 day SMA of 8490 can now seen as good support for nifty future. TREND: SIDEWAYS SUPPORT : 8490 & 8440 RESISTANCE: 8610 & 8650 MARKET POSITIONS ’āśMarkets recover from day low; Nifty above 8500 level. ’āśOMCs rallied on fall in oil prices; IOC hits fresh high. ’āśMetals shares were under pressure; Vedanta hits new low. ’āśTechM dips in an otherwise market on weak quarter outlook. ’āśKotak Bank gains after received nod from FIPB to increase FII limit. ’āśBharat Forge falls on negative outlook of stock by BoAML.

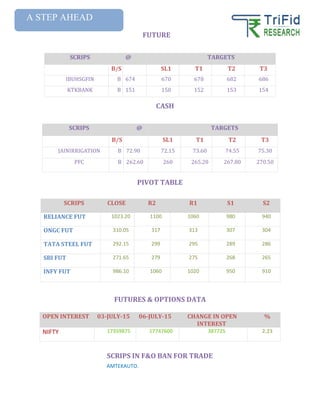

- 3. SCRIPS @ TARGETS B/S SL1 T1 T2 T3 IBUHSGFIN B 674 670 678 682 686 KTKBANK B 151 150 152 153 154 SCRIPS @ TARGETS B/S SL1 T1 T2 T3 JAINIRRIGATION B 72.90 72.15 73.60 74.55 75.30 PFC B 262.60 260 265.20 267.80 270.50 SCRIPS CLOSE R2 R1 S1 S2 RELIANCE FUT 1023.20 1100 1060 980 940 ONGC FUT 310.05 317 313 307 304 TATA STEEL FUT 292.15 299 295 289 286 SBI FUT 271.65 279 275 268 265 INFY FUT 986.10 1060 1020 950 910 AMTEKAUTO. OPEN INTEREST 03-JULY-15 06-JULY-15 CHANGE IN OPEN INTEREST % NIFTY 17359875 17747600 387725 2.23 FUTURE CASH PIVOT TABLE FUTURES & OPTIONS DATA SCRIPS IN F&O BAN FOR TRADE A STEP AHEAD