Template_ver3

- 1. Valuation of AirThread Connections Prepared 11.12.2016 by: Delphine Finders-Binje Hermine Theunissen Kim Pierlot OphÃĐlie Simonart Vitaly Pentegov

- 2. 2 Contents Valuation Methods Cash Flows Calculation Discount Rate Terminal Value Enterprise Value Tax Shield

- 3. 3 Valuation Methods DCF APV Value of Equity Value of Debt Value of All- equity Firm Value of Tax Shield Description Intrinsic value of the company was calculated as the sum of free cash flows generated by the upstream assets discounted by specific cost of capital Consideration âĒ Give theoretically right result if there is an implicit assumption that the financial structure will remain constant. âĒ If debt is expected not to increase with the enterprise value but to remain stable or decrease over time, WACC valuation is not appropriate. Description Consideration NPV of company if financed solely by equity plus the present value of any financing benefits, which are the additional effects of debt. âĒ If debt levels are scheduled to decrease through time, it overestimates the beta, and therefore underestimates the value.

- 4. 4 Cash Flows Calculation Sources: Growth NFA: -1.0123% sum NFA 2005 4,876.35 sum NFA2006 4,825.70 sum NFA 2007 4,778.12 sum NFA 2008 4,729.75 sum NFA 2009 4,681.87 sum NFA 2010 4,634.48 sum NFA 2011 4,587.56 sum NFA 2012 4,541.12 Growth K 7.99% K 2005 2,741.04 K 2006 2,993.28 K 2007 3,196.16 K 2008 3,451.53 K 2009 3,727.31 K 2010 4,025.12 K 2011 4,346.72 K 2012 4,694.03 Cash Flows CF op 988.46 1,126.85 1,256.52 1,372.55 1,458.35 NI 283.23 322.89 389.08 450.18 505.44 Dep 705.23 803.96 867.44 922.38 952.91 delta WCR 0 0 0 0 0 CF inv (753.6) (851.8) (914.8) (969.3) (999.4) delta NFA (48.37) (47.88) (47.39) (46.91) (46.44) Depreciation (705.2) (804.0) (867.4) (922.4) (952.9) CF fin 255.37 275.78 297.81 321.61 347.30 delta K 255.37 275.78 297.81 321.61 347.30 delta D 0 0 0 0 0 Div 0 0 0 0 0 Operating Cash Flows Investing Cash Flows Financing Cash Flows

- 5. 5 Discount Rate Sources: US Treasury, Case assumptions, Team estimates * no preferred equity in case WACC Cost of Debt Comparable Companies Unlevered Beta Cost of Debt 8.4% Predicted Debt/ Marginal Unlevered Tax Rate 40.0% Company Levered Beta(4) Equity Tax Rate Beta After-tax Cost of Debt 5.1% Universal Mobile 0.86 58.3% 40.0% 0.64 Neuberger Wireless 0.89 41.9% 40.0% 0.71 Cost of Equity Agile Connections 1.17 24.1% 40.0% 1.02 Risk Free Rate 4.4% Big Country Communications 0.97 31.7% 40.0% 0.81 Equity risk premium 5.0% Rocky Mountain Wireless 1.13 44.4% 40.0% 0.89 Levered Beta 1.02 Mean 1.00 40.1% 0.82 Cost of Equity 9.5% Median 0.97 41.9% 0.81 WACC 8.2% ValueCo Relevered Beta Mean Target Target Unlevered Debt/ Marginal Relevered Beta Equity Tax Rate Beta Relevered Beta 0.82 42.2% 40.0% 1.02 CAPM: Ã ( ) Unlevered Levered US Treasury 20Y Weight of equity in capital structure * Weight of debt in capital structure Interest Expense / Debt

- 6. 6 Terminal Value Sources: Case, Team estimates Growth rate= ROC Ã Reinvestment Rate Terminal Growth Rate ROC 5.88% Reinvestment rate 59.90% CapEx 548.52 ÎWCR 231.30 D&A 582.269 NOPAT 329.79 Growth rate 3.52% ðððððððððð ð·ð· + ðļðļ ðķðķðķðķðķðķðķðķðķðķ + ðĨðĨðððððð â ð·ð·&ðīðī ðððððððððð Growth Rate Terminal Value Terminal Value FCFF 2012 367.61 FCFF 2012 (1+g) 380.55 Terminal Value 8145.79 ðððð = ðđðđðđðđðđðđðđðđðð + ðļðļðļðļðļðļ ðļðļðļðļðļðļ ðððððððððððððððð Ã ðļðļðļðļðļðļ ðļðļðļðļðļðļ Perpetuate Growth Method Multiple Method 7 852.7

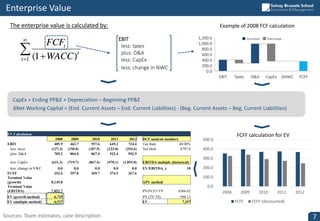

- 7. 7 Enterprise Value The enterprise value is calculated by: Example of 2008 FCF calculation EBIT less: taxes plus: D&A less: CapEx less: change in NWC 0.0 100.0 200.0 300.0 400.0 500.0 2008 2009 2010 2011 2012 FCFF FCFF (discounted) FCFF calculation for EV CapEx = Ending PP&E + Depreciation â Beginning PP&E ÎNet Working Capital = (End. Current Assets â End. Current Liabilities) - (Beg. Current Assets â Beg. Current Liabilities) EV Calculation 2008 2009 2010 2011 2012 DCF analysis numbers EBIT 405.9 462.7 557.6 645.2 724.4 Tax Rate 40.00% less: taxes (127.3) (150.0) (187.9) (223.0) (254.6) Net Debt $797.8 plus: D&A 705.2 804.0 867.4 922.4 952.9 less: CapEx (631.3) (719.7) (867.4) (970.1) (1,055.0) EBITDA multiple (historical) less: change in NWC 0.0 0.0 0.0 0.0 0.0 EV/EBITDA, x 10 FCFF 352.6 397.0 369.7 374.5 367.6 Terminal Value (growth) 8,145.8 APV method Terminal Value (EBITDA) 7,852.7 PV(FCF)+TV 6366.62 EV (growth method) 6,725 PV (TV TS) 990.13 EV (multiple method) 6,527 EV 7,357 Sources: Team estimates, case description

- 8. 8 Synergy Assumption Sources: Team estimates, case description * perpetual growth method Synergy Cost Synergy Revenue Synergy 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 System Operating Expenses 838.87 956.31 1075.85 1183.43 1266.27 Av. Monthly subscribers 0.3 0.5 0.7 1 1.2 System Operating Exp./Service Revenue 0.20 0.20 0.20 0.20 0.20 Av. Monthly Minutes 859 885 911 939 967 Estimated Costs 167.77 191.26 215.17 236.69 253.25 Total Monthly Minutes 258 443 638 939 1160 Reduction 0.00 0.07 0.12 0.22 0.30 Revenue per minute 0.05 0.05 0.05 0.05 0.05 Savings 0.00 13.39 25.82 52.54 75.98 Revenue Increase 156.48 268.69 387.21 570.16 704.59 0 200 400 600 800 1000 2008 2009 2010 2011 2012 FCF (no synergy) Synergy Contibution Assuming Ms. Zhang's estimates for synergies Enterprise Value EV calculation 2008 2009 2010 2011 2012 DCF analysis adjustments APV method EBIT 405.9 462.7 557.6 645.2 724.4 Tax Rate 40.00% PV(FCF)+TV 13630.77 Synergy adj. EBIT 562.4 744.8 970.6 1,267.9 1,504.9 Net Debt $797.8 PV (TV TS) 990.13 less: taxes (189.9) (262.8) (353.2) (472.1) (566.9) EV 14620.90 plus: D&A 705.2 804.0 867.4 922.4 952.9 EBITDA mult less: CapEx (631.3) (719.7) (867.4) (970.1) (1,055.0) EV/EBITDA, x 10 less: change in NWC 0.0 0.0 0.0 0.0 0.0 FCFF 446.5 566.3 617.5 748.1 836.0 Terminal Value (growth) 18,523.6 Terminal Value (EBITDA) 16,387.0 EV (growth method) 14,425 EV (multiple method) 12,984 We get the following enterprise value numbers + $7700 MM Synergy contribution to the AirThreadâs Enterprise Value * Synergy contribution to the free cash flows

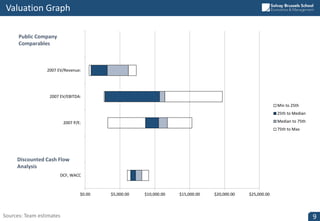

- 9. 9 Valuation Graph Sources: Team estimates $0.00 $5,000.00 $10,000.00 $15,000.00 $20,000.00 $25,000.00 DCF, WACC 2007 P/E: 2007 EV/EBITDA: 2007 EV/Revenue: Min to 25th 25th to Median Median to 75th 75th to Max Public Company Comparables Discounted Cash Flow Analysis

- 10. 10 Tax Shield Consideration Sources: Berk/DeMarzo â Corporate Finance The value of the tax shields reflect the personal tax disadvantage of interest income to ordinary debt holders as personal taxes may offset the corporate tax benefits of leverage. Investors are generally taxed on interest income from debt and dividend income from a stock; they are also taxed on capital gains when they sell a stock. Where, Ïðð - the personal tax rate on equity income Ïðð - the personal tax rate on interest income Ïðð - corporate tax Tax Shield = Ïâ Ã interest expense Therefore, if Ïðð > Ïðð then Ïâ > Ïðð then there is a tax disadvantage of leverage

- 11. Thank you for your attention!