Tax

- 1. PRESENTATION TOPIC TAX AVOIDANCE AND TAX EVASION SUBMMITED TO:-> Dr.Kamal Pant SUBMMITED BY:-> Amir Alam [MBA-IB&Finance]

- 2. The line of demarcation between tax planning and tax avoidance is very thin and blurred. The English courts about eight decades ago recognized the right of a taxpayer to resort to the legal method of tax avoidance. It is well-settled that it is unconstitutional for the Government to attempt tax collection without the authority of law or legal basis.

- 3. *Legitimate arrangement of affairs in such a way so as to minimize tax liability. *Avoidance of tax is not tax evasion and carries no public disgrace with it. *there is no element of mala fide motive involved in tax avoidance .

- 4. All methods by which tax liability is illegally avoided are termed as tax evasion. An assessee guilty the of tax evasion may be punished under the relevant laws. Tax evasion may involve stating an untrue statement knowingly , submitted misleading documents, omission of facts, not maintaining proper accounts of income earned (if required under law), omission of material facts on assessment. All such procedures and method are required by the statute to be abided with but the assessee who dishonestly claims the benefit under the statute before complying with the said abidance by making false statement, would be within the ambit of tax evasion.

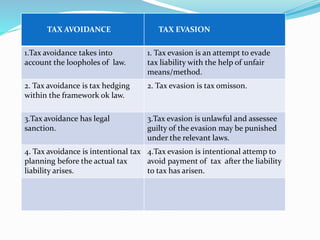

- 5. TAX AVOIDANCE TAX EVASION 1.Tax avoidance takes into account the loopholes of law. 1. Tax evasion is an attempt to evade tax liability with the help of unfair means/method. 2. Tax avoidance is tax hedging within the framework ok law. 2. Tax evasion is tax omisson. 3.Tax avoidance has legal sanction. 3.Tax evasion is unlawful and assessee guilty of the evasion may be punished under the relevant laws. 4. Tax avoidance is intentional tax planning before the actual tax liability arises. 4.Tax evasion is intentional attemp to avoid payment of tax after the liability to tax has arisen.

- 6. THANK YOU

![PRESENTATION TOPIC

TAX AVOIDANCE AND TAX EVASION

SUBMMITED TO:->

Dr.Kamal Pant

SUBMMITED BY:->

Amir Alam [MBA-IB&Finance]](https://image.slidesharecdn.com/tax-141121094114-conversion-gate02/85/Tax-1-320.jpg)