Fiscal Analysis of Stoughton School District Budget

0 likes345 views

A project I completed for my master\'s degree- I evaluated the effects of the legislature\'s revenue caps on the Stoughton Area School District\'s ability to provide educational services.

1 of 14

Recommended

Beyond The Numbers

Beyond The NumbersGROTONCS

╠²

The document summarizes the negative financial impact of the governor's fiscal proposal on a small, rural school district. It shows that level state funding over the next two years, along with a one-time assessment, would require over a 10% tax increase to maintain current programs. Additional costs not covered could lead to cuts impacting students, such as larger class sizes and reduced course offerings. The district has already implemented cost-saving measures but faces difficult decisions if funding does not increase.Government 101

Government 101MSCSA

╠²

Presented by Sarah Clarke

How does state government╠²really╠²work? ╠²Who holds the power? ╠²Who sets the agenda? ╠²Who makes the law and how? ╠²The answers to these questions may not be as simple as you think.╠² This workshop will move beyond the ŌĆ£Schoolhouse RockŌĆØ explanation of the political process to take a reality-based look at how your government operates. ╠²You will learn how to navigate legislative procedures, who the important decision makers at each level are, and how to identify and pursue opportunities for advocacy.Senator Harmon Budget Presentation

Senator Harmon Budget PresentationIllinois State Senate Democratic Caucus

╠²

This document summarizes Senator Don Harmon's presentation to the Business and Civic Council of Oak Park on June 26, 2015. It discusses the state of Illinois' budget process and challenges, including Governor Rauner's proposed budget cuts and the resulting impacts. It also outlines Democratic proposals for alternative budget and reforms, including investing in education, human services, and a middle class agenda. Potential areas of compromise are identified. Background on pension reforms and Illinois' economic strengths are also provided.Budget Presentation Feb. 16, 2011

Budget Presentation Feb. 16, 2011wcsd_01

╠²

The document summarizes the challenges facing the Williamson Central School District's 2011-2012 budget. Significant cuts were made, including the elimination of 9 professional and 1.4 classified positions. State aid was cut by $1.48 million or 16.24% of the previous year's funding. For the 2011-2012 school year, the district is facing a shortfall of $2.2 million despite applying federal funding and reserves. Further cuts of 7-10 professional and 3-5 support positions may be necessary.Welfare reforms and reducing rent arrears

Welfare reforms and reducing rent arrears Policy in Practice

╠²

Paul Howarth, Policy Consultant for Policy in Practice was invited to speak at the Westminster Briefing in November 2019 on the topic of 'Welfare reforms and reducing rent arrears'.

This presentation provided a detailed look of the current benefits system, a forecast of the latest Universal Credit updates as well as an overview of Policy in Practice's data-led approach to tackling poverty and reducing rent arrears.

For further information visit www.policyinpractice.co.uk, call 0330 088 9242 or email hello@policyinpractice.co.uk.Overview of House Republican Budget

Overview of House Republican BudgetAbdul-Hakim Shabazz

╠²

Indiana House Republicans have unveiled a budget that gives more money to schools and raises the cigarette tax. AACC Year End Legislative Update

AACC Year End Legislative UpdateAmerican Association of Community Colleges

╠²

AACC conducted a webinar on December 14, 2010 which covered topics ranging from the latest status of key legislative issues for community colleges to a discussion of the expected impacts of the 2010 elections on Congress and our priorities.Pensions Core Course 2013: Measures to Increase Coverage in the 2008 Chilean ...

Pensions Core Course 2013: Measures to Increase Coverage in the 2008 Chilean ...Health, Education, Social Protection and Labor World Bank

╠²

The 2008 Chilean pension reform aimed to increase coverage of the pension system. Key measures included creating a new solidarity pillar with a basic pension and supplement, mandating contributions from self-employed workers, and providing subsidies for young workers' early contributions and voluntary savings. Initial results showed positive trends in contributory coverage and uptake of the new solidarity benefits. Fiscal costs of 0.4-0.5% of GDP were in line with estimates, and projected to reach 1% of GDP by 2025 primarily due to the new solidarity pillar. The reform took an integrated approach to address high mobility in and out of formal employment and gender inequities in the defined contribution system.AACC Federal Legislative Update Webinar, Sept. 21, 2011

AACC Federal Legislative Update Webinar, Sept. 21, 2011American Association of Community Colleges

╠²

The AACC government relations team provided an overview of what Congress has on its plate this Fall. Topics included up-to-the-moment information on FY 2012 funding for Pell Grants and other key programs, the work of the deficit reduction "super committee," Trade Adjustment Assistance reauthorization and the latest status of the TAA Community College and Career Training Program, and more. Indiana Senate Budget proposal 2022 2023

Indiana Senate Budget proposal 2022 2023Abdul-Hakim Shabazz

╠²

More money for education and no increase in the cigarette tax are two of the key highlights in the budget unveiled today by Indiana Senate Republicans.The affects of government budgets on inequalities

The affects of government budgets on inequalitiesCCPANS

╠²

This presentation was part of a lunch and learn hosted by the Canadian Centre for Policy Alternatives-NS and the Community Coalition to End Poverty NS entitled WhereŌĆÖs the Social and Economic Justice in Recent Government Budgets? Other panelists included Wayne MacNaughton from the Community Advocates Network and Sheri Lecker from Adsum for Women in Children.2013 2014 tax planning for individuals

2013 2014 tax planning for individualsNexus Financial

╠²

This document provides 2013 4th quarter tax planning tips for individuals. It outlines several actions people can take to minimize their 2013 tax liability, including deferring income to 2014 if in a lower tax bracket, leveraging itemized deductions, timing investment gains and losses, and maximizing available tax credits. It also notes upcoming tax law changes and thresholds for 2014 under the Affordable Care Act.Put FL state corporate tax dollars to work for students!

Put FL state corporate tax dollars to work for students!Kim Grant

╠²

The document discusses the Community Contribution Tax Credit Program in Florida which provides tax incentives for businesses to donate to eligible community programs. It specifically focuses on promoting donations to the Jacksonville Alliance for KIPP Schools. KIPP is a national network of free public charter schools that opened two schools in Jacksonville in 2010 and 2012 and aims to grow to 5 schools by 2017. The tax credit program provides up to a 50% tax credit for business donations to approved community sponsors like KIPP Schools.Aisd budget overview for fy2012

Aisd budget overview for fy2012austinreps

╠²

The document summarizes the Austin Independent School District's budget outlook and challenges for fiscal year 2012. It notes declining local property values and expected state funding cuts of $2-5 billion. This would result in a budget shortfall for AISD of $94-114 million. To close this gap, AISD proposes reductions like increasing class sizes, employee furloughs, and using $31 million of its fund balance, with more cuts needed if state funding is reduced further. Maintaining adequate fund balance is important for the district's credit rating and borrowing ability.2017 Federal Budget Insights

2017 Federal Budget InsightsBentleys (WA) Pty Ltd

╠²

Australia needs to remain competitive on a global market and to do this the government needs to deliver a budget that will give the right level of monetary support to the right areas, but will the Turnbull Government focus on the areas that need it most?

What will the 2017 Federal budget mean for local business, our state economy, and what are the taxation and political implications?

If the rumours are to be believed the budget that will be handed down on the 9th of May will focus on tax cuts and housing prices.

Will the Government cut taxes for all businesses or just some? Will it tinker with negative gearing or the CGT discount? Will it do more than reaffirm what has already been said in specific industries?

Join the Bentleys team for our 2017 Federal Budget Insights where our expert team will analyse and review what the changes mean to you as an individual and as a business.Uleac non contributory pension for the elderly in lebanon part 3

Uleac non contributory pension for the elderly in lebanon part 3Lebanese Economic Association

╠²

This document proposes a non-contributory pension scheme for the elderly in Lebanon. It summarizes the objectives and need for such a scheme given that 80% of elderly Lebanese over 65 do not have pensions and rely on family support. It then outlines Lebanon's existing social security schemes and their limitations. Several options for a non-contributory pension scheme are proposed, estimating the number of beneficiaries, pension amounts, and total costs. Financing options through the national budget are discussed. The scheme aims to alleviate poverty among the elderly and complement existing social security.Is Mandatory Pensions Savings the Answer?

Is Mandatory Pensions Savings the Answer?victoriamutual

╠²

With Jamaicans living 20-25 years beyond the retirement age and a low rate of retirement planning, financing retirement is becoming a looming issue. Is mandatory pensions savings the answer?The Cost of the Trump and Biden Campaign Plans

The Cost of the Trump and Biden Campaign PlansCommittee for a Responsible Federal Budget

╠²

The Committee for a Responsible Federal Budget published the only existing comprehensive study to detail and compare the fiscal cost of President Donald Trump and Vice President Joe Biden's campaign agendas. We estimate that both candidates would add trillions to the debt ŌĆō but in very different ways.Development finance impact project ŌĆō digital artifact

Development finance impact project ŌĆō digital artifactEdeje Michael-Ekam

╠²

The document discusses financing solutions for infrastructure development in Liberia. It proposes that Liberia partner with multilateral development banks, the IFC, and donor aids to obtain low-cost, mid-term loans for agricultural and infrastructure projects. It also suggests assistance in designing a better tax administration system, providing a favorable environment for public-private partnerships, and building financial management capacities. This would help Liberia address issues like poor roads, unreliable power, and food shortages while also improving domestic revenue mobilization. Key obstacles include Liberia's history of conflict, lack of trust, over-dependence on foreign aid, and high mortality/fertility rates. Proposed solutions involve preparing infrastructure projects, supporting varied risk-return profiles, ensuringState Budget Cuts

State Budget Cutskjhatzi

╠²

California public schools and colleges have seen over $17 billion in budget cuts in the last two years, with K-12 schools receiving 60% of the cuts. This has resulted in increased class sizes, the elimination of programs, and over 16,000 teacher layoffs across the state. The proposed 2010-2011 budget includes another $2.5 billion in cuts, which will likely lead to further staff reductions, increased class sizes, and reduced course offerings. The Benicia Unified School District faces cutting $4 million from its budget by 2011, which may require eliminating 39 positions, mostly at the elementary and secondary levels. Additional state budget cuts are expected and could force deeper reductions.US Fiscal Cliff Deal 2012 PPT

US Fiscal Cliff Deal 2012 PPTNaman Rastogi

╠²

The PPT is based on the US Fiscal Cliff deal, a the popular term to describe the expiry of tax breaks and introduction of spending cuts leading to conundrum that the US economy faced at the end of 2012Ch. 5 - Taxing & Spending

Ch. 5 - Taxing & SpendingMelissa

╠²

The document discusses the US federal budget process, including how the government collects tax revenue and spends funds. It explains that the government collects over $3.6 trillion in tax revenue annually, which it then allocates to various spending categories like defense, healthcare, social security, and interest on the national debt. The budget process involves Congress approving spending bills and appropriating funds to government agencies and programs.What's in the Latest COVID Relief Act?

What's in the Latest COVID Relief Act?Committee for a Responsible Federal Budget

╠²

The Committee for a Responsible Federal Budget gave an overview of the latest COVID relief deal and how much it will boost incomes and economic growth, and discussed the proposal for $2,000 checks. Frank Ellis - Evolving social protection in Africa

Frank Ellis - Evolving social protection in AfricaInstitute of Development Studies

╠²

Frank Ellis - Evolving social protection in Africa

Presentation given at conference on 17/18 November in honour of Sir Richard JollyImplications of public pension enhancement in Canada

Implications of public pension enhancement in CanadaAlex Mazer

╠²

Common Wealth co-founder Alex Mazer's presentation on the Ontario Retirement Pension Plan and Canada Pension Plan enhancement to SHARE's Toronto Pension and Investment Governance Course on May 6, 2016. The Spending Review and social care - Andrew Cozens

The Spending Review and social care - Andrew CozensThe King's Fund

╠²

Andrew Cozens CBE, Strategic Adviser for Children, Adults and Health Services at the Local Government Association, gives his outlook on the Spending Review implications for social care.Child Poverty ŌĆō A National Perspective

Child Poverty ŌĆō A National PerspectiveVoluntary Action LeicesterShire

╠²

The document discusses child poverty in the UK, including targets set by previous governments to reduce it and measures taken that achieved some success. However, it notes that recent government policies, including significant cuts to benefits and tax credits, are expected to cause child poverty levels to substantially increase again. It argues more investment is needed to both improve living standards and support families' ability to work if the goal of ending child poverty is to be achieved.Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetCommittee for a Responsible Federal Budget

╠²

This document discusses federal budget priorities and spending on children. It finds that while children represent the future and economic growth, they receive a relatively small portion of federal spending. Spending on children has declined as a share of the budget since 2010 and is projected to continue declining. It is more temporary, discretionary and lacks built-in growth compared to spending on older populations. The long-term outlook for children is especially troubling as interest on the debt is projected to surpass spending on children. Some potential solutions proposed include accounting for children more in budget projections, prioritizing children through new committees or positions, and improving policies around children's health care and dedicated revenue sources.Averting a Fiscal Crisis

Averting a Fiscal CrisisCRFB.org

╠²

The non-partisan Committee for a Responsible Federal Budget (CRFB) has compiled a brief background on the scope of our nation's fiscal challenges and the drivers of our debt and deficits, while outlining some of the types of solutions available to address the problems. This Powerpoint is meant to offer an objective, easily-accessible view of our country's fiscal situation as an educational tool meant to help foster open and honest discussion about these issues.

Fiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...

Fiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...Lincoln Institute of Land Policy

╠²

Michael Lawson, a researcher for the George Mason University Fiscal Sustainability Project, provides a fiscal comparison of Baltimore and San BernardinoMore Related Content

What's hot (20)

AACC Federal Legislative Update Webinar, Sept. 21, 2011

AACC Federal Legislative Update Webinar, Sept. 21, 2011American Association of Community Colleges

╠²

The AACC government relations team provided an overview of what Congress has on its plate this Fall. Topics included up-to-the-moment information on FY 2012 funding for Pell Grants and other key programs, the work of the deficit reduction "super committee," Trade Adjustment Assistance reauthorization and the latest status of the TAA Community College and Career Training Program, and more. Indiana Senate Budget proposal 2022 2023

Indiana Senate Budget proposal 2022 2023Abdul-Hakim Shabazz

╠²

More money for education and no increase in the cigarette tax are two of the key highlights in the budget unveiled today by Indiana Senate Republicans.The affects of government budgets on inequalities

The affects of government budgets on inequalitiesCCPANS

╠²

This presentation was part of a lunch and learn hosted by the Canadian Centre for Policy Alternatives-NS and the Community Coalition to End Poverty NS entitled WhereŌĆÖs the Social and Economic Justice in Recent Government Budgets? Other panelists included Wayne MacNaughton from the Community Advocates Network and Sheri Lecker from Adsum for Women in Children.2013 2014 tax planning for individuals

2013 2014 tax planning for individualsNexus Financial

╠²

This document provides 2013 4th quarter tax planning tips for individuals. It outlines several actions people can take to minimize their 2013 tax liability, including deferring income to 2014 if in a lower tax bracket, leveraging itemized deductions, timing investment gains and losses, and maximizing available tax credits. It also notes upcoming tax law changes and thresholds for 2014 under the Affordable Care Act.Put FL state corporate tax dollars to work for students!

Put FL state corporate tax dollars to work for students!Kim Grant

╠²

The document discusses the Community Contribution Tax Credit Program in Florida which provides tax incentives for businesses to donate to eligible community programs. It specifically focuses on promoting donations to the Jacksonville Alliance for KIPP Schools. KIPP is a national network of free public charter schools that opened two schools in Jacksonville in 2010 and 2012 and aims to grow to 5 schools by 2017. The tax credit program provides up to a 50% tax credit for business donations to approved community sponsors like KIPP Schools.Aisd budget overview for fy2012

Aisd budget overview for fy2012austinreps

╠²

The document summarizes the Austin Independent School District's budget outlook and challenges for fiscal year 2012. It notes declining local property values and expected state funding cuts of $2-5 billion. This would result in a budget shortfall for AISD of $94-114 million. To close this gap, AISD proposes reductions like increasing class sizes, employee furloughs, and using $31 million of its fund balance, with more cuts needed if state funding is reduced further. Maintaining adequate fund balance is important for the district's credit rating and borrowing ability.2017 Federal Budget Insights

2017 Federal Budget InsightsBentleys (WA) Pty Ltd

╠²

Australia needs to remain competitive on a global market and to do this the government needs to deliver a budget that will give the right level of monetary support to the right areas, but will the Turnbull Government focus on the areas that need it most?

What will the 2017 Federal budget mean for local business, our state economy, and what are the taxation and political implications?

If the rumours are to be believed the budget that will be handed down on the 9th of May will focus on tax cuts and housing prices.

Will the Government cut taxes for all businesses or just some? Will it tinker with negative gearing or the CGT discount? Will it do more than reaffirm what has already been said in specific industries?

Join the Bentleys team for our 2017 Federal Budget Insights where our expert team will analyse and review what the changes mean to you as an individual and as a business.Uleac non contributory pension for the elderly in lebanon part 3

Uleac non contributory pension for the elderly in lebanon part 3Lebanese Economic Association

╠²

This document proposes a non-contributory pension scheme for the elderly in Lebanon. It summarizes the objectives and need for such a scheme given that 80% of elderly Lebanese over 65 do not have pensions and rely on family support. It then outlines Lebanon's existing social security schemes and their limitations. Several options for a non-contributory pension scheme are proposed, estimating the number of beneficiaries, pension amounts, and total costs. Financing options through the national budget are discussed. The scheme aims to alleviate poverty among the elderly and complement existing social security.Is Mandatory Pensions Savings the Answer?

Is Mandatory Pensions Savings the Answer?victoriamutual

╠²

With Jamaicans living 20-25 years beyond the retirement age and a low rate of retirement planning, financing retirement is becoming a looming issue. Is mandatory pensions savings the answer?The Cost of the Trump and Biden Campaign Plans

The Cost of the Trump and Biden Campaign PlansCommittee for a Responsible Federal Budget

╠²

The Committee for a Responsible Federal Budget published the only existing comprehensive study to detail and compare the fiscal cost of President Donald Trump and Vice President Joe Biden's campaign agendas. We estimate that both candidates would add trillions to the debt ŌĆō but in very different ways.Development finance impact project ŌĆō digital artifact

Development finance impact project ŌĆō digital artifactEdeje Michael-Ekam

╠²

The document discusses financing solutions for infrastructure development in Liberia. It proposes that Liberia partner with multilateral development banks, the IFC, and donor aids to obtain low-cost, mid-term loans for agricultural and infrastructure projects. It also suggests assistance in designing a better tax administration system, providing a favorable environment for public-private partnerships, and building financial management capacities. This would help Liberia address issues like poor roads, unreliable power, and food shortages while also improving domestic revenue mobilization. Key obstacles include Liberia's history of conflict, lack of trust, over-dependence on foreign aid, and high mortality/fertility rates. Proposed solutions involve preparing infrastructure projects, supporting varied risk-return profiles, ensuringState Budget Cuts

State Budget Cutskjhatzi

╠²

California public schools and colleges have seen over $17 billion in budget cuts in the last two years, with K-12 schools receiving 60% of the cuts. This has resulted in increased class sizes, the elimination of programs, and over 16,000 teacher layoffs across the state. The proposed 2010-2011 budget includes another $2.5 billion in cuts, which will likely lead to further staff reductions, increased class sizes, and reduced course offerings. The Benicia Unified School District faces cutting $4 million from its budget by 2011, which may require eliminating 39 positions, mostly at the elementary and secondary levels. Additional state budget cuts are expected and could force deeper reductions.US Fiscal Cliff Deal 2012 PPT

US Fiscal Cliff Deal 2012 PPTNaman Rastogi

╠²

The PPT is based on the US Fiscal Cliff deal, a the popular term to describe the expiry of tax breaks and introduction of spending cuts leading to conundrum that the US economy faced at the end of 2012Ch. 5 - Taxing & Spending

Ch. 5 - Taxing & SpendingMelissa

╠²

The document discusses the US federal budget process, including how the government collects tax revenue and spends funds. It explains that the government collects over $3.6 trillion in tax revenue annually, which it then allocates to various spending categories like defense, healthcare, social security, and interest on the national debt. The budget process involves Congress approving spending bills and appropriating funds to government agencies and programs.What's in the Latest COVID Relief Act?

What's in the Latest COVID Relief Act?Committee for a Responsible Federal Budget

╠²

The Committee for a Responsible Federal Budget gave an overview of the latest COVID relief deal and how much it will boost incomes and economic growth, and discussed the proposal for $2,000 checks. Frank Ellis - Evolving social protection in Africa

Frank Ellis - Evolving social protection in AfricaInstitute of Development Studies

╠²

Frank Ellis - Evolving social protection in Africa

Presentation given at conference on 17/18 November in honour of Sir Richard JollyImplications of public pension enhancement in Canada

Implications of public pension enhancement in CanadaAlex Mazer

╠²

Common Wealth co-founder Alex Mazer's presentation on the Ontario Retirement Pension Plan and Canada Pension Plan enhancement to SHARE's Toronto Pension and Investment Governance Course on May 6, 2016. The Spending Review and social care - Andrew Cozens

The Spending Review and social care - Andrew CozensThe King's Fund

╠²

Andrew Cozens CBE, Strategic Adviser for Children, Adults and Health Services at the Local Government Association, gives his outlook on the Spending Review implications for social care.Child Poverty ŌĆō A National Perspective

Child Poverty ŌĆō A National PerspectiveVoluntary Action LeicesterShire

╠²

The document discusses child poverty in the UK, including targets set by previous governments to reduce it and measures taken that achieved some success. However, it notes that recent government policies, including significant cuts to benefits and tax credits, are expected to cause child poverty levels to substantially increase again. It argues more investment is needed to both improve living standards and support families' ability to work if the goal of ending child poverty is to be achieved.Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetCommittee for a Responsible Federal Budget

╠²

This document discusses federal budget priorities and spending on children. It finds that while children represent the future and economic growth, they receive a relatively small portion of federal spending. Spending on children has declined as a share of the budget since 2010 and is projected to continue declining. It is more temporary, discretionary and lacks built-in growth compared to spending on older populations. The long-term outlook for children is especially troubling as interest on the debt is projected to surpass spending on children. Some potential solutions proposed include accounting for children more in budget projections, prioritizing children through new committees or positions, and improving policies around children's health care and dedicated revenue sources.Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetCommittee for a Responsible Federal Budget

╠²

Viewers also liked (7)

Averting a Fiscal Crisis

Averting a Fiscal CrisisCRFB.org

╠²

The non-partisan Committee for a Responsible Federal Budget (CRFB) has compiled a brief background on the scope of our nation's fiscal challenges and the drivers of our debt and deficits, while outlining some of the types of solutions available to address the problems. This Powerpoint is meant to offer an objective, easily-accessible view of our country's fiscal situation as an educational tool meant to help foster open and honest discussion about these issues.

Fiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...

Fiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...Lincoln Institute of Land Policy

╠²

Michael Lawson, a researcher for the George Mason University Fiscal Sustainability Project, provides a fiscal comparison of Baltimore and San BernardinoWeathering the Storm ABFM Present 10[1].06![Weathering the Storm ABFM Present 10[1].06](https://cdn.slidesharecdn.com/ss_thumbnails/abfmpresent10106-13262070188303-phpapp02-120110085309-phpapp02-thumbnail.jpg?width=560&fit=bounds)

![Weathering the Storm ABFM Present 10[1].06](https://cdn.slidesharecdn.com/ss_thumbnails/abfmpresent10106-13262070188303-phpapp02-120110085309-phpapp02-thumbnail.jpg?width=560&fit=bounds)

![Weathering the Storm ABFM Present 10[1].06](https://cdn.slidesharecdn.com/ss_thumbnails/abfmpresent10106-13262070188303-phpapp02-120110085309-phpapp02-thumbnail.jpg?width=560&fit=bounds)

![Weathering the Storm ABFM Present 10[1].06](https://cdn.slidesharecdn.com/ss_thumbnails/abfmpresent10106-13262070188303-phpapp02-120110085309-phpapp02-thumbnail.jpg?width=560&fit=bounds)

Weathering the Storm ABFM Present 10[1].06mdpcell

╠²

A local government fiscal crisis occurs when there is reasonable concern over a government's ability to pay its bills on time and its revenues and expenditures are consistently imbalanced. States can respond by reviewing audits, approving bonds, withholding funds, or taking over financial operations. Early warning signs include an inability to adopt budgets on time, expenditure increases outpacing revenue growth, and long-term liabilities growing faster than inflation. Understanding common factors among distressed cities allows for earlier detection and prevention of full-blown financial emergencies.MACPA 2012 PIU / Town Hall Leg / Reg Update

MACPA 2012 PIU / Town Hall Leg / Reg UpdateTom Hood, CPA,CITP,CGMA

╠²

Tom Hood, CEO of Maryland Association of CPAs provides these special updates on the CPA Profession to their members. This is the latest developments in the CPA Profession featuring the latest developments in trends and issue in the legislative & regulatory areas. Covering the latest from the IRS, FASB, IASB, and the State of Maryland.Alaska's Fiscal Crisis: The Challenge, the Solution and How to Achieve It (1....

Alaska's Fiscal Crisis: The Challenge, the Solution and How to Achieve It (1....Brad Keithley

╠²

This document discusses Alaska's fiscal crisis and proposes a solution. It notes that Alaska is projected to run out of savings by 2023 due to declining oil revenues and continued overspending. The proposed solution is to set a sustainable budget level based on expected revenues from the Permanent Fund, oil/gas production, and other sources. The sustainable budget level is estimated at $4.5 billion annually. However, the current budget is $5.9 billion, which is $1.4 billion over the sustainable level. To achieve fiscal sustainability, annual budget reductions of around $500 million are recommended over three years to bring spending in line with expected long-term revenues. The document argues for the governor and legislature to work together toImpact of Illinois state cuts - substance abuse

Impact of Illinois state cuts - substance abuseHealth & Medicine Policy Research Group

╠²

On June 14, 2010, Health & Medicine Policy Research group (HMPRG) hosted a forum, ŌĆ£The StateŌĆÖs Fiscal Crisis: Changing Our Collective Response.ŌĆØ With over 70 attendees, the forum explored the impact of the StateŌĆÖs budget and recent cuts on health and human services in Illinois. Participants heard from panel speakers about how we might collectively respond to the crisis and ensure responsible and adequate funding for education, health, and human services in Illinois. Materials from the forum can be found on the HMPRG website (www.hmprg.org) February 2016 - States: How to get past the fiscal crisis

February 2016 - States: How to get past the fiscal crisisFGV Brazil

╠²

As states are confronted with rigid spending requirements and falling tax revenues, public services are deteriorating. The federal government allowed states to borrow from BNDES because it was not making mandatory financial transfers to them, so that a number of states are now in danger of outstripping Fiscal Responsibility Law limits.

The Brazilian Economy is one of the oldest publications for expert economic analysis of both the Brazilian and international economies. Through this publication, FGVŌĆÖs Brazilian Institute of Economics and Finance (FGV/IBRE) compares different periods of the economy, assessing both macroeconomic considerations and scenarios related to finance, administration, marketing, management, insurance, statistics, and price indices.

For more information, and Brazilian economic index results, visit: http://bit.ly/1EA1LozFiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...

Fiscal Resilience & Fiscal Crisis: The Case Studies of Baltimore and San Bern...Lincoln Institute of Land Policy

╠²

Similar to Fiscal Analysis of Stoughton School District Budget (20)

Speaking With One Voice 020509

Speaking With One Voice 020509subcoal

╠²

The document discusses the current fiscal challenges facing municipalities in Massachusetts and positions of the Suburban Coalition on these issues. It outlines a large budget deficit and cuts to local aid. It discusses health insurance costs, special education funding increases, proposals to increase local taxes, charter school funding, and capital spending recommendations. The Suburban Coalition supports increasing certain local taxes and limiting increases to private special education school tuition rates. It encourages coordination with legislators to address these fiscal issues.TABOR Summary

TABOR SummaryEducationNC

╠²

1) TABOR's local property tax limit has led to unequal property tax burdens across Colorado school districts, with rates increasing for some districts and decreasing for others.

2) The local property tax that supports public schools has become more regressive under TABOR.

3) Funding disparities between districts have increased as some districts implemented local tax overrides to supplement declining base funding, exacerbating unequal impacts of TABOR.

4) As a result of TABOR, taxpayers in 74 districts now pay more in school taxes than if TABOR had not passed, affecting 81% of Colorado's population.SB36

SB36weolmstead

╠²

Presentation to parent and professional groups laying out changes in educational funding in Alaska, with speaker notes.Senate Ed VASBO Testimony - Mar 18 2015

Senate Ed VASBO Testimony - Mar 18 2015Richard Pembroke, SFO

╠²

The Vermont Association of School Business Officials (VASBO) provided testimony to the Senate Education Committee on March 18, 2015 regarding bill H.361. VASBO expressed concerns about the proposed education spending cap, arguing it would limit local control and be unrealistic given cost increases districts will face. While VASBO did not take a position on the dollar equivalent tax rate proposal, they supported the proposed tax rates and base education amounts for fiscal year 2016. VASBO also advocated for single, unified preK-12 school districts as proposed in the bill and supported continued tax incentives for voluntary school district mergers.Blog budget presentation

Blog budget presentationJackie Klerk Waldie

╠²

1) State funding for K-12 schools in South Dakota has dropped 10% over the last 10 years, with schools now receiving less than 15% of the state's budget.

2) The Rapid City Area Schools district will need to cut 60-70 positions per year, equivalent to $3 million in cuts, if funding is not increased as enrollment grows.

3) Voters will be asked to approve a $6 million per year "opt-out" of property tax limitations for 5 years to make up funding shortfalls and avoid further cuts to programs and teachers.Ann Arbor Public Schools: Financial Overview

Ann Arbor Public Schools: Financial OverviewEdward Vielmetti

╠²

Presentation from Robert Allen, Deputy Superintendent For Operations, Ann Arbor Public Schools, on the financial overview of the school system and its budgetCounty Executive Budget Presentation on the FY 2019 Advertised Budget Plan

County Executive Budget Presentation on the FY 2019 Advertised Budget PlanFairfax County

╠²

The document discusses Fairfax County's proposed FY 2019 budget. It focuses on priorities like expanding county-school cooperation and incorporating strategic planning. It recommends a 2.5 cent real estate tax rate increase to 4.38% overall budget growth. This would fully fund school and county employee compensation increases. The budget forecasts continued economic and job growth for the county and region.Budget 2 9-11

Budget 2 9-11wcsd_01

╠²

The document summarizes budget cuts and challenges facing a school district over several years. State aid to the district was cut by over $1 million (16.24% of the budget). Non-mandated programs and positions were eliminated to offset these losses, including teaching assistants, athletics, and technology positions. The district faces a potential state tax cap in the future which will limit budget increases to 2% annually despite projected ongoing cuts to state aid.Budget101

Budget101Jake Anderson

╠²

This document provides an overview of California's K-12 education budget and funding history. It discusses key lawsuits and ballot measures that have impacted school funding, including Proposition 13 in 1978, Proposition 98 in 1988, and Proposition 20 in 2000. It also reviews how California's lottery revenues have affected education funding over time, providing about 1.5% of total funding currently. The document then examines specifics of one school district's budget, including sources of revenue, expenditures, and reserve requirements. It concludes with contacts for additional information on understanding education budgets in California.2011 Year-End Legislative Update

2011 Year-End Legislative UpdateAmerican Association of Community Colleges

╠²

The AACC government relations team provided an overview of the year-end action in Congress and a peek into the year ahead. Topics included up-to-the-moment information on FY 2012 funding for Pell Grants and other key programs and the impact of the Budget Control Act now that the Supercommittee has failed to propose a deficit reduction plan. The webinar also covered the latest developments on the American Jobs Act, the Trade Adjustment Assistance Community College and Career Training Program, Department of Education regulations, and more. Budget Presentation 3-9-11

Budget Presentation 3-9-11wcsd_01

╠²

The document summarizes the budget situation for a public school district for the 2011-2012 school year. It notes that while the graduation rate has remained high, the Governor cut state aid significantly more than anticipated, resulting in a $1.48 million loss of funding. To address a projected $2.2 million shortfall, the district plans to use federal stimulus funds, reserves, and $993,615 in cuts and concessions. This would result in a proposed 2.21% decrease in the budget but a 3.2% increase in the tax levy and a 1.53% increase in the tax rate.Jared Polis Foundation Education Report Spring 2003

Jared Polis Foundation Education Report Spring 2003Lisa Finkelstein

╠²

From 2002-2008, the Jared Polis Foundation (JPF) Education Report reached out to Colorado households, organizations and government entities semi-annually highlighting educational reform, advances and local educational issues.

The foundation decided to end the program in the fall 2008.Strengthening Resources For Missouri Budget Presentation Updated Feb 2010

Strengthening Resources For Missouri Budget Presentation Updated Feb 2010Nonprofit Services Center

╠²

Amy Blouin of The Missouri Budget Project detailed the Missouri Budget and 2011 recommended budget from the Missouri Governor.2013 District Meetings

2013 District MeetingsNorth Carolina Association of County Commissioners

╠²

This document summarizes a meeting of the NCACC District held in Randolph County on April 3, 2013. It discusses the current political landscape in North Carolina with Republicans controlling the Governorship and both legislative chambers for the first time since 1896. It also summarizes Governor McCrory's proposed budget, including initiatives focused on the economy, education, and efficiency. The budget impacts counties both positively, with no shifts of state responsibilities, and negatively by not restoring some lottery and mental health funding. The document outlines next steps on finalizing the state budget.Colorado Budget Impact on St Vrain and Prop 103

Colorado Budget Impact on St Vrain and Prop 103JohnCr8on

╠²

Presentation prepared by St. Vrain board members to help community understand short and long term choices.Maryland FY 2013 Budget Presentation

Maryland FY 2013 Budget Presentation mdgov

╠²

The document summarizes Maryland's fiscal year 2013 budget and priorities under Governor Martin O'Malley. It highlights job creation, education funding, health care expansion, crime reduction, and maintaining a balanced budget through spending cuts and limited tax increases on high earners. Over $3.6 billion is allocated to capital projects focused on education, health, transportation, and economic development to support an estimated 52,000 jobs.Report to the community narrated

Report to the community narratedkmatsudo

╠²

The 'Report to the Community' provides specific information about the state of the school district and district finances.Governor's Budget Update

Governor's Budget Update dvodicka

╠²

The Governor's budget update proposes another "crisis" budget that relies on temporary tax increases to avoid deep cuts to education. If the tax measure fails, K-14 education would be cut by $4.8 billion, reducing per-student funding by about $370. The budget also introduces a weighted student funding formula to replace most categorical programs and revenue limits over five years, but districts could gain or lose funding depending on their student demographics. Locally-funded districts may see impacts from changes to redevelopment agency funding and the new finance model. Districts must develop budgets with uncertain funding levels and await the final state budget.Education Funding in Michigan

Education Funding in MichiganLivoniaPTSACouncil

╠²

The document discusses Michigan's Proposal A from 1994 which amended the state constitution to increase sales taxes and dedicate revenue to K-12 education, limit annual increases in property tax assessments, and guarantee minimum per-pupil funding levels for local school districts. It also outlines the governor's recommendations for K-12 education funding for fiscal years 2012-13 and 2013-14 which include keeping the foundation grant at $6846 per pupil and allocating funding for all-day kindergarten programs.Anoka-Henn 2011-12 Budget Hearings (Jan 2010)

Anoka-Henn 2011-12 Budget Hearings (Jan 2010)Anoka-Hennepin School District

╠²

School district's presentation on the 2011-12 budget, with proposed reductions, delivered Jan 12 at Blaine High School and Jan 20 at Champlin Park High School.Strengthening Resources For Missouri Budget Presentation Updated Feb 2010

Strengthening Resources For Missouri Budget Presentation Updated Feb 2010Nonprofit Services Center

╠²

Fiscal Analysis of Stoughton School District Budget

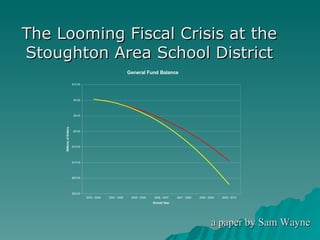

- 1. The Looming Fiscal Crisis at the Stoughton Area School District a paper by Sam Wayne

- 2. About SASD District has approximately 3,650 students Enrollment is declining at about 1% annually Per Pupil spending is very low 87% of state average Less than 90% of districts statewide High School recently failed to meet Adequate Yearly Progress standards for No Child Left Behind Legislation Performance of Disabled subgroup was not adequate

- 3. Revenue Limits In 1993, the State Legislature passed Statute 121.90 limiting the rate at which per pupil spending can increase Passed in response to statewide call for property tax ŌĆ£reliefŌĆØ $241.01 per pupil increase allowed next year Districts can override spending limits by passing a referendum

- 4. Effects of Revenue Limits on SASD Salaries and Benefits account for 76% of SASDŌĆÖs 2003-4 budget These costs rise annually at average of 5%

- 5. Possible Expenditure Reductions Republican Majority in Assembly and Senate wish to pass a Property Tax Freeze or Taxpayers Bill of Rights (TABOR) Amendment in next session In 2003, Property Tax Freeze failed to override Gov. DoyleŌĆÖs veto by 1 vote in Senate TABOR was on the agenda this year, but did not garner enough support to come to a vote

- 6. General Provisions of Tax Freeze Districts may increase their property tax levy by $100 per pupil each year SASD projects that all increases in expenditures will be funded by property taxes Likely result- replace $241.01 per pupil increase with $100 per pupil increase If state further cuts equalization aid, the district will still be allowed only $100 per pupil increase in property tax levy

- 7. Effects of Tax Freeze on SASD Assuming state aid remains constant Tax Freeze cuts allowable growth from 2.6% to 1%

- 8. Effects of TABOR on Schools School districts may increase their per pupil spending by the previous yearŌĆÖs CPI index (inflation) Average inflation 1986-2002 is 2.94% Current revenue caps allow per pupil spending to increase by 2.6% If TABOR were enacted in 1986, it would have lowered SASD spending in 9 of 18 years between 1986 and 2002

- 9. SASDŌĆÖs Budget Cut Options Increase class size District policy to average 20 students per class Most classrooms in district can seat 25 students Will cut at most 20% of teachers Save $3.475 million annually if all cut immediately Eliminate non-essentials Art, Music, Phys-ed, ŌĆ£Talented and GiftedŌĆØ program, advanced classes, junior varsity, and varsity sports Will cut at most 10% of expenses Neither of these, even when combined, will cut enough expenses to avoid eventual need for annual referenda

- 10. Need for Ongoing Referenda In order to provide district services at or near current levels, spending referenda will have to pass annually once General Fund is depleted To operate at bare-bones capacity, referenda will have to pass annually starting in 2015 Superintendent Dr. Myron Palomba says that annual referenda will be necessary to keep the district from shutting down

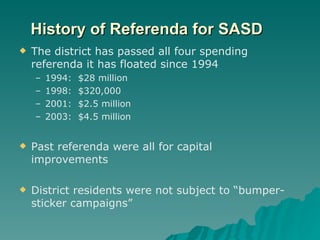

- 11. History of Referenda for SASD The district has passed all four spending referenda it has floated since 1994 1994: $28 million 1998: $320,000 2001: $2.5 million 2003: $4.5 million Past referenda were all for capital improvements District residents were not subject to ŌĆ£bumper-sticker campaignsŌĆØ

- 12. Legitimizing an Ongoing Referenda To avoid a negative fund balance, the district plans on floating a referendum this year This is a good way to test public sentiment towards exceeding revenue limits, and allows for a failure before a negative fund balance In order to credibly float referenda annually, the district will have to make a few service cuts Immediately laying off 4-5 teachers may be necessary In addition, there may have to be a hiring freeze for the next few years as the public gets acclimated to voting on the district budget

- 13. Structuring an Ongoing Referenda After proposing referendum this year, use General Fund monies until they expire in 2006-2007 Each year referendum should cover all operating costs above imposed restrictions Postponing payment by lowering the amount sought only increases funds necessary in the future The public should be aware that a referendum will have to pass every year to prevent severe service cuts

- 14. Other Recommendations Lobby incoming State Senator Mark Miller and incoming Assemblyman Gary Hebl against a Property Tax Freeze, a TABOR amendment, and the current Revenue Limits This will not be very effective, because: Both men are already against these issues Both men are generally powerless, as they are new members in the minority party Join with other school districts affected by Revenue Limits to create a lobbying force separate from WEAC