The Lifetime Exemption to Gift and Estate Taxes

- 8. All assets must be identified and valued as part of the probate process The gift and estate tax has been as high as 55 percent in recent years American Taxpayer Relief Act of 2013, or ATRA, permanently set the tax rate at a maximum of 40 percent Careful estate planning can decrease, or eliminate, exposure to gift and estate taxes

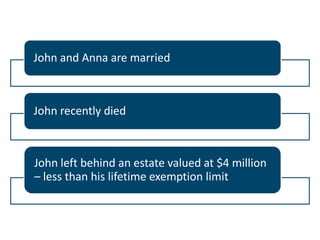

- 15. John and Anna are married John recently died John left behind an estate valued at $4 million ÔÇô less than his lifetime exemption limit

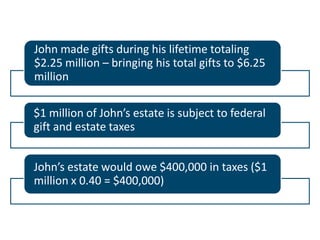

- 16. John made gifts during his lifetime totaling $2.25 million ÔÇô bringing his total gifts to $6.25 million $1 million of JohnÔÇÖs estate is subject to federal gift and estate taxes JohnÔÇÖs estate would owe $400,000 in taxes ($1 million x 0.40 = $400,000)

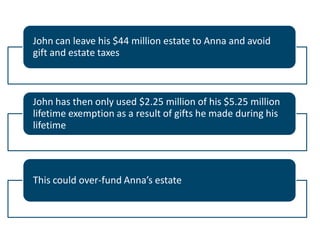

- 19. John can leave his $44 million estate to Anna and avoid gift and estate taxes John has then only used $2.25 million of his $5.25 million lifetime exemption as a result of gifts he made during his lifetime This could over-fund AnnaÔÇÖs estate

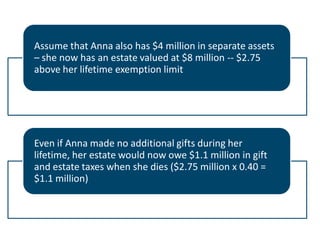

- 20. Assume that Anna also has $4 million in separate assets ÔÇô she now has an estate valued at $8 million -- $2.75 above her lifetime exemption limit Even if Anna made no additional gifts during her lifetime, her estate would now owe $1.1 million in gift and estate taxes when she dies ($2.75 million x 0.40 = $1.1 million)

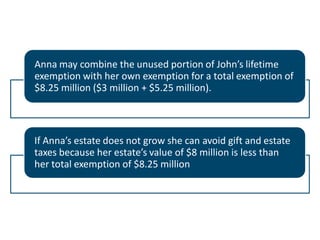

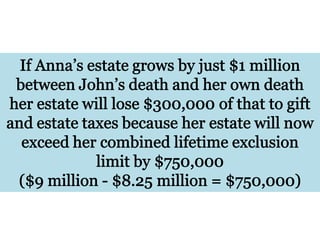

- 24. Anna may combine the unused portion of JohnÔÇÖs lifetime exemption with her own exemption for a total exemption of $8.25 million ($3 million + $5.25 million). If AnnaÔÇÖs estate does not grow she can avoid gift and estate taxes because her estateÔÇÖs value of $8 million is less than her total exemption of $8.25 million

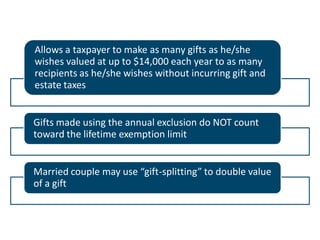

- 30. Allows a taxpayer to make as many gifts as he/she wishes valued at up to $14,000 each year to as many recipients as he/she wishes without incurring gift and estate taxes Gifts made using the annual exclusion do NOT count toward the lifetime exemption limit Married couple may use ÔÇ£gift-splittingÔÇØ to double value of a gift

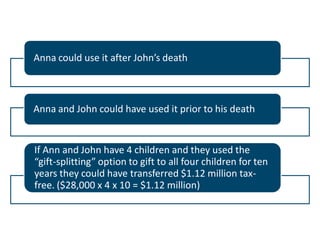

- 31. Anna could use it after JohnÔÇÖs death Anna and John could have used it prior to his death If Ann and John have 4 children and they used the ÔÇ£gift-splittingÔÇØ option to gift to all four children for ten years they could have transferred $1.12 million taxfree. ($28,000 x 4 x 10 = $1.12 million)