The Good Form campaign generic taxback pack

- 1. If undelivered please return to: YOUR CHARITY NAME & ADDRESS HERE YOUR CHARITY CEADĂšNAS HERE 138 YOUR CHARITY LOGO Thank you for your generosity HERE Now you can give again for FREE

- 2. YOUR Jonathan, you have already CHARITY done so much. LOGO HERE Jonathan O’Connell, Address Line 1, Town, Dublin 3 YOUR Now, just with your signature, CEO PHOTO you can give to us again for free. HERE Dear Jonathan, Your generosity has already made a difference. I want to thank you, on behalf of everyone at YOUR CHARITY NAME HERE, and all the people we are working to help, for your support. The good news is that we are not asking you for any more money. Instead there is something you can do, that will only take a few moments of your time and will cost you absolutely nothing, yet it could be worth millions to good causes that reach out across Ireland and the whole world. How simply it works YOUR CHARITY NAME HERE can claim a substantial tax refund that is available from the Revenue. This is for donations from generous donors like you that give €250 or more in a year, and pay income tax under the PAYE system ONLY. This refund can only be claimed by the charity concerned in respect of the PAYE-only donor. It sounds complicated, but it is simple to do and the form is quick and easy to complete. This year many Irish charities have come together to highlight how important this form is. We have decided to call it The Good Form, because it can do so much good, and because it’s so painless to do. As you can see on the form attached, we’ve filled in your name, address and amount you’ve given. If there is more than one year which is due to be claimed, we enclose a form for each year. What you need to put in is your PPS number, tick the rate at which you are taxed, and then just sign and date it. Then pop it in the prepaid envelope provided and post it. Pay no more money. Don’t even buy a stamp - unless you want to! continues overleaf Your charity contacts details and CHY No. here

- 3. YOUR CHARITY LOGO HERE What your signature can achieve The group of charities who have come together to help each other claim these refunds are supported by thousands of PAYE-only donors like you. Indeed, across all Irish charities, over a hundred thousand people have donated €250 or more in the past year, just as you have. But we can only get Revenue to pay the tax refunds on your donations if you complete, sign and send back the The Good Form. That is why it is so vital that you do this one more task for YOUR CHARITY NAME HERE, as others are doing for the charities they support. We know that you are a busy person, with many other things to do. That is why we are urging you to attend to The Good Form right now. If you put it away in a drawer, you might end up forgetting all about it. So please, do it now, while it’s on your mind. There are millions of euro at stake, and so many people, in so many ways, are depending on you. Thank you for your time. I hope you have a biro handy. Any questions, please call us on YOUR CHARITY PHONE NO HERE. Thank you, once again, CHARITY CEO SIGNATURE CHARITY CEO Name & Title IMAGES, E.G. OF YOUR CHARITY’S BENEFICIARIES Simply signing this form means we can do so much more. Your charity contacts details and CHY No. here

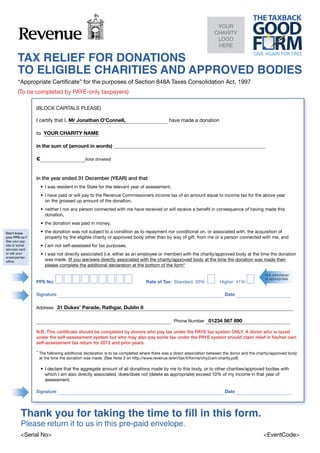

- 4. YOUR CHARITY LOGO HERE TAX RELIEF FOR DONATIONS TO ELIGIBLE CHARITIES AND APPROVED BODIES “Appropriate Certificate” for the purposes of Section 848A Taxes Consolidation Act, 1997 (To be completed by PAYE-only taxpayers) (BLOCK CAPITALS PLEASE) I certify that I, Mr Jonathan O’Connell, have made a donation to YOUR CHARITY NAME in the sum of (amount in words) € (total donated) in the year ended 31 December (YEAR) and that • I was resident in the State for the relevant year of assessment, • I have paid or will pay to the Revenue Commissioners income tax of an amount equal to income tax for the above year on the grossed up amount of the donation, • neither I nor any person connected with me have received or will receive a benefit in consequence of having made this donation, • the donation was paid in money, Don’t know • the donation was not subject to a condition as to repayment nor conditional on, or associated with, the acquisition of your PPS no.? property by the eligible charity or approved body other than by way of gift, from me or a person connected with me, and See your pay slip or social • I am not self-assessed for tax purposes. services card or ask your • I was not directly associated (i.e. either as an employee or member) with the charity/approved body at the time the donation employer/tax office. was made. (If you are/were directly associated with the charity/approved body at the time the donation was made then please complete the additional declaration at the bottom of the form* Tick whichever is appropriate PPS No: Rate of Tax: Standard 20% Higher 41% Signature Date Address: 31 Dukes’ Parade, Rathgar, Dublin 8 Phone Number 01234 567 890 N.B. This certificate should be completed by donors who pay tax under the PAYE tax system ONLY. A donor who is taxed under the self-assessment system but who may also pay some tax under the PAYE system should claim relief in his/her own self-assessment tax return for 2012 and prior years. * The following additional declaration is to be completed where there was a direct association between the donor and the charity/approved body at the time the donation was made (See Note 3 on http://www.revenue.ie/en/tax/it/forms/chy2cert-charity.pdf) • I declare that the aggregate amount of all donations made by me to this body, or to other charities/approved bodies with which I am also directly associated, does/does not (delete as appropriate) exceed 10% of my income in that year of assessment. Signature Date Thank you for taking the time to fill in this form. Please return it to us in this pre-paid envelope. <Serial No> <EventCode>

- 5. YOUR CHARITY LOGO HERE Ten good reasons why you should sign this form now for YOUR CHARITY NAME. 1. It’s free. 2. We’re sure you have a pen! 3. It should take less than three minutes. 4. You don’t even need to buy a stamp - unless you want to! 5. We can reclaim up to 69% of your donation, depending on your tax bracket. It won’t affect your finances at all. 6. Charity related benefit e.g. One in seven people accessing YOUR CHARITY NAME’s services is a child. 7. Charity related benefit 8. Charity related benefit 9. Charity related benefit 10. Charity related benefit

- 6. Adding a stamp will save YOUR CHARITY NAME paying the postage - but please don't let that delay posting. YOUR CHARITY NAME, Address Line 1, Address Line 2, Address Line 3. YOUR CHARITY LOGO HERE