Summer training presentation

- 1. Presented by : Manikant MBA-2A Presented to : Mr. Arun Dutta PCTE

- 2. ?

- 3. HSBC's origins in India date back to 1853, when the Mercantile Bank of India was established in Mumbai. The acquisition in 1959 by The Hongkong and Shanghai Banking Corporation Limited of the Mercantile Bank was a decisive factor in laying the foundation for today's HSBC Group.

- 4. HSBC has given India its first ATM way back in 1987. The organisation's adaptability, resilience and commitment to its customers have further enabled it to survive through turbulent times and prosper through good times over the past 150 years.

- 5. The company serves the retail and corporate customers in India. It offers its products through its 77 branches and 151 franchise outlets. The company was formerly known as IL&FS Invest smart Limited and changed its name to HSBC Invest Direct (India) Limited in August 2009.

- 6. To become the preferred long-term financial partner to a wide base of customers whilst optimizing stakeholdersˇŻ value.

- 7. To establish a base of 1million satisfied customers by 2010. It will be created by being a responsible and trustworthy partner! Mission statement

- 8. An approach to business that reflects:- Responsibility Transparency Ethical Behavior Respect for Employees, Clients & Stakeholder groups.

- 9. All the products of ILFS can be broadly divided into the following two categories: Online Trading Products Advisory Service Other Services

- 10. ?

- 11. ?

- 12. SWOT ANALYSIS Strengths Customization Expertise One-stop-shop for all the investment needs Unbiased and objective advice Extensive reach Brand image Competitive pricing

- 13. Weaknesses Expensive products Tedious procedures Fund transfer Attrition

- 14. Opportunities Right time for investors to re-enter the market. Huge untapped market. Increasing number of management graduates. Increase the tie-ups for fund transfers .

- 15. Threats Stiff competition Increasing awareness of mutual funds and ULIPs. Changing economic scenario in India and changes in government policies. Many a investors burnt their figures during the bearish market conditions

- 16. Ratio analysis Year 2009 2008 2007 Current Assets 3298.7 2469.43 2075.54 Current Liabilities 1794.24 1114.86 980.14 Current Ratio 1.84 2.22 2.12

- 17. Quick ratio QUICK ASSETS 2009 2008 2007 Accounts Receivable 1027.73 909.58 770.39 Cash and Cash Equivalents 792.69 121.22 86.06 Other Current Assets 8.32 1 0.91 Total Quick Assets 1828.74 1031.8 857.36 Current Liabilities 1794.24 1114.86 980.14 QUICK RATIO 1.019228 0.925497 0.874732

- 18. Gross Margin Ratio Year 2009 2008 2007 Gross Profit 1846.1 1602.31 1505 Sales 6106.43 5208.38 4777.64 Gross Margin Ratio 30.23207 30.76408 31.50091

- 19. Net Profit Ratio Year 2009 2008 2007 Net Profit 401.52 286.5 291.12 Sales 6106.43 5208.38 4777.64 Net Profit Ratio 6.575364 5.500751 6.093385

- 20. Operating Margin Ratio Year 2009 2008 2007 Operating Margin 1036.44 809.69 784.68 Net Sales 6106.43 5208.38 4777.64 Operating Margin Ratio 16.97293 15.54591 16.42401

- 21. Return on Assets Ratio Year 2009 2008 2007 Net Profit Before Tax 683.1 461.15 456.15 Total Assets 9413.18 5681.25 5274.84 Return on Total Assets Ratio 7.256846 8.117052 8.647656

- 22. Year Net Sales Trend (%) Mar'07 4777.64 100 Mar'08 5208.38 109.02 Mar'09 6106.43 127.81

- 23. (ii) Trend of net Profit

- 24. (iii) Trend Of EPS

- 25. Capital Market in India

- 26. Study on IPO in India: Performance Evaluation and Investors Perception Objectives: To evaluate can immediate performance of an IPO be relied upon for the equity in long run. To analyse that more the subscription of the IPO, more is the immediate performance. To study the factors affecting IPO purchase decision of the Retail Investors

- 27. TodayˇŻs trying economic conditions have forced difficult decisions for companies. Understanding investment need of investors on an ongoing basis is critical for survival. More than ever management needs ongoing feedback from the customers, partners and employees in order to continue to innovate and grow.

- 30. Contdˇˇ. Data Collection----Primary and Secondary Sources Primary Data : Questionnaires. Secondary Data: Websites, Newspapers, Journals Tools of Analysis Percentage, Mean method, Karl PearsonˇŻs Coefficient of Correlation, Probable Error.

- 31. ?

- 32. The analysis of immediate and long term performance of 25 IPOˇŻs which were issued from 1 st January 2009 to 31 st May 2010. For this purpose, coefficient of correlation (Karl PearsonˇŻs coefficient of correlation) was calculated between percentage change in the issue price & list price and percentage change in the issue price & current market price of the same. IMMEDIATE AND LONG TERM PERFOMANCE

- 33. Co-efficient of correlation ( r) = 0.233 Probable Error of ˇ°rˇ± = 0.6745 * ( 1 ¨C r 2 ) /ˇĚN =0.1275 IMMEDIATE AND LONG TERM PERFORMANCE

- 34. The probable error existed at 0.1275. However degree of correlation was not significant as it was not 6 times greater than its Probable Error which was 0 .1275. As for , 6 times probable error is equal to 6 * 0.1275, gives result 0.765, Which is greater than the degree of correlation. Inference: Therefore, it can be concluded that there is no significant correlation between immediate performance and long term performance . ? IMMEDIATE AND LONG TERM PERFORMANCE

- 35. L isting Gain of 25 IPO

- 36. Long term gain of 25 IPO

- 37. SUBSCRIPTION AND IMMEDIATE PERFORMANCE For the purpose of this section, a total of 25 IPOs have been taken from 1 st January 2009 to 31 st May 2010. Coefficient of correlation (Karl PearsonˇŻs coefficient of correlation) was calculated between percentage change in the issue price & list price and subscription of the same. ?

- 38. SUBSCRIPTION AND IMMEDIATE PERFORMANCE Co-efficient of correlation ? ( r) = 0.6347 Probable Error of ˇ°rˇ± = 0.6745 * (1 ¨C r 2 )/ ˇĚN =.080

- 39. Contˇ. The probable error existed at 0.080. Thus, degree of correlation was significant as it was 6 times greater than its Probable Error which was 0 .080. As for , 6 times probable error is equal to 6 * 0.0238, gives result 0.48, Which is less than the degree of correlation. Inference: Therefore, it can be concluded that there is significant positive correlation between Subscription and Immediate performance of the issue.

- 41. NO. OF YEARS THE INVESTORS HAVE BEEN IN THE MARKET N=100

- 42. AVERAGE YEARLY INVESTMENT N=100

- 43. PRIMARY AREA OF INTEREST N=100

- 44. TYPE OF INESTMENT N=100

- 45. PURPOSE OF INVESTMENT N=100

- 46. PROFESSIONAL KNOWLEDGE IN STOCK MARKET N=100

- 47. FINANCIAL STATEMENTS Mean = (5*7)+(4*36)+(3*24)*( 2*32)+(1*1) /100 = 3.16 N=100

- 48. BUSINESS OF COMPANY Mean = (5*11)+(4*43)+(3*24)+(2*18)+(1*4)/100 = 3.39

- 49. SUPPLIERS OF COMPANY Mean = (5*4)+(4*18)+(3*31)+(2*43)+(1*4) /100 = 2.75

- 50. Reputation of the promoters Mean = (5*4)+(4*29)+(3*34)+(2*4)+(1*4) /100 = 2.95

- 51. Past growth of the industry Mean = (5*10)+(4*47)+(3*22)+(2*19)+(1*2) /100 = 3.44

- 52. Future Prospects of the Industry Mean = (5*13)+(4*31)+(3*35)+(2*21)+(1*0) /100 = 3.36

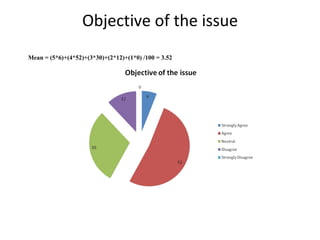

- 53. Objective of the issue Mean = (5*6)+(4*52)+(3*30)+(2*12)+(1*0) /100 = 3.52

- 54. Price band Mean = (5*10)+(4*65)+(3*16)+(2*8)+(1*0) /100 = 3.65

- 55. Issue size Mean = (5*8)+(4*65)+(3*37)+(2*5)+(1*1) /100 = 3.58

- 56. Underwriter of the issuing company Mean = (5*7)+(4*43)+(3*35)+(2*14)+(1*1) /100 = 3.41

- 57. Inflation Mean = (5*17)+(4*56)+(3*23)+(2*4)+(1*1) /100 = 3.86

- 58. More investment in IPO when other investments carry low interest rates Mean = (5*25)+(4*52)+(3*17)+(2*3)+(1*3) /100 = 3.93

- 59. Legal Hassels Mean = (5*17)+(4*19)+(3*44)+(2*17)+(1*3) /100 = 2.45

- 60. Duration for which company has been in business Mean = (5*13)+(4*41)+(3*34)+(2*9)+(1*3) /100 = 2.67

- 61. Foreign Collaborations Mean = (5*30)+(4*34)+(3*28)+(2*5)+(1*3) /100 = 2.98

- 62. Prevailing Trend of the market Mean = (5*10)+(4*34)+(3*28)+(2*19)+(1*9) /100 = 3.17

- 63. IPO of an MNC Mean = (5*16)+(4*53)+(3*22)+(2*7)+(1*2) /100 = 3.74

- 64. Recent IPO Performances Mean = (5*17)+(4*20)+(3*50)+(2*10)+(1*3) /100 = 2.53

- 65. Views of Top Fund Managers Mean = (5*25)+(4*52)+(3*19)+(2*4)+(1*0) /100 = 2.98

- 66. Ratings by a research analyst Mean = (5*23)+(4*21)+(3*50)+(2*0)+(1*6) /100 = 2.85

- 67. Listing in a well known Stock Exchange Mean = (5*9)+(4*27)+(3*37)+(2*25)+(1*2) /100 = 3.16

- 68. Performance of IPOs in the recent past Mean = (5*9)+(4*28)+(3*36)+(2*26)+(1*1) /100 = 3.23

- 69. Media Advertisements Mean = (5*4)+(4*32)+(3*39)+(2*19)+(1*6) /100 = 3.09

- 70. Market Volatility Mean = (5*4)+(4*13)+(3*46)+(2*18)+(1*19) /100 = 3.45

- 71. FINDINGS Immediate performance of IPO can be relied upon for the equity in the long run is rejected . It is proved from the fact that over last 1 and Half years, there existed statistically insignificant positive correlation between percentage change in the issue price & list price of the IPO and percentage change in the issue price & current market price of the same. ? More the subscription (times of issue size) of the IPO, more is the immediate performance, is accepted. As there existed statistically significant positive correlation between subscription (times of issue size) of the IPO and its immediate performance at the time of listing.

- 72. FINDINGS Investors evaluate an IPO maximum from Promoters of the company, prevailing Market Trend & Recent IPO performance & Issue Size of the IPO. Investors evaluate an IPO minimum from Suppliers of the company, Listing in Well Known Stock exchanges & Media Advertisements

- 73. ?

Editor's Notes

- #26: Say, ˇ°Let us learn about the Capital Markets in India where equity shares and debt instruments are purchased and soldˇ±. Say, ˇ°The first two broad categories of capital markets are the Primary Market and the Secondary Marketˇ±. Explain the Primary Market as one where new, unlisted companies offer their equity shares for subscription to investors. The first issue of shares is termed as an IPO which stands for ˇ°Initial Public Offerˇ±. The shares are issued either at par with their face value or at a premium to their face value, depending on the companyˇŻs present and potential financial situation. Follow-on issues as well as Right issues are also made through this market. Secondary market is the market where existing and listed companyˇŻs shares are purchased and sold (traded) everyday through the Stock Exchange mechanism. Presently, the two main Stock Exchanges in the country are the Bombay Stock Exchange and National Stock Exchange. Both markets are regulated by SEBI. Now explain the two market indexes. Say, ˇ°in order to gauge and express the market movements, i.e. the rise and fall of prices of the listed equity shares, the B.S.E. has devised an index which represents the variations. B.S.E. selects from time to time shares of a total of 30 companies whose price variations are averaged to show the rise and fall of the stock market. Originally, B.S.E. took the prices of 30 stocks on a particular day in the year 1978 and assigned it a value of 100. Similarly, the N.S.E. had chosen 50 shares whose prices on a particular day were given a value of 100. Since then the daily prices of the selected shares are averaged into a particular value which becomes the Sensex for B.S.E. and Nifty for the N.S.E.

![FA_Presentation[1]_ppt[1][1] new done.pptx](https://cdn.slidesharecdn.com/ss_thumbnails/fapresentation1ppt11newdone-241229185058-139d033d-thumbnail.jpg?width=560&fit=bounds)