KEYNOTE: FINNOVASIA 2017: The Ambient Advisory Experience : Beyond Robo-Advice

- 1. S m a r t e r C o n v e r s a t i o n s i n F i n a n c e Nathan Stev ens on CEO, Founder @Forward_Lane

- 2. F O R W A R D L A N E 2

- 3. F O R W A R D L A N E 3 Robo is forecast to be 10% of global wealth management. AI is set to transform the 90% ROBO &AI

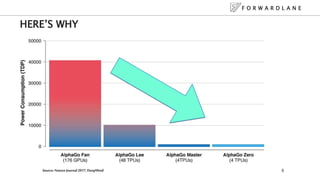

- 4. F O R W A R D L A N E 4 HEREˇŻS WHY 3 Days ¨C All human Go knowledge 21 Days ¨C Beat the Master, Alpha Go Master 40 Days ¨C Won 100-0 Alpha Go Source:Nature Journal, DeepMind

- 5. F O R W A R D L A N E 5 HEREˇŻS WHY Source:Nature Journal 2017, DeepMind

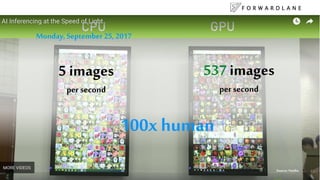

- 6. F O R W A R D L A N E 5 images per second Monday, September 25, 2017 537 images per second 100x human Source: Nvidia

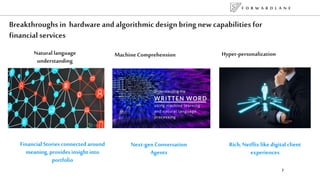

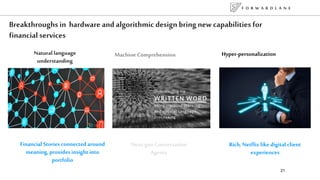

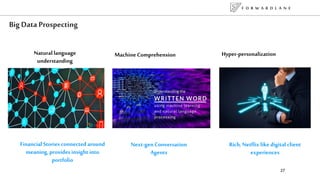

- 7. F O R W A R D L A N E 7 Breakthroughs in hardware and algorithmic design bring new capabilities for financial services Machine Comprehension Hyper-personalizationNatural language understanding Next-gen Conversation Agents Financial Stories connected around meaning, provides insight into portfolio Rich, Netflix like digital client experiences

- 8. F O R W A R D L A N E How to provide a Differentiated, Personalized experience at scale? New Generation New Expectations

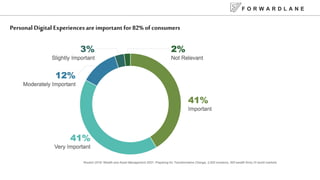

- 9. F O R W A R D L A N E Personal Digital Experiences are important for 82% of consumers

- 10. F O R W A R D L A N E 10 119 RoboˇŻs worldwide What is beyond robo?

- 11. Multi-disciplinary team of Quantitative Strategists, Wealth Specialists, and PhD-Level Technologists Award-winning Cognitive Finance startup Featured 4x in Q2/3 ˇŻ17 ? AI in Fintech top 16 ? Global RoboAdvisory ? Banking Incumbents ? Future of Fintech 2017 F O R W A R D L A N E

- 12. Powering Personalized Insights and Expert Conversation For Wealth Managers, Asset Managers and Insurers F O R W A R D L A N E

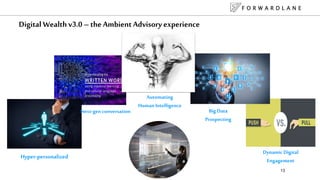

- 13. F O R W A R D L A N E 13 Digital Wealth v3.0 ¨C the Ambient Advisory experience Hyper-personalized Next-gen conversation Dynamic Digital Engagement Big Data Prospecting Automating Human Intelligence

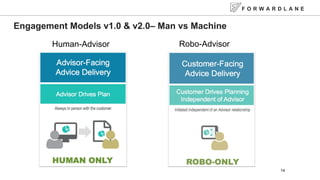

- 14. F O R W A R D L A N E 14 Engagement Models v1.0 & v2.0¨C Man vs Machine Human-Advisor Robo-Advisor

- 15. F O R W A R D L A N E 15 Evolving Engagement Models v3.0 ¨C Man + Machine Coach + Digital Digital + Concierge Human Robo

- 16. Meet Su A high-performing relationship manager for a top wealth manager with offices in Hong Kong, Shanghai and Singapore F O R W A R D L A N E

- 17. Her Clients Expect the best personalized service ¨C digital and in person F O R W A R D L A N E

- 18. F O R W A R D L A N E CIO Views, Research CRM Notes Products Relevant Stories Client Interests Investments Why Private Banking works

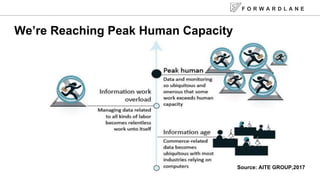

- 19. F O R W A R D L A N E WeˇŻre Reaching Peak Human Capacity Source: AITE GROUP,2017

- 20. CIO Views, Research CRM Notes Products Trending Stories Client Interests Portfolios F O R W A R D L A N E

- 21. F O R W A R D L A N E 21 Breakthroughs in hardware and algorithmic design bring new capabilities for financial services Machine Comprehension Hyper-personalizationNatural language understanding Next-gen Conversation Agents Financial Stories connected around meaning, provides insight into portfolio Rich, Netflix like digital client experiences

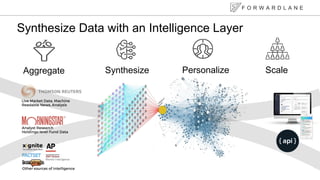

- 22. Aggregate Synthesize Personalize Scale F O R W A R D L A N E Synthesize Data with an Intelligence Layer

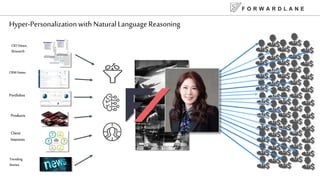

- 23. F O R W A R D L A N E Hyper-PersonalizationwithNaturalLanguage Reasoning CIO Views, Research CRM Notes Products Trending Stories Client Interests Portfolios

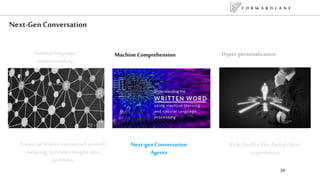

- 24. F O R W A R D L A N E 24 Next-Gen Conversation Machine Comprehension Hyper-personalizationNatural language understanding Next-gen Conversation Agents Financial Stories connected around meaning, provides insight into portfolio Rich, Netflix like digital client experiences

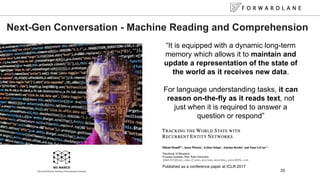

- 25. F O R W A R D L A N E 25 Next-Gen Conversation - Machine Reading and Comprehension ˇ°It is equipped with a dynamic long-term memory which allows it to maintain and update a representation of the state of the world as it receives new data. For language understanding tasks, it can reason on-the-fly as it reads text, not just when it is required to answer a question or respondˇ± Published as a conference paper at ICLR 2017

- 26. Next-Gen Conversation with Context Reduce time spent preparing for meetings Higher ROI on Active Advisory Time Smarter, Contextual supercharged advice Next-generationDigital Client Engagement F O R W A R D L A N E

- 27. F O R W A R D L A N E 27 Big Data Prospecting Machine Comprehension Hyper-personalizationNatural language understanding Next-gen Conversation Agents Financial Stories connected around meaning, provides insight into portfolio Rich, Netflix like digital client experiences

- 28. F O R W A R D L A N E 28 Big Data Prospecting

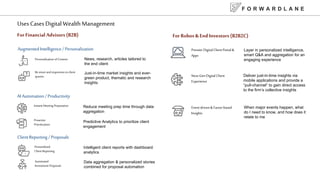

- 29. Uses Cases Digital Wealth Management ForFinancial Advisors (B2B) ForRobos& End Investors (B2B2C) Premier Digital Client Portal & Apps Layer in personalized intelligence, smart Q&A and aggregation for an engaging experience Next-Gen Digital Client Experience Deliver just-in-time insights via mobile applications and provide a ˇ°pull-channelˇ± to gain direct access to the firmˇŻs collective insights Event-driven & Factor-based Insights When major events happen, what do I need to know, and how does it relate to me Personalization of Content News, research, articles tailored to the end client Besmart and responsive to client queries Just-in-time market insights and ever- green product, thematic and research insights Augmented Intelligence / Personalization Proactive Prioritization Predictive Analytics to prioritize client engagement Instant Meeting Preparation Reduce meeting prep time through data aggregation AI Automation/ Productivity Personalized Client Reporting Intelligent client reports with dashboard analytics Automated Investment Proposals Data aggregation & personalized stories combined for proposal automation Client Reporting / Proposals F O R W A R D L A N E

- 30. ? Beyond ˇ°Peak Humanˇ± - Extend my reach beyond whatis currently humanlypossible¨C dynamicportfolio, factor, macro, eventanalysis ? Get Proactiveand Predictive ¨CWhoshouldI speak with? What shouldI say to them? Whathappened?Why? ? Becomean instant expert¨C expert Q&A focused onfinancial products covering thousands of questions What can AI do for financial advisors? F O R W A R D L A N E 30

- 31. ? The ˇ°Ambient Advisory Experienceˇ± - ability to seamlesslypickup aconversation across channels,immediatelypicking upwhereyou left off ? Personalized, data-driven advice -each timeI speakto my advisor(or robo) I get the best the firm has tooffer in terms of intelligence,news, research ? Smart Conversational Interfaces -enableme to get information Iwant just as easily asgoogle ? Omni-channel, 24x7, Pull-based engagement ¨Ccustomer experience transformation What can AI do for the Customer? F O R W A R D L A N E 31

- 32. S m a r t e r C o n v e r s a t i o n s i n F i n a n c e Nathan Stev ens on CEO, Founder www.forwardlane.com

Editor's Notes

- #3: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #4: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #5: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #6: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #8: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #11: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #14: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #15: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #16: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #17: External wholesales JaneˇŻs clients are wealth managers and financial advisors at top wirehouses and broker-dealers How does jane maintain a relationship over time with her top customers? She needs to take a diagnostic approach and provide her clients with insights and solutions. Her clients are arguably more demanding today than in the past ¨C gone, or at least rapidly changing are commissions and

- #18: External wholesales JaneˇŻs clients are wealth managers and financial advisors at top wirehouses and broker-dealers How does jane maintain a relationship over time with her top customers? She needs to take a diagnostic approach and provide her clients with insights and solutions. Her clients are arguably more demanding today than in the past ¨C gone, or at least rapidly changing are commissions and

- #19: External wholesales JaneˇŻs clients are wealth managers and financial advisors at top wirehouses and broker-dealers How does jane maintain a relationship over time with her top customers? She needs to take a diagnostic approach and provide her clients with insights and solutions. Her clients are arguably more demanding today than in the past ¨C gone, or at least rapidly changing are commissions and

- #21: She is excellent at her job. She can do an amazing job for 10 of her top clients, maybe 25. But she has 250.

- #22: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #24: External wholesales JaneˇŻs clients are wealth managers and financial advisors at top wirehouses and broker-dealers How does jane maintain a relationship over time with her top customers? She needs to take a diagnostic approach and provide her clients with insights and solutions. Her clients are arguably more demanding today than in the past ¨C gone, or at least rapidly changing are commissions and

- #25: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #26: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #28: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #29: Robo is rules-based operational automation of portfolio construction, rebalancing, tax loss harvesting and increasingly further capabilities such as Motifs, ˇ°personalized ETFsˇ± and newer innovations.

- #31: Beyond ˇ°Peak Humanˇ± - Extend my reach beyond what is currently humanly possible - dramatically increasing capacity, while reducing complexity at the same time. Get Proactive and Predictive - Analyse and organize who I should speak, to and engage with in my book of business based on constantly changing market and portfolio analytics Become an instant expert - Help advisors become instant experts on a wide variety of complex financial products by organizing and synthesizing product information and making it immediately accessible

- #32: Personalized, data-driven advice - each time I speak to my advisor I get the best the firm has to offer in terms of intelligence, news, research High-resolution, risk transparency - hedge fund grade risk analytics can now be scaled downstream to all clients? Omni-channel, 24x7, Pull-based engagement - total overhaul in customer experience, as clients get direct access to firmˇŻs personalized intelligence, I am able to get 90% of my questions answered to an accurate and high degree of confidence by intelligence-driven AI assets Smart Conversational Interfaces - enable me to get information I want just as easily as google Ambient advisory experience - ability to seamlessly pick up a conversation across channels, immediately picking up where you left off