SVB crash explained.pdf

1 like3,458 views

SVB (Silicon Valley Bank) experienced financial difficulties due to macroeconomic conditions and risks in its investment portfolio. As startups had excess cash and did not need loans, SVB invested heavily in government bonds. However, rising interest rates caused the value of these bonds to fall. SVB then faced a "bank run" as customers withdrew deposits, forcing SVB to seek an emergency $2 billion funding increase. The failure of SVB could significantly impact startups and their access to capital.

1 of 11

Downloaded 343 times

Ad

Recommended

COLLAPSE OF SILICON VALLEY BANK.pptx

COLLAPSE OF SILICON VALLEY BANK.pptxprasadsalwe

╠²

1) Silicon Valley Bank grew to become the 16th largest bank in the US catering to technology companies, but a series of ill-fated investment decisions led to its collapse. The bank invested heavily in long-dated bonds that declined in value as interest rates rose rapidly.

2) As the tech industry slowed, SVB customers started withdrawing deposits, requiring the bank to sell bonds at a loss. Within 48 hours, losses led to insolvency and regulators seized the bank's assets.

3) The collapse could significantly impact tech and startup industries by reducing available financing, as well as investors and high-net-worth individuals who could lose assets. It may also influence the Federal Reserve to slow interest rateSVB collapse F1.pptx

SVB collapse F1.pptxkritiprasad5

╠²

- Silicon Valley Bank (SVB), one of the largest banks in the US, collapsed on March 10, 2022 due to losses from rising interest rates and withdrawals during a "startup winter".

- Its failure caused panic in stock and banking markets. The FDIC took control of SVB's $175B in deposits and created a new bank to protect depositors.

- The collapse impacted many startups and companies with funds at SVB. The US government took measures like insuring all deposits to prevent further bank failures.svb collapse reasons by techsigma.pdf

svb collapse reasons by techsigma.pdfSachinMenon25

╠²

Silicon Valley Bank (SVB), one of the largest banks in America, has experienced a significant decline in stock prices and announced a $1.8 billion loss after selling $21 billion in investments. This has prompted panic among venture capitalists and tech startups, who are advising withdrawals due to the bank's liquidity concerns caused by a mismatch in its asset-liability management. If withdrawals persist, SVB could face severe liquidity and solvency issues.Collapse of Silicon valley bank.pptx

Collapse of Silicon valley bank.pptxABHISEKPADHI5

╠²

SVB was founded in 1983 to serve technology startups and grew successfully by focusing on their unique needs. However, heavy losses in its bond portfolio due to interest rate hikes and a bank run led to its collapse in 2022. SVB invested most deposits into securities that lost value as rates rose. Venture capital firms then withdrew funds, forcing more losses as SVB sold positions. A failed capital raise and bank run depleted its reserves. The collapse impacted confidence in the banking system and showed the importance of effective risk management.SVB Crisis Report.pdf

SVB Crisis Report.pdfRoy Ahuja

╠²

The report analyzes audience sentiment regarding the collapse of Silicon Valley Bank (SVB) from March 10 to March 13, 2023, highlighting a shift from neutrality to predominantly negative sentiments. Key issues discussed include SVB's bankruptcy, regulatory failures, and its implications on the financial industry, affecting various banks and the equity market. The analysis also reveals significant mentions of public figures, notably Donald Trump and Jim Cramer, as well as concerns for startups, particularly in relation to cash flow and investor pressures.Micro finance - an introduction

Micro finance - an introductionSuman Bhattarai

╠²

Microfinance provides banking services to unemployed and low-income individuals who lack access to traditional financial systems, aiming to alleviate poverty and promote self-employment. It gained popularity in the 1970s, with notable organizations like Grameen Bank leading the way, and has since significantly benefited millions globally. Key features include small, short-term loans without collateral, and a focus on empowering notably women in the community.Blinkit Marketing Case Study

Blinkit Marketing Case StudySnehal Pandey

╠²

Blinkit, formerly known as Grofers, is an Indian on-demand grocery delivery service founded in 2013 that aims to revolutionize grocery shopping through quick commerce, offering deliveries in as little as 10 minutes. The company operates in 28 cities with a valuation of $1.01 billion and focuses on a commission-based revenue model by partnering with local grocery suppliers. Despite facing challenges such as competition and operational setbacks, Blinkit aspires to expand its market share and diversify its product offerings, targeting significant growth in the coming years.Basel iii presentation

Basel iii presentationReadingLLMlegaleagles

╠²

Basel III is a global regulatory standard that aims to strengthen bank capital requirements and introduce new regulatory requirements on bank liquidity and leverage. It was implemented in response to deficiencies in the previous Basel II framework that were exposed by the global financial crisis. The goals of Basel III include improving the banking sector's ability to absorb shocks, reducing systemic risk, and increasing transparency. It establishes stricter capital standards, introduces capital buffers, and imposes new liquidity measures including the liquidity coverage ratio and net stable funding ratio.Lehman Brothers Bankruptcy

Lehman Brothers BankruptcyHassaan13

╠²

Founded in 1850, Lehman Brothers filed for bankruptcy in 2008 due to its overexposure to subprime mortgages through securitization and derivatives trading. Its collapse exacerbated the global financial crisis and had far-reaching consequences. Money market funds broke the buck due to Lehman losses. Lehman's $639 billion in assets and $613 billion in debt overwhelmed the bankruptcy system. Its failure devastated the financial industry and significantly deepened the worldwide economic recession.Economic Bubbles, Crises, and Crashes

Economic Bubbles, Crises, and CrashesMBA ASAP

╠²

The document discusses economic bubbles and crashes throughout history, highlighting events like Tulip Mania, the South Sea and Mississippi bubbles, and the 1929 stock market crash. It explains how speculation and irrational exuberance can inflate asset prices until they collapse, leading to significant economic downturns. The narrative further explores responses to these crises, including the establishment of the Federal Reserve and regulatory measures to stabilize markets.Camels approach

Camels approachVishal Parmar

╠²

The CAMELS approach is used internationally to evaluate bank risk across six key factors: Capital adequacy, Asset quality, Management quality, Earnings, Liquidity, and Sensitivity to market risk. Ratings are assigned on a scale of A to E based on an assessment of each factor, with A indicating a sound bank and E indicating a bank with critical weaknesses and high risk of failure. The document provides details on how each CAMELS factor is evaluated.Camel rating

Camel rating Priya Tiwari

╠²

This document provides an overview of the CAMELS rating system used to evaluate the overall health and risk profile of banks. CAMELS stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity to market risk. Each component is rated on a scale of 1 to 5, with 1 being the strongest. The ratings are used by regulators in the US, India, and other countries to monitor banks and determine which may require support.Hdfc ICICI comparative

Hdfc ICICI comparative Aditya Chaturvedi

╠²

HDFC Bank is one of India's largest banks based in Mumbai. It was incorporated in 1994 by Housing Development Finance Corporation. While ICICI Bank has a higher earnings per share, HDFC Bank has a better dividend payout ratio and return on net worth. HDFC Bank also has a higher asset turnover ratio, showing more efficient use of assets to generate revenue. However, ICICI Bank has a lower debt-to-equity ratio and higher quick ratio, indicating it uses less debt in its capital structure and has a greater ability to quickly pay current liabilities. In conclusion, while ICICI Bank outperforms HDFC Bank on some financial metrics, HDFC Bank has potential for growth by expanding rural outreach and increasing itsThe Barings Bank Collapse

The Barings Bank CollapseUday Tharar

╠²

The Barings Bank collapsed in 1995 due to unauthorized speculative derivatives trading by Nick Leeson in the bank's Singapore office. Leeson, who was employed to engage in low-risk arbitrage opportunities, was instead speculating heavily and incurred losses of over $1.4 billion to cover his earlier losses. As he controlled both the trading and back-office functions, Leeson was able to hide his unauthorized trading and losses until it was too late, causing the 233-year-old bank to become insolvent. The collapse highlighted the need for stronger internal controls, risk management, oversight, and segregation of duties in financial institutions.Fall Of Lehman Brother

Fall Of Lehman BrotherRakesh Sancheti

╠²

The document provides an overview of the downfall of Lehman Brothers, which filed for Chapter 11 bankruptcy in September 2008. It discusses several factors that contributed to Lehman Brothers' collapse, including the US housing bubble and subprime mortgage crisis, Lehman's high leverage and reliance on short-term funding, and flaws in risk management practices. After Lehman filed for bankruptcy, parts of its business were acquired by Barclays and Nomura. The collapse had widespread effects on financial markets and the global economy.Banking industry ppt

Banking industry pptSipra Debnath

╠²

The document discusses the banking industry in India. It outlines objectives like identifying market share and competition. It describes the market structure in India and globally, with public sector banks, private sector banks, and foreign banks in India. The top 10 banks in India and worldwide are listed. Industry concentration is examined using the Herfindahl Index. Technological changes, demand conditions, pricing, advertising, and mergers and acquisitions in the industry are analyzed. The future outlook is positive due to India's growing population and incomes.Securitization and 2008 financial crisis

Securitization and 2008 financial crisisShubham Agrawal

╠²

This document discusses securitization and its role in the 2008 financial crisis. It defines securitization as pooling various debt obligations like mortgages and selling their cash flows as securities. It describes the securitization process and key players like originators and special purpose vehicles. It then explains that the financial crisis was caused by the bursting of the US housing bubble fueled by subprime lending and securitization of risky mortgages. The crisis led to a global recession, unemployment rising to 10% in the US, and housing market and stock market declines worldwide. India was also impacted through economic downturn and currency depreciation, but prudent financial regulation protected it from the worst effects.Non Performing Assets

Non Performing AssetsAditya

╠²

The document discusses Non-Performing Assets (NPAs) in the Indian banking sector. It defines an NPA as an asset that ceases to generate income for the bank. It provides data showing that public sector banks had the highest NPA ratio in FY2010 at 2.27%, while foreign banks had the lowest at 4.26%. The criteria for classifying different types of loans as NPAs, including term loans, cash credits, project loans and more, are explained in detail. NPAs are further classified as substandard, doubtful or loss assets based on the period of delinquency. Banks are required to make provisions against NPAs as per RBI guidelines.Types of Risks and its Management in Banking

Types of Risks and its Management in BankingMohit Chhabra

╠²

The document discusses various types of risks in banking and rural finance, including credit, liquidity, interest rate, and market risks, as well as methods for their assessment and management. Credit risk involves the likelihood of borrower default and is measured using metrics like the expected loss method and Altman Z-score. Liquidity risk is the inability to meet short-term obligations, while market risk refers to potential losses from market factors, with tools like Value at Risk (VaR) used for measurement.Yes bank crisis

Yes bank crisisHemanth

╠²

1) Yes Bank faced a crisis in 2020 when the RBI placed it under moratorium due to high levels of bad loans and a deteriorating financial position.

2) The RBI capped withdrawals at Rs. 50,000 per account for a month due to issues such as poor governance and an inability to raise fresh capital.

3) A revival plan was announced where SBI would acquire a 49% stake in Yes Bank and inject capital, while other investors would purchase the remaining shares. This aimed to address the bank's troubled finances and restore depositors' confidence.Covid-19: Impact on the Banking Sector

Covid-19: Impact on the Banking SectorDVSResearchFoundatio

╠²

The document discusses the impact of COVID-19 on India's banking sector, highlighting that public sector banks (PSBs) struggle with poor performance metrics despite holding significant market share. It points out a decline in bank credit growth since 2013, resulting in substantial losses for PSBs, while also detailing the Reserve Bank of India's monetary policy responses aimed at alleviating financial stress. Additionally, it contrasts the performance of PSBs with private banks and emphasizes the need for banking sector efficiencies to support economic growth.2008 World Economic crisis, Global Meltdown, Global Financial Crisis

2008 World Economic crisis, Global Meltdown, Global Financial CrisisJagmeet Singh Bajaj

╠²

The 2008 financial crisis was caused by a combination of factors: rising housing prices, risky lending practices, and overreliance on complex financial instruments. When the housing bubble burst, it exposed vulnerabilities throughout the financial system. Major investment banks collapsed and governments had to bail out firms like AIG, Fannie Mae and Freddie Mac. The crisis led to a global economic downturn, trillions in wealth destruction, and high unemployment in many countries. Governments addressed the crisis through stimulus spending, bank bailouts, and new financial regulations aimed at preventing future crises.Treasury operations in_banks

Treasury operations in_banksVaibhav Banjan

╠²

Treasury operations in banks involve managing investments, foreign exchange transactions, derivatives trading, and funds management. This includes maintaining statutory liquidity and cash reserve ratios, deploying surplus funds, hedging risks, and trading in financial markets. Key functions of the treasury division are investments in securities, currency trading, derivatives trading like swaps and options, and funds management activities. The treasury aims to meet regulatory requirements, earn profits, and mitigate risks through its operations.Capital adequacy (final)

Capital adequacy (final)Harsh Chadha

╠²

Here are the key points about reverse repo rate from the document:

- Reverse repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) borrows money from commercial banks.

- It is a monetary policy instrument used by the central bank to control money supply. An increase in reverse repo rate will decrease money supply and vice versa.

- When reverse repo rate is increased, it provides more incentive for commercial banks to park their funds with the central bank, thus decreasing the money available in the market.HDFC_ HDFC BANK MERGER.pdf

HDFC_ HDFC BANK MERGER.pdfKhushboo Dange

╠²

The Board of HDFC and HDFC Bank have approved the merger of HDFC into HDFC Bank. Post-merger, HDFC Bank will have a larger share of the home loan market in India at 33% compared to its current 11%. The merger will enable HDFC Bank to expand its home loan portfolio and customer base, achieving greater economies of scale. It will benefit from HDFC's expertise in real estate and a larger balance sheet. For customers, it means access to a wider range of financial products through HDFC Bank branches. The share exchange ratio for the merger was set at 42 HDFC Bank shares for every 25 HDFC shares.Asset liability management

Asset liability managementfiroze p

╠²

Asset liability management (ALM) is the process of managing a bank's assets and liabilities to maximize profits and minimize risk. It involves planning asset and liability maturities and interest rates to ensure adequate liquidity and stable net interest income. The ALM process includes risk identification, measurement, and management of liquidity risk, interest rate risk, currency risk, and other risks. Banks use ALM techniques like maturity gap analysis, duration analysis, simulation, and value at risk to measure different types of risks. The asset liability committee (ALCO) oversees the ALM process and makes strategic decisions about the balance sheet, pricing, and risk management.LTCM Case

LTCM CaseVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

Long Term Capital Management (LTCM) was a hedge fund founded in 1994 by John Meriwether that utilized quantitative models and leverage to profit from convergence trades. While initially successful, LTCM lost billions in 1998 during the Russian financial crisis as markets became volatile and liquidity dried up. To prevent systemic risk, the Federal Reserve orchestrated an emergency bailout. The crisis showed that highly leveraged positions are vulnerable to shifts in market liquidity and correlations between assets. Key lessons include incorporating liquidity as a risk factor, stress testing models, and relying more on judgment than purely quantitative analysis.Risk Management in Banking Sectors.

Risk Management in Banking Sectors.Rupesh neupane

╠²

The document details various risks faced by banks, including liquidity, interest, market, credit, off-balance sheet, foreign exchange, and operational risks. It outlines definitions, measurements, and management strategies for each type of risk, emphasizing the necessity of regular monitoring and effective policies. Additionally, it highlights the importance of a sound credit risk environment and ongoing evaluation by the board of directors.SVB_Collapse_Presentation_With_Meme_Updated.pptx

SVB_Collapse_Presentation_With_Meme_Updated.pptxabhirupd05

╠²

Silicon Valley Bank (SVB), founded in 1983, grew to be a major financial institution for tech startups but collapsed in March 2023 due to rising interest rates, poor risk management, and a lack of diversification. A mass withdrawal of deposits followed a significant loss from securities sales, leading to intervention by regulators. The event underscored the need for improved risk management and diversification in the banking sector, particularly among institutions dealing with tech-focused clients.MINI PROJECT 2023.pptx

MINI PROJECT 2023.pptxNiharika151971

╠²

Silicon Valley Bank (SVB) faced financial difficulties due to over-indexing on government bonds as interest rates rose, shrinking the value of its bond portfolio. SVB's deposits also shrank during a period of economic uncertainty, requiring SVB to raise $2 billion in funds. Speculation around the fund raise caused a bank run as customers withdrew deposits, exacerbating SVB's troubles. The potential failure of SVB could impact startups who use the bank for funding.More Related Content

What's hot (20)

Lehman Brothers Bankruptcy

Lehman Brothers BankruptcyHassaan13

╠²

Founded in 1850, Lehman Brothers filed for bankruptcy in 2008 due to its overexposure to subprime mortgages through securitization and derivatives trading. Its collapse exacerbated the global financial crisis and had far-reaching consequences. Money market funds broke the buck due to Lehman losses. Lehman's $639 billion in assets and $613 billion in debt overwhelmed the bankruptcy system. Its failure devastated the financial industry and significantly deepened the worldwide economic recession.Economic Bubbles, Crises, and Crashes

Economic Bubbles, Crises, and CrashesMBA ASAP

╠²

The document discusses economic bubbles and crashes throughout history, highlighting events like Tulip Mania, the South Sea and Mississippi bubbles, and the 1929 stock market crash. It explains how speculation and irrational exuberance can inflate asset prices until they collapse, leading to significant economic downturns. The narrative further explores responses to these crises, including the establishment of the Federal Reserve and regulatory measures to stabilize markets.Camels approach

Camels approachVishal Parmar

╠²

The CAMELS approach is used internationally to evaluate bank risk across six key factors: Capital adequacy, Asset quality, Management quality, Earnings, Liquidity, and Sensitivity to market risk. Ratings are assigned on a scale of A to E based on an assessment of each factor, with A indicating a sound bank and E indicating a bank with critical weaknesses and high risk of failure. The document provides details on how each CAMELS factor is evaluated.Camel rating

Camel rating Priya Tiwari

╠²

This document provides an overview of the CAMELS rating system used to evaluate the overall health and risk profile of banks. CAMELS stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity to market risk. Each component is rated on a scale of 1 to 5, with 1 being the strongest. The ratings are used by regulators in the US, India, and other countries to monitor banks and determine which may require support.Hdfc ICICI comparative

Hdfc ICICI comparative Aditya Chaturvedi

╠²

HDFC Bank is one of India's largest banks based in Mumbai. It was incorporated in 1994 by Housing Development Finance Corporation. While ICICI Bank has a higher earnings per share, HDFC Bank has a better dividend payout ratio and return on net worth. HDFC Bank also has a higher asset turnover ratio, showing more efficient use of assets to generate revenue. However, ICICI Bank has a lower debt-to-equity ratio and higher quick ratio, indicating it uses less debt in its capital structure and has a greater ability to quickly pay current liabilities. In conclusion, while ICICI Bank outperforms HDFC Bank on some financial metrics, HDFC Bank has potential for growth by expanding rural outreach and increasing itsThe Barings Bank Collapse

The Barings Bank CollapseUday Tharar

╠²

The Barings Bank collapsed in 1995 due to unauthorized speculative derivatives trading by Nick Leeson in the bank's Singapore office. Leeson, who was employed to engage in low-risk arbitrage opportunities, was instead speculating heavily and incurred losses of over $1.4 billion to cover his earlier losses. As he controlled both the trading and back-office functions, Leeson was able to hide his unauthorized trading and losses until it was too late, causing the 233-year-old bank to become insolvent. The collapse highlighted the need for stronger internal controls, risk management, oversight, and segregation of duties in financial institutions.Fall Of Lehman Brother

Fall Of Lehman BrotherRakesh Sancheti

╠²

The document provides an overview of the downfall of Lehman Brothers, which filed for Chapter 11 bankruptcy in September 2008. It discusses several factors that contributed to Lehman Brothers' collapse, including the US housing bubble and subprime mortgage crisis, Lehman's high leverage and reliance on short-term funding, and flaws in risk management practices. After Lehman filed for bankruptcy, parts of its business were acquired by Barclays and Nomura. The collapse had widespread effects on financial markets and the global economy.Banking industry ppt

Banking industry pptSipra Debnath

╠²

The document discusses the banking industry in India. It outlines objectives like identifying market share and competition. It describes the market structure in India and globally, with public sector banks, private sector banks, and foreign banks in India. The top 10 banks in India and worldwide are listed. Industry concentration is examined using the Herfindahl Index. Technological changes, demand conditions, pricing, advertising, and mergers and acquisitions in the industry are analyzed. The future outlook is positive due to India's growing population and incomes.Securitization and 2008 financial crisis

Securitization and 2008 financial crisisShubham Agrawal

╠²

This document discusses securitization and its role in the 2008 financial crisis. It defines securitization as pooling various debt obligations like mortgages and selling their cash flows as securities. It describes the securitization process and key players like originators and special purpose vehicles. It then explains that the financial crisis was caused by the bursting of the US housing bubble fueled by subprime lending and securitization of risky mortgages. The crisis led to a global recession, unemployment rising to 10% in the US, and housing market and stock market declines worldwide. India was also impacted through economic downturn and currency depreciation, but prudent financial regulation protected it from the worst effects.Non Performing Assets

Non Performing AssetsAditya

╠²

The document discusses Non-Performing Assets (NPAs) in the Indian banking sector. It defines an NPA as an asset that ceases to generate income for the bank. It provides data showing that public sector banks had the highest NPA ratio in FY2010 at 2.27%, while foreign banks had the lowest at 4.26%. The criteria for classifying different types of loans as NPAs, including term loans, cash credits, project loans and more, are explained in detail. NPAs are further classified as substandard, doubtful or loss assets based on the period of delinquency. Banks are required to make provisions against NPAs as per RBI guidelines.Types of Risks and its Management in Banking

Types of Risks and its Management in BankingMohit Chhabra

╠²

The document discusses various types of risks in banking and rural finance, including credit, liquidity, interest rate, and market risks, as well as methods for their assessment and management. Credit risk involves the likelihood of borrower default and is measured using metrics like the expected loss method and Altman Z-score. Liquidity risk is the inability to meet short-term obligations, while market risk refers to potential losses from market factors, with tools like Value at Risk (VaR) used for measurement.Yes bank crisis

Yes bank crisisHemanth

╠²

1) Yes Bank faced a crisis in 2020 when the RBI placed it under moratorium due to high levels of bad loans and a deteriorating financial position.

2) The RBI capped withdrawals at Rs. 50,000 per account for a month due to issues such as poor governance and an inability to raise fresh capital.

3) A revival plan was announced where SBI would acquire a 49% stake in Yes Bank and inject capital, while other investors would purchase the remaining shares. This aimed to address the bank's troubled finances and restore depositors' confidence.Covid-19: Impact on the Banking Sector

Covid-19: Impact on the Banking SectorDVSResearchFoundatio

╠²

The document discusses the impact of COVID-19 on India's banking sector, highlighting that public sector banks (PSBs) struggle with poor performance metrics despite holding significant market share. It points out a decline in bank credit growth since 2013, resulting in substantial losses for PSBs, while also detailing the Reserve Bank of India's monetary policy responses aimed at alleviating financial stress. Additionally, it contrasts the performance of PSBs with private banks and emphasizes the need for banking sector efficiencies to support economic growth.2008 World Economic crisis, Global Meltdown, Global Financial Crisis

2008 World Economic crisis, Global Meltdown, Global Financial CrisisJagmeet Singh Bajaj

╠²

The 2008 financial crisis was caused by a combination of factors: rising housing prices, risky lending practices, and overreliance on complex financial instruments. When the housing bubble burst, it exposed vulnerabilities throughout the financial system. Major investment banks collapsed and governments had to bail out firms like AIG, Fannie Mae and Freddie Mac. The crisis led to a global economic downturn, trillions in wealth destruction, and high unemployment in many countries. Governments addressed the crisis through stimulus spending, bank bailouts, and new financial regulations aimed at preventing future crises.Treasury operations in_banks

Treasury operations in_banksVaibhav Banjan

╠²

Treasury operations in banks involve managing investments, foreign exchange transactions, derivatives trading, and funds management. This includes maintaining statutory liquidity and cash reserve ratios, deploying surplus funds, hedging risks, and trading in financial markets. Key functions of the treasury division are investments in securities, currency trading, derivatives trading like swaps and options, and funds management activities. The treasury aims to meet regulatory requirements, earn profits, and mitigate risks through its operations.Capital adequacy (final)

Capital adequacy (final)Harsh Chadha

╠²

Here are the key points about reverse repo rate from the document:

- Reverse repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) borrows money from commercial banks.

- It is a monetary policy instrument used by the central bank to control money supply. An increase in reverse repo rate will decrease money supply and vice versa.

- When reverse repo rate is increased, it provides more incentive for commercial banks to park their funds with the central bank, thus decreasing the money available in the market.HDFC_ HDFC BANK MERGER.pdf

HDFC_ HDFC BANK MERGER.pdfKhushboo Dange

╠²

The Board of HDFC and HDFC Bank have approved the merger of HDFC into HDFC Bank. Post-merger, HDFC Bank will have a larger share of the home loan market in India at 33% compared to its current 11%. The merger will enable HDFC Bank to expand its home loan portfolio and customer base, achieving greater economies of scale. It will benefit from HDFC's expertise in real estate and a larger balance sheet. For customers, it means access to a wider range of financial products through HDFC Bank branches. The share exchange ratio for the merger was set at 42 HDFC Bank shares for every 25 HDFC shares.Asset liability management

Asset liability managementfiroze p

╠²

Asset liability management (ALM) is the process of managing a bank's assets and liabilities to maximize profits and minimize risk. It involves planning asset and liability maturities and interest rates to ensure adequate liquidity and stable net interest income. The ALM process includes risk identification, measurement, and management of liquidity risk, interest rate risk, currency risk, and other risks. Banks use ALM techniques like maturity gap analysis, duration analysis, simulation, and value at risk to measure different types of risks. The asset liability committee (ALCO) oversees the ALM process and makes strategic decisions about the balance sheet, pricing, and risk management.LTCM Case

LTCM CaseVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

Long Term Capital Management (LTCM) was a hedge fund founded in 1994 by John Meriwether that utilized quantitative models and leverage to profit from convergence trades. While initially successful, LTCM lost billions in 1998 during the Russian financial crisis as markets became volatile and liquidity dried up. To prevent systemic risk, the Federal Reserve orchestrated an emergency bailout. The crisis showed that highly leveraged positions are vulnerable to shifts in market liquidity and correlations between assets. Key lessons include incorporating liquidity as a risk factor, stress testing models, and relying more on judgment than purely quantitative analysis.Risk Management in Banking Sectors.

Risk Management in Banking Sectors.Rupesh neupane

╠²

The document details various risks faced by banks, including liquidity, interest, market, credit, off-balance sheet, foreign exchange, and operational risks. It outlines definitions, measurements, and management strategies for each type of risk, emphasizing the necessity of regular monitoring and effective policies. Additionally, it highlights the importance of a sound credit risk environment and ongoing evaluation by the board of directors.Similar to SVB crash explained.pdf (8)

SVB_Collapse_Presentation_With_Meme_Updated.pptx

SVB_Collapse_Presentation_With_Meme_Updated.pptxabhirupd05

╠²

Silicon Valley Bank (SVB), founded in 1983, grew to be a major financial institution for tech startups but collapsed in March 2023 due to rising interest rates, poor risk management, and a lack of diversification. A mass withdrawal of deposits followed a significant loss from securities sales, leading to intervention by regulators. The event underscored the need for improved risk management and diversification in the banking sector, particularly among institutions dealing with tech-focused clients.MINI PROJECT 2023.pptx

MINI PROJECT 2023.pptxNiharika151971

╠²

Silicon Valley Bank (SVB) faced financial difficulties due to over-indexing on government bonds as interest rates rose, shrinking the value of its bond portfolio. SVB's deposits also shrank during a period of economic uncertainty, requiring SVB to raise $2 billion in funds. Speculation around the fund raise caused a bank run as customers withdrew deposits, exacerbating SVB's troubles. The potential failure of SVB could impact startups who use the bank for funding.Silicon Valley Bank (SVB) Collapse: Causes and Impact

Silicon Valley Bank (SVB) Collapse: Causes and ImpactSumitDwivedi32

╠²

the event desribing the fallout of the sillicaon valley bank and the events behind itThe SVB Crisis Its Implication on India.pdf

The SVB Crisis Its Implication on India.pdfSaugata Dastider

╠²

The document discusses the crisis surrounding Silicon Valley Bank (SVB), highlighting its rapid decline in assets from $200 billion to $173 billion and the significant losses in its securities portfolio due to rising interest rates. The impact on Indian banking appears limited according to experts, though there may be temporary effects on the capital market and startup ecosystem due to the interconnectedness with US financial systems. Indian startups, particularly those with US exposure, face challenges, with some unable to meet payroll obligations in the near future.SVB CRISES.pptx

SVB CRISES.pptxParthrajMaharaul

╠²

Silicon Valley Bank (SVB) was founded in 1983 to cater to startup companies and became one of the largest banks in the U.S., specializing in financing venture-backed firms. On March 10, 2023, SVB failed following a bank run, marking the largest bank failure since the 2008 financial crisis, amplified by issues such as increased interest rates and a 'startup winter' leading to significant deposit withdrawals. The crisis resulted in a panic among depositors and a broader reaction in the financial markets, illustrating the impact of behavioral finance principles like excessive rationality-assumption bias and crowd psychology.Silicon valley bankŌĆÖs collapse-St. Gr..pptx

Silicon valley bankŌĆÖs collapse-St. Gr..pptxDipendraKarki17

╠²

Silicon Valley Bank (SVB), once the 16th largest bank in the U.S., collapsed on March 10, 2023, due to a combination of rising interest rates, asset-liability mismatches, and a significant drop in deposits amidst a downturn in startup funding. The failure triggered a panic in the financial markets, impacting numerous companies with substantial deposits at SVB and prompting government interventions including the creation of a new bank to protect depositors. The collapse also raised concerns about the stability of other banks, with reports indicating that many banks are at risk due to high uninsured deposits.Failure of Silicon Valley Bank in USA Global Impact and Lessons for the Niger...

Failure of Silicon Valley Bank in USA Global Impact and Lessons for the Niger...Godwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

╠²

The failure of Silicon Valley Bank (SVB) in March 2023 has had significant global implications, particularly affecting the financial ecosystem and raising concerns about liquidity and loan defaults in various sectors, including India's technology market. Its collapse, the second largest in U.S. history, stemmed from a combination of factors, including the end of the tech boom and rising interest rates, leading to diminished asset values and rapid deposit withdrawals. The incident underscores the need for stronger financial regulation and better risk management strategies, calling for a reassessment of the current practices in both U.S. and Nigerian banking systems. Act Now for a $750 PayPal Gift Card!

Act Now for a $750 PayPal Gift Card!Monibul

╠²

The collapse of Silicon Valley Bank (SVB) and Signature Bank has triggered significant turmoil in the U.S. banking system, prompting regulators to guarantee all deposits to prevent contagion. SVB's failure, largely due to its unpreparedness for rising interest rates, highlights the vulnerability of smaller banks, while the broader banking sector remains deemed safe. Despite government assurances, concerns persist about the potential for future bank runs and the implications of taxpayer-funded bailouts.Failure of Silicon Valley Bank in USA Global Impact and Lessons for the Niger...

Failure of Silicon Valley Bank in USA Global Impact and Lessons for the Niger...Godwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

╠²

Ad

Recently uploaded (20)

Paul Turovsky - A Key Contributor

Paul Turovsky - A Key ContributorPaul Turovsky

╠²

Paul Turovsky is a manager for Foursquare Realty Investments. He graduated from Ave Maria School of Law in 2013 and received his undergraduate degree from Baruch College. Mr. Turovsky has founded multiple real estate firms to serve various functions. What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...

What Drives Collectors in Sports and Beyond, and How Mantel is Bringing Them ...Neil Horowitz

╠²

On episode 2947of the Digital and Social Media Sports Podcast, Neil chatted with Evan Parker, CEO of Mantel.

What follows is a collection of snippets from the podcast. To hear the full interview and more, check out the podcast on all podcast platforms and at www.dsmsports.net.BOURNS POTENTIOMETER Provide You Precision

BOURNS POTENTIOMETER Provide You Precisionsmidmart

╠²

Bourns potentiometers are high-quality variable resistors designed for precision control in a wide range of electronic applications. Known for their durability, accuracy, and reliability, Bourns potentiometers are ideal for adjusting signal levels, tuning circuits, or setting reference voltages in industrial, automotive, and consumer electronics.

Available in rotary and slide variants, these components offer excellent repeatability, smooth operation, and long mechanical life, making them a trusted choice for engineers and designers worldwide.

Streamline Success: How Well-Defined SOPs Drive Organizational Efficiency

Streamline Success: How Well-Defined SOPs Drive Organizational EfficiencyRUPAL AGARWAL

╠²

Confusion, inconsistency, and inefficiency can cripple any organization ŌĆö unless clear Standard Operating Procedures (SOPs) are in place. This presentation explores the transformative impact of well-defined SOPs on productivity, quality, employee accountability, and operational consistency. Discover how structured processes can reduce errors, accelerate onboarding, and enable scalable growth. A must-see for managers, team leaders, HR professionals, and business owners.Book - Behavioral finance and wealth management(1).pdf

Book - Behavioral finance and wealth management(1).pdfGamingwithUBAID

╠²

Book - Behavioral finance and wealth management(1).pdfEnterprise Architecture Professional Journal Vol IX June 2025.pdf

Enterprise Architecture Professional Journal Vol IX June 2025.pdfDarryl_Carr

╠²

Volume IX of the Enterprise Architecture Professional Journal on EAPJ.org, released June 2025.

It features:

- A welcome from the EAPJ Editor, Darryl Carr.

- A special note from the EAPJ Founder, Steve Else.

- An article from Alexandre Luis Prim and Tiago Lemos de Oliveira featuring a case study of value creation from Enterprise Architecture.

We hope you enjoy the latest publication, with insights into the world of Enterprise Architecture.Stuart Frost - The Chief Executive Officer Of Geminos

Stuart Frost - The Chief Executive Officer Of GeminosStuart Frost

╠²

Stuart Frost, CEO of Geminos, is a pioneering force in the IIoT and data analytics industry. After graduating from Nottingham University in Electronic and Computer Engineering, Stu founded SELECT Software Tools and led it through a NASDAQ IPO in 1996. His ventures in the IIoT space include Maana, OspreyData, and SWARM. IEA_Press_Release_Tullow_Agreement-16-6-2025-1.pdf

IEA_Press_Release_Tullow_Agreement-16-6-2025-1.pdfbusinessweekghana

╠²

DonŌĆÖt extend petroleum licenses of Tullow ŌĆō IEA appeals to GovŌĆÖtOleksandr Osypenko: Defining PMO Structure and Governance (UA)

Oleksandr Osypenko: Defining PMO Structure and Governance (UA)Lviv Startup Club

╠²

Oleksandr Osypenko: Defining PMO Structure and Governance (UA)

LemBS PMO School 2025

Website ŌĆō https://lembs.com/pmoschool

Youtube ŌĆō https://www.youtube.com/startuplviv

FB ŌĆō https://www.facebook.com/pmdayconference Electronic Shelf Labels & Digital Price Tags in Delhi | Foodcare

Electronic Shelf Labels & Digital Price Tags in Delhi | FoodcareFoodcare llp

╠²

Foodcare brings advanced electronic shelf labels and digital price tags to Delhi, transforming the way retailers manage pricing and product displays. Designed for modern retail environments, our solutions offer real-time price updates, reduce manual errors, and save operational time. These digital tags are ideal for supermarkets, grocery stores, pharmacies, and other retail formats looking to enhance efficiency and accuracy. With wireless connectivity and centralized control, you can update pricing, promotions, and product details instantly across multiple shelves. The high-contrast, energy-efficient displays ensure clear visibility for customers, improving overall shopping experience. Our labels are available in various sizes to suit different product categories and shelf designs. Easy to install and maintain, FoodcareŌĆÖs electronic shelf label systems provide a seamless upgrade to your storeŌĆÖs infrastructure. Choose Foodcare in Delhi for smart pricing solutions that combine innovation, reliability, and professional presentation. Stay competitive with digital technology that simplifies retail operations. For more information visithttps://foodcare.co.in/electronic-price-tags-in-Delhi/Power of the Many: Digital Energy Masterclass

Power of the Many: Digital Energy Masterclassmariana491193

╠²

Masterclass on digitalisation of Energy SystemsZero-emission zones in the Netherlands 2025

Zero-emission zones in the Netherlands 2025Walther Ploos van Amstel

╠²

Since 2014, the Netherlands has worked toward more sustainable urban logistics through the Green Deal Zero Emission City Logistics. Early years focused on local pilot projectsŌĆösuch as city hubs, electric vehicles, and water transportŌĆödesigned as ŌĆØliving labsŌĆØ to explore and learn. Following the 2019 Climate Agreement, the ambition increased: by 2025, 30 to 40 major municipalities aim to establish zero-emission zones, where only fully electric trucks and vans may operate. As of January 2025, 14 cities have implemented such zones, banning vehicles with Euro 4 or lower emission standards. By 2030, only zero-emission vehicles will be permitted.

The rollout raises important questions: Which transitions are smooth? Where are the main challenges, and who is most affected? Are issues local or widespread? How are small and large companies affected differently? Researchers play a vital role in evaluating these developments, sharing insights, and supporting a just and effective transition to zero-emission city logistics.

Walther Ploos van Amstel.From Visibility to Action: How Modern Cloud Teams Regain Control

From Visibility to Action: How Modern Cloud Teams Regain ControlAmnic

╠²

As cloud environments become increasingly sophisticated, visibility into usage and cost is no longer sufficient. Today's teams must transition from being reactive observers to having confident, knowledgeable action. This presentation delves into how companies can turn dispersed insights into decisions that avoid surprises and foster accountability.

From Visibility to Action: How Modern Cloud Teams Regain Control takes you through the changing requirements of cloud-native organizations: from creating a single pane of costs to eliminating alert fatigue, applying guardrails, and folding cost visibility directly into DevOps pipelines.

You will learn here how to:

- Get past visibility into actionable control in multi-cloud and K8s

- Solve visibility fatigue using prioritized contextual information

- Move the cost responsibility left into the engineering process

Regain clarity in a fragmented cloud landscape

Whether youŌĆÖre a startup scaling fast or an enterprise navigating complexity, this will help your team turn cloud data into decisions and bills into predictable outcomes. IndiaŌĆÖs Leading Mining Fleet Management Companies Revolutionizing Mining

IndiaŌĆÖs Leading Mining Fleet Management Companies Revolutionizing MiningNaaraayani Minerals Pvt.Ltd

╠²

India's mining sector is undergoing a rapid transformation, driven by technological innovation, sustainability goals, and operational efficiency. At the core of this change are advanced fleet management practices that are reshaping how resources are extracted, transported, and traded. With Odisha playing a central role in mineral production, especially in iron ore logistics, the integration of intelligent transport and monitoring solutions is more crucial than ever.

Power of the Many Masterclasses - 2nd draft .pptx

Power of the Many Masterclasses - 2nd draft .pptxAlexBausch2

╠²

Masterclass on digitalisation of Energy SystemsBenefits of virtual events For the Business

Benefits of virtual events For the BusinessTrevento media Private Limited

╠²

Virtual events are successful and efficient for all audiences because they reduce expenses, increase global reach, increase engagement, provide real-time data, and promote sustainability.The Key Cultural Role of PuneŌĆÖs Shivsrushti

The Key Cultural Role of PuneŌĆÖs Shivsrushtikapoorgita1991

╠²

Shivsrushti, a heritage park in Pune envisioned by Babasaheb Purandare, offers a powerful blend of immersive storytelling, historical accuracy, and civic education centered around the life and values of Chhatrapati Shivaji Maharaj. Through lifelike exhibits and recreated experiences, it brings history to life for people of all ages, encouraging reflection on leadership, inclusivity, and ethical governance. The Abhay Bhutada Foundation has played a pivotal role in expanding access to Shivsrushti by supporting educational visits for underprivileged students, ensuring that this cultural treasure is shared widely and meaningfully. More than a tribute to the past, Shivsrushti serves as a public model for how history can inspire civic pride and social unity in contemporary India.

S4F02 Col11 Management Accounting in SAP S/4HANA for SAP ERP CO Professionals

S4F02 Col11 Management Accounting in SAP S/4HANA for SAP ERP CO ProfessionalsLibreria ERP

╠²

This material provides a comprehensive guide to Management Accounting in SAP S/4HANA, tailored for SAP ERP CO professionals. It covers the architecture of SAP S/4HANA Management Accounting, configuration and usage of new functionalities, and the application of standard SAP Fiori tools. Additionally, it delves into the changes in data models, posting logic, and master data in Management Accounting, along with an overview of event-based revenue recognition. The content also includes insights into the migration process to SAP S/4HANA and the new architecture of accounting, offering a detailed understanding of the financial processes and reporting options in SAP S/4HANA.IndiaŌĆÖs Leading Mining Fleet Management Companies Revolutionizing Mining

IndiaŌĆÖs Leading Mining Fleet Management Companies Revolutionizing MiningNaaraayani Minerals Pvt.Ltd

╠²

Ad

SVB crash explained.pdf

- 1. SVB crash explained what happened? who SVB? but why did this happen?

- 2. Loan $$ interest (SVBŌĆÖs earnings) Unlike a usual bank, SVB couldnŌĆÖt earn on loans since itŌĆÖs customers (startups) were cash rich from in 2020-21. SVB then invested 56% of itŌĆÖs portfolio in govt. bondsŌĆ” ŌĆ£Someone borrow money from me so I can charge you interest and make profitŌĆØ - SVB ŌĆ£Imma give you loads of moneyŌĆØ Startup founders Investors ŌĆ£We donŌĆÖt need no loans anymore. We got loads of cash.ŌĆØ SVB Reason 1 of 3 | SVB over-indexed on govt. bonds SVBŌĆÖs deposits were growingŌĆ”but not pro fi tŌĆ”

- 3. which was okay, untilŌĆ” Reason 1 of 3 | SVB over-indexed on govt. bonds

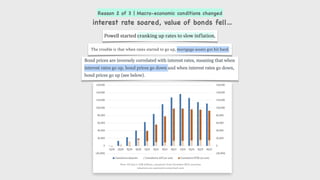

- 4. Reason 2 of 3 | Macro-economic conditions changed interest rate soared, value of bonds fellŌĆ”

- 5. SVBŌĆÖs deposits shrank in the funding winter, SVB needed to raise 2 billionŌĆ” Reason 2 of 3 | Macro-economic conditions changed interest rate soared, value of bonds fellŌĆ”

- 6. speculation over $2 bn fund raise caused panic (and perhaps, SilvergateŌĆÖs collapse added to it) Reason 3 of 3 | bank run Other factors: sharp hike in interest rates by Fed, gaps in Fed policy enforcement and poor risk management at SVB

- 7. why was this signi fi cant? Startups fear OpEx shortage, employee furloughs

- 8. govt. bailout? investor loans? customer bailout? bank takeover?ŌĆ” what happens next?

- 9. meanwhile, some comic relief ;-)

- 10. what could SVB have done differently?