Tata Motors DVR An Analysis Abhinay Mohan

- 1. TATA MOTORS DVR AN ANALYSIS Abhinay Mohan PGPM – Sunstone Business School 2012 Batch

- 2. DVR’S?  DVR share is like an ordinary equity share, having fewer voting rights and most of the times having slightly higher economic value as compared to ordinary equity share.

- 3. WHY COMPANIES ISSUE DVR’S?  To fund new large products, without diluting voting rights.

- 4. WHY INVESTORS SHOULD BE INTERESTED IN DVR’S?  Investors who are not concerned about voting rights.  Looking for higher economic value in terms of higher discounts and also incremental dividends.  Normally higher dividends are attached to DVR’s in order to attract investors in lieu of less voting rights.

- 5. DISADVANTAGES WITH DVR’S?  Thin traded scripts.  DVR’s trade at a discount as compared to ordinary shares of the company.

- 6. HISTORICAL EVENTS OF TATA MOTORS DVR?  Tata motors was the first company in India to issue DVR’s in October 2008.  Issue was highly under subscribed, only 34% of the issue was subscribed.  Promoters need to buy major portion of the issue.  After this promoters are regularly reducing their stake in DVR’s by selling these in open market.

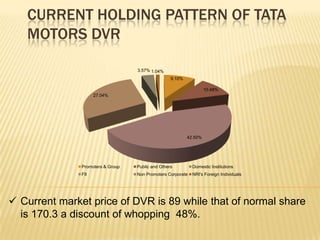

- 7. CURRENT HOLDING PATTERN OF TATA MOTORS DVR 3.57% 1.04% 9.10% 10.48% 27.04% 42.50% Promoters & Group Public and Others Domestic Institutions FII Non Promoters Corporate NRI's Foreign Individuals  Current market price of DVR is 89 while that of normal share is 170.3 a discount of whopping 48%.

- 8. PANTALOON INDIA’S DVR’S CURRENT HOLDING PATTERN 14.60% 9.50% 46.50% 8.10% 21.30% Promoters Public and Others Domestic Institutions FII Non Promoters Corporate  Price of DVR is 146.90 while original shares of Pantaloon is trading at 198.40 a discount of 26%.

- 9. GUJRAT NRE COKE DVR’S CURRENT HOLDING PATTERN 0.70% 13.43% 13.27% 45.92% 0.28% 25.10% Promoters & Group Public and Others Domestic Institutions FII Non Promoters Corporate NRI's Foreign Individuals  Price of DVR is 14.75 while original shares of Gujrat NRE is trading at 18.70 a discount of 21%.

- 10. INTERNATIONAL DVR’S  There are number of companies in International markets who have issued DVR shares.  Google, Berkshire Hathaway (Warren Buffet) are some of the big names to issue DVR’s.  Apart from having differential voting rights, Berkshire is always willing to exchange 30 shares of Class A (DVR) for a single share of Class B (ordinary shares).  This flexibility does not exist in any of our Indian DVR shares

- 11. HISTORICAL TREND OF TATA MOTOR’S DVR PRICES? 450 50.00% 41.89% 22.15% 400 35.79% 31.22% 31.73% 45.00% 39.96% 39.85% 25.34% 45.47% 37.53% 42.34% 42.85% 28.07% 40.00% 350 28.55% 42.09% 44.46% 27.68% 35.00% 300 44.25% 44.59% 30.00% 250 39.06% 35.11% 39.82% 27.53% 43.69% 25.00% 200 46.03% 20.00% 150 15.00% 100 10.00% 50 5.00% 0 0.00% Tata Motors DVR Tata Motors Discount %

- 12. HISTORICAL SHAREHOLDING PATTERN IN TATA MOTORS DVR 120 100 11.75 13.66 13.66 10.68 10.54 14.84 15.56 80 35.37 50.17 50.17 60 70.22 70.56 75.99 75.35 40 52.88 20 36.17 36.17 19.1 18.9 9.17 9.1 0 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Promoter & Group Institution Non-Institution

- 13. HISTORICAL TREND OF PANTALOON INDIA’S DVR PRICES? 1000 50.00% 900 45.00% 800 40.00% 700 35.00% 600 30.00% 500 25.00% 400 20.00% 300 15.00% 200 10.00% 100 5.00% 0 0.00% Pantaloon Retail DVR Pantaloon Retail Discount %

- 14. HISTORICAL TREND OF GUJRAT NRE COKE’S DVR PRICES? 70 60.00% 60 50.00% 50 40.00% 40 30.00% 30 20.00% 20 10.00% 10 0 0.00% GUJNREDVR(Rs.) GUJNRECOKE(Rs.) Discount %

- 15. IMPORTANT EVENTS TRIGGERING CHANGES IN TATA MOTOR’S DVR PRICES? Booking-building by Tata Sons, thorugh this promoters wanted to offload DVR’s in the market and that too to big institutions who will hold the stock for long. Consistent selling by large DVR holders, IFCI and Tata Steel. In Jun 2010 quarter Institutions increased their share from 35% to 50% discount rose from 31% to 37%. In Dec 2010 quarter Institutions increased their share from 50% to 70% discount rose from 30% to 39%. In Jun 2011 quarter Institutions increased their share from 70% to 75% discount rose from 44% to 45%.

- 16. CONCLUSION DVR’s follows trends of ordinary share prices. There is a discount between normal shares and DVR’s due to various reasons like Lack of awareness, hesitation by investor and low liquidity. Prices of DVR depends upon individual demand and supply scenario in the market. Discount in Tata Motors DVR widens when sustained institutional buying is there in limited period of time. This discount narrows when buying is reduced. So conclusion is Buy Tata Motors DVR if you want to invest in Tata Motors. There is no certainty of time when the discount between normal and DVR shares will reduce. There is no sure shot way to tell the time period in which liquidity of DVR

Editor's Notes

- #11: Whenever 30 shares of class A are cheaper than a single share of class B, there is an opportunity to profit from. Under these circumstances arbitrageurs sell Class A shares and buy Class B shares. This buying and selling by investors results in maintaining a fixed price ratio between the two classes of shares.

- #16: expects to restrict the supply of DVRs to a few large investors who would stay invested for sometime. This will in turn prevent the depreciation in prices of DVR’s

- #17: expects to restrict the supply of DVRs to a few large investors who would stay invested for sometime. This will in turn prevent the depreciation in prices of DVR’s