Tarrant Tax Sale - 2017

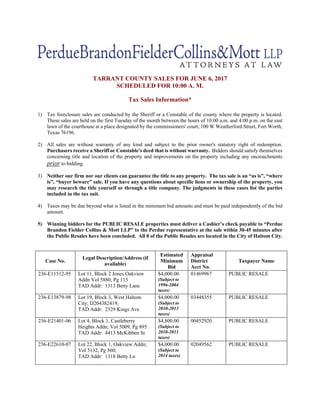

- 1. TARRANT COUNTY SALES FOR JUNE 6, 2017 SCHEDULED FOR 10:00 A. M. Tax Sales Information* 1) Tax foreclosure sales are conducted by the Sheriff or a Constable of the county where the property is located. These sales are held on the first Tuesday of the month between the hours of 10:00 a.m. and 4:00 p.m. on the east lawn of the courthouse at a place designated by the commissioners' court; 100 W Weatherford Street, Fort Worth, Texas 76196. 2) All sales are without warranty of any kind and subject to the prior owner's statutory right of redemption. Purchasers receive a Sheriff or Constable's deed that is without warranty. Bidders should satisfy themselves concerning title and location of the property and improvements on the property including any encroachments prior to bidding. 3) Neither our firm nor our clients can guarantee the title to any property. The tax sale is an âas isâ, âwhere isâ, âbuyer bewareâ sale. If you have any questions about specific liens or ownership of the property, you may research the title yourself or through a title company. The judgments in these cases list the parties included in the tax suit. 4) Taxes may be due beyond what is listed in the minimum bid amounts and must be paid independently of the bid amount. 5) Winning bidders for the PUBLIC RESALE properties must deliver a Cashierâs check payable to âPerdue Brandon Fielder Collins & Mott LLPâ to the Perdue representative at the sale within 30-45 minutes after the Public Resales have been concluded. All 8 of the Public Resales are located in the City of Haltom City. Case No. Legal Description/Address (if available) Estimated Minimum Bid Appraisal District Acct No. Taxpayer Name 236-E11512-95 Lot 11, Block 2 Jones Oakview Addn Vol 5880, Pg 113 TAD Addr: 1313 Betty Lane $4,000.00 (Subject to 1996-2004 taxes) 01469967 PUBLIC RESALE 236-E13879-98 Lot 19, Block 3, West Haltom City; D204382419; TAD Addr: 2329 Kings Ave $4,000.00 (Subject to 2010-2013 taxes) 03448355 PUBLIC RESALE 236-E21401-06 Lot 4, Block 1, Castleberry Heights Addn; Vol 5009, Pg 895 TAD Addr: 4413 McKibben St $4,800.00 (Subject to 2010-2011 taxes) 00452920 PUBLIC RESALE 236-E22610-07 Lot 22, Block 1, Oakview Addn; Vol 5132, Pg 560; TAD Addr: 1318 Betty Ln $4,000.00 (Subject to 2014 taxes) 02049562 PUBLIC RESALE

- 2. Case No. Legal Description/Address (if available) Estimated Minimum Bid Appraisal District Acct No. Taxpayer Name 236-E23884-08 Lot 14, Block 2, Wayne Courts; Vol 7283, Pg 345; TAD Addr: 4424 Wayne Court S $4,000.00 (Subject to 2014 taxes) 03317609 PUBLIC RESALE 236-E24532-08 Lot 12, Block 5, Haltom Acres Addn; Vol 4960, Pg 297; TAD Addr: 3525 Rita Lane $4,800.00 (Subject to 2013 taxes) 01163558 PUBLIC RESALE 236-E26107-10 South 55â of Lot 10A2, Block 2, Fairview Acres Addn; D207242196; TAD Addr: 3308 Aurora St $4,800.00 (Subject to 2013-2014 taxes) 00917877 PUBLIC RESALE 236-L10934-93 Lot 1R, Block 1, Gus Jackson Addn; Vol 388-19, Pg 57; TAD Addr: 3900 Woodlane Ave $4,800.00 (Subject to 1994-2004 taxes) 01444549 PUBLIC RESALE 352-D02517-14 Lot 1, Block 14, Sansom Park Addn, Sansom Park; D211101496; TAD Addr: 5708 Terrace Tr $3,999.00 (Subject to 2016 taxes) 02680637 DRAGON ACQUISITIONS LLC 067-D06992-15 3.38 acres, more or less, known as Tracts 1 and 2, D.B. Bennett Survey, Abst 91 & A.L. Ray Survey Abst 1883; D211143328; TAD Addr: 14300 FM Road 718 $8,470.00 (Subject to 2016 taxes) 03742156 & 04303687 S-2 PROPERTIES, LP 048-E31013-13 Lot 12, Block 5, Benbrook Estates Addn, City of Benbrook; Vol 14181, Pg 510 & Vol 14181, Pg 515; TAD Addr: $24,854.00 (Subject to 2016 taxes) 00191787 NANCY FONDREN 141-l29173-13 Lot 7A J.W. Hawkins Addn, City of Arlington; D190093104; TAD Addr: 6800 Calendar Rd $2,072.00 (Subject to 2016 taxes) 04976509 ROGER & SANDRA SIMONSON * This notice and the materials provided herein are for informational purposes only and do not constitute any legal advice. No reader should rely on, act, or refrain from acting on the basis of any information contained in this notice without seeking their own legal or other professional advice. Perdue, Brandon, Fielder, Collins, & Mott. L.L.P. (âPBFCMâ) DOES NOT WARRANT the quality or completeness of the information provided herein. The information in this notice is not intended to nor does it create any attorney-client relationship between the reader and PBFCM. Useful links: www.TAD.org Tarrant Appraisal District www.tarrantcounty.com /Government/Tax Assessor-Collector FOR ANY QUESTIONS REGARDING THE ITEMS ON THIS LIST, CONTACT OUR OFFICE AT 817-461-3344 OR by email: rpfaffengut@pbfcm.com, or dedwards@pbfcm.com .