Sueldos eimpuestos

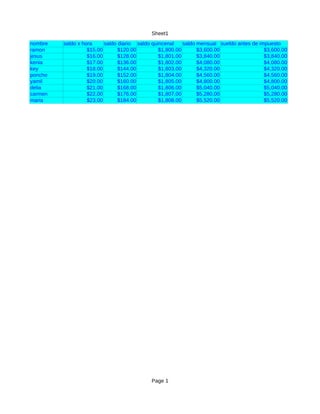

- 1. Sheet1 nombre saldo x hora saldo diario saldo quincenal saldo mensual sueldo antes de impuesto ramon $15.00 $120.00 $1,800.00 $3,600.00 $3,600.00 jesus $16.00 $128.00 $1,801.00 $3,840.00 $3,840.00 kenia $17.00 $136.00 $1,802.00 $4,080.00 $4,080.00 key $18.00 $144.00 $1,803.00 $4,320.00 $4,320.00 poncho $19.00 $152.00 $1,804.00 $4,560.00 $4,560.00 yamil $20.00 $160.00 $1,805.00 $4,800.00 $4,800.00 delia $21.00 $168.00 $1,806.00 $5,040.00 $5,040.00 carmen $22.00 $176.00 $1,807.00 $5,280.00 $5,280.00 maria $23.00 $184.00 $1,808.00 $5,520.00 $5,520.00 Page 1

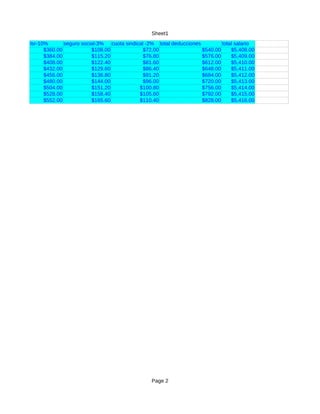

- 2. Sheet1 Isr-10% seguro social-3% cuota sindical -2% total deducciones total salario $360.00 $108.00 $72.00 $540.00 $5,408.00 $384.00 $115.20 $76.80 $576.00 $5,409.00 $408.00 $122.40 $81.60 $612.00 $5,410.00 $432.00 $129.60 $86.40 $648.00 $5,411.00 $456.00 $136.80 $91.20 $684.00 $5,412.00 $480.00 $144.00 $96.00 $720.00 $5,413.00 $504.00 $151.20 $100.80 $756.00 $5,414.00 $528.00 $158.40 $105.60 $792.00 $5,415.00 $552.00 $165.60 $110.40 $828.00 $5,416.00 Page 2

- 3. Sheet1 $6,000.00 $5,000.00 $4,000.00 saldo x hora saldo diario salarios e impuestos saldo quincenal $3,000.00 saldo mensual sueldo antes de $2,000.00 impuesto Isr-10% seguro social-3% $1,000.00 cuota sindical -2% total deducciones total salario $0.00 ramon jesus kenia key poncho yamil delia carmen maria trabajadores Page 3

- 4. Sheet1 saldo x hora saldo diario saldo quincenal saldo mensual sueldo antes de impuesto Isr-10% seguro social-3% cuota sindical -2% total deducciones total salario Page 4