Tally patch for GSTR 2 - ClearTax GST

- 1. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 GSTR 2 with Tally Patch Download Tally Patch Now Download Tally Patch Set up Tally Patch Configure Tally Export from Tally Import to ClearTax and file GSTR-2 Troubleshooting errors

- 2. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 1. Download Tally Patch ŌŚÅ Click on Download button on this page ŌŚÅ A Zip file will be downloaded to your computer

- 3. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 2.a Copy TCP file ŌŚÅ Open the zip folder ŌŚÅ Copy the TCP file ŌĆśClearTax_Tally_ConnectorŌĆÖ

- 4. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 2.b Open Tally folder ŌŚÅ Go to your desktop ŌŚÅ Right click on Tally shortcut

- 5. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 2.b Open Tally folder ŌŚÅ Click on ŌĆśOpen file locationŌĆÖ

- 6. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 2.c Tally folder is now open

- 7. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 2.d Paste TCP file in Tally folder

- 8. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Open Tally ŌŚÅ Press F1 to select your business entity 3.a Choose your business entity in Tally

- 9. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Press F12 to open Configuration Settings ŌŚÅ On Configuration menu, click on Product & FeaturesŌĆÖ option 3.b Open Configurations

- 10. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Press F4 to set up TDL configuration ŌŚÅ Make ŌĆśLoad TDL files on startupŌĆÖ as Yes 3.c Open Configurations

- 11. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 3.d Open Configurations ŌŚÅ Go to tally folder >select the path & copy it ŌŚÅ Come back to tally screen , press CTL+ALT+V to paste the tally folder path ŌŚÅ Go to tally folder & right click on tcp file> properties> copy file name ŌŚÅ On tally screen , press ŌĆ£ ŌĆ£ after path & then press CTL+ALT+V to paste tcp file name

- 12. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 3.e Patch is ready to use now

- 13. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Press ESC twice & come to Gateway of Tally ŌŚÅ Under reports , choose ŌĆśClearTax ModuleŌĆÖ 4.a Exporting purchase data to Excel

- 14. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Choose ŌĆśPurchase GSTR-2ŌĆÖ 4.b Exporting purchase data to Excel

- 15. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Press F2 to set the period. ŌŚÅ For example, to export GSTR 2 data for July, set: ŌŚŗ From date as 1-7-2017 to 31-07-2017 ŌŚŗ To date as 31-7-2017 4.b Set the period

- 16. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 ŌŚÅ Press Alt + E ŌŚÅ Note down the location where the file is exported to. 4.b Export to Excel

- 17. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.a Login to ClearTax GST & Select Your Business ŌŚÅ Login to your account on ClearTax GST. Select the business for which you wish to prepare GSTR-2 and choose ŌĆśGSTR 2ŌĆÖ

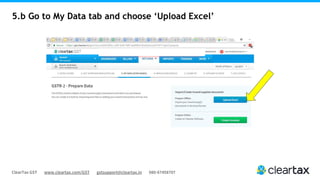

- 18. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.b Go to My Data tab and choose ŌĆśUpload ExcelŌĆÖ

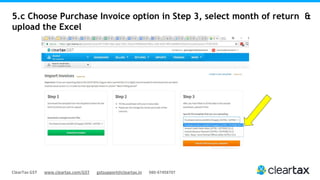

- 19. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.c Choose Purchase Invoice option in Step 3, select month of return & upload the Excel

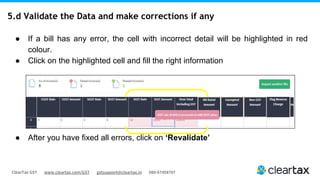

- 20. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.d Validate the Data and make corrections if any ŌŚÅ If a bill has any error, the cell with incorrect detail will be highlighted in red colour. ŌŚÅ Click on the highlighted cell and fill the right information ŌŚÅ After you have fixed all errors, click on ŌĆśRevalidateŌĆÖ

- 21. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.e Your data is now in ClearTax GST ŌŚÅ On successful import of all the invoices, the following screen will be shown.

- 22. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 5.f Read the guide given below & file your return Read our complete guide for the next steps

- 23. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 6a. Troubleshooting errors: Missing Invoice Number ŌŚÅ If supplier invoice no. is missing in Tally, you will see error while uploading your data. ŌŚÅ Enter supplier invoice number in Tally & re-upload the file & click on ŌĆ£re-validate buttonŌĆØ

- 24. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 6b. Troubleshooting errors: Item Qty Item is a Service: Here you canŌĆÖt have quantity as ŌĆ£0ŌĆØ. Delete the figure & leave the cell as blank.

- 25. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 7. Here is how your ClearTax Tally Patch works When data is exported from Tally, the patch reads your data such as tax rate, nature of transaction etc in the below order: 1)Tax classification 2)Accounting Ledger 3) Accounting Group 4)Item Ledger 5)Item Group 6)Company Level Which means if any data is missing, in Tax classification screen, patch will read the values mentioned in accounting ledger and so on. For example : In tax classification, if nature of transaction is not mentioned, then it will be picked from accounting ledger. To avoid any confusion enter the correct details in tax classification screen-explained in next slide

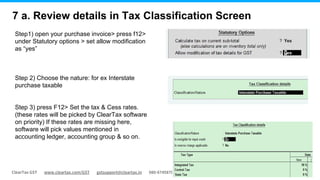

- 26. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 7 a. Review details in Tax Classification Screen Step1) open your purchase invoice> press f12> under Statutory options > set allow modification as ŌĆ£yesŌĆØ Step 2) Choose the nature: for ex Interstate purchase taxable Step 3) press F12> Set the tax & Cess rates. (these rates will be picked by ClearTax software on priority) If these rates are missing here, software will pick values mentioned in accounting ledger, accounting group & so on.

- 27. ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 Thanks for reading! ŌŚÅ Go to www.cleartax.in/GST to file or create bills ŌŚÅ Share this guide and help others ŌŚÅ Read our guides, email or call us for any support