Tadeen oman mining oman 2015

- 1. Silicon Manufacturing in Oman Exploring the future of Silica mining Dipl. Eng. Lou Parous Executive Director Dipl. Eng. Lou Parous Executive Director phone +49 7531 698 4628 mobile +49 175 727 3943 lou.parous@viridis-iq.de Register Office: Freiburg - Commercial Register No. HRB 708759 Managing Director: Louis C. Parous III, Dr. Wolfgang Herbst

- 2. 2ÂĐ Viridis.iQ Brief Introduction Corporate Focus Silicon Recycling Technology PV Systems Silicon and Ferroalloy Manufacturing Solar Manufacturing Taadeen Oman â Muscat, Dec 1-3rd, 2015

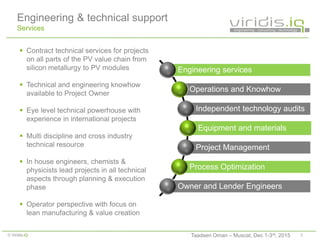

- 3. 3ÂĐ Viridis.iQ Engineering & technical support Services ï§ Contract technical services for projects on all parts of the PV value chain from silicon metallurgy to PV modules ï§ Technical and engineering knowhow available to Project Owner ï§ Eye level technical powerhouse with experience in international projects ï§ Multi discipline and cross industry technical resource ï§ In house engineers, chemists & physicists lead projects in all technical aspects through planning & execution phase ï§ Operator perspective with focus on lean manufacturing & value creation Engineering services Operations and Knowhow Independent technology audits Equipment and materials Project Management Process Optimization Owner and Lender Engineers Taadeen Oman â Muscat, Dec 1-3rd, 2015

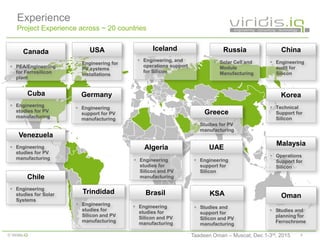

- 4. 4ÂĐ Viridis.iQ UAE ï§ Engineering support for Silicon Malaysia ï§ Operations Support for Silicon Russia ï§ Solar Cell and Module Manufacturing Canada ï§ PEA/Engineering for Ferrosilicon plant Iceland ï§ Engineering, and operations support for Silicon Oman ï§ Studies and planning for Ferrochrome KSA ï§ Studies and support for Silicon and PV manufacturing Chile ï§ Engineering studies for Solar Systems Brasil ï§ Engineering studies for Silicon and PV manufacturing Venezuela ï§ Engineering studies for PV manufacturing Cuba ï§ Engineering studies for PV manufacturing USA ï§ Engineering for PV systems installations Algeria ï§ Engineering studies for Silicon and PV manufacturing Trindidad ï§ Engineering studies for Silicon and PV manufacturing Korea ï§ Technical Support for Silicon China ï§ Engineering audit for Silicon Greece ï§ Studies for PV manufacturing Experience Project Experience across ~ 20 countries Germany ï§ Engineering support for PV manufacturing Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 5. 5ÂĐ Viridis.iQ Chemicals ï§ Silicones for plastics, paints, medical applications, cookware, and insulation ï§ Silicon is consumed in the chemical process and derivitives of silicon are further processed ï§ Wells established industry that is expanding in the emerging markets as consumer goods consumption rises ï§ Approx 2 kgs of silicon are needed for 1 kg of silicones Aluminium ï§ Used as an alloying element to alumium for improved properties ï§ Used in both primary and secondard alumium industry ï§ Increasing use of alumimum â silicon alloys is pushing higher demand of silicon ï§ Typically up to 12% silicon is used in cast aluminum alloys . Electronics and Photovoltaics ï§ Key raw material for production of polysilicon ï§ Consumed in process ï§ 1.2 to 1.4 kgs are needed for 1 kg of polysilicon ï§ Large cost componant of polysilicon production ï§ High consistancy in quality requirements Sectors and Drivers End Markets for mgSilicon Metallurgical Silicon is used in a diverse number of industries. As a key feedstock, it is consumed in the process of making other industrial end products or consumer goods. Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 6. 6ÂĐ Viridis.iQ Lump: 10 x 100 mm $ 2.5/kg Powder: 45Âĩm- 425Âĩm $3.0/kg Aluminum Sector PV Sector Chemical Sector Waste Powder: <45Âĩm $0.50 - 1.3/kg** Refractory Sector Process description Silicon smelting ** Quality of waste impacts price. Western markets have higher waste silicon prices than China due to trade barriers Milling Quartz Wood Coal ï§ ~ Global production: 2.5 million tons/yr ï§ Aluminum: 1200 kt/a ï§ Polysilicon (Solar): 500 kts/a ï§ Chemicals (Silicones): 800 kts/a ï§ ~ Global demand: 2.5 million tons/yr ï§ ~ Annual growth in supply/demand: 5% ï§ Technology is well proven and low risk ï§ Main drivers for competitive advantage ï§ Electricity price ï§ Long term power contract ï§ Low cost capital ï§ Middle east has a growing demand based on Aluminum and Solar manufacturing ï§ No middle east silicon manufacturer (yet) Taadeen Oman â Muscat, Dec 1-3rd, 2015 Submerged Arc Electric Furnace

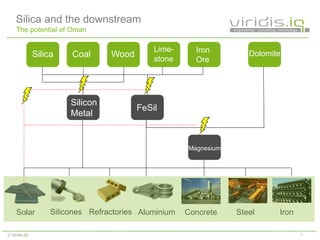

- 7. 7ÂĐ Viridis.iQ Silica and the downstream The potential of Oman Silica Coal Wood Silica Lime- stone Iron Ore Silicon Metal FeSil Dolomite Magnesium Solar Silicones Refractories Aluminium Concrete Steel Iron

- 8. 8ÂĐ Viridis.iQ Silica for Silicon and Silica for Glass The potential of Oman Silica for Silicon Silica for Glass

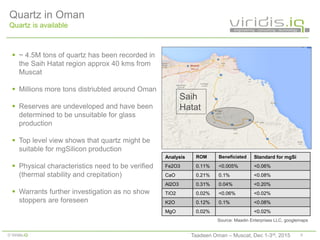

- 9. 9ÂĐ Viridis.iQ ï§ ~ 4.5M tons of quartz has been recorded in the Saih Hatat region approx 40 kms from Muscat ï§ Millions more tons distriubted around Oman ï§ Reserves are undeveloped and have been determined to be unsuitable for glass production ï§ Top level view shows that quartz might be suitable for mgSilicon production ï§ Physical characteristics need to be verified (thermal stability and crepitation) ï§ Warrants further investigation as no show stoppers are foreseen Source: Maadin Enterprises LLC, googlemaps Saih Hatat Analysis ROM Beneficiated Standard for mgSi Fe2O3 0.11% <0.005% <0.06% CaO 0.21% 0.1% <0.08% Al2O3 0.31% 0.04% <0.20% TiO2 0.02% <0.06% <0.02% K2O 0.12% 0.1% <0.08% MgO 0.02% <0.02% Quartz in Oman Quartz is available Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 10. 10ÂĐ Viridis.iQ mgSilicon Greenfield Growth Do all these projects have strong fundamentals? New Silicon Plants (planned or being studied) PCC Islandic Silicon FerroAtlantica Mississippi Silicon Saudi Silicon SIMAUnited Silicon âChinaâ Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 11. 11ÂĐ Viridis.iQ âCarbon management and security is fundamental due to the impact this raw material has on the cost and quality of the project. Limited suppliers of low ash coal and the volatility of this commodity can introduce significant risk to the project.â Carbon Critical Impacts Examples of key factors for new entrants âOver-engineering, over-buying and excessive focus on turnkey offers can impede financial performance of the project for many years. Equally, purchasing substandard equipment can result in permanent operational problems for the life of the project and reduce overall project value as well as operational margins. CAPEX âA team of operations experts is needed in all project phases to foresee risks, support engineering and planning, prepare mitigation strategies, design processes and transfer knowhow to project owner operators. Lack of experienced operations personnel is largest risk to new projects.â Operations âLong term power contracts designed for silicon operations are required. Understanding the operations boundary conditions of a particular site or country is crucial to design the correct contractual conditions that will not impede future operations or affect costsâ Power Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 12. ÂĐ Viridis.iQ Source: Alloy Consult, Viridis.iQ mgSilicon price levels Money to be made with silicon? Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 13. ÂĐ Viridis.iQ Source: Alloy Consult, CRU, Viridis.iQ mgSilicon western production costs Margins are attractive Taadeen Oman â Muscat, Dec 1-3rd, 2015

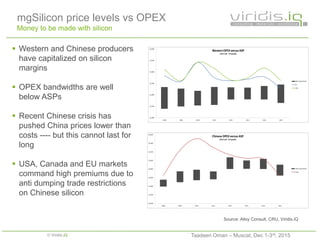

- 14. ÂĐ Viridis.iQ Source: Alloy Consult, CRU, Viridis.iQ mgSilicon price levels vs OPEX Money to be made with silicon ï§ Western and Chinese producers have capitalized on silicon margins ï§ OPEX bandwidths are well below ASPs ï§ Recent Chinese crisis has pushed China prices lower than costs ---- but this cannot last for long ï§ USA, Canada and EU markets command high premiums due to anti dumping trade restrictions on Chinese silicon Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 15. 15ÂĐ Viridis.iQ Production Costs What are the drivers ï§ Electricity, depreciation (capex) and raw materials make up the bulk of cost (~80%) ï§ Coal is largest raw material cost and represents a strategic risk which can be mitigated by vertical integration to coal mining or charcoal production ï§ Electricity prices have to be advantageous for long term periods. Long term incentivized power structure is needed to offset depreciation and provide long term fixed cost ï§ Smart design and informed procurement can avoid over engineering while minimizing project and capital risks. Turn key offers are not always the best option and can bring legacy costs. ï§ Experienced start up operations teams reduce learning curves and assist in factory planning, engineering and process design to mitigate over design and higher than needed CAPEX; as well reduce electricity demand by improving KWh/ton ratios and electrode and reductant consumption Hypothetical Silicon Smelter â early years, all in costs Taadeen Oman â Muscat, Dec 1-3rd, 2015

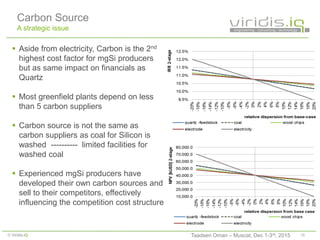

- 16. 16ÂĐ Viridis.iQ Carbon Source A strategic issue ï§ Aside from electricity, Carbon is the 2nd highest cost factor for mgSi producers but as same impact on financials as Quartz ï§ Most greenfield plants depend on less than 5 carbon suppliers ï§ Carbon source is not the same as carbon suppliers as coal for Silicon is washed ---------- limited facilities for washed coal ï§ Experienced mgSi producers have developed their own carbon sources and sell to their competitors, effectively influencing the competition cost structure Taadeen Oman â Muscat, Dec 1-3rd, 2015

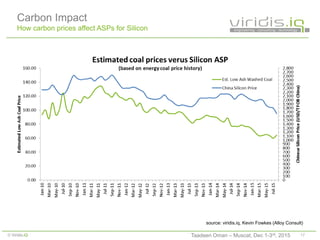

- 17. 17ÂĐ Viridis.iQ source: viridis.iq, Kevin Fowkes (Alloy Consult) Carbon Impact How carbon prices affect ASPs for Silicon Taadeen Oman â Muscat, Dec 1-3rd, 2015

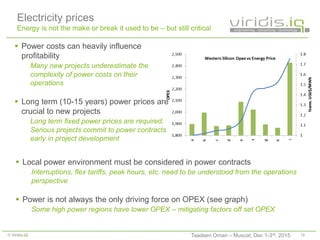

- 18. 18ÂĐ Viridis.iQ Electricity prices Energy is not the make or break it used to be â but still critical ï§ Power costs can heavily influence profitability Many new projects underestimate the complexity of power costs on their operations ï§ Long term (10-15 years) power prices are crucial to new projects Long term fixed power prices are required. Serious projects commit to power contracts early in project development ï§ Local power environment must be considered in power contracts Interruptions, flex tariffs, peak hours, etc. need to be understood from the operations perspective ï§ Power is not always the only driving force on OPEX (see graph) Some high power regions have lower OPEX â mitigating factors off set OPEX Taadeen Oman â Muscat, Dec 1-3rd, 2015

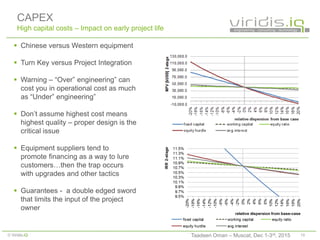

- 19. 19ÂĐ Viridis.iQ CAPEX High capital costs â Impact on early project life ï§ Chinese versus Western equipment ï§ Turn Key versus Project Integration ï§ Warning â âOverâ engineeringâ can cost you in operational cost as much as âUnderâ engineeringâ ï§ Donât assume highest cost means highest quality â proper design is the critical issue ï§ Equipment suppliers tend to promote financing as a way to lure customersâĶthen the trap occurs with upgrades and other tactics ï§ Guarantees - a double edged sword that limits the input of the project owner Taadeen Oman â Muscat, Dec 1-3rd, 2015

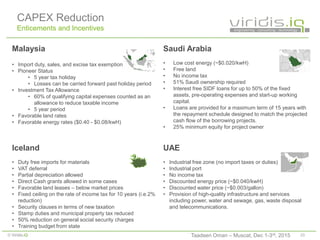

- 20. 20ÂĐ Viridis.iQ Malaysia âĒ Import duty, sales, and excise tax exemptions âĒ Pioneer Status âĒ 5 year tax holiday âĒ Losses can be carried forward past holiday period âĒ Investment Tax Allowance âĒ 60% of qualifying capital expenses counted as an allowance to reduce taxable income âĒ 5 year period âĒ Favorable land rates âĒ Favorable energy rates ($0.40 - $0.08/kwH) Saudi Arabia âĒ Low cost energy (~$0.020/kwH) âĒ Free land âĒ No income tax âĒ 51% Saudi ownership required âĒ Interest free SIDF loans for up to 50% of the fixed assets, pre-operating expenses and start-up working capital. âĒ Loans are provided for a maximum term of 15 years with the repayment schedule designed to match the projected cash flow of the borrowing projects. âĒ 25% minimum equity for project owner Iceland âĒ Duty free imports for materials âĒ VAT deferral âĒ Partial depreciation allowed âĒ Direct Cash grants allowed in some cases âĒ Favorable land leases â below market prices âĒ Fixed ceiling on the rate of income tax for 10 years (i.e.2% reduction) âĒ Security clauses in terms of new taxation âĒ Stamp duties and municipal property tax reduced âĒ 50% reduction on general social security charges âĒ Training budget from state UAE âĒ Industrial free zone (no import taxes or duties) âĒ Industrial port âĒ No income tax âĒ Discounted energy price (~$0.040/kwH) âĒ Discounted water price (~$0.003/gallon) âĒ Provision of high-quality infrastructure and services including power, water and sewage, gas, waste disposal and telecommunications. CAPEX Reduction Enticements and Incentives Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 21. 21ÂĐ Viridis.iQ Current Trend Parallel tracks Taadeen Oman â Muscat, Dec 1-3rd, 2015 Existing producers New entrants ï§ Tier 1 and 2 producers who cannot expand at their current sites ï§ Seek new locations with attractive fundamentals AND ï§ More importantlyâĶ in attractive markets (USA) ï§ Have little need for local project sponsor ï§ Control own supply chain, distribution channels ï§ Has knowhow but may not be able to transfer ï§ Normally not cash rich ï§ New players who seek industrial investment opportunity ï§ Need to find intrinsic advantage ï§ Local project sponsor is highly important if local stakeholders are needed ï§ Local offtakes and suppliers can be developed early on â creates advantage ï§ Seek new locations with attractive ï§ Has no knowhow, but can buy it ï§ Financing can be tricky

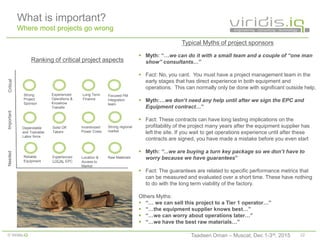

- 22. 22ÂĐ Viridis.iQ What is important? Where most projects go wrong Typical Myths of project sponsors ï§ Myth: ââĶwe can do it with a small team and a couple of âone man showâ consultantsâĶâ ï§ Fact: No, you cant. You must have a project management team in the early stages that has direct experience in both equipment and operations. This can normally only be done with significant outside help. ï§ Myth:âĶwe donât need any help until after we sign the EPC and Equipment contractâĶâ ï§ Fact: These contracts can have long lasting implications on the profitability of the project many years after the equipment supplier has left the site. If you wait to get operations experience until after these contracts are signed, you have made a mistake before you even start ï§ Myth: â...we are buying a turn key package so we donât have to worry because we have guaranteesâ ï§ Fact: The guarantees are related to specific performance metrics that can be measured and evaluated over a short time. These have nothing to do with the long term viability of the factory. Others Myths: ï§ ââĶ we can sell this project to a Tier 1 operatorâĶâ ï§ ââĶthe equipment supplier knows bestâĶâ ï§ ââĶwe can worry about operations laterâĶâ ï§ ââĶwe have the best raw materialsâĶâ Strong Project Sponsor Location & Access to Market Incentivized Power Costs Solid Off Takers Reliable Equipment Experienced Operations & Knowhow Transfer Long Term Finance Dependable and Trainable Labor force Focused PM Integration team Experienced LOCAL EPC NeededCriticalImportant Ranking of critical project aspects Strong regional market Raw Materials Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 23. 23ÂĐ Viridis.iQ Can Oman enter mgSilicon market What are showstoppers ï§ Long term electricity prices? ï§ Low cost capital? ï§ Access to regional markets? ï§ Available raw materials? ï§ Industrial infrastructure? ï§ National incentives? ï§ Domestic demand? âUpgrading mineral quartz deposits in Oman to metallurgical Silicon can compliment existing manufacturing projects in the region and increase Omanâs industrial footprint in the Middle East.â Taadeen Oman â Muscat, Dec 1-3rd, 2015

- 24. Thank you Contact details: Dipl. Eng. Lou Parous Executive Director phone +49 7531 698 4628 mobile +49 175 727 3943 lou.parous@viridis-iq.de Register Office: Freiburg - Commercial Register No. HRB 708759 Managing Director: Louis C. Parous III, Dr. Wolfgang Herbst