The good life presentation slide1

- 1. Ìı

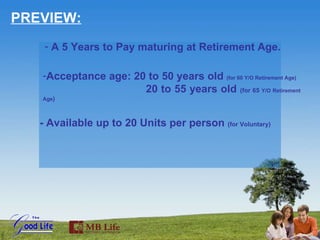

- 2. PREVIEW: A 5 Years to Pay maturing at Retirement Age. - Available up to 20 Units per person (for Voluntary) Acceptance age: 20 to 50 years old (for 60 Y/O Retirement Age) 20 to 55 years old (for 65 Y/O Retirement Age )

- 3. FEATURES: Supplemental Retirement Program Supplemental to: SSS GSIS Other corporate retirement benefits

- 4. DISTINCT FEATURES: Upgradeable Life & Premium Protection Maturity on Retirement With Paid-up Whole Life Option With Loan Benefit Affordable rates Short term contribution period; Coverage of up to the Retirement Age.

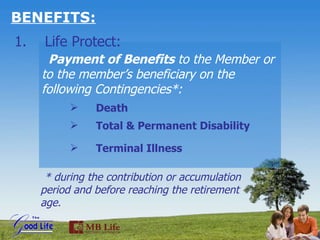

- 5. BENEFITS: Life Protect: Payment of Benefits to the Member or to the member’s beneficiary on the following Contingencies*: Death Total & Permanent Disability Terminal Illness * during the contribution or accumulation period and before reaching the retirement age.

- 6. BENEFITS: 2. Premium Protect: Return of Contributions Paid on the following Contingencies*: Death Total & Permanent Disability Terminal Illness * during the contribution or accumulation period and before reaching the retirement age.

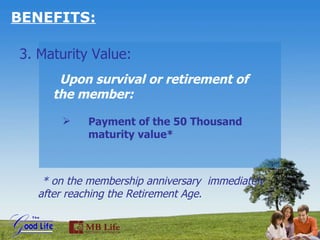

- 7. BENEFITS: 3. Maturity Value: Upon survival or retirement of the member: Payment of the 50 Thousand maturity value* * on the membership anniversary immediately after reaching the Retirement Age.

- 8. BENEFITS: 4. Program Discontinuation: Upon the member’s discontinuation of the program: An amount will be paid to the Employer (if Corporate) or to the Member (If Voluntary)* * Based on the Table of Program Discontinuation Values.

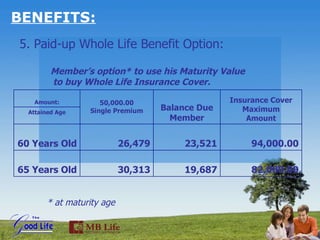

- 9. BENEFITS: 5. Paid-up Whole Life Benefit Option: Member’s option* to use his Maturity Value to buy Whole Life Insurance Cover. * at maturity age 82,000.00 19,687 30,313 65 Years Old 94,000.00 23,521 26,479 60 Years Old Attained Age Insurance Cover Maximum Amount Balance Due Member 50,000.00 Single Premium Amount:

- 10. BENEFITS: 6. Loan Benefit*: > Loan of up to 90% of the Membership Discontinuation Value. > Available after the member’s 1 st year membership. * during the contribution or accumulation period and before reaching the retirement age.

- 11. ANNUAL CONTRIBUTION PER ATTAINED AGE @ 1 UNIT FOR VOLUNTARY 9,900.00 - 55 8,300.00 9,150.00 50 5,370.00 5,920.00 40 3,340.00 3,790.00 3 0 2,230.00 2,560.00 20 65 Years Old 60 Years Old MATURITY DATE Attained Age

- 12. ANNUAL CONTRIBUTION PER ATTAINED AGE @ 1 UNIT FOR CORPORATE 9, 0 00.00 - 55 7 , 4 00.00 8 , 200 .00 50 4 , 80 0.00 5, 30 0.00 40 3, 00 0.00 3, 40 0.00 3 0 2, 00 0.00 2, 30 0.00 20 65 Years Old 60 Years Old MATURITY DATE Attained Age

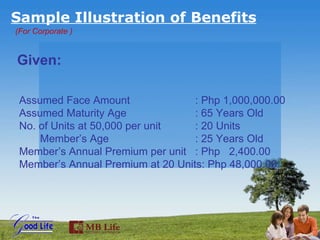

- 13. Sample Illustration of Benefits Assumed Face Amount : Php 1,000,000.00 Assumed Maturity Age : 65 Years Old No. of Units at 50,000 per unit : 20 Units Member’s Age : 25 Years Ol d Member’s Annual Premium per unit : Php 2,400.00 Member’s Annual Premium at 20 Units: Php 48,000.00 Given: (For Corporate )

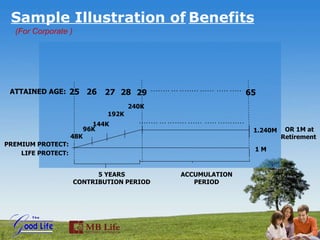

- 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PREMIUM PROTECT: LIFE PROTECT: ATTAINED AGE: 25 26 27 28 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 5 YEARS CONTRIBUTION PERIOD ACCUMULATION PERIOD 48K 96K 144K 192K 240K 1.240M 1 M OR 1M at Retirement Sample Illustration of Benefits (For Corporate )

- 15. Sample Illustration of Benefits Assumed Face Amount : Php 1,000,000.00 Assumed Maturity Age : 65 Years Old No. of Units at 50,000 per unit : 20 Units Member’s Age : 25 Years Ol d Member’s Annual Premium per unit : Php 2,670.00 Member’s Annual Premium at 20 Units: Php 53,400.00 Given: (For Voluntary )

- 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PREMIUM PROTECT: LIFE PROTECT: ATTAINED AGE: 25 26 27 28 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 5 YEARS CONTRIBUTION PERIOD ACCUMULATION PERIOD 53.4K 106.8K 160.2K 213.6K 267K 1.267M 1 M OR 1M at Retirement Sample Illustration of Benefits (For Voluntary )

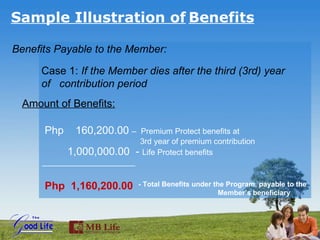

- 17. Benefits Payable to the Member: Case 1: If the Member dies after the third (3rd) year of contribution period Amount of Benefits: Php 1 60 , 2 00.00 – Premium Protect benefits at 3rd year of premium contribution 1,000,000.00 - Life Protect benefits _______ ___ ___________ Php 1,160,200.00 - Total Benefits under the Program, payable to the Member’s beneficiary Sample Illustration of Benefits

- 18. Condition Applicant need only be in good health and actively at work at the time of program effectivity

- 19. Usual underwriting restrictions shall be applied.

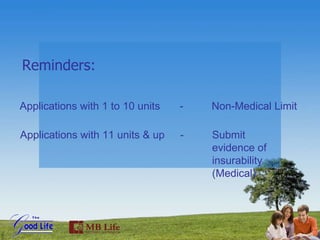

- 20. Reminders: Applications with 1 to 10 units - Non-Medical Limit Applications with 11 units & up - Submit evidence of insurability (Medical)

- 21. 05% 3 rd Year 05% 2 nd Year 15 % 1 st Year Corporate Annual Commission Commission: (This slide is to be showed for Allies and Marketing Associates only)

- 22. Thank you!