Strategy table decision quality

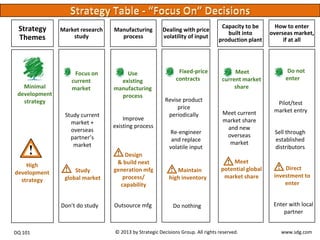

- 2. Strategy Themes Minimal development strategy Market research study Focus on current market Study current market + overseas partnerŌĆÖs market High development strategy Study global market DonŌĆÖt do study DQ 101 Manufacturing process Dealing with price volatility of input Use existing manufacturing process Fixed-price contracts Improve existing process Design & build next generation mfg process/ capability Outsource mfg Revise product price periodically Re-engineer and replace volatile input Maintain high inventory Capacity to be built into production plant Meet current market share Meet current market share and new overseas market Meet potential global market share Do nothing ┬® 2013 by Strategic Decisions Group. All rights reserved. How to enter overseas market, if at all Do not enter Pilot/test market entry Sell through established distributors Direct investment to enter Enter with local partner www.sdg.com

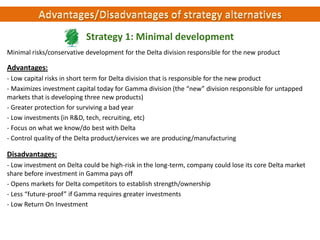

- 3. Strategy 1: Minimal development Minimal risks/conservative development for the Delta division responsible for the new product Advantages: - Low capital risks in short term for Delta division that is responsible for the new product - Maximizes investment capital today for Gamma division (the ŌĆ£newŌĆØ division responsible for untapped markets that is developing three new products) - Greater protection for surviving a bad year - Low investments (in R&D, tech, recruiting, etc) - Focus on what we know/do best with Delta - Control quality of the Delta product/services we are producing/manufacturing Disadvantages: - Low investment on Delta could be high-risk in the long-term, company could lose its core Delta market share before investment in Gamma pays off - Opens markets for Delta competitors to establish strength/ownership - Less ŌĆ£future-proofŌĆØ if Gamma requires greater investments - Low Return On Investment

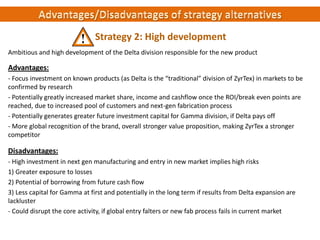

- 4. Strategy 2: High development Ambitious and high development of the Delta division responsible for the new product Advantages: - Focus investment on known products (as Delta is the ŌĆ£traditionalŌĆØ division of ZyrTex) in markets to be confirmed by research - Potentially greatly increased market share, income and cashflow once the ROI/break even points are reached, due to increased pool of customers and next-gen fabrication process - Potentially generates greater future investment capital for Gamma division, if Delta pays off - More global recognition of the brand, overall stronger value proposition, making ZyrTex a stronger competitor Disadvantages: - High investment in next gen manufacturing and entry in new market implies high risks 1) Greater exposure to losses 2) Potential of borrowing from future cash flow 3) Less capital for Gamma at first and potentially in the long term if results from Delta expansion are lackluster - Could disrupt the core activity, if global entry falters or new fab process fails in current market