TDS Presentation ITO TDS Faizabad for Govt Deductors (1).pptx

- 1. TDS (Tax Deduction at Source) Awareness Programme for Deductors By : Income Tax Office-TDS Faizabad

- 2. Concept of TDS  TDS is an arrangement to deduct taxes from the very source of Income.  A person (Deductor) making specified payments to other person (Deductee) is liable to deduct tax as per provisions of Income-Tax Act and remit the same into account of Central Government.  The deductor is also liable to issue Certificates of TDS to the tax payers on prescribed forms and within specified time.

- 3. Benefits of TDS (For The Government) • It helps in regular collection of taxes. • Ensures a flow of regular income to the government for the ongoing development work. • It also helps to keep a check on tax evasion. (For The Public) • Reduces the burden of lump-sum tax payment altogether. It helps in spreading the entire tax payment through out the year, which makes it easier for the taxpayer to pay his tax liability. • Offers an easy mode of tax payment to the payer.

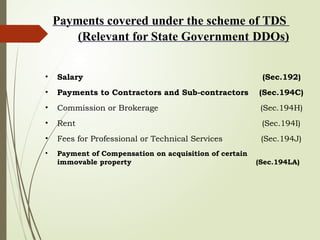

- 4. Payments covered under the scheme of TDS (Relevant for State Government DDOs) • Salary (Sec.192) • Payments to Contractors and Sub-contractors (Sec.194C) • Commission or Brokerage (Sec.194H) • Rent (Sec.194I) • Fees for Professional or Technical Services (Sec.194J) • Payment of Compensation on acquisition of certain immovable property (Sec.194LA)

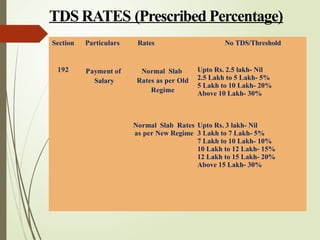

- 5. TDS RATES (Prescribed Percentage) Section Particulars Rates No TDS/Threshold 192 Payment of Salary Normal Slab Rates as per Old Regime Upto Rs. 2.5 lakh- Nil 2.5 Lakh to 5 Lakh- 5% 5 Lakh to 10 Lakh- 20% Above 10 Lakh- 30% Normal Slab Rates as per New Regime Upto Rs. 3 lakh- Nil 3 Lakh to 7 Lakh- 5% 7 Lakh to 10 Lakh- 10% 10 Lakh to 12 Lakh- 15% 12 Lakh to 15 Lakh- 20% Above 15 Lakh- 30%

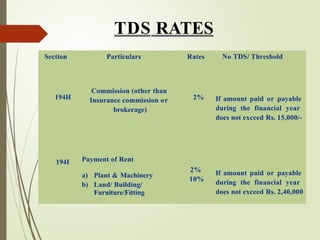

- 6. TDS RATES Section Particulars Rates No TDS/ Threshold 194H Commission (other than Insurance commission or brokerage) 2% If amount paid or payable during the financial year does not exceed Rs. 15,000/- 194I Payment of Rent a) Plant & Machinery b) Land/ Building/ Furniture/Fitting 2% 10% If amount paid or payable during the financial year does not exceed Rs. 2,40,000

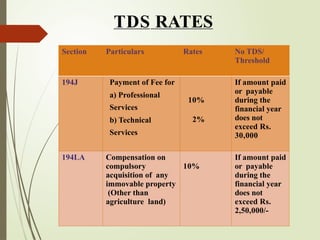

- 7. TDS RATES Section Particulars Rates No TDS/ Threshold 194J Payment of Fee for a) Professional Services b) Technical Services 10% 2% If amount paid or payable during the financial year does not exceed Rs. 30,000 194LA Compensation on compulsory acquisition of any immovable property (Other than agriculture land) 10% If amount paid or payable during the financial year does not exceed Rs. 2,50,000/-

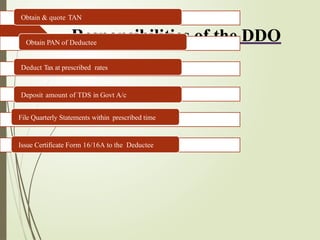

- 8. Responsibilities of the DDO Obtain & quote TAN Obtain PAN of Deductee Deduct Tax at prescribed rates Deposit amount of TDS in Govt A/c File Quarterly Statements within prescribed time Issue Certificate Form 16/16A to the Deductee

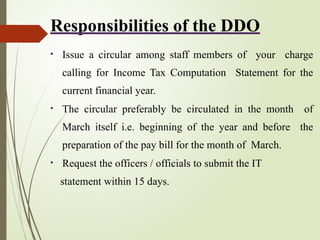

- 9. Responsibilities of the DDO • Issue a circular among staff members of your charge calling for Income Tax Computation Statement for the current financial year. • The circular preferably be circulated in the month of March itself i.e. beginning of the year and before the preparation of the pay bill for the month of March. • Request the officers / officials to submit the IT statement within 15 days.

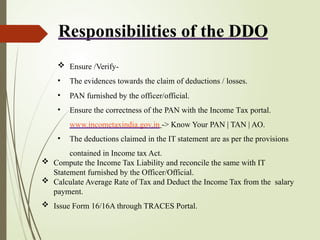

- 10. Responsibilities of the DDO  Ensure /Verify- • The evidences towards the claim of deductions / losses. • PAN furnished by the officer/official. • Ensure the correctness of the PAN with the Income Tax portal. www.incometaxindia.gov.in -> Know Your PAN | TAN | AO. • The deductions claimed in the IT statement are as per the provisions contained in Income tax Act.  Compute the Income Tax Liability and reconcile the same with IT Statement furnished by the Officer/Official.  Calculate Average Rate of Tax and Deduct the Income Tax from the salary payment.  Issue Form 16/16A through TRACES Portal.

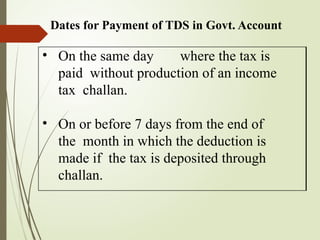

- 11. Dates for Payment of TDS in Govt. Account • On the same day where the tax is paid without production of an income tax challan. • On or before 7 days from the end of the month in which the deduction is made if the tax is deposited through challan.

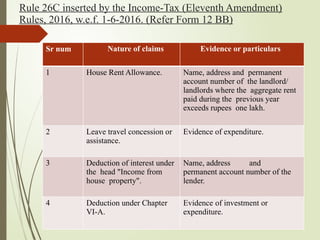

- 12. Rule 26C inserted by the Income-Tax (Eleventh Amendment) Rules, 2016, w.e.f. 1-6-2016. (Refer Form 12 BB) Sr num Nature of claims Evidence or particulars 1 House Rent Allowance. Name, address and permanent account number of the landlord/ landlords where the aggregate rent paid during the previous year exceeds rupees one lakh. 2 Leave travel concession or assistance. Evidence of expenditure. 3 Deduction of interest under the head "Income from house property". Name, address and permanent account number of the lender. 4 Deduction under Chapter VI-A. Evidence of investment or expenditure.

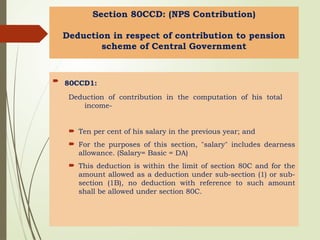

- 13. Section 80CCD: (NPS Contribution) Deduction in respect of contribution to pension scheme of Central Government ÔÇ¥ 80CCD1: Deduction of contribution in the computation of his total income- ÔÇ¥ Ten per cent of his salary in the previous year; and ÔÇ¥ For the purposes of this section, "salary" includes dearness allowance. (Salary= Basic = DA) ÔÇ¥ This deduction is within the limit of section 80C and for the amount allowed as a deduction under sub-section (1) or sub- section (1B), no deduction with reference to such amount shall be allowed under section 80C.

- 14.  80CCD(1B) :  A deduction of maximum fifty thousand rupees shall be allowed of the whole of the amount paid or deposited in the previous year in his account under a pension scheme notified or as may be notified by the Central Government.  This is in addition of the limit/amount of deduction claimed u/s 80C.  No deduction under this sub-section shall be allowed in respect of the amount on which a deduction has been claimed and allowed under sub-section (1)  80CCD2:  A deduction of employer’s contribution in the computation of his total income, of the whole of the amount contributed by the Central Government [or the State Government] or any other employer as does not exceed-  (a) fourteen per cent, where such contribution is made by the Central Government [or the State Government];

- 15. 7 • Where PAN of the deductee is not quoted or wrongly quoted, TDS has to be made at 20% or applicable rate, whichever is higher (Section 206AA). When to Deduct Tax at Source at Higher Rate

- 16. As per Income-tax Department Notification no. 41/2010 dated May 31, 2010, in case of a Government office where tax has been paid to the credit of Central Government without the production of a challan, the PAO / CDDO / DTO or an equivalent office is required to file Form 24G. Applicability of Form 24G

- 17. • It is mandatory for each PAO / CDDO / DTO to have an AIN for filing Form 24G. • AIN is the identification of the PAO/ CDDO/DTO for the purpose of filing Form 24G. • Every Accounts Office shall furnish one complete, correct and consolidated Form 24G every month having details of all type of deduction / collection viz. TDS-Salary / TDS- Non Salary / TDS- Non Salary Non Residents / TCS.

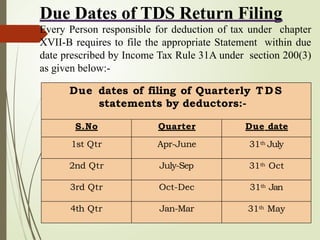

- 18. Due dates of filing of Quarterly TDS statements by deductors:- S.No Quarter Due date 1st Qtr Apr-June 31th July 2nd Qtr July-Sep 31th Oct 3rd Qtr Oct-Dec 31th Jan 4th Qtr Jan-Mar 31th May Due Dates of TDS Return Filing Every Person responsible for deduction of tax under chapter XVII-B requires to file the appropriate Statement within due date prescribed by Income Tax Rule 31A under section 200(3) as given below:-

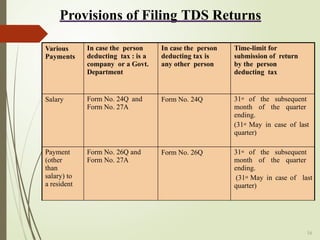

- 19. Provisions of Filing TDS Returns Various Payments In case the person deducting tax : is a company or a Govt. Department In case the person deducting tax is any other person Time-limit for submission of return by the person deducting tax Salary Form No. 24Q and Form No. 27A Form No. 24Q 31st of the subsequent month of the quarter ending. (31st May in case of last quarter) Payment (other than salary) to a resident Form No. 26Q and Form No. 27A Form No. 26Q 31st of the subsequent month of the quarter ending. (31st May in case of last quarter) 16

- 20. Issuance of TDS Certificates {Sec. 203} Sr. No. Form No. Periodicity Cut off Date 1 16 for Salary Annual 15th June of following financial year 2 16A Other than salary Quarterly Within 15 days from due date of furnishing the TDS statement under rule 31A 17

- 21. Consequences of Non Compliance of TDS Provisions

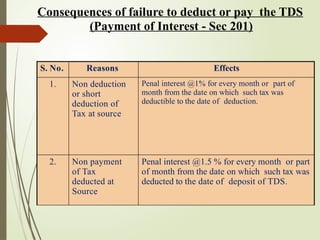

- 22. Consequences of failure to deduct or pay the TDS (Payment of Interest - Sec 201) S. No. Reasons Effects 1. Non deduction or short deduction of Tax at source Penal interest @1% for every month or part of month from the date on which such tax was deductible to the date of deduction. 2. Non payment of Tax deducted at Source Penal interest @1.5 % for every month or part of month from the date on which such tax was deducted to the date of deposit of TDS.

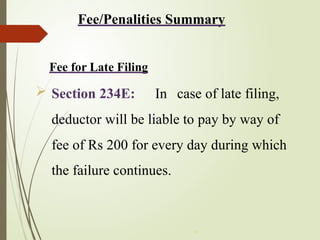

- 23. Fee/Penalities Summary Fee for Late Filing ÔÉò Section 234E: In case of late filing, deductor will be liable to pay by way of fee of Rs 200 for every day during which the failure continues. *

- 24. Penalty for failure to deduct tax at source • Section 271C: On failure to deduct the whole or any part of the tax as required may lead to imposition of a penalty u/s 271C of the I.T. Act of sum equal to amount of tax which such person failed to deduct.

- 25. Penalty for Late filing • Section 271H: Penalty for late filing/Non filing/ furnishing incorrect information in TDS statement as per section 271H is minimum Rs. 10,000 to Rs. 1,00,000 which is applicable for :- 1. Not filing the TDS statement within specified time limit. 2. Furnishing incorrect information in quarterly statement of TDS.

- 26. Penalty for failure to furnish a certificate Section 272A(2)(g) – If any person fails to furnish a certificate as required by section section 203 (i.e. Form 16 or Form 16A) he shall be liable to pay a sum of Rs.500 for everyday during which the failure continues (w.e.f. 01.04.2022).

- 27. Prosecution Section 276B- If a person deducts tax at source but fails to pay the same to the credit of Central Government as prescribed (Within 60 days), he can be sentenced to rigorous imprisonment for a term not less than 3 months and extendable upto 7 years with fine as well.

![ÔÇ¥ 80CCD(1B) :

ÔÇ¥ A deduction of maximum fifty thousand rupees shall be

allowed of the whole of the amount paid or deposited in the

previous year in his account under a pension scheme

notified or as may be notified by the Central Government.

ÔÇ¥ This is in addition of the limit/amount of deduction claimed

u/s 80C.

ÔÇ¥ No deduction under this sub-section shall be allowed in

respect of the amount on which a deduction has been

claimed and allowed under sub-section (1)

ÔÇ¥ 80CCD2:

 A deduction of employer’s contribution in the computation of his

total income, of the whole of the amount contributed by the

Central Government [or the State Government] or any other

employer as does not exceed-

ÔÇ¥ (a) fourteen per cent, where such contribution is made by the

Central Government [or the State Government];](https://image.slidesharecdn.com/tdspresentationitotdsfaizabadforgovtdeductors1-250122085914-cd8787ce/85/TDS-Presentation-ITO-TDS-Faizabad-for-Govt-Deductors-1-pptx-14-320.jpg)