Stockout

- 1. Estimation of Retail Demand Under Partially-Observed Out-of-Stocks

- 2. Agenda Motivation Big Picture Contribution Model & Methodology Empirical Results Managerial Implications Extensions Conclusions

- 3. Motivation: iPhone How would the analyst with Apple store data know whether when you went to buy the product the store was OOS?

- 4. Big Picture: Many situations in which we don’t observe individual behavior, but we may have some aggregate or limited information. Key: use aggregate data to formulate constraints on the unobserved individual behavior. Dependent variables: Choices Independent variables: Coupon promotions Environment: Out-of-stocks Other applications: Shopping paths

- 5. What fraction of consumers were exposed to an out-of-stock (OOS)? How many choose not to buy ? (money left on the table) How many choose to buy another product ? Can we reduce lost sales via improved inventory methods? What is the impact of these policies on the retailer’s profits ? Can OOS’s lead to misleading demand estimates? (assortment planning, inventory decisions) Managerial Issues:

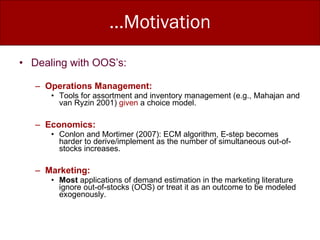

- 6. …Motivation Dealing with OOS’s: Operations Management: Tools for assortment and inventory management (e.g., Mahajan and van Ryzin 2001) given a choice model. Economics: Conlon and Mortimer (2007): ECM algorithm, E-step becomes harder to derive/implement as the number of simultaneous out-of-stocks increases. Marketing: Most applications of demand estimation in the marketing literature ignore out-of-stocks (OOS) or treat it as an outcome to be modeled exogenously.

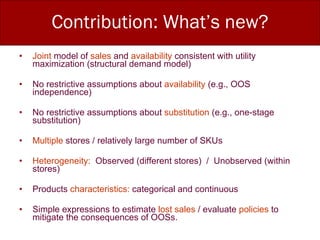

- 7. Contribution: What’s new? Joint model of sales and availability consistent with utility maximization (structural demand model) No restrictive assumptions about availability (e.g., OOS independence) No restrictive assumptions about substitution (e.g., one-stage substitution) Multiple stores / relatively large number of SKUs Heterogeneity: Observed (different stores) / Unobserved (within stores) Products characteristics: categorical and continuous Simple expressions to estimate lost sales / evaluate policies to mitigate the consequences of OOSs.

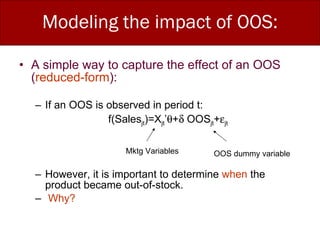

- 8. Modeling the impact of OOS: A simple way to capture the effect of an OOS ( reduced-form ): If an OOS is observed in period t: f(Sales jt )=X jt ’  +  OOS jt +  jt However, it is important to determine when the product became out-of-stock. Why? Mktg Variables OOS dummy variable

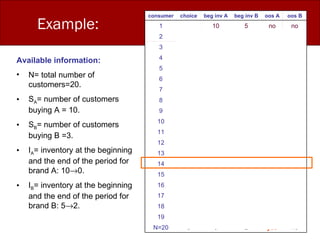

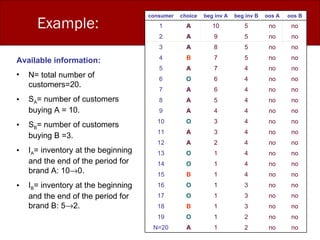

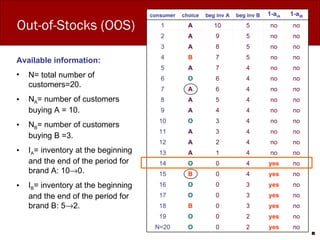

- 9. Available information: N= total number of customers=20. S A = number of customers buying A = 10. S B = number of customers buying B =3. I A = inventory at the beginning and the end of the period for brand A: 10 ÔÇÆ 0. I B = inventory at the beginning and the end of the period for brand B: 5 ÔÇÆ 2. Example: no yes 2 0 O N=20 no yes 2 0 O 19 no yes 3 0 B 18 no yes 3 0 O 17 no yes 3 0 O 16 no yes 4 0 B 15 no yes 4 0 O 14 no no 4 1 A 13 no no 4 2 A 12 no no 4 3 A 11 no no 4 3 O 10 no no 4 4 A 9 no no 4 5 A 8 no no 4 6 A 7 no no 4 6 O 6 no no 4 7 A 5 no no 5 7 B 4 no no 5 8 A 3 no no 5 9 A 2 no no 5 10 A 1 oos B oos A beg inv B beg inv A choice consumer

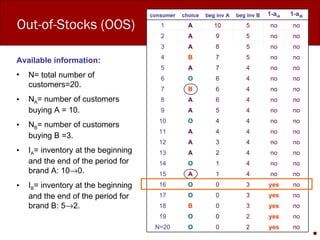

- 10. Example: Available information: N= total number of customers=20. S A = number of customers buying A = 10. S B = number of customers buying B =3. I A = inventory at the beginning and the end of the period for brand A: 10 ÔÇÆ 0. I B = inventory at the beginning and the end of the period for brand B: 5 ÔÇÆ 2. no no 2 1 A N=20 no no 2 1 O 19 no no 3 1 B 18 no no 3 1 O 17 no no 3 1 O 16 no no 4 1 B 15 no no 4 1 O 14 no no 4 1 O 13 no no 4 2 A 12 no no 4 3 A 11 no no 4 3 O 10 no no 4 4 A 9 no no 4 5 A 8 no no 4 6 A 7 no no 4 6 O 6 no no 4 7 A 5 no no 5 7 B 4 no no 5 8 A 3 no no 5 9 A 2 no no 5 10 A 1 oos B oos A beg inv B beg inv A choice consumer

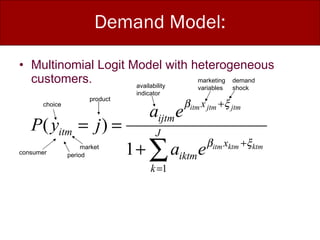

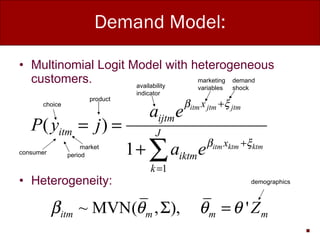

- 11. Demand Model: Multinomial Logit Model with heterogeneous customers. consumer product period choice availability indicator marketing variables market demand shock

- 12. Demand Model: Multinomial Logit Model with heterogeneous customers. Heterogeneity: demographics consumer product period choice availability indicator marketing variables market demand shock

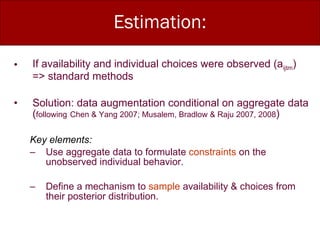

- 13. Estimation: If availability and individual choices were observed (a ijtm ) => standard methods Solution: data augmentation conditional on aggregate data ( following Chen & Yang 2007; Musalem, Bradlow & Raju 2007, 2008 ) Key elements: Use aggregate data to formulate constraints on the unobserved individual behavior. Define a mechanism to sample availability & choices from their posterior distribution.

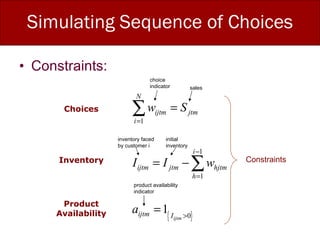

- 14. Simulating Sequence of Choices Constraints: choice indicator Choices Inventory Product Availability initial inventory sales inventory faced by customer i product availability indicator Constraints

- 15. Available information: N= total number of customers=20. N A = number of customers buying A = 10. N B = number of customers buying B =3. I A = inventory at the beginning and the end of the period for brand A: 10 ÔÇÆ 0. I B = inventory at the beginning and the end of the period for brand B: 5 ÔÇÆ 2. Out-of-Stocks (OOS) no yes 2 0 O N=20 no yes 2 0 O 19 no yes 3 0 B 18 no yes 3 0 O 17 no yes 3 0 O 16 no yes 4 0 B 15 no yes 4 0 O 14 no no 4 1 A 13 no no 4 2 A 12 no no 4 3 A 11 no no 4 3 O 10 no no 4 4 A 9 no no 4 5 A 8 no no 4 6 A 7 no no 4 6 O 6 no no 4 7 A 5 no no 5 7 B 4 no no 5 8 A 3 no no 5 9 A 2 no no 5 10 A 1 1-a iB 1-a iA beg inv B beg inv A choice consumer

- 16. Out-of-Stocks (OOS) Available information: N= total number of customers=20. N A = number of customers buying A = 10. N B = number of customers buying B =3. I A = inventory at the beginning and the end of the period for brand A: 10 ÔÇÆ 0. I B = inventory at the beginning and the end of the period for brand B: 5 ÔÇÆ 2. no yes 2 0 O N=20 no yes 2 0 O 19 no yes 3 0 B 18 no yes 3 0 O 17 no yes 3 0 O 16 no no 4 1 A 15 no no 4 1 O 14 no no 4 2 A 13 no no 4 3 A 12 no no 4 4 A 11 no no 4 4 O 10 no no 4 5 A 9 no no 4 6 A 8 no no 4 6 B 7 no no 4 6 O 6 no no 4 7 A 5 no no 5 7 B 4 no no 5 8 A 3 no no 5 9 A 2 no no 5 10 A 1 1-a iB 1-a iA beg inv B beg inv A choice consumer

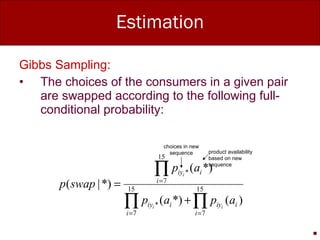

- 17. Estimation Gibbs Sampling: The choices of the consumers in a given pair are swapped according to the following full-conditional probability: choices in new sequence product availability based on new sequence

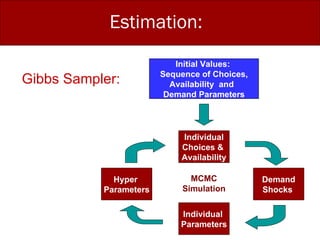

- 18. Estimation: Initial Values: Sequence of Choices, Availability and Demand Parameters Individual Choices & Availability Individual Parameters Hyper Parameters Gibbs Sampler: MCMC Simulation Demand Shocks

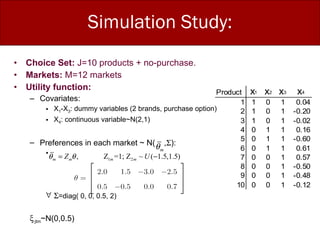

- 19. Simulation Study: Choice Set: J=10 products + no-purchase. Markets: M=12 markets Utility function: Covariates: X 1 -X 3 : dummy variables (2 brands, purchase option) X 4 : continuous variable~N(2,1) Preferences in each market ~ N( ,  ):  =diag( 0, 0, 0.5, 2)  jtm ~N(0,0.5)

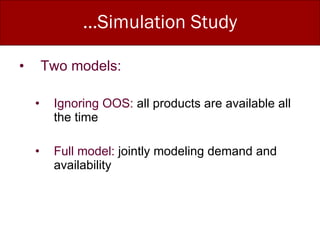

- 20. …Simulation Study Two models: Ignoring OOS: all products are available all the time Full model: jointly modeling demand and availability

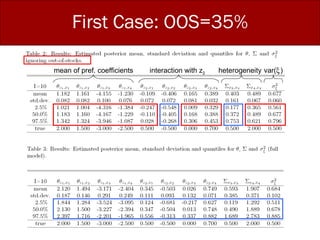

- 21. First Case: OOS=35% mean of pref. coefficients interaction with z 2 heterogeneity var(  )

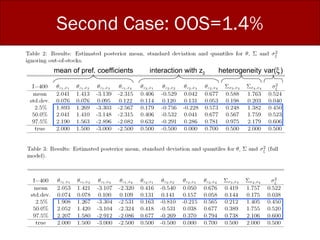

- 22. Second Case: OOS=1.4% mean of pref. coefficients interaction with z 2 heterogeneity var(  )

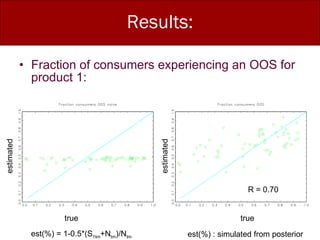

- 23. Results: Fraction of consumers experiencing an OOS for product 1: true true estimated estimated est(%) = 1-0.5*(S 1tm +N tm )/N tm est(%) : simulated from posterior R = 0.70

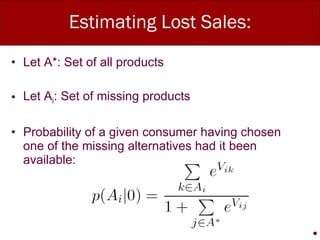

- 24. Estimating Lost Sales: Let A*: Set of all products Let A i : Set of missing products Probability of a given consumer having chosen one of the missing alternatives had it been available:

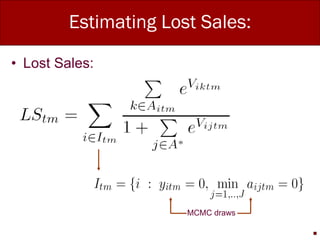

- 25. Estimating Lost Sales: Lost Sales: MCMC draws

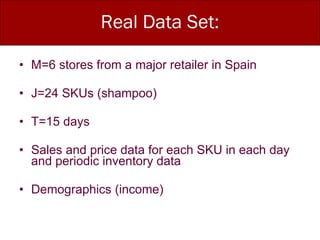

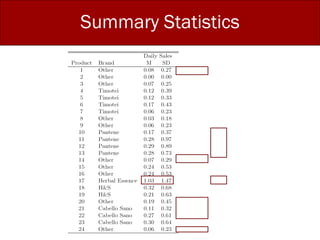

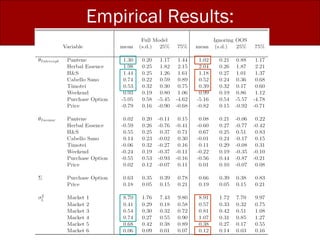

- 26. Real Data Set: M=6 stores from a major retailer in Spain J=24 SKUs (shampoo) T=15 days Sales and price data for each SKU in each day and periodic inventory data Demographics (income)

- 29. Estimating Lost Purchases: Market 1 Market 2 Market 3 Market 4 Market 5 Market 6

- 30. % Lost Sales vs. OOS incidence Number of OOS products % Lost Sales

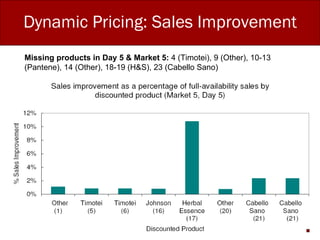

- 31. Dynamic Pricing: Sales Improvement Missing products in Day 5 & Market 5: 4 (Timotei), 9 (Other), 10-13 (Pantene), 14 (Other), 18-19 (H&S), 23 (Cabello Sano)

- 32. Dynamic Pricing: Profit Improvement Item implied by Lost Revenue ≠ Lost Profit ≠ Most Frequent OOS

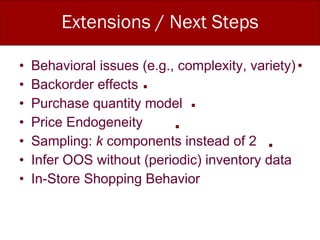

- 33. Extensions / Next Steps Behavioral issues (e.g., complexity, variety) Backorder effects Purchase quantity model Price Endogeneity Sampling: k components instead of 2 Infer OOS without (periodic) inventory data In-Store Shopping Behavior

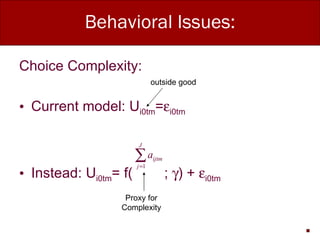

- 34. Behavioral Issues: Choice Complexity: Current model: U i0tm = ÔÅ• i0tm Instead: U i0tm = f( ; ÔÅß ) + ÔÅ• i0tm Proxy for Complexity outside good

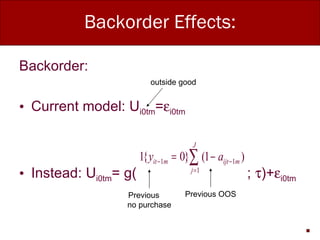

- 35. Backorder Effects: Backorder: Current model: U i0tm = ÔÅ• i0tm Instead: U i0tm = g( ; ÔÅ¥ )+ ÔÅ• i0tm Previous OOS outside good Previous no purchase

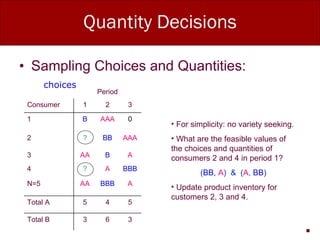

- 36. Quantity Decisions Sampling Choices and Quantities: choices For simplicity: no variety seeking. What are the feasible values of the choices and quantities of consumers 2 and 4 in period 1? ( BB , A ) & ( A , BB ) Update product inventory for customers 2, 3 and 4. 5 4 5 Total A BBB A ? 4 AAA BB ? 2 A B AA 3 A BBB AA N=5 3 6 3 Total B 0 AAA B 1 3 2 1 Consumer Period

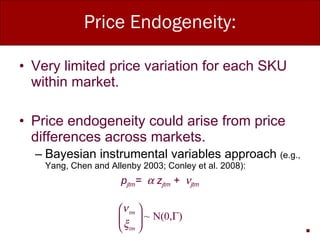

- 37. Price Endogeneity: Very limited price variation for each SKU within market. Price endogeneity could arise from price differences across markets. Bayesian instrumental variables approach (e.g., Yang, Chen and Allenby 2003; Conley et al. 2008): p jtm =  z jtm +  jtm

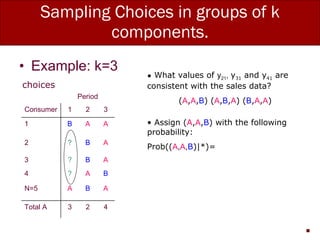

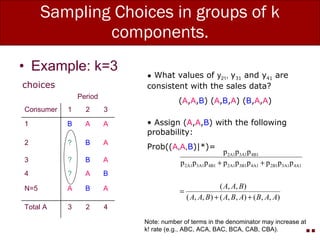

- 38. Sampling Choices in groups of k components. Example: k=3 choices What values of y 21 , y 31 and y 41 are consistent with the sales data? ( A , A , B ) ( A , B , A ) ( B , A , A ) Assign ( A , A , B ) with the following probability: Prob(( A , A , B )|*)= B A ? 4 A B ? 2 A B ? 3 A B A N=5 4 2 3 Total A A A B 1 3 2 1 Consumer Period

- 39. Sampling Choices in groups of k components. Example: k=3 Note: number of terms in the denominator may increase at k! rate (e.g., ABC, ACA, BAC, BCA, CAB, CBA). choices What values of y 21 , y 31 and y 41 are consistent with the sales data? ( A , A , B ) ( A , B , A ) ( B , A , A ) Assign ( A , A , B ) with the following probability: Prob(( A , A , B )|*)= B A ? 4 A B ? 2 A B ? 3 A B A N=5 4 2 3 Total A A A B 1 3 2 1 Consumer Period

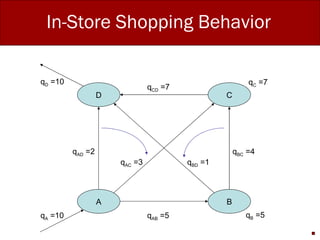

- 40. In-Store Shopping Behavior Using RFID technology it is possible to track the location of shopping carts in a grocery store every 5 seconds ( disaggregate data). Alternatively: record the number of shopping carts that pass through a measuring point ( aggregate data). Infer the trajectory of shopping carts using only these aggregate measurements.

- 41. In-Store Shopping Behavior A B C D q A =10 q B =5 q C =7 q D =10 q AB =5 q BC =4 q BD =1 q AC =3 q AD =2 q CD =7

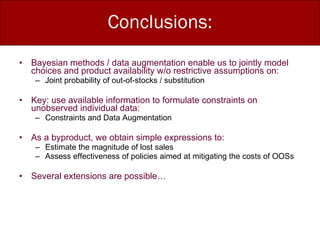

- 42. Conclusions: Bayesian methods / data augmentation enable us to jointly model choices and product availability w/o restrictive assumptions on: Joint probability of out-of-stocks / substitution Key: use available information to formulate constraints on unobserved individual data: Constraints and Data Augmentation As a byproduct, we obtain simple expressions to: Estimate the magnitude of lost sales Assess effectiveness of policies aimed at mitigating the costs of OOSs Several extensions are possible…

- 43. Thank You

Editor's Notes

- OOS are quite common…a recent notable example… May 12 th , 2008: Apple Inc. said iPhone is out of stock online, but added that brick-and-mortar stores run by Apple and iPhone carriers including AT&T Inc. might still have units available. CNN:http://www.cnn.com/2008/TECH/ptech/05/12/iphone.sold.out.ap iPhone sold out online Story Highlights Apple: U.S. and UK online stores are sold out of the popular smart phone Apple retail stores and AT&T may have units left, according to Apple Analysts say this may indicate upcoming launch of next-gen iPhone SAN FRANCISCO, California (AP) -- Apple Inc. said Monday its online stores in the U.S. and UK are sold out of the iPhone, a sign supplies are being winnowed ahead of the launch of the device's next generation featuring faster Internet surfing speeds.The Cupertino-based company confirmed that the iPhone is out of stock online, but added that brick-and-mortar stores run by Apple and iPhone carriers including AT&T Inc. might still have units available.Apple spokeswoman Natalie Kerris declined to comment on reasons for the shortage and on Apple's plans for an update to the device, which is widely expected to be unveiled in June at Apple's Worldwide Developers Conference in San Francisco.The paucity of iPhones for sale in some markets comes as Apple is hustling to meet its goal of selling 10 million of the hybrid iPod-cell phone-Internet surfing gadgets by the end of 2008. So far, Apple has sold 5.4 million iPhones, according to the latest data as of the end of March. Watch how new iPhones will compete with a new BlackBerry model » One way Apple is expanding the iPhone's reach is by inking deals with wireless carriers around the world, even breaking with its pattern of requiring exclusivity to sell in a certain country. On Monday, four mobile providers in the Asia-Pacific region announced partnerships with Apple to bring the iPhone to their regions later this year. SingTel will sell the gadget in Singapore, Bharti Airtel Ltd. in India, Globe Telecom Inc. in the Philippines and Optus in Australia, the companies said in a brief joint statement, without giving details. SingTel owns Optus and holds a 30.5 percent stake in Bharti and 44.5 percent in Globe. SingTel has about 2.3 million mobile subscribers in Singapore and around 7 million in Australia, according to data as of December 31, 2007. Bharti currently has about 64 million subscribers, while Globe reported a 21.3 million mobile subscriber base for the quarter ended March 31. Last week, the top mobile phone operator in Latin America, America Movil SAB, also announced plans to deliver the iPhone to its region. America Movil has 159.2 million subscribers in 16 countries, including Argentina, Brazil, Chile, Colombia and Mexico. In recent weeks Apple has also signed deals with Rogers Communications Inc. to sell the device in Canada; Milan-based Telecom Italia SpA to sell the iPhone in Italy; and Vodafone Group PLC, the world's biggest mobile company by sales, to sell it in a total of 10 countries, including Australia, India, Italy and Turkey. Until the spate of the latest deals, Apple adhered to its policy of exclusivity with one carrier in each country. The exclusive deals for the iPhone were with AT&T Inc. in the United States, O2 in Britain, T-Mobile in Germany and France Telecom's Orange wireless arm in France. Industry observers say some people may be holding off on buying an iPhone until the much-rumored next-generation of the device is launched, and the phone is officially rolled out in more countries. It takes some technical gymnastics, but it's still possible to get the phone in some markets where Apple doesn't have arrangements with wireless carriers. Many of the phones sold so far have been bought legitimately in one country, modified to work on any cellular network, and resold in countries where Apple doesn't have agreements to sell the iPhone. The trend expands the iPhone's reach but deprives Apple of some of the subscriber fees that Apple splits with its carrier partners. Apple is also planning a software update for this summer that makes the iPhone work better with corporate e-mail, a necessary upgrade to help the iPhone compete with Research in Motion Ltd.'s BlackBerry and Palm Inc.'s Treo smart phones. Copyright 2008 The Associated Press . All rights reserved.This material may not be published, broadcast, rewritten, or redistributed. All About Apple iPhone All About Apple Inc.       Find this article at: http://www.cnn.com/2008/TECH/ptech/05/12/iphone.sold.out.ap

- Full model: Correlation between true and estimated: 0.76093 Simple model: Correlation between true and estimated: 0.40463 This is important because it’s needed to compute lost sales.

- Market #OOS products 1 4.5 2 3.6 3 2.5 4 2.1 5 8.0 6 7.3

- 6.6% to 24%

- One could also include the log-sum (V missing products)