Tax heaven

Download as PPTX, PDF1 like2,538 views

This document defines a tax haven as a country that levies low or no taxes while maintaining good governance. It lists various countries and territories considered tax havens in Europe, the Caribbean, Africa, and the Pacific Rim. It then discusses the OECD (Organisation for Economic Co-operation and Development) model, which seeks improved transparency and exchange of information between countries through cooperation rather than tax rate harmonization or impinging on national sovereignty. The OECD has initiated approaches to address harmful tax practices and improve access to bank information.

1 of 6

Downloaded 102 times

Recommended

Tax haven : Problems and Solutions

Tax haven : Problems and SolutionsBismay Mishra

Ėý

This seminar discusses tax havens and their problems and potential solutions. It begins by defining tax havens as countries that offer little to no tax liability and financial transparency to attract foreign businesses and individuals. It then lists several well-known tax havens and notes that some have signed agreements to provide more financial information to foreign governments. The presentation outlines the factors used to rank jurisdictions on the Financial Secrecy Index, and provides the top 10 rankings. It then discusses problems caused by tax havens, such as depriving governments of revenue, enabling criminal activity, and increasing inequality. Potential solutions proposed include country-by-country reporting of multinational taxes, unitary taxation, automatic information exchange, public registers of company owners, andTax Havens , Major Tax Havens around the world.

Tax Havens , Major Tax Havens around the world.JASEEM LAL

Ėý

What is a Tax Haven

OECD Criteria for a Tax Haven

Characteristics of a Tax Haven

Uses of a Tax Haven

Legal entities in a Tax Haven

Major Tax Havens around the world

Types of Tax Havens

Examples: Types of Tax Havens

# Cayman Islands

Effects of Tax Havens

Four Reasons Of Tax Havens Are Good

The response of Governments

OECD objectives

Is there a future for Tax HavensTax havens

Tax havensComitÃĐ Estrategico de Nuevo LeÃģn

Ėý

Tax havens are countries that offer low or no tax rates to foreign individuals and businesses in order to attract capital. They provide secrecy and flexibility in business regulations. Many multinational corporations and wealthy individuals use tax havens to avoid paying taxes in their home countries by routing profits through shell companies in havens. This reduces government tax revenues and allows corporations and individuals to escape legal accountability. Critics argue tax havens exacerbate inequality and financial instability, while supporters view them as legitimate tools for business competitiveness and individual choice.ICAI - Presentation on Tax Havens - 29.04.2012

ICAI - Presentation on Tax Havens - 29.04.2012P P Shah & Associates

Ėý

This document provides an overview of tax havens, including definitions, criteria, characteristics, types, examples, effects, and approaches taken by governments and organizations like the OECD. It discusses what constitutes a tax haven according to the OECD and other sources. It outlines the major tax haven locations around the world and different types of tax havens. It also summarizes the responses by governments and regulatory bodies to promote transparency and exchange of information between jurisdictions.Eurobonds

EurobondsStudsPlanet.com

Ėý

Eurobonds are international bonds that are underwritten by multinational banks and placed in countries other than where the currency is from. Around 75% are denominated in US dollars. Companies issuing Eurobonds pay slightly lower interest than domestic US bonds. The main advantages are increased liquidity, protection from market shocks, guaranteed funding for EU countries and improvement of the euro internationally. The main disadvantages are possible free-riding, tensions with the no-bailout clause, and questions around credibility and politics. The Eurobond market has grown since 2001 as the euro became more important internationally for investors and issuers.Foreign institutional investor

Foreign institutional investorPooja Meena

Ėý

Foreign investors were first allowed to invest in India's stock market in September 1992. Since 1993, foreign institutional investors can make portfolio investments in Indian equities through foreign institutional investment. To trade in the Indian equity market, foreign corporations must register as a Foreign Institutional Investor (FII) with SEBI. FIIs refer to outside companies investing in India's financial markets and can include pension funds, mutual funds, investment trusts, insurance companies, and asset management firms. SEBI decides FII applicants' eligibility based on factors like their track record, competence, financial soundness, experience, and reputation for fairness. The key difference between FDI and FII is that FDI involves control and long-term direct investment while FIIWorld bank & imf

World bank & imfSyeda Tariq

Ėý

The document summarizes the purpose and history of the World Bank and IMF. The World Bank provides low-interest loans and grants to developing countries for projects to reduce poverty, while the IMF provides short-term loans to countries facing currency crises. Both were created at Bretton Woods in 1944 to help rebuild Europe after WWII. While the World Bank lends for development projects, the IMF aims to stabilize global economies and prevent financial crises. The document also discusses the large external debts Pakistan has accumulated from World Bank and IMF loans and how this has negatively impacted the country's economy.Asian financial crisis 1997 theme 2

Asian financial crisis 1997 theme 2saakshi1992

Ėý

The Asian Financial Crisis began in Thailand in 1997 and spread to other Asian countries. Countries had high debt levels, currency pressures, and collapsed asset prices as foreign capital rapidly pulled out. Thailand, Indonesia, South Korea, and other Southeast Asian countries were most affected. The IMF intervened and provided bailout loans with conditions of austerity measures, which some argue exacerbated recessions. While some countries recovered, the crisis highlighted the risks of heavy reliance on foreign capital inflows and foreign debt.Euro Pros And Cons

Euro Pros And Consrsoosaar

Ėý

The document summarizes information about the euro currency, including that it was launched in 1999 and adopted by 16 EU countries totaling 329 million citizens. It lists the eurozone countries and years they adopted the euro. Details are provided about euro coins and banknotes. Reasons for adopting the euro include ensuring stable economic growth and controlling inflation. Adopting the euro makes travel easier and decreases currency exchange costs for businesses. Estonia is considering adopting the euro to boost economic confidence and protect savings from currency devaluation.Stock Market in Sri Lanka

Stock Market in Sri Lankankaushik

Ėý

The document summarizes the stock market in Sri Lanka, including the Colombo Stock Exchange (CSE) which operates the market. As of 2013, the CSE had 287 listed companies across 20 sectors with a total market capitalization of over $18.5 billion, about 1/3 of Sri Lanka's GDP. The CSE uses indices like the All Share Price Index and S&P Sri Lanka 20 Index to track market performance. The CSE aims to further grow the equity market by listing more companies and increasing free floats to broaden market participation.Government influence on exchange rate

Government influence on exchange rateManas Saha

Ėý

1) The document discusses various exchange rate systems such as fixed rates, floating rates, managed floats, and pegged rates. It also discusses currency boards and the exposure of pegged currencies.

2) It describes the European single currency, including participating countries, its impact on monetary policy and business, and its status.

3) The document outlines how governments can directly and indirectly intervene in currency markets and discusses intervention as a policy tool to influence economic outcomes. It also discusses how central bank intervention can affect the value of multinational corporations.Sebi & Mutual Funds

Sebi & Mutual FundsPriaVishwakarma

Ėý

Mutual funds pool money from investors and invest it in a portfolio of securities like stocks, bonds and money market instruments. The document provides an overview of mutual funds in India including their definition, benefits, types, risks, regulations and more. It discusses the key entities involved like SEBI, sponsors, trustees, asset management companies and more. It also summarizes the various guidelines and regulations around mutual funds as per SEBI.Money market and capital market

Money market and capital marketmatin nazari

Ėý

a slide of money market and capital market for ma economics students written by abdul matin nazari and it is for free and it will be.Stock(Share) Market

Stock(Share) MarketAshish Chandak

Ėý

The document discusses key concepts related to stock markets and shares. It defines that shares represent fractional ownership of a company and stocks refer to the total number of shares a person owns. The major stock exchanges in India are BSE and NSE. A stock market allows for trading of company shares and derivatives. It functions as an important source for companies to raise capital and for public trading of companies. Stockholders are individuals or entities that own company shares and have associated rights.Interest rates and currency swaps

Interest rates and currency swapsStudsPlanet.com

Ėý

This chapter discusses interest rate swaps and currency swaps. Interest rate swaps involve the exchange of interest rate payment obligations on a set notional principal between two counterparties, while currency swaps involve the exchange of principal and interest rate payment obligations in different currencies. The size of the global swap market is substantial, with over $127 trillion in notional principal outstanding for interest rate swaps and over $7 trillion for currency swaps as of mid-2004. The chapter covers the role of swap banks, how swaps are quoted in the market, the mechanics of interest rate and currency swaps, and risks involved in swap transactions.mutual funds of pakistan

mutual funds of pakistanChandni Saleem

Ėý

Mutual funds in Pakistan are registered as trusts under the Trust Act of 1882 and regulated by the Securities and Exchange Commission of Pakistan (SECP). Mutual funds were first introduced in Pakistan in 1962 with the public offering of the National Investment Trust. There are two main types of mutual funds in Pakistan - open-end funds and close-end funds. Open-end funds issue redeemable units, while close-end funds issue shares that are listed and trade on stock exchanges. The mutual fund industry in Pakistan is overseen by the Mutual Funds Association of Pakistan (MUFAP), which works to promote transparency, ethics and growth in the asset management industry.Foreign Exchange Risk

Foreign Exchange RiskRohitKumarUpadhyay3

Ėý

Foreign exchange risk arises when companies or individuals engage in transactions denominated in foreign currencies. There are three main types of foreign exchange risk: transaction risk, translation risk, and economic risk. Exchange rate fluctuations, market volatility, and political/economic factors affect foreign exchange risk. Companies can mitigate this risk through hedging strategies like forwards, options, and futures contracts, diversifying currency exposure, and using financial derivatives. The case study of Toyota highlights how currency movements impacted its profits and how it employs hedging to offset foreign exchange risk. Understanding and managing this risk is important for multinational companies.Stock broking

Stock brokingVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

Ėý

A stock broker is required to register with SEBI and be a member of a recognized stock exchange in order to buy, sell, or deal in securities. They must abide by the rules and regulations of the exchange, pay fees, and address investor complaints. Registration requires application through a stock exchange, which forwards the application to SEBI. SEBI verifies eligibility requirements prior to granting registration. Registered stock brokers must follow capital adequacy norms, codes of conduct, and are subject to inspection and penalties for non-compliance. The National Stock Exchange was established to provide a nationwide trading facility and screen-based trading system for securities including equities, debt instruments, and derivatives.Recent changes in ifm

Recent changes in ifmN A M COLLEGE KALLIKKANDY

Ėý

The document discusses recent changes in international financial markets over the past few decades. It notes the liberalization and deregulation of cross-border financial transactions, leading to integration and globalization of previously separate markets. New financial instruments and the rise of derivatives markets have increased complexity and speculation. While greater access to capital has benefits, it has also increased risks and volatility in markets.London stock exchange

London stock exchangeAugustine Micahel

Ėý

The London Stock Exchange is located in London, UK and was founded in 1801. It began as brokers and dealers congregating in coffee houses to trade shares and has grown to be one of the largest stock exchanges in the world. The London Stock Exchange has two main markets - the premium listed Main Market that caters to large companies, and the Alternative Investment Market for smaller companies. It lists over 3,000 companies and has a total market capitalization in excess of $10 trillion making it the largest stock exchange in Europe.Colombo Stock Exchange - A Basic Guide to Investing in Shares

Colombo Stock Exchange - A Basic Guide to Investing in SharesWasantha Perera

Ėý

The document provides information about the Colombo Stock Exchange (CSE) in Sri Lanka. It discusses that the CSE operates the only share market in Sri Lanka and is responsible for providing a regulated environment for companies and investors. It also briefly outlines the history of stock trading in Sri Lanka dating back to 1896, and discusses the establishment of the CSE as a formal stock exchange in 1985. The document then provides details about the types of companies and securities listed on the CSE, as well as the key indices and methods for disseminating market data and information.Offshore financial centre and international banks (ppt)

Offshore financial centre and international banks (ppt)akanksha007

Ėý

Offshore financial centres specialize in providing corporate and commercial services to non-residents through offshore companies and investment funds. Panama and the Isle of Man are examples of offshore centres, with Panama having liberal tax laws and the Isle of Man exempting non-resident owned companies from income taxes. Leading international banks that operate in offshore centres include HSBC, Standard Chartered Bank, American Express Bank, and Deutsche Bank, providing services like loans, investment products, foreign exchange, and deposits globally.Corporate Governance under Companies Act, 2017 of Pakistan

Corporate Governance under Companies Act, 2017 of PakistanSayyid Mansoob Hasan

Ėý

The document discusses corporate governance under the Companies Act, 2017 in Pakistan. It defines corporate governance and outlines reasons for its importance, including corporate corruption cases and safeguarding public money. It describes Pakistan's corporate governance mechanisms including the Companies Act, Code of Corporate Governance, and Listed Companies Regulations. It also discusses types of companies, statutory officers like directors, CEO, CFO, and committees including the audit committee.Transaction exposure 1

Transaction exposure 1jpsir

Ėý

- The document discusses transaction exposure (TE), which is the risk from changes in exchange rates for contracts that have been agreed to but not yet settled.

- It describes various ways to manage TE, including through forward contracts, money market hedges, options, and swaps. It also discusses operational techniques like invoice currency choice and exposure netting.

- Examples are provided to illustrate comparing forward contracts to money market hedges for an exporter receiving foreign currency and an importer paying foreign currency. The more advantageous hedge depends on interest rate differences.Foreign exchange risk

Foreign exchange riskLijo Stalin

Ėý

This document discusses foreign exchange risk and its management. It defines foreign exchange risk as the risk of an investment's value changing due to currency fluctuations. It identifies the main types of foreign exchange risk as transaction risk, translation risk, and economic risk. Transaction risk arises from currency movements between the signing and execution of contracts. Translation risk occurs when consolidating financial statements in different currencies. Economic risk affects the long-term expected profits and wealth of a company due to currency changes. The document outlines various hedging strategies to manage these risks, including the use of forwards, futures, and money markets.Foreign direct investment

Foreign direct investmentJubayer Alam Shoikat

Ėý

foreign direct investment

,

the direction of fdi

,

the source of fdi

,

why foreign direct investment

,

the form of fdi: acquisitions

versus greenfield i

,

foreign direct investment

in the world economy

,

trends in fdi

,

theories of foreign direct investment

,

the radical view

,

benefits and costs of fdiSecurities & Exchange commission of Pakistan (SECP)

Securities & Exchange commission of Pakistan (SECP)IRFAN UR REHMAN

Ėý

This power point file contains the details of Securities & Exchange Commission of Pakistan (SECP), Its brief history, functions and objectives, organizational structure, process of registering a private company and divisions.

It also shows the types of companies at the end.

With Reference as: -

https://www.secp.gov.pk/ FTA Economics Presentation

FTA Economics Presentationjisunfoo

Ėý

A free trade area is a group of countries that have signed an agreement to reduce or eliminate tariffs and quotas between member countries. This allows nations to specialize in goods they are comparatively efficient at producing, increasing overall efficiency and profits. Free trade agreements further reduce trade barriers and create more stable markets. Examples include NAFTA, ASEAN, and the European Union. The ASEAN Free Trade Area agreement aims to increase ASEAN's competitiveness and attract foreign investment by expanding intra-regional trade through tariff reductions. This has led to increased trade, investment, and economic growth among member nations.AP Automation: The Competitive Advantage Your Business Needs

AP Automation: The Competitive Advantage Your Business NeedsAggregage

Ėý

https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.Accounting Strategies for Businesses with Dak Gilinsky

Accounting Strategies for Businesses with Dak GilinskyDak Gilinsky

Ėý

Dak Gilinsky provides expert guidance on managing business finances, bookkeeping, and tax compliance. Learn essential accounting strategies to improve financial transparency, reduce errors, and optimize profitability. Whether you're a startup or an established company, these insights will help you stay financially organized and compliant.More Related Content

What's hot (20)

Euro Pros And Cons

Euro Pros And Consrsoosaar

Ėý

The document summarizes information about the euro currency, including that it was launched in 1999 and adopted by 16 EU countries totaling 329 million citizens. It lists the eurozone countries and years they adopted the euro. Details are provided about euro coins and banknotes. Reasons for adopting the euro include ensuring stable economic growth and controlling inflation. Adopting the euro makes travel easier and decreases currency exchange costs for businesses. Estonia is considering adopting the euro to boost economic confidence and protect savings from currency devaluation.Stock Market in Sri Lanka

Stock Market in Sri Lankankaushik

Ėý

The document summarizes the stock market in Sri Lanka, including the Colombo Stock Exchange (CSE) which operates the market. As of 2013, the CSE had 287 listed companies across 20 sectors with a total market capitalization of over $18.5 billion, about 1/3 of Sri Lanka's GDP. The CSE uses indices like the All Share Price Index and S&P Sri Lanka 20 Index to track market performance. The CSE aims to further grow the equity market by listing more companies and increasing free floats to broaden market participation.Government influence on exchange rate

Government influence on exchange rateManas Saha

Ėý

1) The document discusses various exchange rate systems such as fixed rates, floating rates, managed floats, and pegged rates. It also discusses currency boards and the exposure of pegged currencies.

2) It describes the European single currency, including participating countries, its impact on monetary policy and business, and its status.

3) The document outlines how governments can directly and indirectly intervene in currency markets and discusses intervention as a policy tool to influence economic outcomes. It also discusses how central bank intervention can affect the value of multinational corporations.Sebi & Mutual Funds

Sebi & Mutual FundsPriaVishwakarma

Ėý

Mutual funds pool money from investors and invest it in a portfolio of securities like stocks, bonds and money market instruments. The document provides an overview of mutual funds in India including their definition, benefits, types, risks, regulations and more. It discusses the key entities involved like SEBI, sponsors, trustees, asset management companies and more. It also summarizes the various guidelines and regulations around mutual funds as per SEBI.Money market and capital market

Money market and capital marketmatin nazari

Ėý

a slide of money market and capital market for ma economics students written by abdul matin nazari and it is for free and it will be.Stock(Share) Market

Stock(Share) MarketAshish Chandak

Ėý

The document discusses key concepts related to stock markets and shares. It defines that shares represent fractional ownership of a company and stocks refer to the total number of shares a person owns. The major stock exchanges in India are BSE and NSE. A stock market allows for trading of company shares and derivatives. It functions as an important source for companies to raise capital and for public trading of companies. Stockholders are individuals or entities that own company shares and have associated rights.Interest rates and currency swaps

Interest rates and currency swapsStudsPlanet.com

Ėý

This chapter discusses interest rate swaps and currency swaps. Interest rate swaps involve the exchange of interest rate payment obligations on a set notional principal between two counterparties, while currency swaps involve the exchange of principal and interest rate payment obligations in different currencies. The size of the global swap market is substantial, with over $127 trillion in notional principal outstanding for interest rate swaps and over $7 trillion for currency swaps as of mid-2004. The chapter covers the role of swap banks, how swaps are quoted in the market, the mechanics of interest rate and currency swaps, and risks involved in swap transactions.mutual funds of pakistan

mutual funds of pakistanChandni Saleem

Ėý

Mutual funds in Pakistan are registered as trusts under the Trust Act of 1882 and regulated by the Securities and Exchange Commission of Pakistan (SECP). Mutual funds were first introduced in Pakistan in 1962 with the public offering of the National Investment Trust. There are two main types of mutual funds in Pakistan - open-end funds and close-end funds. Open-end funds issue redeemable units, while close-end funds issue shares that are listed and trade on stock exchanges. The mutual fund industry in Pakistan is overseen by the Mutual Funds Association of Pakistan (MUFAP), which works to promote transparency, ethics and growth in the asset management industry.Foreign Exchange Risk

Foreign Exchange RiskRohitKumarUpadhyay3

Ėý

Foreign exchange risk arises when companies or individuals engage in transactions denominated in foreign currencies. There are three main types of foreign exchange risk: transaction risk, translation risk, and economic risk. Exchange rate fluctuations, market volatility, and political/economic factors affect foreign exchange risk. Companies can mitigate this risk through hedging strategies like forwards, options, and futures contracts, diversifying currency exposure, and using financial derivatives. The case study of Toyota highlights how currency movements impacted its profits and how it employs hedging to offset foreign exchange risk. Understanding and managing this risk is important for multinational companies.Stock broking

Stock brokingVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

Ėý

A stock broker is required to register with SEBI and be a member of a recognized stock exchange in order to buy, sell, or deal in securities. They must abide by the rules and regulations of the exchange, pay fees, and address investor complaints. Registration requires application through a stock exchange, which forwards the application to SEBI. SEBI verifies eligibility requirements prior to granting registration. Registered stock brokers must follow capital adequacy norms, codes of conduct, and are subject to inspection and penalties for non-compliance. The National Stock Exchange was established to provide a nationwide trading facility and screen-based trading system for securities including equities, debt instruments, and derivatives.Recent changes in ifm

Recent changes in ifmN A M COLLEGE KALLIKKANDY

Ėý

The document discusses recent changes in international financial markets over the past few decades. It notes the liberalization and deregulation of cross-border financial transactions, leading to integration and globalization of previously separate markets. New financial instruments and the rise of derivatives markets have increased complexity and speculation. While greater access to capital has benefits, it has also increased risks and volatility in markets.London stock exchange

London stock exchangeAugustine Micahel

Ėý

The London Stock Exchange is located in London, UK and was founded in 1801. It began as brokers and dealers congregating in coffee houses to trade shares and has grown to be one of the largest stock exchanges in the world. The London Stock Exchange has two main markets - the premium listed Main Market that caters to large companies, and the Alternative Investment Market for smaller companies. It lists over 3,000 companies and has a total market capitalization in excess of $10 trillion making it the largest stock exchange in Europe.Colombo Stock Exchange - A Basic Guide to Investing in Shares

Colombo Stock Exchange - A Basic Guide to Investing in SharesWasantha Perera

Ėý

The document provides information about the Colombo Stock Exchange (CSE) in Sri Lanka. It discusses that the CSE operates the only share market in Sri Lanka and is responsible for providing a regulated environment for companies and investors. It also briefly outlines the history of stock trading in Sri Lanka dating back to 1896, and discusses the establishment of the CSE as a formal stock exchange in 1985. The document then provides details about the types of companies and securities listed on the CSE, as well as the key indices and methods for disseminating market data and information.Offshore financial centre and international banks (ppt)

Offshore financial centre and international banks (ppt)akanksha007

Ėý

Offshore financial centres specialize in providing corporate and commercial services to non-residents through offshore companies and investment funds. Panama and the Isle of Man are examples of offshore centres, with Panama having liberal tax laws and the Isle of Man exempting non-resident owned companies from income taxes. Leading international banks that operate in offshore centres include HSBC, Standard Chartered Bank, American Express Bank, and Deutsche Bank, providing services like loans, investment products, foreign exchange, and deposits globally.Corporate Governance under Companies Act, 2017 of Pakistan

Corporate Governance under Companies Act, 2017 of PakistanSayyid Mansoob Hasan

Ėý

The document discusses corporate governance under the Companies Act, 2017 in Pakistan. It defines corporate governance and outlines reasons for its importance, including corporate corruption cases and safeguarding public money. It describes Pakistan's corporate governance mechanisms including the Companies Act, Code of Corporate Governance, and Listed Companies Regulations. It also discusses types of companies, statutory officers like directors, CEO, CFO, and committees including the audit committee.Transaction exposure 1

Transaction exposure 1jpsir

Ėý

- The document discusses transaction exposure (TE), which is the risk from changes in exchange rates for contracts that have been agreed to but not yet settled.

- It describes various ways to manage TE, including through forward contracts, money market hedges, options, and swaps. It also discusses operational techniques like invoice currency choice and exposure netting.

- Examples are provided to illustrate comparing forward contracts to money market hedges for an exporter receiving foreign currency and an importer paying foreign currency. The more advantageous hedge depends on interest rate differences.Foreign exchange risk

Foreign exchange riskLijo Stalin

Ėý

This document discusses foreign exchange risk and its management. It defines foreign exchange risk as the risk of an investment's value changing due to currency fluctuations. It identifies the main types of foreign exchange risk as transaction risk, translation risk, and economic risk. Transaction risk arises from currency movements between the signing and execution of contracts. Translation risk occurs when consolidating financial statements in different currencies. Economic risk affects the long-term expected profits and wealth of a company due to currency changes. The document outlines various hedging strategies to manage these risks, including the use of forwards, futures, and money markets.Foreign direct investment

Foreign direct investmentJubayer Alam Shoikat

Ėý

foreign direct investment

,

the direction of fdi

,

the source of fdi

,

why foreign direct investment

,

the form of fdi: acquisitions

versus greenfield i

,

foreign direct investment

in the world economy

,

trends in fdi

,

theories of foreign direct investment

,

the radical view

,

benefits and costs of fdiSecurities & Exchange commission of Pakistan (SECP)

Securities & Exchange commission of Pakistan (SECP)IRFAN UR REHMAN

Ėý

This power point file contains the details of Securities & Exchange Commission of Pakistan (SECP), Its brief history, functions and objectives, organizational structure, process of registering a private company and divisions.

It also shows the types of companies at the end.

With Reference as: -

https://www.secp.gov.pk/ FTA Economics Presentation

FTA Economics Presentationjisunfoo

Ėý

A free trade area is a group of countries that have signed an agreement to reduce or eliminate tariffs and quotas between member countries. This allows nations to specialize in goods they are comparatively efficient at producing, increasing overall efficiency and profits. Free trade agreements further reduce trade barriers and create more stable markets. Examples include NAFTA, ASEAN, and the European Union. The ASEAN Free Trade Area agreement aims to increase ASEAN's competitiveness and attract foreign investment by expanding intra-regional trade through tariff reductions. This has led to increased trade, investment, and economic growth among member nations.Recently uploaded (20)

AP Automation: The Competitive Advantage Your Business Needs

AP Automation: The Competitive Advantage Your Business NeedsAggregage

Ėý

https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.Accounting Strategies for Businesses with Dak Gilinsky

Accounting Strategies for Businesses with Dak GilinskyDak Gilinsky

Ėý

Dak Gilinsky provides expert guidance on managing business finances, bookkeeping, and tax compliance. Learn essential accounting strategies to improve financial transparency, reduce errors, and optimize profitability. Whether you're a startup or an established company, these insights will help you stay financially organized and compliant.HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERY

HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERYraclawwysocki2

Ėý

ĖýĖýMy name is Raclaw Wysocki, a real estate investor from Warszawa, Poland. Last year, I invested in cryptocurrency, hoping to double my investment by the start of the new year. However, I soon discovered that I had fallen victim to a scam. It was a devastating experience for me and my family, and without iFORCE HACKER RECOVERY, I wouldnât have been able to recover my funds.ĖýiFORCE HACKER RECOVERY is a leading cryptocurrency and data recovery company specializing in retrieving lost crypto assets from hackers and fraudulent investment brokers. Thanks to their expertise, I successfully recovered $950,000 worth of crypto. I highly recommend their services. They are trustworthy, reliable, and have a proven 100% success rate.

Website; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. comĖý

Call/whatsapp +1 240 (80) (33) 706Ėý Ėý Ėý

Women Economy The presentation, Breaking the Silence: The Untapped Potential ...

Women Economy The presentation, Breaking the Silence: The Untapped Potential ...snehadeeproy085

Ėý

The presentation, *Breaking the Silence: The Untapped Potential of Educated Women in the Economy*, explores the disparity between women's education and workforce participation. Despite significant progress in women's education, many educated women remain outside the workforce, which not only impacts their personal growth but also limits economic productivity. The introduction highlights how this gap affects national economies, emphasizing the need for urgent intervention. The presentation then examines the current scenario with global and national statistics, using visual aids such as bar charts to illustrate the stark differences in workforce participation between men and women.

A major section of the presentation is dedicated to understanding why educated women are not actively participating in the workforce. Social and cultural barriers, such as traditional gender roles, societal expectations, and family pressures, often discourage women from pursuing careers. Workplace challenges, including gender discrimination, wage gaps, and the lack of flexible work arrangements, further hinder their participation. Economic and policy-related factors, such as insufficient maternity leave policies, lack of childcare support, and the undervaluation of unpaid labor, also contribute to this issue. A pie chart highlights the most common barriers, with family responsibilities emerging as the biggest obstacle, followed by workplace discrimination and the wage gap.

The economic cost of women's exclusion from the workforce is another key focus. The presentation discusses how lower female workforce participation results in reduced productivity and slower economic growth. According to a report by McKinsey Global Institute, closing the gender gap in the workforce could add $28 trillion to global GDP by 2025. Additionally, industries suffering from a shortage of skilled workers continue to overlook a large pool of educated women, leading to talent waste. The social impact of economic exclusion is also significant, as financial dependency increases gender inequality and contributes to higher poverty rates in societies with lower female workforce participation. A graph comparing female workforce participation and GDP growth across different countries demonstrates that nations with higher female employment tend to have stronger economic stability.

To address these issues, the presentation proposes several solutions. Government policies such as stronger maternity and childcare support, enforcement of equal pay laws, and skill development programs can help bridge the gap. Corporate initiatives, including flexible work policies, diversity programs, and mentorship opportunities, can create a more inclusive work environment. Societal changes, such as redefining gender roles, encouraging women entrepreneurs, and raising awareness through education and media, are also essential to breaking long-standing barriers. Another bar graph illustrates how increased female workANALYSIS AND PRESENTATION OF SAUSAGE SUPPLY CHAIN SHINSHU NT LIMITED

ANALYSIS AND PRESENTATION OF SAUSAGE SUPPLY CHAIN SHINSHU NT LIMITEDlamluanvan.net Viášŋt thuÊ luášn vÄn

Ėý

Luášn VÄn Group háŧ tráŧĢ viášŋt luášn vÄn thᚥc sÄĐ, chuyÊn Äáŧ, khÃģa luášn táŧt nghiáŧp, bÃĄo cÃĄo tháŧąc tášp, Assignment, Essay

Zalo/Sdt 0886 091 915/0967 538 624 Website:lamluanvan.net

Tham gia nhÃģm háŧ tráŧĢ viášŋt bà i fb: https://www.facebook.com/groups/285625754522599?locale=vi_VNPearson's Chi-square Test for Research Analysis

Pearson's Chi-square Test for Research AnalysisYuli Paul

Ėý

The Chi-Square test is a powerful statistical tool used to analyze categorical data by comparing observed and expected frequencies. It helps determine whether a dataset follows an expected distribution (Goodness-of-Fit Test) or whether two categorical variables are related (Test for Independence). Being a non-parametric test, it is widely applicable but requires large sample sizes and independent observations for reliable results. While it identifies associations between variables, it does not measure causation or the strength of relationships. Despite its limitations, the Chi-Square test remains a fundamental method in statistics for hypothesis testing in various fields.Ghana Ethereum Stablecoin (GES) WhitePaper

Ghana Ethereum Stablecoin (GES) WhitePaperHRH. JOHN BABATUNDE LEE

Ėý

Ghana Ethereum Stablecoin (GES) is a blockchain-based stablecoin designed to promote financial inclusion, stability, and innovation in Ghana. Pegged 1:1 to Ethereum (ETH), GES ensures seamless transactions, decentralized finance (DeFi) integration, and a transparent digital financial ecosystem. This whitepaper outlines the vision, technical architecture, economic model, and use cases of GES, demonstrating its potential as a transformative force in Ghana's financial landscape.PFMS Public Finance Management System Presentation Dr. Konka BAMU

PFMS Public Finance Management System Presentation Dr. Konka BAMUPrakash Konka

Ėý

National Service Scheme Transaction on PFMS Portal4 yyyExcept for the maxillary molars, the orifices of the canals lie on a lin...

4 yyyExcept for the maxillary molars, the orifices of the canals lie on a lin...KhalidLafi2

Ėý

Except for the maxillary molars, the orifices of the canals lie on a line perpendicular to a line drawn in a mesial-distal direction across the centre of the floor of the pulp chamber.

Financial Leadership Redefined: Nadia Dawedâs Success Story

Financial Leadership Redefined: Nadia Dawedâs Success StoryNadia Dawed

Ėý

Nadia Dawedâs remarkable journey in financial management reflects her commitment to delivering measurable results. With extensive experience in supply chain financial analysis and compliance, she ensures businesses operate efficiently and profitably. Her ability to collaborate with cross-functional teams and implement strategic solutions makes her an invaluable leader in financial operations.ANALYSIS AND PRESENTATION OF SAUSAGE SUPPLY CHAIN SHINSHU NT LIMITED

ANALYSIS AND PRESENTATION OF SAUSAGE SUPPLY CHAIN SHINSHU NT LIMITEDlamluanvan.net Viášŋt thuÊ luášn vÄn

Ėý

Tax heaven

- 1. TAX HEAVEN

- 2. What is tax heaven? âĒ A tax haven is a state, country or territory where certain taxes are levied at a low rate or not at all while offering due process, good governance, and a low corruption rate. âĒ Related to international taxation.

- 3. Tax Haven Countries Europe Bahamas & Carribean ï Eire ï Bahamas ï Isle of Man ï Bermuda ï Jersey ï Turks & Caicos ï Alderney ï U.S. Virgin Islands ï Guernsey ï British Virgin Islands ï Monaco ï Anguilla ï Gibraltar ï Antigua ï Madeira ï Nevis ï Andorra ï Montserrat ï Luxembourg ï Barbados ï Liechtenstein ï Grenada ï Malta ï Netherlands Antilles ï Cyprus ï Aruba ï Panama Africa ï Costa Rica ï Liberia ï Cayman Islands ï Seychelles ï Belize ï Mauritius Pacific Rim ï Cook Islands ï Samoa ï Niue

- 4. What is OECD model? ï Organisation economic Co-operation and Development ï An organization that acts as a meeting ground for 30 countries which believe strongly in the free market system, The OECD provides a forum for discussing issues and reaching agreements, some of which are legally binding.

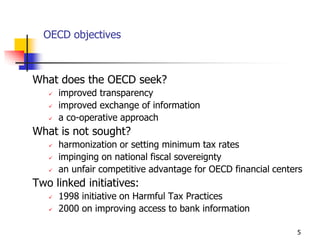

- 5. OECD objectives What does the OECD seek? ïž improved transparency ïž improved exchange of information ïž a co-operative approach What is not sought? ïž harmonization or setting minimum tax rates ïž impinging on national fiscal sovereignty ïž an unfair competitive advantage for OECD financial centers Two linked initiatives: ïž 1998 initiative on Harmful Tax Practices ïž 2000 on improving access to bank information 5

- 6. OECD approach Recognizes: ïž Interest of government in protecting integrity of tax system and confidentiality of taxpayer information ïž Interest of business community in avoiding excessive burden ïž Countriesâ right to tailor their own tax systems to their own needs ïž The need to move towards a level playing field and mutual benefits