The Credit Crunch

- 1. The Credit Crunch Jee Manghani, January 10, 2008

- 2. Definition ï― sudden reduction in the availability of credit ï― may be due to: ï― An increased perception of risk ï― A change in monetary conditions ï― An imposition of credit controls

- 3. Fractional Reserve Banking ï― Letâs go over a couple basics on how credit is created. ï― FRB: A way to temporarily increase the money supply without creating new money.

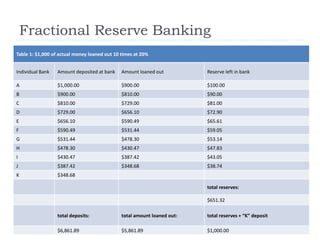

- 4. Fractional Reserve Banking Table 1: $1,000 of actual money loaned out 10 times at 20% Individual Bank Amount deposited at bank Amount loaned out Reserve left in bank A $1,000.00 $900.00 $100.00 B $900.00 $810.00 $90.00 C $810.00 $729.00 $81.00 D $729.00 $656.10 $72.90 E $656.10 $590.49 $65.61 F $590.49 $531.44 $59.05 G $531.44 $478.30 $53.14 H $478.30 $430.47 $47.83 I $430.47 $387.42 $43.05 J $387.42 $348.68 $38.74 K $348.68 total reserves: $651.32 total deposits: total amount loaned out: total reserves + âKâ deposit $6,861.89 $5,861.89 $1,000.00

- 6. Securitization ï― Traditional lending has risks when the yield to depositors becomes greater than the yield from borrowers. ï― Especially in the 1970s, when interest rates shot up and the fixed rate mortgages would not adjust. ï― In the 1970s, mortgages were securitized.

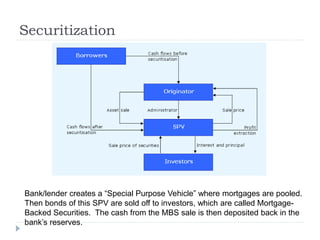

- 7. Securitization Bank/lender creates a âSpecial Purpose Vehicleâ where mortgages are pooled. Then bonds of this SPV are sold off to investors, which are called Mortgage- Backed Securities. The cash from the MBS sale is then deposited back in the bankâs reserves.

- 8. Benefits of Mortgage Backed Securities ï― Transform illiquid assets into tradeable market securities. ï― Diversify financing sources ï― Fund replenishment for more loans ï― Quickly remove assets from the balance sheet and raise cash to improve financial ratios (e.g. Fractional Reserves)

- 9. Collateralized Debt Obligation ï― Any defaults and less than 100% recovery rates on houses would theoretically impact all MBSs from the same SPV evenly. ï― Letâs try to make investment in MBS a bit saferâĶcreate a CDO! ï― CDOs organize a many MBSs (regardless of their safety) into tranches. ï― The higher risk tranches face the first losses in foreclosures, but reap the highest returns. ï― The lower risk tranches have lower returns, but are among the last to face losses.

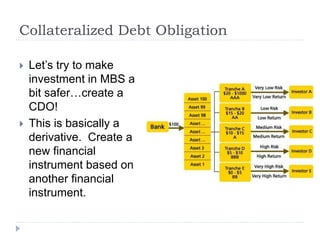

- 10. Collateralized Debt Obligation ï― Letâs try to make investment in MBS a bit saferâĶcreate a CDO! ï― This is basically a derivative. Create a new financial instrument based on another financial instrument.

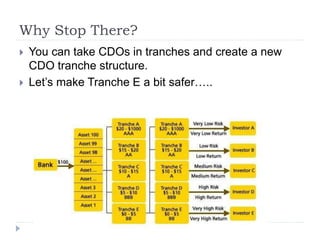

- 11. Why Stop There? ï― You can take CDOs in tranches and create a new CDO tranche structure. ï― Letâs make Tranche E a bit saferâĶ..

- 12. Letâs Hedge Our Bets ï― Credit Default Swaps can be placed on a CDO within a tranche. ï― This is basically insurance, in case the principal is eroded through defaults in payments. ï― In return, sellers of CDSs get regular payments from the holders of CDOs, lowering their returns on the CDOs.

- 13. The Rabbit Hole Gets Deeper ï― CDSs in themselves can be a bit risky. ï― Investors are banging on the door to participate. ï― CDSs are organized into CDO tranches and sell them to investors. ï― Investors buy them up, since the return on them is attractive.

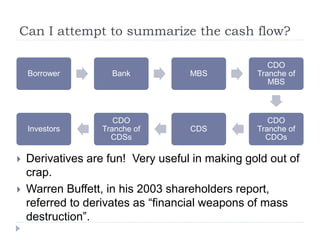

- 14. Can I attempt to summarize the cash flow? Borrower Bank MBS CDO Tranche of MBS CDO Tranche of CDOs CDS CDO Tranche of CDSs Investors ï― Derivatives are fun! Very useful in making gold out of crap. ï― Warren Buffett, in his 2003 shareholders report, referred to derivates as âfinancial weapons of mass destructionâ.

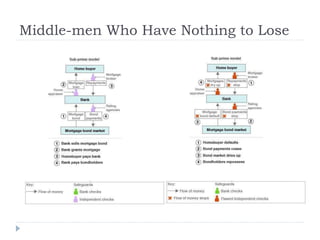

- 15. Middle-men Who Have Nothing to Lose

- 16. Where is the Personal Responsibility? ï― By selling mortgages as securities, banks earned fees or gained value in the securities. Capital preservation was no longer of first importance. ï― Banks and lenders paid high fees independent mortgage brokers to originate loans. Capital preservation was not on their radar as long as the lender/bank approved. ï― MBS Investors had little visibility into the credit- worthiness of borrowers.

- 17. Everything is rosesâĶ. ï― When the housing market is going upâĶ. ï― By offering mortgages to prime and subprime borrowers, demand in homes increases significantly. ï― Prices shoot up faster than incomes and rents, particularly on the coasts. ï― Even prime borrowers take out risky loans, and extract equity. ï― Feeling richer, Americansâ savings rate goes negative for several years. ï― Defaults on homes only results in increased home values and a profit for everyone in the tranches.

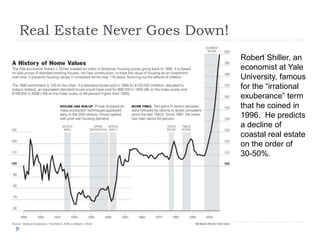

- 18. Real Estate Never Goes Down! Robert Shiller, an economist at Yale University, famous for the âirrational exuberanceâ term that he coined in 1996. He predicts a decline of coastal real estate on the order of 30-50%.

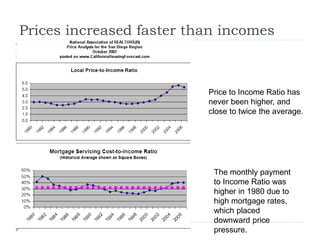

- 19. Prices increased faster than incomes Price to Income Ratio has never been higher, and close to twice the average. The monthly payment to Income Ratio was higher in 1980 due to high mortgage rates, which placed downward price pressure.

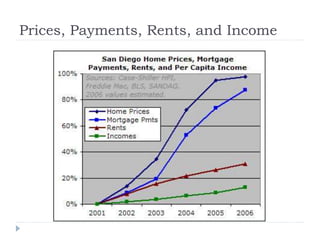

- 20. Prices, Payments, Rents, and Income

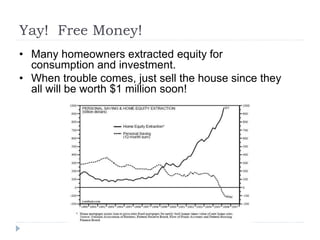

- 21. Yay! Free Money! âĒ Many homeowners extracted equity for consumption and investment. âĒ When trouble comes, just sell the house since they all will be worth $1 million soon!

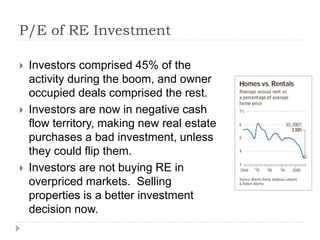

- 22. P/E of RE Investment ï― Investors comprised 45% of the activity during the boom, and owner occupied deals comprised the rest. ï― Investors are now in negative cash flow territory, making new real estate purchases a bad investment, unless they could flip them. ï― Investors are not buying RE in overpriced markets. Selling properties is a better investment decision now.

- 23. Fraud is Rampant! ï― Homes are over-appraised, and the excess sale amount is ârefundedâ back to the buyer, who then pockets the cash and defaults on the home. ï― Investment schemes where scammers pool credit-worthy investorsâ cash to buy homes at inflated prices, default on the home, and steal the cash. ï― Mortgage brokers utilized NINJA loans (No Income, No Job or Assets) ï― Crisp & Cole in Bakersfield (link to story) ï― CA Strawberry Picker earning $15k/year buys a $720k house (link to story) ï― A few other âridiculous mortgage borrower storiesâ (link)

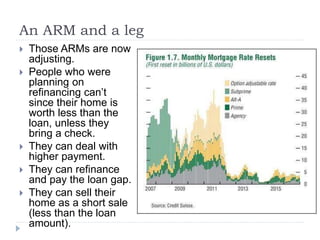

- 24. An ARM and a leg ï― Those ARMs are now adjusting. ï― People who were planning on refinancing canât since their home is worth less than the loan, unless they bring a check. ï― They can deal with higher payment. ï― They can refinance and pay the loan gap. ï― They can sell their home as a short sale (less than the loan amount).

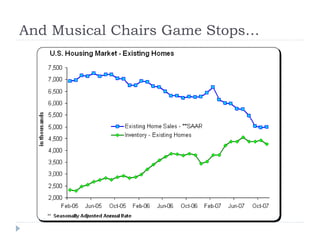

- 25. And Musical Chairs Game StopsâĶ

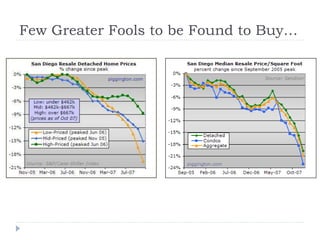

- 26. Few Greater Fools to be Found to BuyâĶ

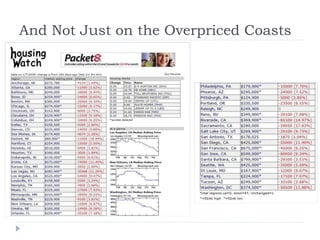

- 27. And Not Just on the Overpriced Coasts

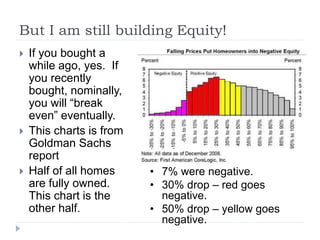

- 28. But I am still building Equity! ï― If you bought a while ago, yes. If you recently bought, nominally, you will âbreak evenâ eventually. ï― This charts is from Goldman Sachs report ï― Half of all homes are fully owned. This chart is the other half. âĒ 7% were negative. âĒ 30% drop â red goes negative. âĒ 50% drop â yellow goes negative.

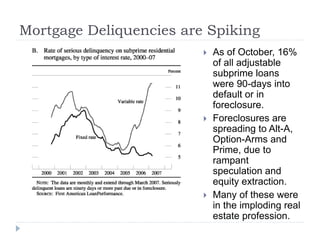

- 29. Mortgage Deliquencies are Spiking ï― As of October, 16% of all adjustable subprime loans were 90-days into default or in foreclosure. ï― Foreclosures are spreading to Alt-A, Option-Arms and Prime, due to rampant speculation and equity extraction. ï― Many of these were in the imploding real estate profession.

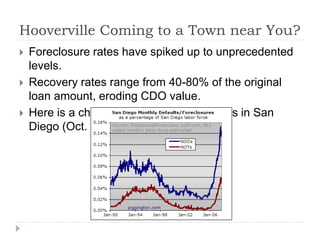

- 30. Hooverville Coming to a Town near You? ï― Foreclosure rates have spiked up to unprecedented levels. ï― Recovery rates range from 40-80% of the original loan amount, eroding CDO value. ï― Here is a chart of defaults & foreclosures in San Diego (Oct. 2007)

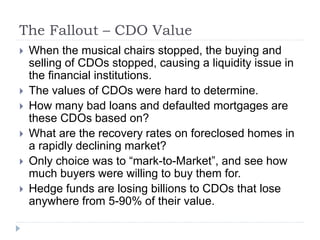

- 31. The Fallout â CDO Value ï― When the musical chairs stopped, the buying and selling of CDOs stopped, causing a liquidity issue in the financial institutions. ï― The values of CDOs were hard to determine. ï― How many bad loans and defaulted mortgages are these CDOs based on? ï― What are the recovery rates on foreclosed homes in a rapidly declining market? ï― Only choice was to âmark-to-Marketâ, and see how much buyers were willing to buy them for. ï― Hedge funds are losing billions to CDOs that lose anywhere from 5-90% of their value.

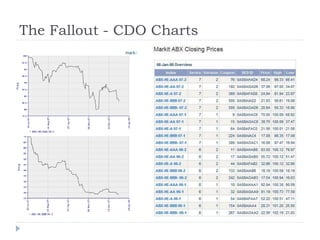

- 32. The Fallout - CDO Charts

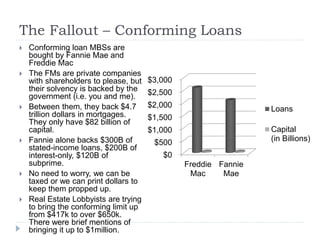

- 33. The Fallout â Conforming Loans ï― Conforming loan MBSs are bought by Fannie Mae and Freddie Mac ï― The FMs are private companies with shareholders to please, but their solvency is backed by the government (i.e. you and me). ï― Between them, they back $4.7 trillion dollars in mortgages. They only have $82 billion of capital. ï― Fannie alone backs $300B of stated-income loans, $200B of interest-only, $120B of subprime. ï― No need to worry, we can be taxed or we can print dollars to keep them propped up. ï― Real Estate Lobbyists are trying to bring the conforming limit up from $417k to over $650k. There were brief mentions of bringing it up to $1million. $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Freddie Mac Fannie Mae Loans Capital (in Billions)

- 34. The Fallout â Jumbo Loans ï― Jumbo loans are bought by private investors. ï― They have lost appetite for MBSs, unless they are assured of a high downpayment and very high FICO scores. ï― Higher rates are needed to attract buyers. ï― Banks can keep the loans on their balance sheets. With the ï― Tougher loan standards means fewer qualified buyers for overpriced markets. ï― Lower demand is leading to long market times for homes for sale, leading to distressed sellers unable to sell their home in time to avoid foreclosure.

- 35. The Fallout â The Federal Reserve ï― Ben Bernanke is an expert on the Great Depression. ï― Conventional wisdom says that the Depression was caused by monetary contraction due to the crisis in the banking system. ï― Bernanke is injecting billions into the system so that banks can continue providing all types of loans. These loans are provided at the âdiscount windowâ rate. ï― Banks were hesitating in publicly taking money from the Fed, for fear of sending a bad message to their depositors. ï― The Fed is now holding auctions for the loans, to be awarded anonymously to the banks.