The 1099 Form, Explained and Annotated

- 1. The 1099 Form, Explained and Annotated

- 3. Box 1, Rents If you paid rent for your business space to an individual, this is where you enter the total amount you paid during the calendar year. You can also enter amounts for things like equipment rentals, as long as theyŌĆÖre paid to an individual.

- 4. Box 2, Royalties If you are paying someone for property rights (whether physical, like mining, oil, or gas; or intellectual, like in the case of a patent or copyright) enter the total amount you paid here.

- 5. Box 3, Other income Basically if you provided a taxable payment to someone over the amount $600 and it doesnŌĆÖt fit in any of the other boxes, it goes in Box 3. Need more details? Pub 525 gets right into the nitty gritty of what qualifies as ŌĆ£other incomeŌĆØ.

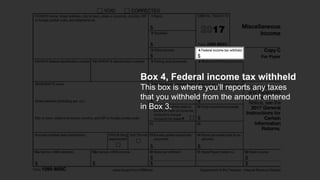

- 6. Box 4, Federal income tax withheld This box is where youŌĆÖll reports any taxes that you withheld from the amount entered in Box 3.

- 7. Box 5, Fishing boat proceeds This field likely doesnŌĆÖt apply to you, but on the off chance that you are the owner of a fishing boat and youŌĆÖre issuing this 1099 to a member of your crew, youŌĆÖre in the right place! Enter the amount paid to them here.

- 8. Box 6, Medical and health care payments Did your business make a payment of $600 or more to an individual who provided medical or health care services this year? Report that amount here.

- 9. Box 7, Nonemployee compensation This is the box that youŌĆÖll most likely use to report any payments paid to a contractor or other non-employee.

- 10. Not sure if a payment qualifies?

- 11. Not sure if a payment qualifies? The IRS provides these four guidelines for determining if this Box 7 is the right place to enter it: 4 3 2 1 You made the payment to someone who is not your employee. You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations). You made the payment to an individual, partnership, estate, or, in some cases, a corporation. You made payments to the payee of at least $600 during the year.

- 12. Box 8, Substitute payments in lieu of dividends or interest Most small business owners wonŌĆÖt use this one, but if you did pay someone a sum of at least $10 instead of dividends or if you are paying someone tax- exempt interest as a result of borrowing their securities, that amount gets entered here.

- 13. Box 9, Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale: This field is actually fairly self-explanatory. Check this box if you sold products directly to someone so that they could then sell them to other people.

- 14. Box 10, Crop insurance proceeds Are you an insurance company issuing this 1099 form to a farmer due to crop insurance payments? Nope, we didnŌĆÖt think so. Most of us will never have a reason to use Box 10.

- 15. Box 11 & 12 Fun tax fact: In the past, the IRS used these boxes to record any foreign taxes paid but these days this information is reported on a separate form. They couldnŌĆÖt just delete these two boxes without also renumbering boxes 13-18, so they just left them blank. (You should, too.)

- 16. Box 13, Excess golden parachute payments Another one you can probably skip - youŌĆÖll only ever enter an amount in Box 13 if you paid a disqualified person like a shareholder or highly paid person at least three times that personŌĆÖs typical amount.

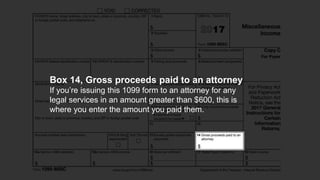

- 17. Box 14, Gross proceeds paid to an attorney If youŌĆÖre issuing this 1099 form to an attorney for any legal services in an amount greater than $600, this is where you enter the amount you paid them.

- 18. Box 15a, Section 409A deferrals DonŌĆÖt worry about entering anything in this box. (If youŌĆÖre a tax nerd, super curious, or just looking for a little light reading, Internal Revenue Bulletin 2008-52 can enlighten you.)

- 19. Box 15b, Section 409A income Did you defer a payment that would have been categorized as section 409A income because a nonqualified deferred compensation plan didnŌĆÖt meet the requirements for section 409A? Enter that amount in this box. (And if you have no idea what we just said, donŌĆÖt worry, Box 15b most likely doesnŌĆÖt apply to you. LetŌĆÖs move on!)

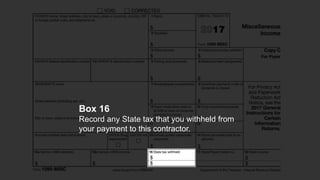

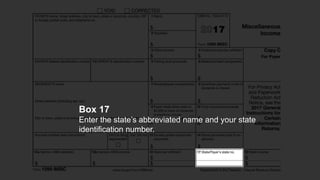

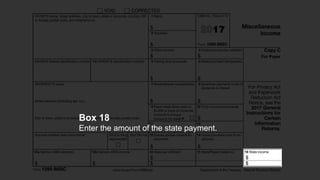

- 20. Box 16, 17 & 18 If your state participates in the Combined Federal/State Filing Program youŌĆÖll need to complete these boxes. Each field is divided in two in case you need to report in two states.

- 21. Box 16 Record any State tax that you withheld from your payment to this contractor.

- 22. Box 17 Enter the stateŌĆÖs abbreviated name and your state identification number.

- 23. Box 18 Enter the amount of the state payment.