The brilliant pyramid outlines the 6 steps to

Download as PPTX, PDF0 likes569 views

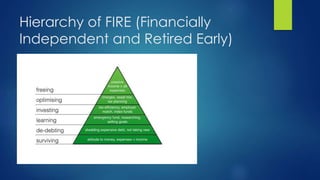

Hierarchy of FIRE (Financially Independent and Retired Early) 1. Surviving 2. De-debting 3. Learning 4. Investing 5. Optimizing 6. Freeing

1 of 5

Downloaded 10 times

Recommended

7 rules of wealth creation

7 rules of wealth creationontah michael

╠²

Visit us

Learn The Powerful Formula To Achieve Your Financial Goals

With Mathematical Precision

www.wealth-rich.blogspot.com

Wealth creation strategies

Wealth creation strategiesfinancialeducation

╠²

This document provides strategies for wealth creation and management. It discusses key concepts like assets, liabilities, growth, risk, and definitions of wealth. Specific investment options are outlined like equity, bank deposits, and mutual funds. The mantra emphasized is to start investing and taking advantage of compounding returns early. Wealth is defined as being able to sustain one's lifestyle without working through liquid assets and passive income exceeding monthly expenses.Confusing familiarity and competence

Confusing familiarity and competenceMark Buzan, APR/CAE ~ Association Executive

╠²

In the nonprofit world (and probably elsewhere too), do we have a tendency to focus on what's comforting and measure up others according to our own measure of passion for a cause?

Whether it's the Board seeking its next Executive Director, a founder struggling to raise funds to get their project off the ground, or a nonprofit looking for new ways to diversify its revenues, I see two common human traits that hold us back:

1. We can be blinded by our passions for a cause that as a result, we fail to see opportunities before us; OR

2. We tend to gravitate to the familiar to the detriment of considering outside possibilities.

Both situations blind us from the COMPETENCIES needed to succeed. As the saying goes, "Birds of a Feather, Flock together". That can be good but it can also exclude the experiences and competencies of those from outside your normal spheres of influence.

In my opinion, those in this life that succeed master the three circles of optimism vs. reality: 1. Knowing what weŌĆÖre

passionate about/who weŌĆÖre familiar with; 2. Understanding what we can be the best in the world in; and 3. Knowing what drives our economic engine.Rat raceescapeplan (1)

Rat raceescapeplan (1)Daniel Nicu

╠²

The document provides an overview of Andy Tanner's "Rat Race Escape Plan" which aims to teach investors how to generate passive income from assets in order to achieve financial freedom and escape the rat race of relying on active income from employment. It describes the forces that keep most people trapped in the rat race such as a lack of education on other options, fear of the unknown, and being unwilling to work on alternative strategies. The plan is to purchase assets that produce ongoing cash flow from dividends, rent, or other means in order to cover expenses without needing employment income. Stocks are presented as one asset class that may be suitable due to low barriers to entry, flexibility, lack of required people skills, liquidity, and potentialThe Rich And their Influence

The Rich And their InfluenceNikksMicheal

╠²

In "Wealth is the Capacity to Push or Precipitate Action on Others with or Without Opposition by Using Several Techniques," readers will delve into the topic of wealth and its inherent power. This book explores how wealthy individuals possess the capacity to push or precipitate action on others, with or without opposition, by using various techniques.

Through the pages of this book, readers will discover how wealth not only has the power to accomplish goals but also enables individuals to shape other people's actions towards a specific purpose. The ability to use riches to control or benefit others can be a double-edged sword, as some individuals may reject being forced to perform certain actions.

This book provides insights into how to influence others like the wealthy, highlighting the techniques and strategies employed by successful individuals to attain and wield their power. Whether you're seeking to improve your own influence or seeking to understand the motivations of those around you, this book is a must-read. With its rich exploration of the relationship between wealth and power, "Wealth is the Capacity to Push or Precipitate Action on Others with or Without Opposition by Using Several Techniques" offers readers a thought-provoking and engaging read.

ACQUIRING FINANCIAL INTELLIGENCE

ACQUIRING FINANCIAL INTELLIGENCECharity Anyika

╠²

This document provides tips for developing a mindset to attract money and achieve financial freedom. It discusses 5 tips for changing one's thinking to attract wealth, including acting like one is already rich, being grateful for money received, accepting opportunities for money, and doing things that make you feel good. It then outlines a 9 step process to financial freedom, which includes changing one's way of thinking, earning more than spending, creating passive income, avoiding credit cards, buying only needs and occasional wants, increasing one's limits, thinking positively, having self-discipline, and avoiding indulgences. The overall message is that one's mindset and behaviors are key to attracting money and achieving financial stability.Intelligent investing

Intelligent investing DipDas40

╠²

This document contains terms and conditions and chapters from a book about investing intelligently. It provides basic information for beginner investors, such as setting investment goals, assessing one's financial situation before investing, and ways to generate additional assets through building businesses rather than just purchasing existing assets. The author emphasizes educating oneself on investing and managing risks.Personal finance & investing

Personal finance & investingZaini Ithnin

╠²

The document discusses 10 habits that can help develop financial stability and success. Some of the key habits mentioned include making savings automatic through regular transfers, controlling impulse spending, evaluating expenses to live frugally, investing for retirement early, keeping family secure through insurance and wills, eliminating debt through a snowball payoff plan, using an envelope system to track spending budgets, paying bills immediately or setting up automatic payments, reading about personal finances to educate oneself, and working to increase one's net worth over time through various means.Intelligent Investing

Intelligent InvestingEsterBenceti

╠²

The beginner's guide to investing intelligently from the start! From the stock market to real estate! Tips, suggestions, strategies, discussions, things to beware of and more!

Never make a bad investment or lose your money again!Secret To Financial Freedom

Secret To Financial FreedomSiddharthBhader

╠²

Financial freedom is desired by all but achieved by very few.

However, financial freedom isn't as elusive as it is construed to be. The secret sauce to financial freedom is simple and accessible to all. Here I uncover those secrets to you which

you should know to reach financial freedom.Iron Out Your Money Ebook

Iron Out Your Money EbookRanda Manning-Johnson

╠²

This document provides tips for young adults to get their finances in order. It discusses the importance of budgeting, paying off credit card debt, contributing to retirement plans, having an emergency fund, starting to save for retirement early, understanding taxes, having health insurance, and protecting your assets with insurance. The key pieces of advice include learning self-control, taking control of your own financial future, knowing where your money goes through budgeting, starting an emergency fund, and starting to save for retirement as early as possible.Ojijo 9 principles of investing -ojijo pascal

Ojijo 9 principles of investing -ojijo pascalOjijo P

╠²

This document outlines Ojijo's Nine Principles of Investing, beginning with the importance of setting SMART financial goals that are specific, measurable, action-oriented, realistic, and time-bound. It discusses the principle of leveraging, which is using fewer resources to achieve more through borrowing money or using other people's resources. The third principle covered is saving-to-invest, where the key is having an effective savings strategy in order to start investing and meet financial goals. It emphasizes paying yourself first by saving a portion of income and directly purchasing assets.How to invest money properly ?

How to invest money properly ?viditgrover3

╠²

This document provides a summary of key points from a book about investing for beginners. It covers establishing investment goals and risk tolerance, getting finances in order before investing, and developing an investment strategy. The strategy should align with one's goals, risk tolerance (conservative, moderate, or aggressive), and focus on long-term growth over get-rich-quick schemes. Common mistakes like not investing, timing the market poorly, or relying only on collectibles are discussed. The overall message is for beginners to educate themselves, start small and be patient, and diversify investments for steady returns over time.The Science of Getting Rich

The Science of Getting Richthescienceofgettingrich

╠²

The Science of Getting Rich ŌĆō http://your-bestyear-ever.info/thesgr/ - In the Science of Getting Rich you will learn the Recession-Proof Formula to Achieve Any Financial Goal with the Precision of a Surgical Laser.

The Science of Getting Rich - Session 1 - The Right to be Rich

The Science of Getting Rich - Session 2 - There is a Science of Getting Rich

The Science of Getting Rich - Session 3 - Is Opportunity Monopolized?

The Science of Getting Rich - Session 4 - The First Principle

The Science of Getting Rich - Session 5 - Increasing Life

The Science of Getting Rich - Session 6 - How Riches Come to You

The Science of Getting Rich - Session 7 ŌĆō Gratitude

The Science of Getting Rich - Session 8 - Thinking in a Certain Way

The Science of Getting Rich - Session 9 - How to Use the Will

The Science of Getting Rich - Session 10 - Further Use of the Will

The Science of Getting Rich - Session 11 - Acting In The Certain Way

The Science of Getting Rich - Session 12 - Effective Action

The Science of Getting Rich - Session 13 - Getting Into The Right Business

The Science of Getting Rich - Session 14 - The Impression of Increase

The Science of Getting Rich - Session 15 - The Advancing Person

The Science of Getting Rich - Session 16 - Some Cautions and Concluding Observations

The Science of Getting Rich - Session 17 -A Summary of The Science of Getting Rich

Emergency cash

Emergency cashMOMOBACHIR

╠²

INTRODUCTION Emergency cash Inside this book, you will discover for yourself everything you need to take a step forwardMoney Talk Book-Chapter 4

Money Talk Book-Chapter 4Barbara O'Neill

╠²

This document provides an overview of investing for retirement. It discusses asset allocation and diversification, building an investment portfolio, and specific retirement planning lessons. The document includes exercises for readers to determine their ideal asset allocation based on factors like age and risk tolerance. It also provides a sample investment portfolio pyramid that illustrates how to divide savings among stocks, bonds, cash equivalents, and specific mutual funds to meet a retirement savings goal. The document aims to educate women on planning financially for retirement.Found money

Found moneyYUNUSOZTURK1

╠²

This document provides tips and strategies for generating quick cash in an emergency situation. It discusses assessing your financial situation, prioritizing debts, increasing cash flow without taking on more debt, starting an emergency fund, reducing credit card usage, and finding painless ways to save small amounts of extra money. The key ideas are to remain calm, crunch the numbers, avoid further debt, build savings over time, and make small, consistent cuts to daily spending.The_Seven_Simple_Secrets_of_Financial_Independence[1]![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

The_Seven_Simple_Secrets_of_Financial_Independence[1]sangura shadrack

╠²

The document outlines the seven simple secrets of financial independence according to Bert Whitehead. It begins by describing Whitehead's experience and credentials as a financial advisor. It then reviews the 10 stages of the typical financial life cycle, from infancy through retirement. Finally, it details the first two of the seven secrets: 1) Fund your future first by always saving 10% of income and reinvesting earnings, and 2) Don't mortgage your future to pay for present expenses by avoiding excessive debt.11 Retirement Mistakes

11 Retirement MistakesLALMcLeod

╠²

A Brief review of why everyone needs a written financial plan, one that has been updated within the last 12 months and the 11 mistakes that you do not want to make in your financial plan.how-money-works-us-version

how-money-works-us-versionTravis Miller

╠²

This document discusses the importance of financial education and provides an overview of basic financial concepts. It is published by Primerica, a financial services company, to help consumers overcome common financial challenges through knowledge. The document encourages readers to take control of their finances by learning principles like paying themselves first, eliminating debt, investing for the long term, and starting early to benefit from the power of compound interest and time. It presents savings and investment strategies as ways for working Americans to achieve financial security and independence.Financial leadership

Financial leadershipTolu Ogunyemi

╠²

This document provides information on financial leadership and the key concepts needed to begin a journey toward financial prosperity. It discusses two important terms: money consciousness, referring to one's mindset about money, and the importance of having a prosperity mindset rather than a scarcity mindset. The document also outlines four fundamental laws that govern wealth creation: the earning law of receiving money in exchange for work, the saving law of deliberately creating surplus through savings, the spending law of exchanging value through purchases, and the investing law of multiplying surplus through investments. Correcting limiting beliefs about money and understanding these laws are presented as important steps toward financial success.5 keys to wealth and success (3)

5 keys to wealth and success (3)laynnemim

╠²

Mark Ling outlines 5 keys to wealth and success in a document promoting an upcoming webinar. He discusses creating "money magnets" like websites, Facebook pages, and Kindle books that generate passive income. Ling emphasizes taking action on opportunities presented and embracing mistakes as opportunities to learn. He encourages readers to develop money magnets that continue earning while they vacation or cannot work in order to achieve financial freedom.5 keys to wealth and success

5 keys to wealth and successHuong Nguyen

╠²

Mark Ling outlines five keys to wealth and success in a document promoting an upcoming webinar. He discusses creating "money magnets" like websites, Facebook pages, and Kindle books that generate passive income. Ling emphasizes taking action on opportunities presented and embracing mistakes as opportunities to learn. He encourages readers to develop money magnets that continue generating income when not actively working.Psychology secrets of the millionaire mind

Psychology secrets of the millionaire mindsecrets behind the successful

╠²

Learn how the millionaires made money and attained success throughout their lives and the mindset that allowed them to do so!Business MentalityŌĆ”

Business MentalityŌĆ”ambitiousleaf4403

╠²

How have ample attitudes where everyone says all is lost within the economy, mortgage crisis, credit...Emergency_Cash.pdf

Emergency_Cash.pdfFakhar Jan

╠²

This document provides 101 tips for generating emergency cash. It discusses coping with cash crises by remaining calm and assessing the situation. It recommends increasing cash flow without taking on more debt, such as taking on a side job or hobby. It emphasizes the importance of starting an emergency fund by saving 3-6 months of living expenses. It also suggests reducing spending by cutting back on credit cards, refinancing loans, reducing car and home energy use, and eating out less. The document aims to help readers prepare for and manage financial emergencies through planning and savings.Cultivating an Innovative Mindset in STEM Presented by Google.pptx

Cultivating an Innovative Mindset in STEM Presented by Google.pptxCareer Communications Group

╠²

Learning objective: Encourage innovation in the face of adversity. Panelists will discuss strategies for cultivating innovation and promoting a resilient growth mindset.More Related Content

Similar to The brilliant pyramid outlines the 6 steps to (20)

Intelligent investing

Intelligent investing DipDas40

╠²

This document contains terms and conditions and chapters from a book about investing intelligently. It provides basic information for beginner investors, such as setting investment goals, assessing one's financial situation before investing, and ways to generate additional assets through building businesses rather than just purchasing existing assets. The author emphasizes educating oneself on investing and managing risks.Personal finance & investing

Personal finance & investingZaini Ithnin

╠²

The document discusses 10 habits that can help develop financial stability and success. Some of the key habits mentioned include making savings automatic through regular transfers, controlling impulse spending, evaluating expenses to live frugally, investing for retirement early, keeping family secure through insurance and wills, eliminating debt through a snowball payoff plan, using an envelope system to track spending budgets, paying bills immediately or setting up automatic payments, reading about personal finances to educate oneself, and working to increase one's net worth over time through various means.Intelligent Investing

Intelligent InvestingEsterBenceti

╠²

The beginner's guide to investing intelligently from the start! From the stock market to real estate! Tips, suggestions, strategies, discussions, things to beware of and more!

Never make a bad investment or lose your money again!Secret To Financial Freedom

Secret To Financial FreedomSiddharthBhader

╠²

Financial freedom is desired by all but achieved by very few.

However, financial freedom isn't as elusive as it is construed to be. The secret sauce to financial freedom is simple and accessible to all. Here I uncover those secrets to you which

you should know to reach financial freedom.Iron Out Your Money Ebook

Iron Out Your Money EbookRanda Manning-Johnson

╠²

This document provides tips for young adults to get their finances in order. It discusses the importance of budgeting, paying off credit card debt, contributing to retirement plans, having an emergency fund, starting to save for retirement early, understanding taxes, having health insurance, and protecting your assets with insurance. The key pieces of advice include learning self-control, taking control of your own financial future, knowing where your money goes through budgeting, starting an emergency fund, and starting to save for retirement as early as possible.Ojijo 9 principles of investing -ojijo pascal

Ojijo 9 principles of investing -ojijo pascalOjijo P

╠²

This document outlines Ojijo's Nine Principles of Investing, beginning with the importance of setting SMART financial goals that are specific, measurable, action-oriented, realistic, and time-bound. It discusses the principle of leveraging, which is using fewer resources to achieve more through borrowing money or using other people's resources. The third principle covered is saving-to-invest, where the key is having an effective savings strategy in order to start investing and meet financial goals. It emphasizes paying yourself first by saving a portion of income and directly purchasing assets.How to invest money properly ?

How to invest money properly ?viditgrover3

╠²

This document provides a summary of key points from a book about investing for beginners. It covers establishing investment goals and risk tolerance, getting finances in order before investing, and developing an investment strategy. The strategy should align with one's goals, risk tolerance (conservative, moderate, or aggressive), and focus on long-term growth over get-rich-quick schemes. Common mistakes like not investing, timing the market poorly, or relying only on collectibles are discussed. The overall message is for beginners to educate themselves, start small and be patient, and diversify investments for steady returns over time.The Science of Getting Rich

The Science of Getting Richthescienceofgettingrich

╠²

The Science of Getting Rich ŌĆō http://your-bestyear-ever.info/thesgr/ - In the Science of Getting Rich you will learn the Recession-Proof Formula to Achieve Any Financial Goal with the Precision of a Surgical Laser.

The Science of Getting Rich - Session 1 - The Right to be Rich

The Science of Getting Rich - Session 2 - There is a Science of Getting Rich

The Science of Getting Rich - Session 3 - Is Opportunity Monopolized?

The Science of Getting Rich - Session 4 - The First Principle

The Science of Getting Rich - Session 5 - Increasing Life

The Science of Getting Rich - Session 6 - How Riches Come to You

The Science of Getting Rich - Session 7 ŌĆō Gratitude

The Science of Getting Rich - Session 8 - Thinking in a Certain Way

The Science of Getting Rich - Session 9 - How to Use the Will

The Science of Getting Rich - Session 10 - Further Use of the Will

The Science of Getting Rich - Session 11 - Acting In The Certain Way

The Science of Getting Rich - Session 12 - Effective Action

The Science of Getting Rich - Session 13 - Getting Into The Right Business

The Science of Getting Rich - Session 14 - The Impression of Increase

The Science of Getting Rich - Session 15 - The Advancing Person

The Science of Getting Rich - Session 16 - Some Cautions and Concluding Observations

The Science of Getting Rich - Session 17 -A Summary of The Science of Getting Rich

Emergency cash

Emergency cashMOMOBACHIR

╠²

INTRODUCTION Emergency cash Inside this book, you will discover for yourself everything you need to take a step forwardMoney Talk Book-Chapter 4

Money Talk Book-Chapter 4Barbara O'Neill

╠²

This document provides an overview of investing for retirement. It discusses asset allocation and diversification, building an investment portfolio, and specific retirement planning lessons. The document includes exercises for readers to determine their ideal asset allocation based on factors like age and risk tolerance. It also provides a sample investment portfolio pyramid that illustrates how to divide savings among stocks, bonds, cash equivalents, and specific mutual funds to meet a retirement savings goal. The document aims to educate women on planning financially for retirement.Found money

Found moneyYUNUSOZTURK1

╠²

This document provides tips and strategies for generating quick cash in an emergency situation. It discusses assessing your financial situation, prioritizing debts, increasing cash flow without taking on more debt, starting an emergency fund, reducing credit card usage, and finding painless ways to save small amounts of extra money. The key ideas are to remain calm, crunch the numbers, avoid further debt, build savings over time, and make small, consistent cuts to daily spending.The_Seven_Simple_Secrets_of_Financial_Independence[1]![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

![The_Seven_Simple_Secrets_of_Financial_Independence[1]](https://cdn.slidesharecdn.com/ss_thumbnails/d0d3cd9d-022c-43e0-90c6-94a00c81407b-160217141705-thumbnail.jpg?width=560&fit=bounds)

The_Seven_Simple_Secrets_of_Financial_Independence[1]sangura shadrack

╠²

The document outlines the seven simple secrets of financial independence according to Bert Whitehead. It begins by describing Whitehead's experience and credentials as a financial advisor. It then reviews the 10 stages of the typical financial life cycle, from infancy through retirement. Finally, it details the first two of the seven secrets: 1) Fund your future first by always saving 10% of income and reinvesting earnings, and 2) Don't mortgage your future to pay for present expenses by avoiding excessive debt.11 Retirement Mistakes

11 Retirement MistakesLALMcLeod

╠²

A Brief review of why everyone needs a written financial plan, one that has been updated within the last 12 months and the 11 mistakes that you do not want to make in your financial plan.how-money-works-us-version

how-money-works-us-versionTravis Miller

╠²

This document discusses the importance of financial education and provides an overview of basic financial concepts. It is published by Primerica, a financial services company, to help consumers overcome common financial challenges through knowledge. The document encourages readers to take control of their finances by learning principles like paying themselves first, eliminating debt, investing for the long term, and starting early to benefit from the power of compound interest and time. It presents savings and investment strategies as ways for working Americans to achieve financial security and independence.Financial leadership

Financial leadershipTolu Ogunyemi

╠²

This document provides information on financial leadership and the key concepts needed to begin a journey toward financial prosperity. It discusses two important terms: money consciousness, referring to one's mindset about money, and the importance of having a prosperity mindset rather than a scarcity mindset. The document also outlines four fundamental laws that govern wealth creation: the earning law of receiving money in exchange for work, the saving law of deliberately creating surplus through savings, the spending law of exchanging value through purchases, and the investing law of multiplying surplus through investments. Correcting limiting beliefs about money and understanding these laws are presented as important steps toward financial success.5 keys to wealth and success (3)

5 keys to wealth and success (3)laynnemim

╠²

Mark Ling outlines 5 keys to wealth and success in a document promoting an upcoming webinar. He discusses creating "money magnets" like websites, Facebook pages, and Kindle books that generate passive income. Ling emphasizes taking action on opportunities presented and embracing mistakes as opportunities to learn. He encourages readers to develop money magnets that continue earning while they vacation or cannot work in order to achieve financial freedom.5 keys to wealth and success

5 keys to wealth and successHuong Nguyen

╠²

Mark Ling outlines five keys to wealth and success in a document promoting an upcoming webinar. He discusses creating "money magnets" like websites, Facebook pages, and Kindle books that generate passive income. Ling emphasizes taking action on opportunities presented and embracing mistakes as opportunities to learn. He encourages readers to develop money magnets that continue generating income when not actively working.Psychology secrets of the millionaire mind

Psychology secrets of the millionaire mindsecrets behind the successful

╠²

Learn how the millionaires made money and attained success throughout their lives and the mindset that allowed them to do so!Business MentalityŌĆ”

Business MentalityŌĆ”ambitiousleaf4403

╠²

How have ample attitudes where everyone says all is lost within the economy, mortgage crisis, credit...Emergency_Cash.pdf

Emergency_Cash.pdfFakhar Jan

╠²

This document provides 101 tips for generating emergency cash. It discusses coping with cash crises by remaining calm and assessing the situation. It recommends increasing cash flow without taking on more debt, such as taking on a side job or hobby. It emphasizes the importance of starting an emergency fund by saving 3-6 months of living expenses. It also suggests reducing spending by cutting back on credit cards, refinancing loans, reducing car and home energy use, and eating out less. The document aims to help readers prepare for and manage financial emergencies through planning and savings.Recently uploaded (9)

Cultivating an Innovative Mindset in STEM Presented by Google.pptx

Cultivating an Innovative Mindset in STEM Presented by Google.pptxCareer Communications Group

╠²

Learning objective: Encourage innovation in the face of adversity. Panelists will discuss strategies for cultivating innovation and promoting a resilient growth mindset.Bullying presentation/How to deal with bullying .pptx

Bullying presentation/How to deal with bullying .pptxssuserb6cf2e

╠²

Any form of verbal, psychological, or physical violence that is repeated by someone or a group, who is in a position of domination against one or more other individuals in a position of weakness and intends to harm its victims that are unable to defend themselves especially when the bully may have one or more followers who are willing to assist the primary bully or who reinforce the bully by providing positive feedback such as laughingMaster Data Science Course in Kerala and How to face an interview

Master Data Science Course in Kerala and How to face an interviewbenjaminoseth

╠²

Cracking a data science interview requires a strategic approach, strong domain knowledge, and hands-on expertise. This PPT is designed to help aspiring data scientists prepare effectively by understanding the core interview topics, real-world problem-solving techniques, and communication strategies. Whether you are new to data science or an experienced professional, this guide covers must-know topics like machine learning, statistics, data wrangling, and coding. With expert insights from a Data Science Course in Kerala, this presentation highlights industry-specific interview patterns, key questions, and problem-solving frameworks. Get ready to excel in your data science interviews with practical tips, real-world case studies, and best practices to land your dream job!HRM Shaker Style KitchenCabinets Catalog.pdf

HRM Shaker Style KitchenCabinets Catalog.pdfhrmflorida77

╠²

Upgrade your kitchen with affordable RTA cabinets that combine style, durability, and budget-friendly pricing. These ready-to-assemble cabinets offer easy installation without compromising on quality. Choose from modern, shaker, and European-style designs to match your space. Perfect for homeowners, contractors, and remodelers seeking wholesale savings. Enjoy high-quality materials and craftsmanship at unbeatable prices. Get the best RTA cabinets for your kitchen today.The brilliant pyramid outlines the 6 steps to

- 1. The brilliant pyramid outlines the 6 steps to financial success MASLOW'S HIERARCHY OF NEEDS IN FINANCIAL TERMS

- 2. Maslow's hierarchy of needs

- 3. Hierarchy of FIRE (Financially Independent and Retired Early)

- 4. Hierarchy of FIRE (Financially Independent and Retired Early) ’üĄ The financial blogger known only as Mister Squirrel (who has since closed his site) shared his own version of Maslow's hierarchy: the path to financial success. ’üĄ Squirrel, who "dreams of a non-corporate life," calls his theory the Hierarchy of FIRE (Financially Independent and Retired Early). The idea is that once you're operating in the highest tier with your money, you're set up to be a financial success ŌĆö and that applies whether or not you're aiming for early retirement.

- 5. Hierarchy of FIRE (Financially Independent and Retired Early) ’üĄ 1. Surviving. Before anything else, we have to get our minds right when it comes to money. As Squirrel puts it, "If you think that the government will look after you, money will take care of itself, or youŌĆÖll win the lottery, then youŌĆÖre not thinking about money correctly." In this stage, you'll also start living below your means, and spending less than your monthly income. ’üĄ 2. De-debting. While everyone's debt situation is different, ridding yourself of "bad debt," (the kind that costs you money without giving you any clear value in return, like credit card debt) needs to be checked off your list before you can make real progress. ’üĄ 3. Learning. This is where you set aside an emergency fund to keep you in the green should something go wrong, and where you start learning about the possibilities for your money. Which accounts should you use? Should you invest, and how? If you have a question, now is the time to find an answer. Luckily, you have the entire internet at your fingertips. ’üĄ 4. Investing. Time to make use of those answers. Squirrel points out that this stage doesn't have hard borders ŌĆö it will continue on through the pyramid's last stages. ’üĄ 5. Optimizing. Now that you have your answers and have gotten your money in order, it's time to start tweaking your plan to perfection: Plan for taxes, get a will, create a system to check on your money. ’üĄ 6. Freeing. "When you get to this stage," Squirrel writes, "you should be 'there.'" Now that you're financially independent and perhaps have even retired early, you have predictable expenses easily covered by passive income streams.