Tally_PPT.pptx

- 1. Introduction of Accounting Accounting:- Accounting is a Process of identifying, recording, summarizing and reporting economic information to decision makers in the form of financial statements.

- 2. Advantages of Accounting ïBy keeping accounting we can understand the profit or loss in a particular time period ïWe can understand the following financial position of business ïAlso we can understand the reasons of profit or loss by keeping accounting.

- 3. Types of Accounts ïPersonal Accounts ïReal Accounts ïNominal Accounts

- 4. Golden Rules of Accounting Golden Rules of Accounting âĒ All the business transactions are recorded on the basis of the following rules. âĒ 1. Personal : The receiver The giver âĒ 2. Real : What comes in What goes out âĒ 3. Nominal : All expenses All incomes and losses and gains.

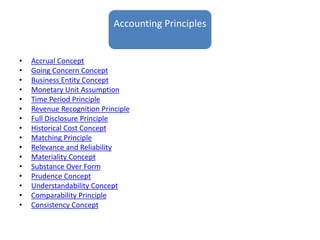

- 6. Accounting Principles âĒ Accrual Concept âĒ Going Concern Concept âĒ Business Entity Concept âĒ Monetary Unit Assumption âĒ Time Period Principle âĒ Revenue Recognition Principle âĒ Full Disclosure Principle âĒ Historical Cost Concept âĒ Matching Principle âĒ Relevance and Reliability âĒ Materiality Concept âĒ Substance Over Form âĒ Prudence Concept âĒ Understandability Concept âĒ Comparability Principle âĒ Consistency Concept

- 8. Introduction to Tally.ERP 9 âĒ Tally ERP 9 is worldâs fastest and most powerful concurrent Multi-lingual business Accounting software. âĒ Tally, designed exclusively to meet the needs of small and medium business, is a fully integrated, affordable and highly reliable software.

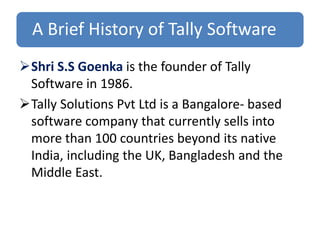

- 9. A Brief History of Tally Software ïShri S.S Goenka is the founder of Tally Software in 1986. ïTally Solutions Pvt Ltd is a Bangalore- based software company that currently sells into more than 100 countries beyond its native India, including the UK, Bangladesh and the Middle East.

- 10. What is ERP âĒ Enterprise Useful resource Planning, also referred to as ERP, is a technique designed to combine a number of different information sources and/or processes into one single unified system.

- 11. Why Tally.ERP9 âĒ Tally is a software company that makes business software. Some of their packages are for accounting, inventory and payroll. âĒ Tally.ERP 9 is a business management software that allows you to activate certain functions that you need at different locations.

- 12. Advantages of Tally.ERP 9 Tally Technology Advantages ïķData Reliability ïķData Security ïķTally Audit ïķTally Vault

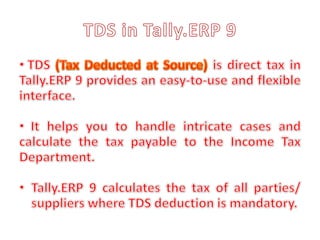

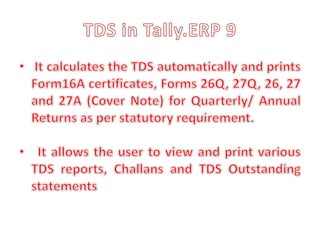

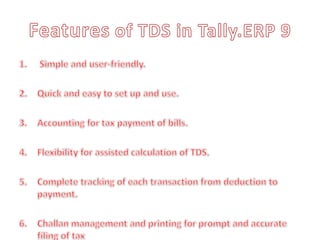

- 13. Features of Tally.ERP9 ïRemote Access ïTally.NET ïSimplified Installation process ïControl Centre ïEnhanced Look and feel ïEnhanced Payroll Compliance ïExcise for Manufactures ïAuditors edition of Tally.ERP9 ïEnhanced Tax Deducted at Source

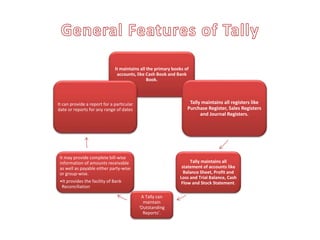

- 14. It maintains all the primary books of accounts, like Cash Book and Bank Book. Tally maintains all registers like Purchase Register, Sales Registers and Journal Registers. Tally maintains all statement of accounts like Balance Sheet, Profit and Loss and Trial Balance, Cash Flow and Stock Statement. A Tally can maintain âOutstanding Reportsâ. It may provide complete bill-wise information of amounts receivable as well as payable either party-wise or group-wise. âĒIt provides the facility of Bank Reconciliation It can provide a report for a particular date or reports for any range of dates

- 19. Budgets in Tally.ERP 9 âĒ Budgeting helps a company to keep a track of how much money it has, where its money is going and allocate those funds at any point in time. A proper budgeting system enables a business to keep a track of its expenditures and use its funds effectively. Hence, business owners can compare revenues and expenses with ease, and more importantly, make better future investments

- 20. Cost Centre & Cost Category in Tally.ERP 9 âĒ The cost centre in Tally.ERP 9 refers to an organizational unit to which costs or expenses can be allocated during transactions while the cost category is used to accumulate costs or profits for parallel sets of cost centres. For example, you can use cost centre to track expenses of each employee while cost category can be used to see the effectiveness of each project. âĒ âĒ To use cost centre in Tally.ERP 9, letâs consider a âSales departmentâ in an organization which has 4 different Salesmen. To record their expenses and incomes

- 21. Job Work In in Tally.ERP 9 âĒ Tally.ERP 9 provides a powerful âJob WorkInâ fe ature that simplifies handling of the Job Work process. Users can now track all Job Worktrans actions and generate reports instantly with all the applicable statutory requirements.

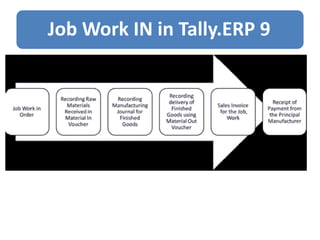

- 22. Job Work IN in Tally.ERP 9

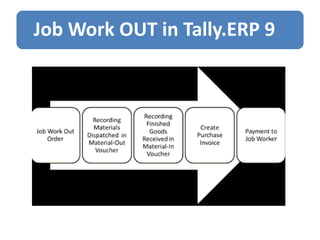

- 23. Job Work OUT in Tally.ERP 9 Tally.ERP9 provides a powerful 'Job Work Outâ feature that simplifies handling the Job Work process. Users can now track all Job Worktransac tions and generate reports instantly with all the applicable statutory requirements. InTally.ERP 9, the process of Job Work Out has the following steps:

- 24. Job Work OUT in Tally.ERP 9

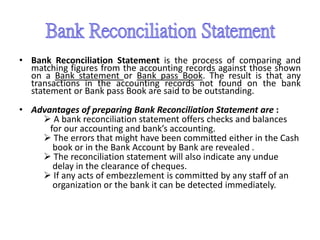

- 25. âĒ Bank Reconciliation Statement is the process of comparing and matching figures from the accounting records against those shown on a Bank statement or Bank pass Book. The result is that any transactions in the accounting records not found on the bank statement or Bank pass Book are said to be outstanding. âĒ Advantages of preparing Bank Reconciliation Statement are : ï A bank reconciliation statement offers checks and balances for our accounting and bankâs accounting. ï The errors that might have been committed either in the Cash book or in the Bank Account by Bank are revealed . ï The reconciliation statement will also indicate any undue delay in the clearance of cheques. ï If any acts of embezzlement is committed by any staff of an organization or the bank it can be detected immediately.

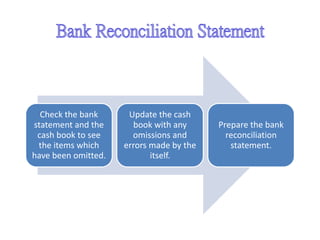

- 26. Check the bank statement and the cash book to see the items which have been omitted. Update the cash book with any omissions and errors made by the itself. Prepare the bank reconciliation statement.

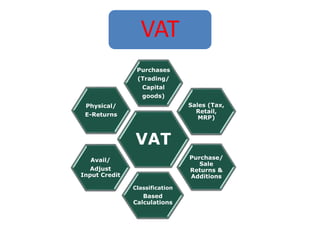

- 33. VAT VAT Purchases (Trading/ Capital goods) Sales (Tax, Retail, MRP) Purchase/ Sale Returns & Additions Classification Based Calculations Avail/ Adjust Input Credit Physical/ E-Returns

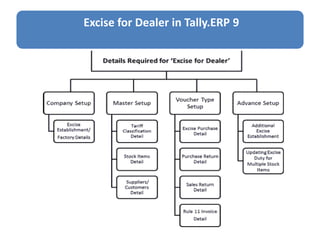

- 34. Excise for Dealer in Tally.ERP 9

- 35. Payroll Bonus & Gratuity Employee Database Leave & Attendance Income Tax Loans & Advances Overtime/P roduction Salary Revision & Increments Professional Tax Employee State Insurance Provident Fund

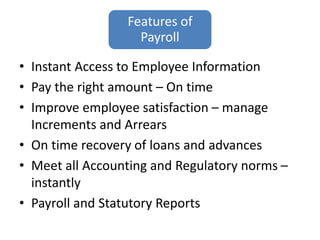

- 36. Features of Payroll âĒ Instant Access to Employee Information âĒ Pay the right amount â On time âĒ Improve employee satisfaction â manage Increments and Arrears âĒ On time recovery of loans and advances âĒ Meet all Accounting and Regulatory norms â instantly âĒ Payroll and Statutory Reports

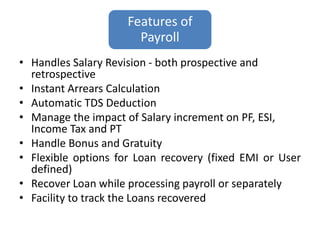

- 37. Features of Payroll âĒ Handles Salary Revision - both prospective and retrospective âĒ Instant Arrears Calculation âĒ Automatic TDS Deduction âĒ Manage the impact of Salary increment on PF, ESI, Income Tax and PT âĒ Handle Bonus and Gratuity âĒ Flexible options for Loan recovery (fixed EMI or User defined) âĒ Recover Loan while processing payroll or separately âĒ Facility to track the Loans recovered

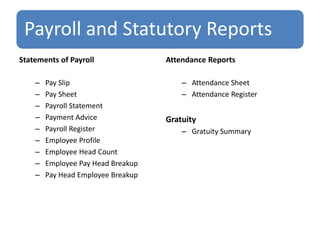

- 38. Payroll and Statutory Reports Statements of Payroll â Pay Slip â Pay Sheet â Payroll Statement â Payment Advice â Payroll Register â Employee Profile â Employee Head Count â Employee Pay Head Breakup â Pay Head Employee Breakup Attendance Reports â Attendance Sheet â Attendance Register Gratuity â Gratuity Summary

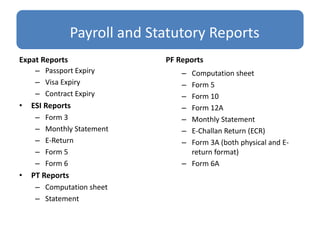

- 39. Payroll and Statutory Reports Expat Reports â Passport Expiry â Visa Expiry â Contract Expiry âĒ ESI Reports â Form 3 â Monthly Statement â E-Return â Form 5 â Form 6 âĒ PT Reports â Computation sheet â Statement PF Reports â Computation sheet â Form 5 â Form 10 â Form 12A â Monthly Statement â E-Challan Return (ECR) â Form 3A (both physical and E- return format) â Form 6A

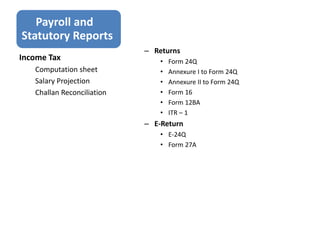

- 40. Payroll and Statutory Reports â Returns âĒ Form 24Q âĒ Annexure I to Form 24Q âĒ Annexure II to Form 24Q âĒ Form 16 âĒ Form 12BA âĒ ITR â 1 â E-Return âĒ E-24Q âĒ Form 27A Income Tax Computation sheet Salary Projection Challan Reconciliation

- 41. Synergy School of Business

Editor's Notes

- #2: Introduction of Accounting