The-Nirav-Modi-Scam-A-Multi-Billion-Dollar-Fraud.pdf

- 1. The Nirav Modi Scam: A Multi-Billion Dollar Fraud The Nirav Modi scam shook India's banking sector. It involved an estimated $2 billion fraud. It exposed vulnerabilities and regulatory loopholes in the system. The case involved unauthorized Letters of Undertaking (LoUs) from Punjab National Bank (PNB) Presented By Avishek 20 Mayank 97 Amaan 08

- 2. Presented By Avishek 20 Mayank 97 Amaan 08

- 3. Who was Nirav Modi? Diamond Legacy Came from a diamond trading family. Billionaire Status Appeared on Forbes list with $1.8 billion net worth. Global Expansion Opened boutiques in London, New York, Hong Kong. Nirav Modi rose from a diamond trading family. He became the founder of a luxury brand. His boutiques attracted celebrity endorsements.

- 4. Modus Operandi: Letters of Undertaking 1 LoU Purpose Letters of Undertaking facilitate international trade finance. 2 Fraudulent LoUs Modi's firms obtained LoUs from PNB's Mumbai branch. 3 PNB Collusion Officials issued LoUs without proper collateral. The scam revolved around Letters of Undertaking (LoUs). Modi's firms colluded with PNB officials. They bypassed standard banking procedures. This unauthorized issuance of LoUs was key to the fraud.

- 5. The Mechanics of the Fraud 1 LoU Application Modi's companies applied for LoUs to PNB. 2 Fraudulent Issuance PNB officials issued LoUs without margin money. 3 Overseas Credit Other Indian banks provided credit based on LoUs. 4 Fund Routing Funds routed back as import payments, siphoning money. The fraud involved a complex process. Modi's companies applied for LoUs. PNB officials fraudulently issued them. Funds were then routed back, siphoning off the money.

- 6. Key Players and Their Roles Nirav Modi Mastermind of the scam, a fugitive. PNB Officials Facilitated fraudulent LoUs. Mehul Choksi Modi's uncle and business partner, also a fugitive. Several key players were involved in the scam. Nirav Modi was the mastermind. Mehul Choksi was his business partner. PNB officials facilitated the fraudulent LoUs.

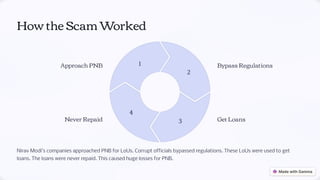

- 7. How the Scam Worked 1 2 3 4 Nirav Modi9s companies approached PNB for LoUs. Corrupt officials bypassed regulations. These LoUs were used to get loans. The loans were never repaid. This caused huge losses for PNB. Approach PNB Bypass Regulations Get Loans Never Repaid

- 8. The Aftermath and Investigation 1 Fraud Discovery PNB reported fraud in January 2018. 2 Govt. Response Asset seizures and travel bans followed. 3 Involvement CBI, ED, and Interpol joined the investigation. 4 Arrest Nirav Modi was arrested in London. The fraud was discovered in January 2018. The government responded with asset seizures. CBI, ED, and Interpol got involved. Nirav Modi was arrested in London.

- 9. Timeline of the Scam 2011-2017 Scam took place undetected. Jan 2018 PNB detected unauthorized LoUs worth ?11,400 crore. Feb 2018 CBI registered an FIR. March 2019 Nirav Modi arrested in London. Feb 2021 UK court approved extradition to India. Present Status Awaiting extradition in London9s Wandsworth Prison. The scam occurred between 2011 and 2017. PNB detected the fraud in January 2018. Nirav Modi was arrested in March 2019. He is awaiting extradition in London.

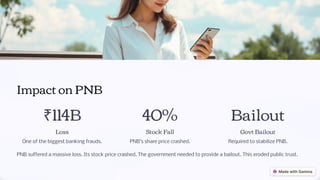

- 10. Impact on PNB ?114B Loss One of the biggest banking frauds. 40% Stock Fall PNB9s share price crashed. Bailout Govt Bailout Required to stabilize PNB. PNB suffered a massive loss. Its stock price crashed. The government needed to provide a bailout. This eroded public trust.

- 11. Impact on Banking Sector 1 Regulatory Gaps Exposed loopholes in regulations. 2 Insider Risk Highlighted risk of insider corruption. 3 Stricter Monitoring Led to stricter financial transaction monitoring. The scam exposed major banking regulation loopholes. It highlighted the risk of insider corruption. It led to stricter monitoring of transactions.

- 12. Conclusion (Part 1 - Scam Exposure & Impact) The Nirav Modi scam exposed serious flaws in India9s banking system. PNB suffered huge financial losses. Investor confidence in PSU banks declined. Banking regulations had to be strengthened. This case became a wake-up call for financial institutions.

- 13. Conclusion (Part 2 - Government Response & Reforms) After the scam, the government and RBI introduced major reforms: ' Banned LoUs to prevent fraud. ? Stronger internal audits & monitoring. ? Strict action against corrupt bank officials. These steps aim to restore trust in India9s financial system.

- 14. Conclusion (Part 3 - Future Implications & Final Thoughts) While efforts to extradite Nirav Modi continue, the case highlights the importance of transparency and corporate accountability. To prevent future scams: ' Strict enforcement of banking rules. ' Zero tolerance for financial fraud. ' Better technology for fraud detection. Only with stronger regulations and accountability can India prevent such scams in the future.

- 15. Thank You